DeFi funding surged in 2022 while ‘CeFi’ struggled in the wake of the FTX implosion

Coinhead

Coinhead

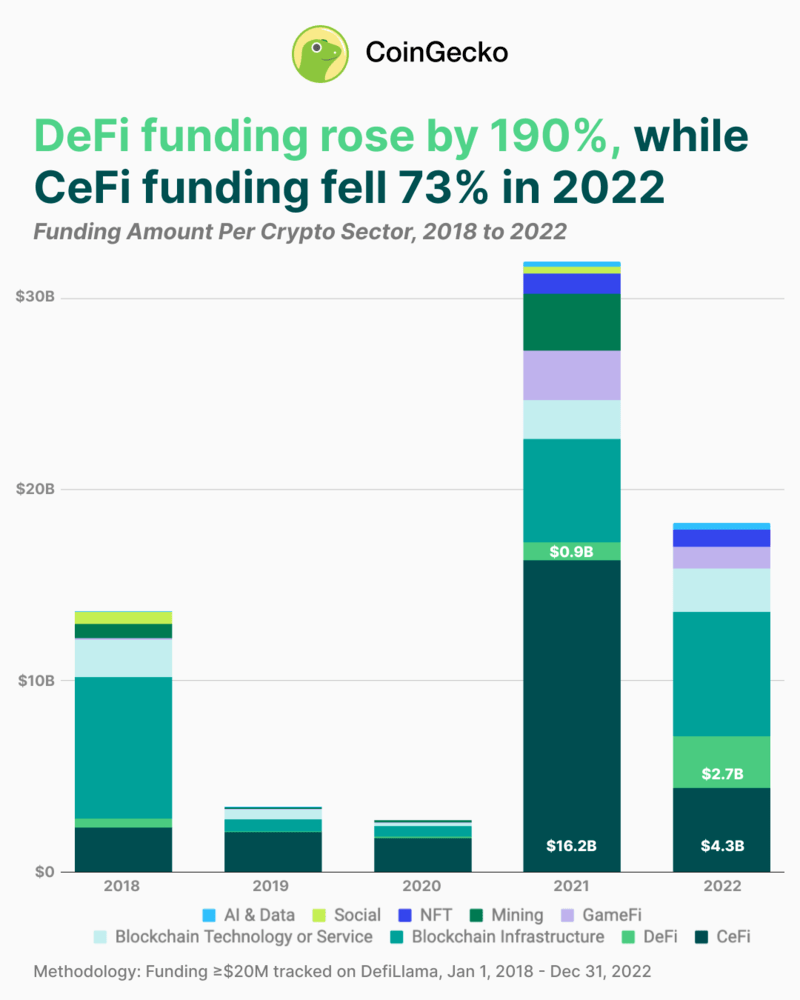

In an overall very bearish 12 months for crypto in 2022, it’s been revealed in a CoinGecko research report that digital asset investment firms poured US$2.7 billion into decentralised finance (DeFi) projects, up 190% from 2021.

Meanwhile, investments into centralised finance (CeFi) projects dipped sharply — falling 73% to US$4.3 billion over the same timeframe.

Yep, that’s still a fair chunk of change, but it reflects a shifting trend, believes the CoinGecko “Growth Team” data analyst Lim Yu Qian, who compiled the research, which was published a few days ago and cited data from popular DeFi analytics site DefiLlama.

DeFi’s investment-funding gains last year almost tripled the funding capital inflows in that sector in 2021, even as the market shifted from a bullish sentiment to bearish fairly swiftly in the first half of 2022.

“This potentially points to DeFi as the new high growth area for the crypto industry in the next few years, with the industry maturing and an increasing number of on-chain participants.,” wrote CoinGecko’s Qian.

“In comparison, the decrease in CeFi funding likely reflects the sector reaching a degree of saturation,” she added.

The near three-fold increase in DeFi investment is also a whopping 65-fold increase from 2020, at the start of the last bull run, noted the Qian in the report.

According to CoinGecko, some of the most notable DeFi projects that managed to raise funds last year included the leading decentralised exchange Uniswap (UNI), with itss Series B round of US$165 million, and the liquid staking protocol Lido, which raised a total of US$94 million “on the back of accelerating growth”.

The largest DeFi funding by far, however, the report noted, was Luna Foundation Guard’s (LFG) US$1 billion sale of LUNA tokens in February 2022, just a few months before the Terra (LUNA) crash. The amount raised by LFG was equivalent to 37.0% of DeFi funding last year.

The imploded, now-bankrupt centralised exchange FTX and its subsidiary FTX US were the largest recipients of CeFi funding, meanwhile, having raised a total of US$800 million in January – which accounted for 18.6% of CeFi funding in 2022 alone.

Other areas of investments included blockchain infrastructure and blockchain technology companies, which raised $2.8 billion and $2.7 billion, respectively, said CoinGecko, noting: “Aside from CeFi, these two sectors had the strongest performance in the past five years.”

DeFi, in particular Ethereum-based DeFi, continues to be the strongest area of focus for a regular Coinhead article collaborator, Australia’s leading crypto fund Apollo Crypto.

In recent Apollo’s Alpha articles, we’ve highlighted:

• Conic Finance – a yield-maximising protocol for Curve liquidity pools. Conic (CNC) is “a potential DeFi blue chip”, believes Apollo analyst David Angliss.

• NFTfi – a sector where DeFi meets NFTs, allowing for capital efficiency and yield opportunities on otherwise dormant non-fungible tokens. Protocols of interest for Apollo in this area include JPEG’d; NFTPerp; and Insrt Finance.

• Lyra Finance – “The most complete decentralised crypto options trading protocol built on Ethereum,” according to Angliss.

• Liquid staking protocols – (such as Lido Finance, see further above) including Swell Network and SSV.