Mooners and Shakers: Crypto market ends year on (reasonably) positive note

Pic: Getty

Bitcoin and the broader cryptocurrency market appeared to be limping to the 2021 finish line yesterday, but a swig or three of Dom Pérignon later, and legs have possibly been found. Or maybe even a bottom.

Usual caveat – that’s very much conjecture, open for debate and unconfirmed at the time of writing. But still, let’s not ruin the positive vibes as we embark on the first day (AEDT) of another adventurous year in crypto.

And while the noted analyst PlanB’s end-of-year BTC target of at least US$100k was way off (he certainly wasn’t the only one with that prediction), he’s given us a good contextual reminder about the sort of year Bitcoin just had compared with other major asset classes…

Happy New Year!

2021: #Bitcoin +60%

Real Estate +35%

Stocks +27%

Bonds -2%

Gold -4% pic.twitter.com/lGnPybkJzD— PlanB (@100trillionUSD) December 31, 2021

How you like them apples, Peter Schiff?

Fidelity “Gets it”.

Mastercard “Gets it”.

Amazon, Tesla, & Walmart “Get it”.

Facebook “Gets it”.

SEC Chairman Gary Gensler “Gets it”.

The top technology advisor to President Biden, Tim Wu, “Gets it”.

Peter Schiff does not “get it”.#Bitcoin

— Rich Rogers (@RichRogers_) December 30, 2021

2021 – an incredible, volatile crypto year

While his beloved gold didn’t exactly have a year to write home about (although that didn’t stop him), Schiff and his Bitcoin comments do highlight an extremely volatile year in crypto. As a reasonably quick recap, here’s a reminder of some major 2021 happenings…

• NFTs exploded into the mainstream with a swathe of celebrity participants, not least of all Snoop “Cozomo de’ Medici” Dogg. And there was an overall 646x increase in transactional volume on the OpenSea NFT marketplace compared with 2020, according to Crypto Briefing.

• China spoilt the all-time-high Bitcoin levels by clamping down on Bitcoin mining, then banning crypto altogether – for absolute real this time.

• Coinbase took its stock public with a much-hyped IPO (which some might say also turned out to be a bit of a BTC top signifier).

• Institutional adoption really kicked into gear, with the likes of Fidelity, Goldman Sachs, JP Morgan, the Commonwealth Bank of Australia, the Bank of America, Mastercard, Visa, Paypal, Tesla, just to name several… all getting involved in crypto to some degree.

• El Salvador’s president Nayib Bukele aped his entire country into Bitcoin – making it legal tender in the Central American nation, planned a “Bitcoin City” powered by Volcanic energy, then proceeded to rival Michael Saylor for the dip-buying crown.

• More layer 1 smart-contract protocols than you can shake a hard wallet at surged up the charts, while layer 2s, DeFi and Web3 protocols kept building their own strong narratives, too.

• That said, it was a hell of a year for DeFi hacks – including one of the biggest heists in history, let alone crypto. Being crypto, though, it had a bizarre twist resulting in most of the funds being returned by a “white hat” hacker. Not all hacks this year had such a positive ending.

• Amid ongoing regulatory uncertainty for the crypto industry in America, Bitcoin finally got its first SEC-approved US-based ETFs (albeit futures backed, not spot). These began with a bang but ended the year with a comparative whimper.

• And last but not least, it’s been both a building year in the play-to-earn crypto-gaming (GameFi) and metaverse sectors, as well as a breakout one, too – with the wild success of Axie Infinity very much leading the way, especially in developing nations such as the Philippines.

Bring on 2022.

Top 10 overview

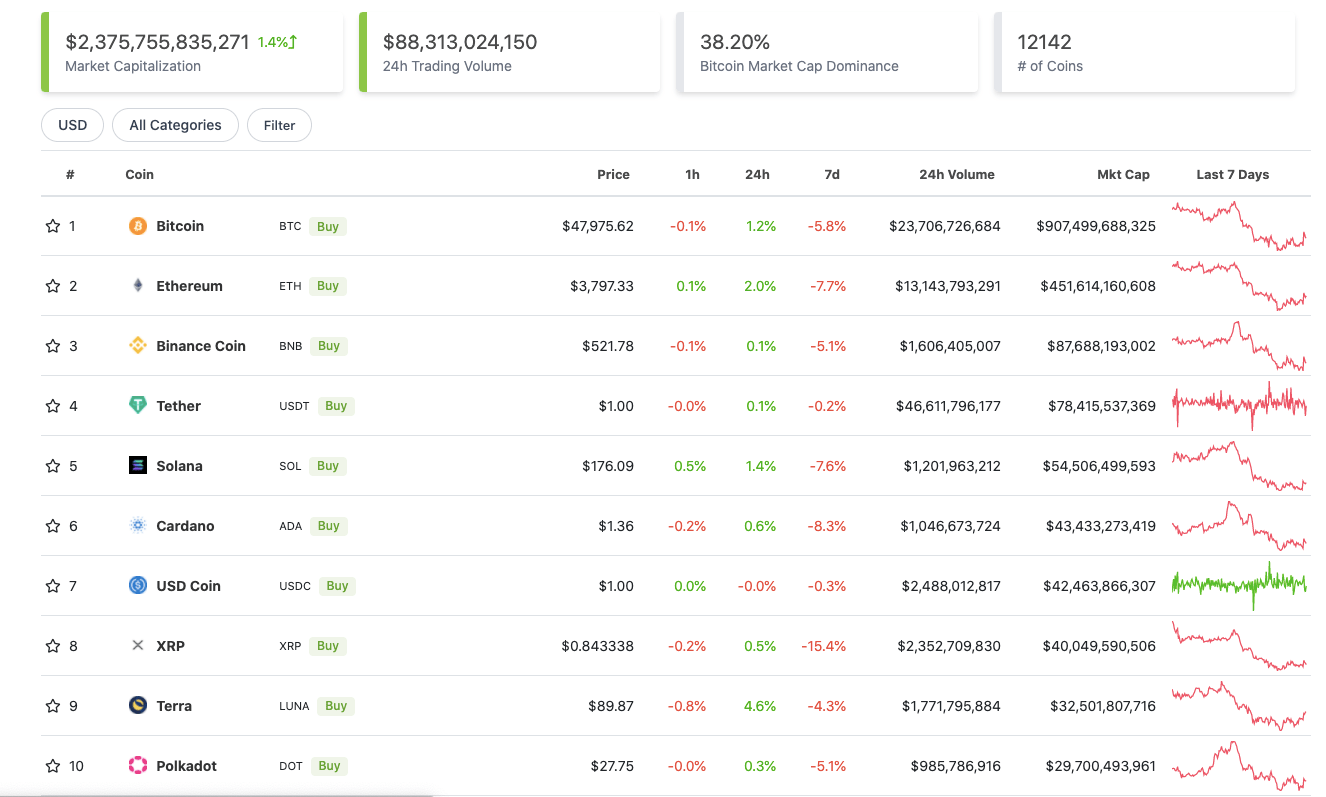

Here’s the state of play in the top 10 by market cap at press time, according to CoinGecko data.

The entire crypto market cap is up about 1.2% since this time yesterday, and the top 10 largely reflects that sort of movement, although layer 1 protocol Terra (LUNA) is clearly the biggest gainer, closing in on a 5% positive over the past 24 hours.

Meanwhile, looking at some further analytical conclusions regarding the OG market-moving crypto (that’d be Bitcoin), full-time crypto chart watcher Rekt Capital is seeing positives ahead for 2022 based around technical support.

The $44000-$47500 #BTC price area figured as resistance in February, August & September

After initial rejection there, $BTC would break beyond this resistance to new highs

This was when this price area was a resistance

Now this same area is acting as support#Crypto #Bitcoin https://t.co/t5H2QCh18b

— Rekt Capital (@rektcapital) December 31, 2021

While there’s a case to be made that this could be a retest of a solid base (and this thesis seems to have plenty of supporters), it’s also easy to find a more bearish take, too. Just gotta throw this one in the mix for balance…

Idk who keeps telling y’all this is bullish but whatever.#bitcoin is below the 200 DMA and 50 WMA. $ETH broke macro uptrend. There is no bullish price action on any timeframe. Inflows in crazy amounts are arriving to exchanges.

Totally Bullish.#cryptocurrency #cryptotrading pic.twitter.com/ifuQU9oL5Y

— Roman (@Roman_Trading) December 31, 2021

Winners and losers: 11–100

Sweeping a market-cap range of about US$26 billion to about US$1.3 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Arweave (AR), (market cap: US$3.15b) +12%

• Aave (AAVE), (mc: US$3.6b) +11%

• Spell Token (SPELL), (mc: US$1.88b) +10.2%

• Celsius Network (CEL), (mc: US$1.92b) +10%

• Convex Finance (CVX), (mc: US$2.2b) +7%

DAILY SLUMPERS

• Olympus (OHM), (mc: US$2.2b) -6%

• IOTA (MIOTA), (market cap: US$3.9b) -4%

• PancakeSwap (CAKE), (mc: US$3b) -2%

Lower-cap winners and losers

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Jade Protocol (JADE), (market cap: US$77m) +250%

• Offshift (XFT), (mc: US$48m) +65%

• Tarot (TAROT), (mc: US$11.4m) +57%

• SafeMoon (SAFEMOON), (mc: US$975m) +38%

• OpenDAO (SOS), (mc: US$249m) +20%

DAILY SLUMPERS

• Universe.XYZ (XYZ), (market cap: US$19m) -12%

• Fusion (FSN), (mc: US$51m) -11.6%

• Glitch Protocol (GLCH), (mc: US$38m) -8%

Happy new year!

https://twitter.com/naiiveclub/status/1476903803806904320

This is @saylor's stacking of sats visualised.

In case anyone wants to something to aspire to for 2022. Best wishes for the New Year. pic.twitter.com/2QX6x3sPhN

— Willy Woo (@woonomic) December 31, 2021

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.