Apollo’s Alpha: NFTs just sitting around? JPEG’d lets you borrow against them to earn yield and more

Getty Images

David Angliss, an analyst with Australia’s leading cryptocurrency investment firm, Apollo Crypto, shares the fund’s regular take on what’s happening in the fast-changing and volatile cryptocurrency space.

NFT Finance is a niche area of DeFi that’s slowly gaining traction – at least with developers and early backers. And that’s largely judging by the amount of new NFTfi projects cropping up, plus a few on-chain metrics such as TVL (total value locked).

It’s a sector that Apollo Crypto and its analysts, including David Angliss, certainly feels has some potential to boom at some stage.

He’s covered at least one highly promising project in this sphere with us recently – NFTPerp – while we think we found an excellent one in Dyve a few weeks ago, too.

For this article, though, the DeFi-delving analyst concentrates on another potential gem – JPEG’d. And, like it has with NFTPerp and another NFTfi protocol, Insrt Finance, Apollo Crypto has allocated a relatively small amount of its investment stack into the project.

“We like the NFT financialisation area,” said Angliss, “but I should also note it’s not a massive position we’ve taken in it. It’s something like 0.2 to 0.5% of our total portfolio.”

What is JPEG’d?

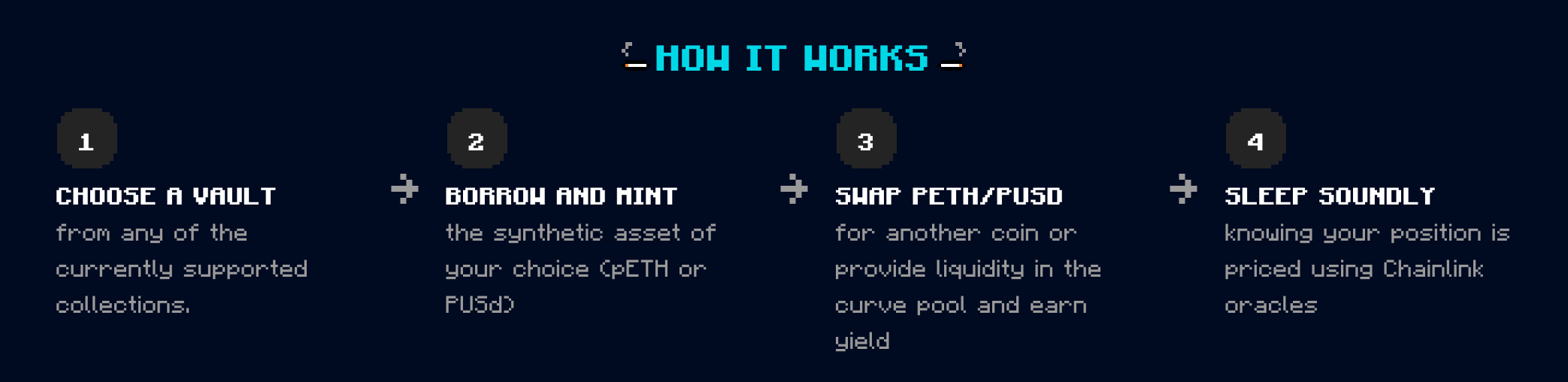

JPEG’d, Angliss explains, is a decentralised lending protocol on the Ethereum blockchain that enables non-fungible token (NFT) holders to open collateralised debt positions (CDPs) using their NFTs as collateral.

Users mint pUSD (the native stablecoin of the protocol) or pETH (the native Ethereum derivative of the protocol) enabling them to effectively obtain leverage on their NFTs.

“So, essentially, if you’re bullish on your NFT collection, you can borrow against them,” explained the Apollo analyst. “You can effectively borrow a derivative version of ETH or the stablecoin and potentially buy more NFTs, or use that capital to go long or even deposit it into the protocol’s Curve pool to earn passive yield.

“Whichever way you use it, what’s basically happening is you’re increasing the capital efficiency of the NFT market.”

The protocol is managed by a governance token, $JPEG, that oversees, administers, and changes parameters to the protocol.

And, as per any DeFi project worth its salt, JPEG’d is completely permissionless, decentralised, and is not controlled by any central entity.

As Angliss explains it, JPEG’s aim is to bridge the gap between DeFi and NFTs and eventually allow any NFT collections, voted by governance, to obtain a line of credit using their NFTs as collateral on the protocol.

Market-leading position

“It’s one of the market leaders at the moment in terms of lending in NFT finance, with a TVL of about US$33 million and more than 500 NFTs deposited on its platform” noted Angliss.

In fact, since he spoke about it with us earlier in the week, the TVL of JPEG’d has increased to about US$60 million, according to DeFiLlama and the protocol has 538 NFTs in its vaults.

“We’re particularly excited about JPEG’s plans to increase its product offering as well as the underlying value held by the protocol’s treasury,” added Angliss.

“It’s also got a nice feature where you can lock up your NFTs for a boost – like a boosted APY. And a large amount of the NFTs in their vaults are locked up for that boost.”

But circling back to what Angliss and Apollo Crypto thinks makes it particularly stand out in the sector is its Collateralised Debt Position Vault mechanism.

“So with the pUSD and pETH derivatives, it’s unique, because it means there’s no need for users to supply liquidity into the lending market itself,” explained Angliss. “Instead, JPEG’d just has to incentivise the pUSD and pETH liquidity on decentralised exchanges. It’s the only protocol providing this sort of derivatives-minting mechanism.”

Currently, the pETH supply in the market is worth around US$10 million, while the pUSD supply is about US$2.17 million.

What about financial runway?

“Yeah, the DAO’s [decentralised autonomous organisation’s] treasury is strong,” said Angliss. “They’ve got about US$30 million in stablecoins, about 8,400 ETH [about US$13.8m] and 940k Convex tokens [about US$5.8m].

“And with a market cap of just over US$21m and fully diluted valuation of about US$71m, that treasury amount gives the JPEG strong value and puts the protocol in a pretty strong position compared with any competitors.”

Protocol developments and growth

“JPEG’d has some good stuff coming in the pipeline,” the Apollo analyst added, referring to a recent Medium article on the subject.

“And that includes an NFT perpetual exchange/DEX. So that’ll be similar to what NFTPerp offers. And then they’ll also be creating an NFT index – that will allow users to gain exposure to a basket of top NFT assets as one investment.”

The protocol currently supports 11 of the highest profile/floor price NFT collections, including BAYC, MAYC, CryptoPunks and EtherRocks, and it has plans to keep adding to its list.

Highly respected founder

And lastly, we’d better ask about the founder, or founders. Is there any reason to be further bullish on JPEG’d from that perspective?

“Yep, so one of the founders goes by the pseudonym Tetranode, and is a very successful crypto tokenomics genius. He’s been involved with a string of very successful protocols in the space, including Curve Finance, JonesDAO, Dopex and Frax.

“We also like him because he’s an ETH maxi, and really promotes Ethereum and helps a lot of big projects in the space with their tokenomics.”

Note: None of the information and views presented in this article should be construed as financial advice.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.