Mooners and Shakers: CPI inflation report fails to ignite crypto market but Fed pause probability rises

Coinhead

Coinhead

Bitcoin had a spurt of upwards action based on the US CPI inflation data reading this morning. Yeah, we know – sexy stuff. But, like a teenage boy’s dream, it was particularly short lived.

At a realised 4.0% Consumer Price Index data increase, inflation and the economy is still sticky over there in the boringly important US of A.

But the good news is, this lands lower than the widely expected 4.1% prediction. And this means the chances of Jerome Powell patting everyone on the back at the Fed for a job well done and ordering a pause on quantitative tightening in less than 24 hours’ time have just significantly increased.

In fact, the CME FedWatch tea leaves reader just hit a 92% probability of that very thing happening. Could this give the crypto market the boost it’s so sorely craving as it enviously watches the S&P 500 and tech-stock-tastic Nasdaq surge over the past couple of days?

News:

CPI YoY – Expected 4.1% – Realised 4.0%

CPI MoM – Expected 0.2% – Realised 0.1%Core CPI YoY – Expected 5.3% – Realised 5.3%

Core CPI MoM – Expected 0.4% – Realised 0.4%Overall, that's a POSITIVE signal as it's dropping substantially.

Markets reacting positive!

— Michaël van de Poppe (@CryptoMichNL) June 13, 2023

CPI inflation: 4%

Food: 6.7%

Shelter: 8%

Transportation: 10.2% pic.twitter.com/RPduCx1NLm

— Bitcoin Magazine (@BitcoinMagazine) June 13, 2023

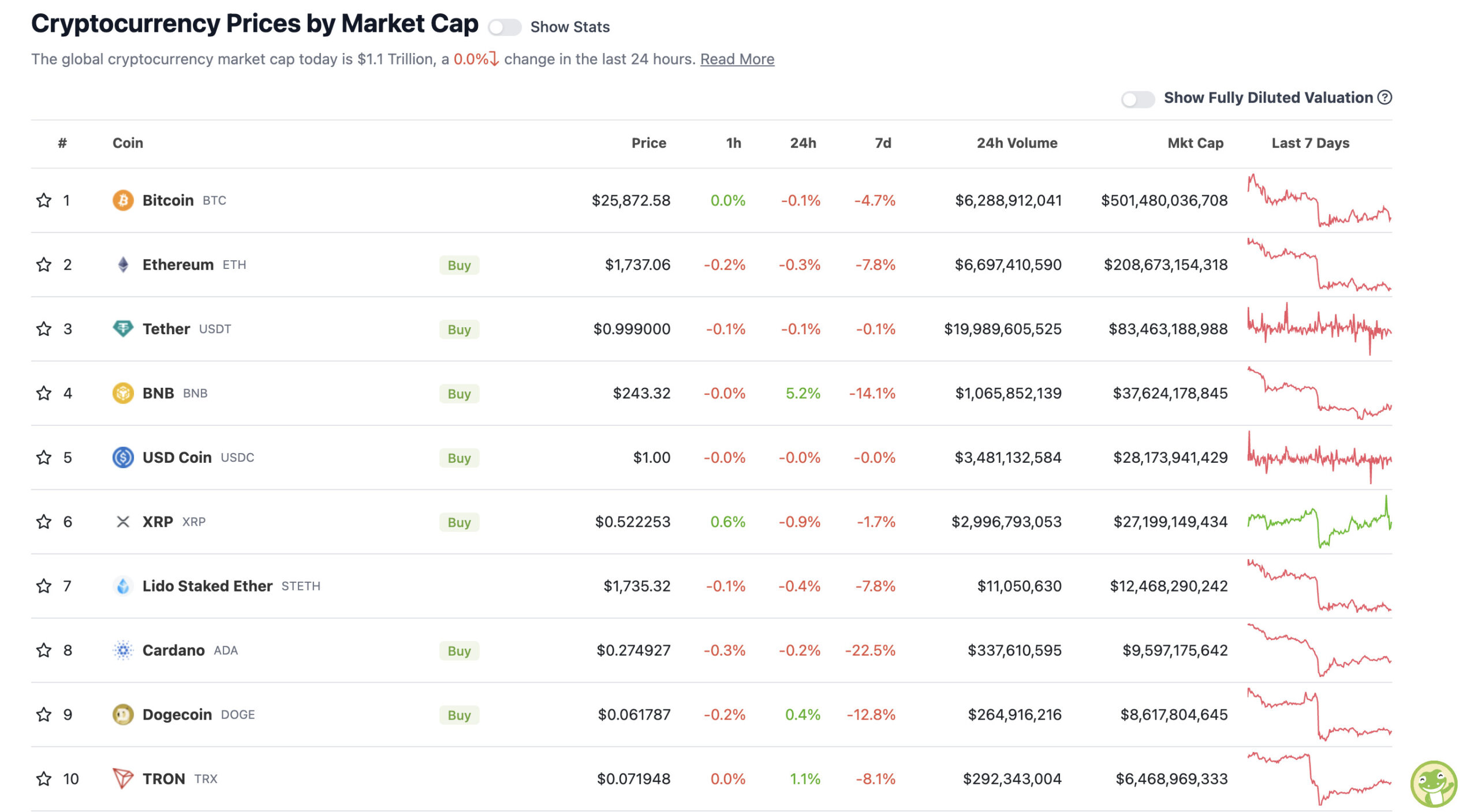

With the overall crypto market cap at US$1.11 trillion, running on fumes since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

The BNB token is, to quote Monty Python, like a stream of bat’s piss today. Or at least its 5% pumping price action is. That is to say, “it’s like a shaft of golden light, when all around is darkness”.

Why is it the only significant gainer in the top 10 over the past 24 hours? It’s because a US judge has quelled the SEC’s hope of enforcing a temporary restraining order on Binance.US for the intention of freezing the exchange’s assets and delivering a hammer blow to the firm’s American operations.

The federal judge, Amy Berman Jackson, who is presiding over the SEC’s lawsuit against Binance and Binance.US has declined the restraining order, indicating that there is “absolutely no need” for one and that the two parties need to reach a level of acceptable compromise.

This would appear to be a small win at this stage for Binance – at least in terms of its continued operation in the States in the meantime and for the potential for some sort of uneasy settlement with the SEC.

Meanwhile, BTC and ETH, the two pack leaders worth looking at first for most sensible (or least crazy) crypto investors and traders, poked their heads above the parapets briefly, but have slunk back to their smoko positions again. Let’s hope they can show some fight after the Fed’s FOMC meeting this week.

Equities: Full Bull.

Crypto: Can't even muster a small pop for us to get short.What a shame lol

— Crypto Chase (@Crypto_Chase) June 13, 2023

Disinflation continues!

Headline CPI prints at +4.0% YoY, which now takes the 3-month annualised rate to +2.21%

The Fed have long targeted 2.0%

PAUSE https://t.co/7lU9yTcQbV pic.twitter.com/gpRH1yTLHF

— ted (@tedtalksmacro) June 13, 2023

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Injective (INJ), (market cap: US$483 million) +6%

• Internet Computer (ICP), (market cap: US$1.72 billion) +6%

• Fantom (FTM), (market cap: US$723 million) +6%

• Terra Luna Classic (LUNC), (market cap: US$548 million) +6%

• Sui (SUI), (market cap: US$373 million) +1%

SLUMPERS

• Monero (XMR), (market cap: US$2.5 billion) -3%

• Gate (GT), (mc: US$557 million) -2%

• IOTA (MIOTA), (mc: US$432 million) -2%

• Cronos (CRO), (mc: US$1.37 billion) -2%

• Theta Network (THETA), (mc: US$640 million) -2%

Various levels of pertinence that stuck with us on our morning moves through the Crypto Twitterverse.

We were half expecting to see the price of XRP well in the green this morning after the public release of the so-called Hinman documents in the SEC vs Ripple legal case. These are emails pertaining to a speech a former SEC director, William Hinman, gave back in 2018, in which he described ETH as not being a security.

There’s a lot of nuance to cover regarding this, too much for this section, although we’ll attempt in a separate article. For now, here are some tweets…

The Hinman emails help @coinbase, #ETH and @Ripple’s fair notice defense. How much it helps anyone in a courtroom is yet to be seen. But in the Court of Public Opinion and in Congress, the emails should help drive attention to how hypocritical and reckless the SEC is being. https://t.co/kdYOSsh2RX

— John E Deaton (@JohnEDeaton1) June 13, 2023

1/25

SEC Hinman email release summary:

-Not a big impact to the $XRP case.

-Decently positive for $ETH.

-Nuance puts Gensler in a corner.Let's recap the Hinman speech and I'll explain why this is damning for Gensler's position! pic.twitter.com/Ca4ljiJYZr

— Adam Cochran (adamscochran.eth) (@adamscochran) June 13, 2023

How do you go from 75% of the crypto market are commodities to everything except Bitcoin is a security?

You become Chairman of the SEC and you’re tasked with bringing an industry to its knees in order to protect and help your incumbent friends. https://t.co/WUEbMpXLz2

— John E Deaton (@JohnEDeaton1) June 12, 2023

1/ It’s been 5 years since Bill Hinman gave his infamous speech – and through the SEC’s lawsuit against @Ripple (and 7 court orders), we can finally share what happened behind the scenes through the now public emails / drafts of the speech. pic.twitter.com/sx2TpW0TYe

— Stuart Alderoty (@s_alderoty) June 13, 2023

Since the US has come after crypto:

• Hong Kong has legalised retail trading

• Europe has introduced a new MiCA framework

• UAE and UK are both pushing "Crypto Hub" narratives

• A16z opens a new London office

• Coinbase + Gemini have launched international platforms

•…— Miles Deutscher (@milesdeutscher) June 13, 2023