Polygon hits new all-time high as Uniswap v3 deploys; NEAR soars

Getty Images

Polygon is soaring to new heights as DeFi blue-chip Uniswap v3 successfully deployed to the network this morning following an overwhelming vote of UNI tokenholders.

“Christmas comes early this year,” tweeted Polygon co-founder Mihailo Bjelic. “The #1 Ethereum app is again available to everyone!”

Soaring Ethereum gas fees have made using Uniswap prohibitively expensive for everyday users, with supplying liquidity costing well over US$100 in Ether. As a solution, Uniswap has deployed on both Arbitrum and Optimism, but Polygon is more popular than both of those Ethereum scaling solutions combined.

According to DeFi Llama, Polygon is the No. 7 smart contract platform by total value locked (TVL) with US$5.2 billion, while Arbitrum has $1.9 billion and Optimism, $316.4 million.

Uniswap v3’s Polygon deployment had already attracted $4.3 million in liquidity and US$606,000 in trading volume around lunchtime (Sydney time).

Polygon has pledged to support the deployment with US$15 million for a long-term liquidity mining campaign and $5 million towards the overall adoption of Uniswap on Polygon.

Just 503,009 UNI tokens were voted against the proposal, with 72.1 million tokens cast in favour.

Polygon (MATIC) tokens were up 5.6 per cent to US$2.55 at noon, and had hit an all-time high of $2.66 overnight, according to Coingecko. UNI tokens were up 8.6 per cent to US$16.34.

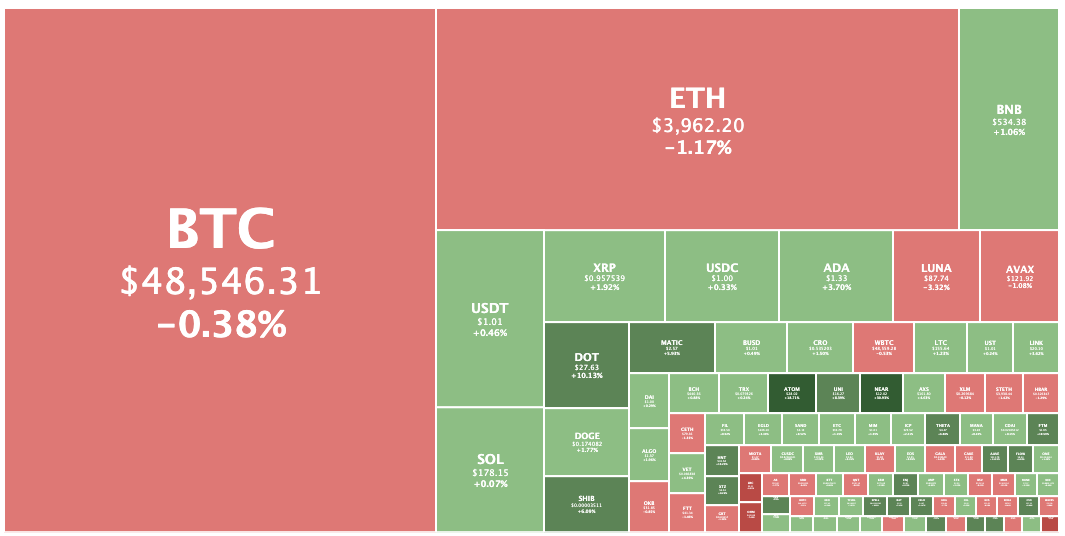

Crypto market up 0.4%

Overall the crypto market was at $2.39 trillion, up 0.4 per cent from 24 hours ago, even though both Bitcoin and Ethereum had edged lower.

BTC was down 1.3 per cent to US$48,380 while Ether had dipped 1.5 per cent to US$3,995.

Terra (LUNA) was down 4.9 per cent to US$86.76, after hitting an all-time high of US$97 yesterday afternoon. The red-hot stablecoin project is still up 40.7 per cent in the past seven days.

Near Protocol was the biggest gainer in the top 100, rising 30.5 per cent to $12, following the launch of its Simple Nightshade sharding solution and a partnership with DePocket Finance.

$NEAR has my attention at the moment..

Seeing some impressive, explosive ecosystem growth 🔥 pic.twitter.com/Ff0baZLlnm

— DREAD BONGO (@DreadBong0) December 21, 2021

Cosmos (ATOM) was up 16.1 per cent to $27.54 and Aave had risen 13.6 per cent to $215.35.

Olympus was biggest loser in the top 100, falling 7.7 per cent to $422.15

.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.