‘WHAT… HAPPENED’? A look back on crypto’s ‘biggest year yet’ (for fraud, hacks, implosions…)

Coinhead

Coinhead

Crypto 2022 was going to be the market and industry’s “biggest year yet” thought many a pundit/expert amid sky-high Bitcoin predictions.

And with a total crypto market cap of around US$2.5 TRILLION on Christmas Day 2021, we were inclined to believe it.

As it stands, though, it’s been one of the very worst years on record for crypto price action. You’ll obviously know this if you’ve managed to hold on to the scraps of some sort of crypto portfolio. (Hopefully you managed to lock in some profits earlier in the year.)

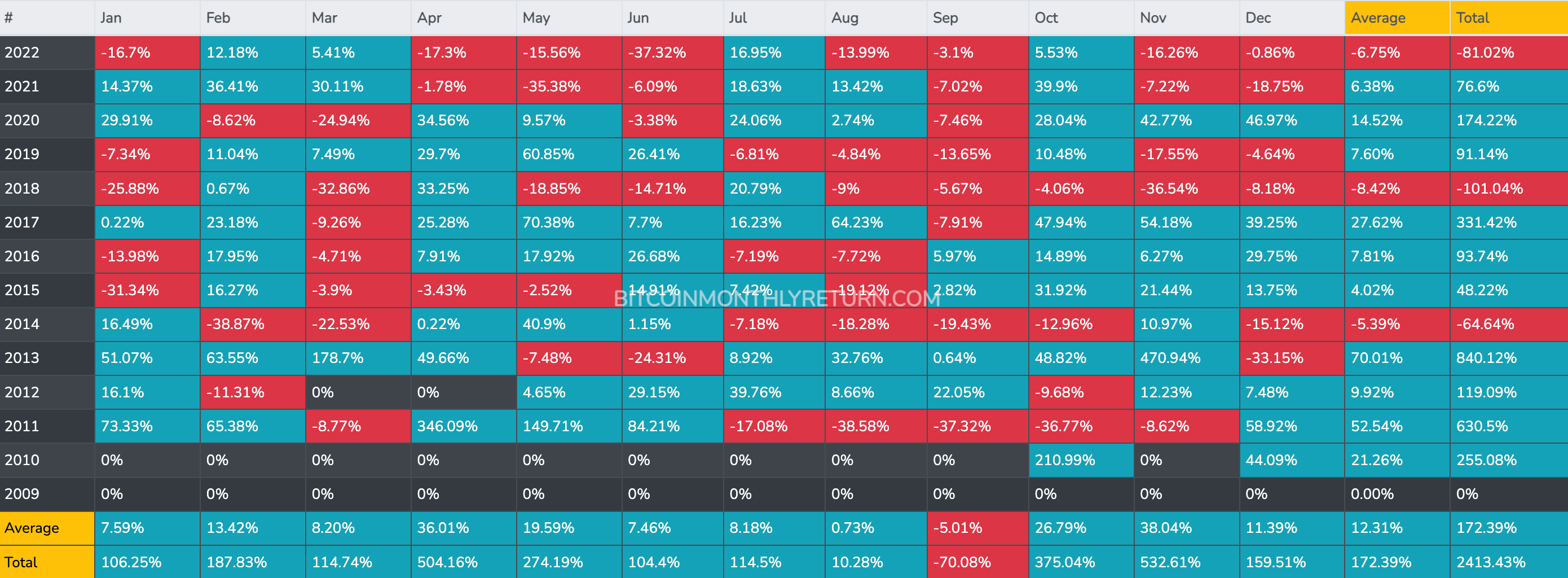

In fact, according to bitcoinmonthlyreturn.com, it’s the second-worst year for Bitcoin since its inception.

So what happened? Lots actually. Including the loss of more than US$1.6 trillion from the market since the end of 2021. And quite a bit more if you trace it back to the peak of the market in November 2021, as Collective Shift’s Ben Simpson points out here:

Since Nov 2021, $2.2 trillion has been wiped from the total crypto market cap.

An industry worth $3 trillion in 2021 is $800 billion today.

Even if we go back to previous ATHs, a small investment here can turn into massive returns.

Keep stacking those blue-chip assets 💰

— Ben Simpson (@bensimpsonau) December 15, 2022

In fact, this Fox Cricket graphic, shown on day three of the second Test against the West Indies in Adelaide in early December, pretty much shows the trajectory of the market from mid 2021 to the end of this year…

“Cryptocurrency doesn’t fall as fast as that!” noted commentator Kerry O’Keeffe, after Steve Smith skied a shot and was dropped on 27 by Alzarri Joseph off Jason Holder’s bowling.

For a more accurate, non-cricket-tragic graphic on this year’s Bitcoin price movement, though, here’s one from CoinGecko… with a few little annotations for context.

So then, delving deeper into the corridors of our selective memory, we thought we’d travel back to the beginning of January 2021 and remind ourselves about: “What… Happened”.

To quote geriatric Han Solo and Princess Leia from the best of that generally pretty ordinary Star Wars trilogy… “It wasn’t all bad, was it? Some of it was… pretty good.”

The crypto year actually started off okay, and, to be completely fair to it (lest we hurt its feelings too much) there really has been a stupendous amount of incredible, eyebrow-raising mainstream adoption news. We know, because we covered a lot of it. So that’s the big silver lining we’re taking from this year.

But… when things turned south for crypto in 2022, it sure felt cataclysmic.

Geopolitical and macroeconomic factors (war, rising inflation, everything Fed boss Jerome Powell says) have obviously had their triggering effects all year on this and other markets. But crypto has also done a pretty damn fine job of shooting itself in both feet.

• Funding is flowing, cash is splashing. Tokenised coins are… tokenising. The FTX global crypto exchange raises a US$2 billion venture fund and is valued at a whopping US$32 billion. Sam Bankman-Fried is clearly a clown-haired, über nerd GENIUS.

• If you’ll excuse the awkward double negative, NFL mega star Tom Brady clearly doesn’t have NFI about NFTs – his sports-focused platform Autograph raises US$170m in a Series B. He might be on to something here, but maybe he should also link up with SBF and FTX in a “Hell yeah, I’m in” business deal before retiring from football and living happily ever after with Gisele Bündchen. Sounds like a plan.

• Goldman Sachs says it reckons BTC can hit US$100k as a “hypothetical store of value”.

• US billionaire investor Bill Miller reveals he holds 50% of his net worth in Bitcoin.

• Reality star Stephanie Matto (no, we’d never heard of her, either), who made $200k selling farts in jars, pivots to NFTs. And yep, it’s a completely insignificant story, but it’s hard to resist that headline.

• Famous podcaster Joe Rogan starts banging on about his high hopes for crypto.

• Tesla launches DOGE merch payments.

• Apple CEO Tim Cook, who has dipped his toe into crypto investing by this point, “sees a lot of potential in metaverse”.

• Rio De Janeiro makes Bitcoin moves, mayor shifts 1% of City Treasury into BTC.

• AFL and AFLW sign huge, $25m, five-year deal with the Crypto.com exchange.

• Walmart signals metaverse move.

• Robinhood begins testing its crypto wallet, while Coinbase partners with Mastercard for NFT purchases.

• The Australian Open serves up some innovative, court-data-utilising NFTs.

• Reddit founder Alex Ohanian’s crypto-focused VC firm raises US$500m, while FTX secures another US$400m in funding and Polygon raises US450m.

• Russia moves to legalise and license crypto exchanges, while crypto donations to Ukraine hit US$20m in just a few days.

• The world’s largest asset manager BlackRock is rumoured to be planning a big crypto move. The “herd is coming”, right Mike Novogratz?

• Canada sanctions 34 crypto wallets connected to Freedom Convoy trucker protest.

• MicroStrategy Buys US$25m worth of Bitcoin at US$37,865 per BTC. Michael Saylor tweets about Bitcoin only about 25 times a day.

• NYSE files trademark for NFT trading. (Herd… coming.)

• Solana DeFi bridge “Wormhole” cops a US$320m hack. Ouch. Major ouch.

• GameStop partners with Immutable on a US$100m gaming fund. Immutable is an Aussie-founded firm focused on Web3 gaming with its Ethereum-scaling blockchain layer ImmutableX.

• Luna Foundation Guard (LFG) raises US$1 billion to create a reserve for the the Terra Luna ecosystem stablecoin UST. Terra’s founder Do Kwon runs LFG, which is also a popular acronym for “Let’s F**king Go”. Sounds legit. What could possibly go wrong?

• Luna Foundation Guard buys US$1.3 billion worth of BTC as treasury reserve for UST, and plans to buy US$10 billion all up. LUNA token moons. This Do Kwon bloke – got some kahunas, eh? What a deadset legend.

• Immutable raises US$200m at $2.5b valuation; Helium raises US$200m; and Bored Ape Creator Yuga Labs raises US$450m at a $4b valuation.

• In fact, March is a huge month for crypto funding in general, with Optimism, Mina Protocol, LayerZero, Lido Finance and ConSensys all benefitting, and several huge crypto venture funds (e.g. Haun Ventures, Electric Capital, Bain, Spartan) launching or raising.

• MicroStrategy takes out US$205m loan from the Silvergate bank to buy more Bitcoin. Why not, eh?

• Yuga Labs acquires CryptoPunks and Meebits from Larva Labs.

• Instagram announces plans to integrate NFTs.

• So far so good for March, then. Uh-oh, hang on… leading play-to-earn game Axie Infinity’s side chain bridge Ronin is hacked for a whopping US$620m in ETH.

• ApeCoin (APE) is airdropped to Yuga Labs, VC investors and Bored Ape holders. The token dips immediately.

• The US government releases Executive Order on Digital Assets, calling for more focused research so that Biden and pals can work out what the eff they actually are.

• Florida knows what crypto is. It decides to accept Bitcoin for tax payments.

• US inflation balloons while price of Bitcoin hits a wall.

• The HSBC bank buys a virtual land plot in blocky blockchain metaverse The Sandbox.

• Legendary US investor Ray Dallio’s hedge fund is said to be investing in Bitcoin/crypto. (It was “probably nothing” we said at the time. Turns out we were pretty much bang on.)

• Oh, nearly forgot, at the start of March, a competitor for the worst crypto-related moment of the year happened. This… from Mark Zuckerberg’s sister Randi…

A decade ago, I sang this song on Broadway. Today I sing this song, surrounded by new friends, as a rallying cry for the women of web3. Together, we can accomplish anything. And have fun doing it! #WAGMI

PS Look for some fun cameos!

PPS Sorry for *language* at the end 🤣 pic.twitter.com/W9pYZmxwXz— Randi Zuckerberg 🤗 (@randizuckerberg) February 28, 2022

And with the added benefit of hindsight, that was as crystal clear a signal you could get that maximum pain was heading the crypto market’s way in coming months. Well, after boring old April at least…

• Gemini describes 2022 as a breakout year for crypto adoption in Australia.

• OTR petrol stations and convenience stores announce that they plan to accept crypto payments.

• DOGE pumps as Elon Musk buys stake in Twitter and joins board. (Why? Musk is a massive Dogecoin fan, for some reason.)

• As MicroStrategy buys another US$190m worth, Terra Luna founder Do Kwon says that Terra will “buy Bitcoin forever”. Bitcoin maxis everywhere are in danger of nodding their heads clean off.

• British Treasury department says it has plans to make UK a “global crypto hub“.

• AFL punts on NFTs in deal with players’ union and Animoca Brands; while Cricket Australia gets on front foot with mon-fungibles, too, in a multi-year deal worth millions. The NRL? For now, it’s thrown a cut-out pass that’s cut out NFTs.

• NEAR Protocol, a layer 1 blockchain Ethereum competitor, raises US$350m.

• USDC stablecoin issuer Circle raises US$400m from BlackRock, Fidelity and others.

• Meta deemed “out of touch” as it plans near 50% fee for sales of digital assets in its metaverse.

• Spot Bitcoin and Ethereum ETFs enter the Aussie exchange-traded-fund landscape. Hopes are high.

• LUNA token soars again, as does a new “blue chip” NFT project called Moonbirds. This crypto writer manages to obtain one, sell it reasonably high, and use resulting funds to leave England and bring his family back to Australia.

• Bitcoin adopted as legal tender by Central African Republic.

• Finder report predicts an $80k Bitcoin in 2022.

• Move-and-Earn crypto narrative kicks on as STEPN gets a Coinbase listing.

• The Bored Apes metaverse project Otherside experiences an NFT land rush, which sparks a gas war. It’s almost as crazy as it sounds.

• Just a reminder from Warren “Bitcoin is Rat Poison Squared” Buffett… he still hates crypto.

• Bitcoin slides to 10-month low as altcoins take a beating.

• The Terra ecosystem’s fateful collapse begins, with the UST stablecoin depegging from its US dollar 1:1 correlation. Do Kwon, eh? What an IDIOT!

• Coinbase CEO Brian Armstrong suggests COIN’s 84% decline is at ‘fire sale prices’ after US$430 million loss.

• NFT sales volumes dive and blue chips such as CryptoPunks and Bored Apes, sell for big losses. Meanwhile, Madonna and Beeple team up for some seriously weird non-fungible action.

• It’s the second biggest crypto-market puke in history as Bitcoin tanks from about US$40k at the beginning of the month to around US$24k.

• In what seems like a ridiculously bold (or just ridiculous) move at this point in proceedings, amid so much uncertainty, Cathie Wood’s ARK Invest buys US$3 million worth of Coinbase (COIN) stock.

• Albo becomes the Aussie PM and the local crypto industry ponders what that means for regulations in this country.

• Bitcoin and crypto languish, but meanwhile, huge VC firm Andreesen Horowitz (aka a16z) raises a stupendous US$4.5 BILLION for a new crypto fund – its fourth and the biggest the industry has seen so far.

• Galaxy Digital’s Mike Novogratz, who was so confident on Terra and Do Kwon that he got a gigantic LUNA tattoo on his arm, breaks his silence on the collapsing Terra ecosystem.

• Crypto Twitter responds with helpful ways to fix his ink:

i got you, @novogratz. pic.twitter.com/mAYwcoIMGS

— badly drawn barry | gladiator lx (💙,🧡) (@badlydrawnbarry) May 13, 2022

• Aussie-founded Web3 game Illuvium manages to sell out its $US75 million virtual land sale in the middle of one of the scariest periods of the brutal bear market this year.

• Canada’s 3iQ launches two crypto ETFs on Cboe Australia with lowest fees on market. Seems like a dicey time to do it, but ah well, YOLO, right?

• Citadel Securities, Virtu, Fidelity and Charles Schwab form fat-cat crypto-platform supergroup.

• Uh-oh, Three Arrows Capital (3AC) – the widely connected crypto hedge fund run by two blokes who invite a hell of a lot of schadenfreude – blows up. The resulting contagion from both this and the Terra Luna implosion roils any chance of the crypto market improving much in the coming months.

We are in the process of communicating with relevant parties and fully committed to working this out

— Zhu Su 🔺 (@zhusu) June 15, 2022

• Huge crypto lending firm Celsius looks like it could be in trouble as it pauses user withdrawals amid liquidity crisis. Spoiler alert: yeah it’s in massive trouble. CEL token tanks.

• Another lender, BlockFi, loses hundreds of millions on bad loans to 3AC and others.

• SBF’s FTX helps out BlockFi with a US$250m loan. He’s a good bloke, this SBF isn’t he? CNBC’s Jim Cramer even compares him with JP Morgan, who bailed out the banks in 1907 – and Cramer’s judgement is usually pretty rock solid… Right?

Sam Bankman-Fried doles out credit lines to save crypto institutions. He's the new JP Morgan!

— Jim Cramer (@jimcramer) June 22, 2022

• ANOTHER large crypto lending firm – Voyager Digital – all but implodes on the 3AC contagion, but luckily it receives an emergency US$500m loan from a company called Alameda Research. Ah, as it so happens Alameda is the sister trading firm of FTX – so it makes sense. It’s a good thing the crypto industry has FTX/Alameda around to prevent things from getting a whole lot worse.

• Annnnd another one… crypto financial services firm Babel Finance looks to be up poo creek minus a paddle. It later turns out it somehow managed to lose about US$280 million trading around with customer funds. Nice job.

• In a surprise to just about everyone, the Bank of England talks up the crypto industry, hypothesising that crypto survivors could become the next ‘Amazons and eBays’.

• The US Securities and Exchange Commission denies Grayscale its BTC ETF. Grayscale spits the dummy and files a lawsuit against the SEC on the very same day.

• While the likes of layer 1 cryptos Solana and Avalanche tank, US Fed boss Jerome Powell speaks in Sintra, Portugal (been there, it’s delightful). He notes that while there is “no guarantee” of a soft landing for the US economy, he thinks there are, um, “pathways for us to achieve the path” back to 2% inflation, while retaining US labour-market strength.

The Fed engineering a soft landing pic.twitter.com/iwZqcacRNZ

— Sven Henrich (@NorthmanTrader) June 28, 2022

• US senators Cynthia Lummis and Kirsten Gillibrand announce their 69-page “Responsible Financial Innovation Act” – a bill designed to implement innovation-friendly regulations for digital assets.

• Floor prices for Bored Ape Yacht Club and other NFT blue chips plummet. In fact, crypto prices in general bleed all month. BTC began June around US$30k and ended it around US$20k.

• Twas a busy month, June. What else happened? Solana announces plan for a smartphone; MicroStrategy keeps buying the Bitcoin dip; Ronaldo partners with Binance for NFTs; PayPal enables transfer of crypto to external wallets for the first time; US prosecutors charge NFT platform OpenSea’s Nathaniel Chastain with insider trading; and Coinbase lays off 18% of its staff.

Whoa… we’re halfway there. Grab a drink, and let’s keep going…

• Gold bug and Bitcoin hater Peter Schiff’s bank is suspended, which delights Bitcoin hodlers everywhere; Deutsche Bank predicts US$28k BTC by end of year.

• The India-based crypto lender Vauld freezes withdrawals. Meanwhile one of the main lending rivals in the space, Nexo, looks to scoop up Vauld, while Voyager files for bankruptcy. Vauld also later files for bankruptcy.

• Despite all the doom and gloom surrounding crypto, funding in the space is still flowing. Influential gaming, NFT and metaverse-focused firm Animoca Brands raises US$75m as its valuation climbs, while Multicoin Capital launches a huge US$430m fund.

• US inflation hits a 40-year high. The macro effects on the crypto industry remain clear this year.

• Celsius files for Chapter 11 bankruptcy.

• Tesla sells about 75% of its Bitcoin holdings for US$936m, but records a US$106m loss on the trade.

• Three Arrows Capital files for bankruptcy and its founders Su Zhu and Kyle Davies go into hiding, apparently due to death threats. Terra’s Do Kwon’s wherabouts, incidentally, is also basically unknown. (Later in the year, though, all three of these disgraced crypto founders re-emerge on social media to offer their largely unwelcome two cents on the FTX saga.)

• It’s revealed the lending arm of crypto-trading platform Genesis has lost hundreds of million of dollars amid the 3AC debacle. Its parent company, the massive Digital Currency Group, assumes its liabilities. Genesis files a US$1.2B claim against 3AC.

• Crypto exchange Blockchain.com loses US$270m amid crypto contagion.

• Money is still flowing into the industry, though. VC firm Variant raises US$450m for two funds, while Multicoin Capital announces a US$430m venture fund.

• Facebook’s Libra spin-out, the new layer 1 project Aptos, raises US$150m, led by FTX Ventures, among others.

• Auction house Christie’s announces Web3 venture fund.

• Russia decides to ban crypto payments, while Minecraft announces a ban on NFTs.

• The US Treasury sanctions the use of Ethereum-based crypto-mixing service Tornado Cash. Later, the developer of Tornado Cash, Alexey Pertsev, is arrested.

• Reserve Bank of Australia commits to testing the viability of a CBDC (Central Bank Digital Currency). For fans of Bitcoin and decentralisation, CBDCs are seen as an Orwellian concept.

• BlackRock hops into bed with Coinbase for the provision of crypto access for its institutional clients.

• CoinFund raises US$300m; Shima Capital raises US$200m, and there’s plenty more crypto funding besides, with the likes of a16z, FTX Ventures, Alameda and Jump Capital highly active.

• FTX and Alameda Research merge their venture-investing operations; Genesis CEO steps down, as the firm slashes staff by 20%; Sam Trabucco resigns as Co-CEO of Alameda Research. In hindsight, there was some foreshadowing going on here.

• Another shocking crypto hack (in what was to become the worst year ever for those). Nomad, a cross-chain bridge protocol used to make transactions between different blockchains faster and simpler, is exploited for roughly US$190m.

• Washington DC Attorney General sues Michael Saylor and MicroStrategy for tax fraud.

• BlackRock apes into Bitcoin further with BTC private trust.

• Skybridge Capital predicts $300k Bitcoin; JP Morgan boss foretells ‘something worse’ than recession.

• DOGE surges on the momentum of the Ethereum-compatable Dogechain.

• US dollar takes off, leaving crypto grounded.

• Aussie government announces plans to learn about and audit the crypto industry in what it dubs “token mapping”, before making plans to regulate.

• Melbourne woman ordered to sell mansion bought with Crypto.com fat finger funds.

• It’s revealed that Google has, to this point, invested US$1.5 BILLION into crypto firms.

• CNBC’s Jim Cramer tells everyone to sell their crypto assets. (We have to reluctantly admit, maybe this wasn’t such a bad call after all at this stage of the bear market.)

• Ethereum’s much-vaunted “Merge” from the energy-chewing Proof of Work model to Proof of Stake is successfully completed. Excitement abounds…

• … although that’s not particularly reflected in the price of ETH across the course of the month, which ends up lower than where it began. Some label it “The Floppening”.

And we finalized!

Happy merge all. This is a big moment for the Ethereum ecosystem. Everyone who helped make the merge happen should feel very proud today.

— vitalik.eth (@VitalikButerin) September 15, 2022

• The ETH PoW hard fork happens (for those who would still prefer the old consensus mechanism – miners, mainly). It trades up and down. Mainly the latter.

• Liz “Lettuce In” Truss becomes the new British PM. She once said some positive things about crypto. This is gonna be great, she seems like a stayer.

• QEII leaves this mortal coil. This even spawns dozens of crypto meme coin cash grabs… like Queen Elizabeth Inu.

Crypto grifters have seized the opportunity to launch over 40 Queen-themed meme coins on Ethereum and Binance’s BNB Chain, just hours after she passed. pic.twitter.com/2HbDEkBm5h

— Zazoo Me⚡️ (@Zazoo_Me) September 9, 2022

• FTX acquires Voyager Digital for US$111 million.

• US Fed continues to rattle the markets with hawkish sentiment and hefty interest rate hiking.

• Facebook’s Libra project offshoot Sui raises US$300m at a US$2b valuation. Funding is led by FTX, a16z, Jump, Binance and Coinbase.

• Wall Street titans Fidelity, Charles Schwab and Citadel Securities launch a crypto exchange called EDXM.

• SEC chair Gary Gensler thinks all Proof-of-Stake coins are securities. In fact, aside from Bitcoin, he pretty much thinks all crypto tokens are securities.

This morning, @GaryGensler, Chair of the SEC, noted that with the exception of #Bitcoin, which he analogizes to “digital gold”, the vast majority of crypto tokens are securities.

— Michael Saylor⚡️ (@saylor) September 8, 2022

• Speaking of the SEC, its lawsuit proceedings against Ripple Labs drags on, while XRP fans begin to feel confident the latter could actually win.

• Nasdaq makes a strong move into the space, planning crypto custody and other services.

• FTX Ventures acquires 30% of Anthony Scaramucci’s Skybridge Capital.

• Celsius CEO Alex Mashinsky resigns; FTX US President Brett Harrison resigns; South Korea issues arrest warrant for Do Kwon as Interpol steps up the search.

• Crypto market maker Wintermute is hacked for US$160m.

• California and New York issue order for crypto lender Nexo to cease its of yield products.

• Famed investor Stanley Druckenmiller hints at crypto ‘renaissance’; Pantera Capital plans US$1.25 billion fund.

• “Uptober” begins with a dip in the market.

• Australia’s NBL dunks into the metaverse with some NFT-related marketing, following in the footsteps of a few other major Aussie sports.

• Coinbase enters the Aussie crypto-exchange market with dedicated new services.

• Relief rally hopes abound with news that Elon Musk is likely to buy Twitter. DOGE surges. Binance CEO CZ invests US$500m into Musk’s bid to buy the social media platform.

the bird is freed

— Elon Musk (@elonmusk) October 28, 2022

• Big adoption news on two fronts. Google taps Coinbase for crypto payments option, while America’s oldest bank, BNY Mellon announces it can now custody BTC and ETH for select customers.

• But wait, there’s more… Fidelity enables ETH trading for institutional clients, while Twitter announces capability to allow buying and selling of NFTs through tweets. Also, Google Cloud announces blockchain node service, beginning with Ethereum.

• Uniswap Labs raises US$165m in a Series B round Led by Polychain; Binance launches US$500m fund to offer loans to struggling Bitcoin miners in the bear market.

• Mango Markets, a Solana-blockchain-based DeFi protocol is hit with a US$100 million exploit. Culprit owns up but claims what he did wasn’t a hack. He agrees to return US$67m. Righto, then.

• Binance Smart Chain hacked for US$100m. Its blockhain is temporarily frozen to prevent further draining.

• Aptos layer 1 blockchain tanks on debut, meanwhile Cathie Wood sees a US$1 million Bitcoin in the future; Polkadot’s co-founder Gavin Wood steps down; Dogecoin pumps on Musk Twitter takeover news and the month ends in the green after all. It’s up 5.53% after dipping in the previous two months.

Elon bought a social media website, so everyone pumped a dog memecoin 2x

we're in the middle of a global recession and this is still going on, if you dont think next cycle is going to be batshit insane you are wrong lol

— moon (@MoonOverlord) October 29, 2022

• The month begins relatively quietly, relatively positively… Something about Steph Curry and the metaverse, something about MoneyGram’s app enabling crypto. A few days in, so far, so not bad.

• We know what happened next to the crypto market, even if Sam Bankman-Fried (aka SBF) seems evasive and inscrutable with his assessment of the situation. Roiled yet again, amid revelations of what looks to be the biggest financial fraud since Enron.

Actually, according to the lawyer brought in to take over FTX and handle its liquidation, he’s not seen a situation as messy as this one, and he’s the guy who handled Enron’s restructuring after it imploded in 2001.

• After some tit for tat exchanges on Twitter between Binance’s CZ with SBF and Alameda’s CEO Caroline Ellison, in which CZ fuelled growing concerns (already laid out by CoinDesk) about FTX’s stability, things very quickly escalated.

• Here’s our coverage of how Sam Bankman-Fried lost US$15 billion and control of one of the world’s biggest crypto exchanges in under 24 hours.

• Around the same time SBF gives apologetic but largely unsatisfying takes across a 32-tweet thread over a handful of days.

2) H

— SBF (@SBF_FTX) November 14, 2022

• FTX files for Chapter 11 bankruptcy and apparently experiences a hack for potentially hundreds of millions of dollars a day later – potentially from an insider. It’s later discovered that a “back door” in FTX’s internal accounting system was available for SBF and certain Alameda team members to utilise customer funds without alerting auditors.

• The crypto community reacts with outrage to perceived soft coverage of SBF, Caroline Ellison and the FTX debacle by mainstream media outlets including Forbes, and the New York Times.

• Crypto Contagion 2.0 begins to take hold, with lender BlockFi halting withdrawals and filing for bankruptcy, Gemini Earn pausing withdrawals and the lending arm of Genesis Global Trading also blocking withdrawals after stating that they were pretty much fine.

• ASIC suspends FTX Australia’s licence, while some 30,000 Aussies wonder if they’ll ever see their FTX locked-up crypto again.

• Continuing a trend of layoffs from several large crypto firms in this bear market year (including Coinbase, Galaxy Digital, and Swyftx among many others), the large exchange Kraken lets go 30% of its workforce.

• Class action lawsuits are filed against Tom Brady, Larry David, Steph Curry, and Shaquille O’Neal over their FTX promotions. The NYC lawyers filing the suit argue that FTX was a Ponzi scheme and that the actions of the defendants constituted fraud that impacted “thousands, if not millions, of consumers nationwide”.

Not sure how that’s going to play out, but, as you’d expect, someone made a quick edit of the FTX Superbowl commercial starring Larry David, using the Curb Your Enthusiasm theme tune.

• The US Department of Justice begins preparing criminal charges against SBF and FTX.

• Congress announces it will hold an FTX hearing on December 13, with the intention to ask SBF, and others, some difficult questions.

• Coinbase shares sink to a new low. Cathie Wood’s Ark Invest buys more.

• NFT Fest, “a ray of sunshine in a tumultous crypto year” takes place over two days in Melbourne’s St Kilda.

Bear markets eventually end, but they can last longer than you think.

If you speak to anyone who has been around for multiple cycles, they will tell you now is the time to focus, build, and learn.

— Pomp 🌪 (@APompliano) November 23, 2022

• The US dollar, which has been ticking up for the majority of the year dumps early in the month, giving stocks some relief. Bitcoin, Ethereum and other major cryptos look like they’re consolidating.

• Chainlink and ApeCoin staking programs go live; Twitter Coin rumours surface.

• “Bitcoin bottom” analysis intensifies as plenty of the market’s chart watchers put forth the idea that the bear market is close to reaching its floor.

• Goldman Sachs is apparently considering throwing “tens of millions” of dollars at crypto firms at on-sale valuations.

• Polygon powers Warner Music’s NFT venture as Animoca Brands invests into metaverse music firm Pixelynx.

• Recession concerns for 2023 keep doubt in traders’ minds.

• Bitcoin could leave Tesla and gold in its dust, according to Bloomberg commodities expert Mike McGlone.

2) I will try to be helpful during the hearing, and to shed what light I can on:

–FTX US's solvency and American customers

–Pathways that could return value to users internationally

–What I think led to the crash

–My own failings

— SBF (@SBF_FTX) December 9, 2022

• A day before he was is due to testify in front of Congress (virtually), SBF is arrested in the Bahamas.

The FTX founder is refused bail and banged up in the medical wing of the notorious Fox Hill prison. Rats, insect infestations, no chances to play League of Legends deep into every single evening. No vegan meals (or would the opposite be worse?). No polycule sex parties… probably.

crypto twitter after hearing SBF got arrestedpic.twitter.com/OSOIiks2r5

— yzy.eth (@LilMoonLambo) December 12, 2022

SBF was just denied the option to self custody … pic.twitter.com/IurScq6enq

— Wall Street Silver (@WallStreetSilv) December 13, 2022

the polycule heard it was “cuffing season” and thought it meant something else entirely

— Chairman Birb Bernanke (✖️,✖️) (@Bonecondor) December 13, 2022

• About a day later, the SEC charges SBF for defrauding crypto investors, which you can read all about in Christian Edwards’ coverage of the situation here.

The crux of it, though, is that SBF faces charges of conspiracy to commit wire fraud on customers and lenders, securities fraud, commodities fraud, money laundering and conspiracy to defraud the US and violate campaign finance law.

“We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto,” said SEC Chair Gary Gensler.

• SBF and his lawyers planned to fight the move to have him extradited to the US. However, he since reversed that decision and, at the time of writing, is now on his way to the States accompanied by the FBI. He’ll face the music there soon enough instead. He reportedly faces up to 165 years in prison in total if he’s found guilty of all charges being thrown at him by US government departments.

• Meanwhile, former Alameda CEO Caroline Ellison and FTX co-founder Gary Wang have both pleaded guilty to charges relating to wire fraud. They’ve been cooperating with US government authorities but could also be staring down the barrel of ridiculously long jail time as well.

Two months ago, SBF was debating the future of crypto policy and nobody knew FTX was a sham.

One month ago, SBF was apologizing for losing billions and everyone worried he might get away with fraud.

Today, SBF is in FBI custody and his chief co-conspirators have pleaded guilty.

— Jake Chervinsky (@jchervinsky) December 22, 2022

• And… just when you thought 2022 couldn’t get any nuttier…

Donald Trump releases an eyebrow-raising (and US$4.45m raising) NFT collection, featuring “very exciting” artworks of himself as, among other things, a superhero, astronaut and a cowboy that looks like he’s off to a “nightclub for gentlemen of a particular sexual orientation” according to Stockhead‘s Gregor Stronach.

Donald Trump just dropped an nft collection

Yes it’s real 🤣pic.twitter.com/Js4tkfCN6w

— Crypto Tea (@CryptoTea_) December 15, 2022

Trump made $6.7m on NFTs last wk.

He’s never leaving crypto now.

— RYAN SΞAN ADAMS – rsa.eth 🏴🦇🔊 (@RyanSAdams) December 18, 2022

• According to a Newsweek report, Russia is considering turning to Bitcoin and crypto as it looks for ways to bolster its flagging finances amid crippling sanctions imposed by the West in response to the Putin-initiated war in Ukraine.

• At the time of writing, December still has a bit to play out. But seriously… what else of note could possibly happen? And what else could possibly tank the market from this point? Binance FUD? Tether collapse? Digital Currency Group implosion? Craig Wright is actually Satoshi? Guess we’d best not tempt fate…

If your only losses this year were due to market downside, you’re one of the lucky ones.

It wasn’t hard to fall victim to:

• Celsius, BlockFi or Voyager

• UST

• Lending to Genesis

• Major DeFi hacks: Ronin, Wormhole, Nomad, Beanstalk

• Funds stuck on FTXWhat a crazy year

— Miles Deutscher (@milesdeutscher) December 17, 2022

So, 2022 – “crypto’s biggest year yet”. It was certainly the biggest year for hacks and sheer fraud on a massive scale.

But with just about every man, woman, and doge predicting a pretty ordinary, or at best sideways “builders”, year ahead for crypto, the contrarian in us wonders if something completely opposite might just eventuate instead.

After all, virtually everyone in the space got it wrong this time last year with their projections. Time will tell.

None of the information presented in this article represents financial advice. Much of it was based on trawling through our own articles over the past year, although we’d like to acknowledge crypto fund manager Travis Kling as an additional source, who provides a great Twitter-based breakdown of each month’s crypto happenings from a fundie perspective.