Mooners and Shakers: Big week for crypto as markets hope for Fed pause; Gary Gensler in firing line again

The crypto market could do with a Fed time-out. (Getty Images)

Bitcoin and the rest of the teetering crypto market appear set for a “HUGE week”, according to many observers, with macro winds (heads or tails) swirling.

So what’s going on? Quite a bit, including prominent Republicans seeking the dismissal of SEC chair Gary Gensler. More on that towards the end of the article.

First, here’s a helpful bullet-pointed list from Aussie crypto analyst Miles Deutscher who is part of a popular crypto YouTubing collective called Crypto Banter.

This is a HUGE week for crypto:

Tuesday:

• US CPI Data

• Hinman Docs Become Public

• SEC's Coinbase Rulemaking Response

• Binance US HearingWednesday:

• US PPI Data

• FOMC MeetingThursday:

• US Jobless Claims

• US Retail Sales DataVolatility incoming.

— Miles Deutscher (@milesdeutscher) June 12, 2023

The all-important US CPI inflation data hits in a matter of hours and, as usual, should prove influential on the Fed’s next move re rate hiking/pausing at its imminent FOMC meeting – also this week.

The consensus, certainly judging by the strong US stock market performance overnight, seems to be that a Fed pause on its mega-tightening epic is the most likely outcome. The CME FedWatch tool predictor is certainly indicating thusly, pointing to a 79% chance of a pause.

Out of all the things on that list in the tweet above, this has the potential to lift the crypto market the most in the short term.

That said, the Hinman documents – emails from 2018 pertaining to an important speech from a former US Securities and Exchange Commission (SEC) director regarding Ethereum – are set to be made public. William Hinman, at that time, publicly stated that Ethereum, the leading crypto altcoin, was not a security.

These emails are said to reveal the broader SEC views on the matter at that time in 2018, and, according to Brad Garlinghouse, CEO of Ripple, which is in a long-standing legal tussle with the US agency, the documents are “well worth the wait”.

Wish I could go in depth now, but we've waited this long (18+ months), I don't want to overstep… suffice it to say @s_alderoty and I believe they were well worth the wait.

— Brad Garlinghouse (@bgarlinghouse) June 12, 2023

https://twitter.com/twobitidiot/status/1668328519334780928

Meanwhile, of course, the crypto market continues to tread extremely nervously given the latest assault on the crypto market from Gary Gensler’s SEC – pointedly on the exchanges Binance.US and Coinbase.

About a week ago now, the SEC filed lawsuits against the two big crypto entities, claiming that 61 different crypto assets, representing about US$100 billion in collective value, are securities.

In particular, over the course of the next 24 hours, a hearing in the US regarding the SEC’s “draconian and unduly burdensome” move (according to Binance.US) to freeze the exchange’s funds via a temporary restraining order, is coming to a head.

We’ll see, but this could end very badly for Binance in the US, which would place further weight on sinking crypto assets, in particular altcoins. That said, crypto-focused lawyer James “MetaLawMan” Murphy seems to think Binance.US is giving itself a decent chance.

The @BinanceUS defendants are represented by Bill McLucas who served at the SEC for 20 years and headed the Division of Enforcement for 8 years.

He is a legendary figure of the securities bar.— MetaLawMan (@MetaLawMan) June 12, 2023

Top 10 overview

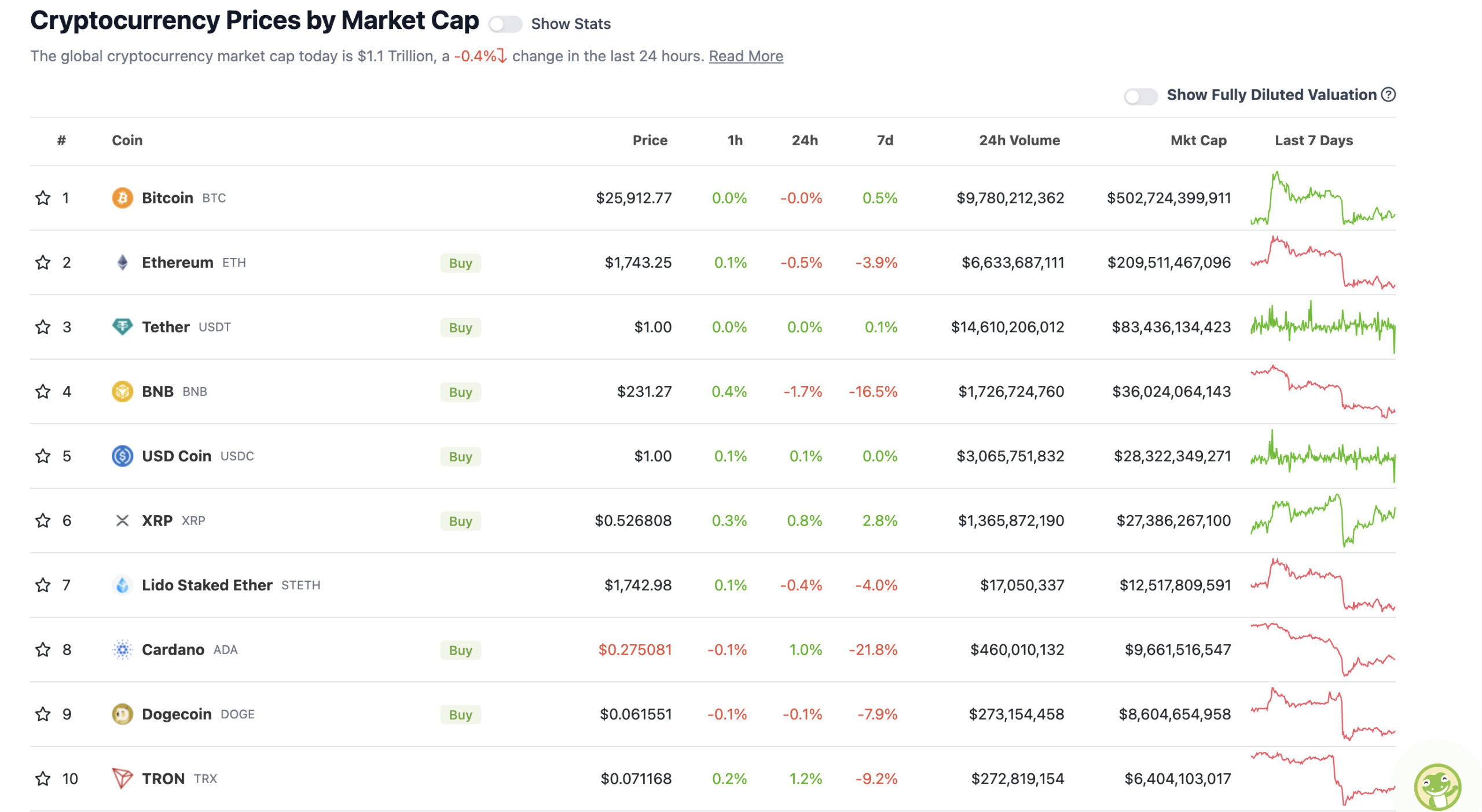

With the overall crypto market cap at US$1.11 trillion, down a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

So, yep, Bitcoin and Ethereum are hanging in there for the moment. Where’s there? Teetering around some support levels. Bitcoin, however, appears in danger of losing its 200-weekly moving average support, and some technical analysts are beginning to get a little gloomy on the leading crypto’s short-to midterm price outlook.

Since the mid-April rally to ~$31000, #BTC has been in a consistent downtrend$BTC has been forming new Lower Highs every 2-3 weeks or so

If this pattern continues, a new Lower High may occur in the next week or two#Crypto #Bitcoin pic.twitter.com/GWx0LO2Gig

— Rekt Capital (@rektcapital) June 12, 2023

Not necessarily Roman Trading, however…

Bitcoin pumped 100% off it’s bottom within 2 months. We’ve corrected 20% since the large upward move.

None of you have patience and it shows. https://t.co/GQy6uRh82I

— Roman (@Roman_Trading) June 12, 2023

$SPX 1W

Currently breaking out into our macro bullish zone. This would give 2/3 confirmations that the bottom is in.

I've stated we've already gone through recess and it is likely that the markets will begin recovery.

Now we need the $DXY below 101 for full confirmation.… pic.twitter.com/zpEIiFcCtW

— Roman (@Roman_Trading) May 19, 2023

Meanwhile, just looking at that top 10 list, we can see that Justin Sun’s Ethereum copycat TRON (TRX) has wormed its way back into the crypto majors after a very lengthy absence. Solana (SOL) and Polygon (MATIC) have dipped out, being two of the cryptos directly named in the securities violation lawsuits levelled at Binance and Coinbase.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Sui (SUI), (market cap: US$354 million) +12%

• Uniswap (UNI), (market cap: US$3.24 billion) +6%

• Optimism (OP), (market cap: US$729 million) +5%

• Cosmos Hub (ATOM), (market cap: US$2.56 billion) +4%

• ImmutableX (IMX), (market cap: US$621 million) +4%

SLUMPERS

• Rocket Pool (RPL), (market cap: US$804 million) -7%

• Curve DAO (CRV), (mc: US$542 million) -4%

• Casper Network (CSPR), (mc: US$441 million) -4%

• ApeCoin (APE), (mc: US$829 million) -4%

• Mina Protocol (MINA), (mc: US$371 million) -2%

Around the blocks: Republicans seek Gensler removal

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Now this is… pertinent.

Warren Davidson, a member of Congress serving on the House Financial Services Committee, has launched, in conjunction with fellow prominent Republican Tom Emmer, a bill called they’re calling the SEC Stabilization Act, in order to “restructure the SEC and fire Gary Gensler”.

If successful, it would remove the overarching control of the head of the agency, spreading rule-making and enforcement decisions across a six-strong board. In other words, heavily diluting the centralised, somewhat tyrannical point of control that currently exists within the US regulator’s setup.

🚨 NEWS – Today I filed the SEC Stabilization Act to restructure the @SECGov and #FireGaryGensler.

U.S. capital markets must be protected from a tyrannical Chairman, including the current one. It’s time for real reform and to fire @GaryGensler as Chair of the SEC. Statement ⬇️ pic.twitter.com/0VUHxUAhtB

— Warren Davidson 🇺🇸 (@WarrenDavidson) June 12, 2023

— Warren Davidson 🇺🇸 (@WarrenDavidson) June 12, 2023

Breaking: US lawmakers file 'SEC Stabilization Act' to fire Gary Gensler. #crypto pic.twitter.com/KMZWZiXCZe

— Altcoin Daily (@AltcoinDailyio) June 12, 2023

https://twitter.com/titopriv/status/1668379762300178437

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.