Apollo’s Moonshots: Swell Network aims to be a post-Merge Ethereum staking surger

Getty Images

David Angliss, an analyst with Australia’s leading cryptocurrency investment firm, Apollo Capital, shares the fund’s regular take on what’s happening in the fast-changing and volatile cryptocurrency space.

This week, we’re talking about Ethereum’s Merge from a Proof-of-Work (PoW) model to Proof-of-Stake (PoS).

Again? Yep, but with a focus on a particular decentralised liquid staking service – Swell Network – which, if you hadn’t already guessed, Apollo Capital rates very highly. And yes, it will have a token – coming soon.

When nut-shelling it at the beginning of our conversation, Angliss described Swell as a “bit like Lido DAO and Rocket Pool rolled into one”. And those are two Ethereum staking solutions that have seen significant growth and attention since inception.

Disclaimer: Apollo Capital is an early-stage investor in, and advisor to, the Swell Network.

Sounds Swell, but first, the Merge

Before we dive into Swell, it’s Merge recap time. This much hyped, long-awaited Ethereum upgrade has been in the planning and developmental works for more than two years, and it’s set to finally come together and complete some time this week (apparently around September 13 EST).

Angliss and his colleagues at Apollo see The Merge as hugely significant for the crypto markets, not least of all for its strong ESG narrative (Ethereum’s move to PoS will reportedly reduce its energy usage by about 99%.), but also for the fact it will bring more decentralisation into the network due to a lower barrier to entry for stakers.

Amongst other changes and benefits, the Merge to PoS will introduce the ability to earn a yield on Ethereum through staking, which as Angliss details in a useful glossary on the topic, is what happens “when a user locks up crypto assets for a set period to help support a blockchain’s consensus mechanism. The user then earns yield in the crypto asset staked in return.”

Swell Network’s co-founder Daniel Dizon believes “the implication of The Merge is not fully priced in”, which is something Angliss and Apollo agrees with.

“There will be a significant demand for ETH as the rewards from participation in ETH staking will increase significantly from priority fees and MEV capture,” said Dizon. “Increased demand and reduced issuance for ETH will result in structural upward pressure on price compared to the existing state of Ethereum today.”

Swell Network staking – the basics

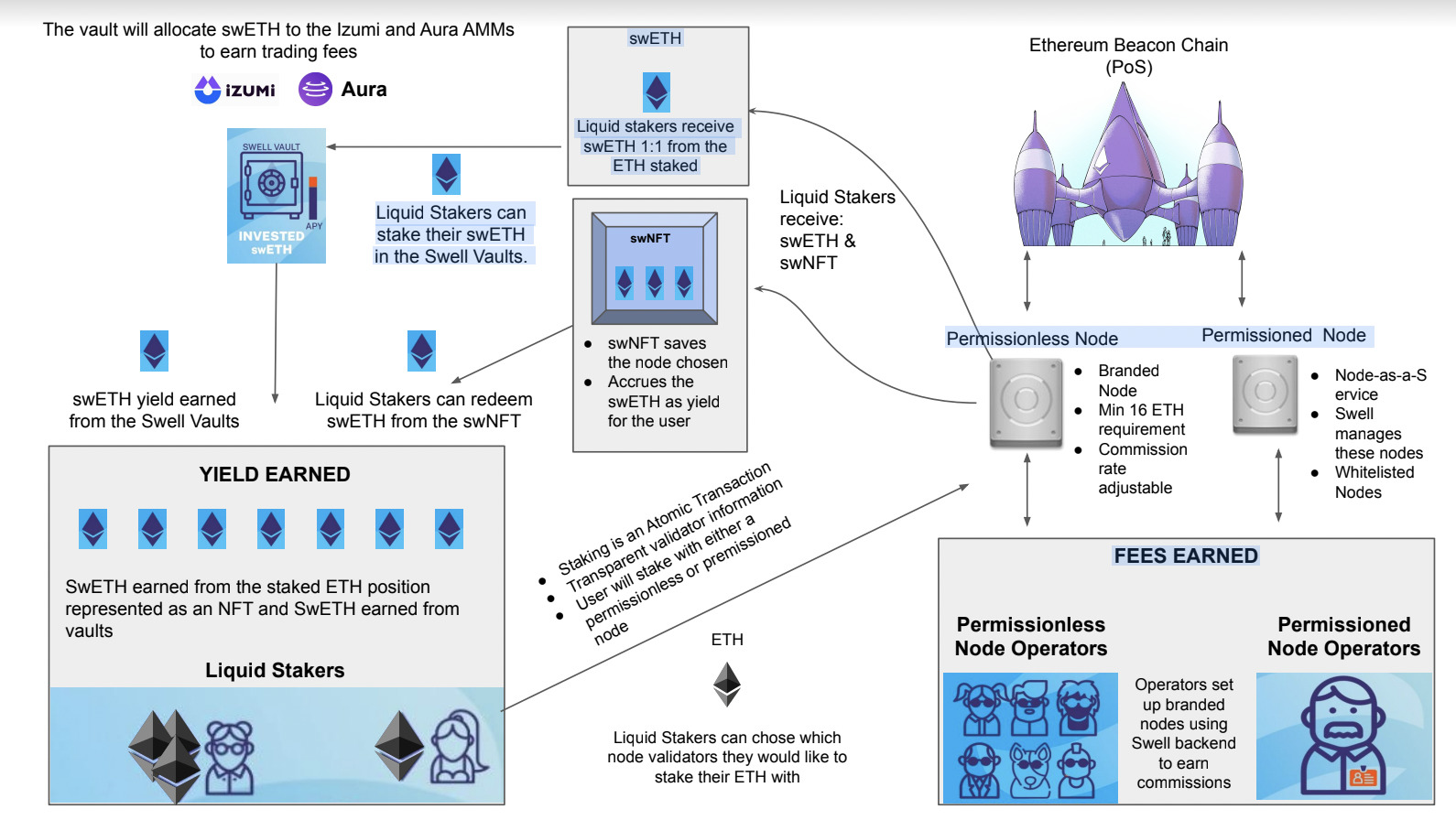

Swell Network is a permissionless, non-custodial, decentralised liquid staking solution that provides users yield from staking Ethereum as well as a yield-bearing derivative asset representing the staked Ethereum.

As Angliss explains it, “this derivative asset can be sold on the secondary market or utilised in certain DeFi activities”.

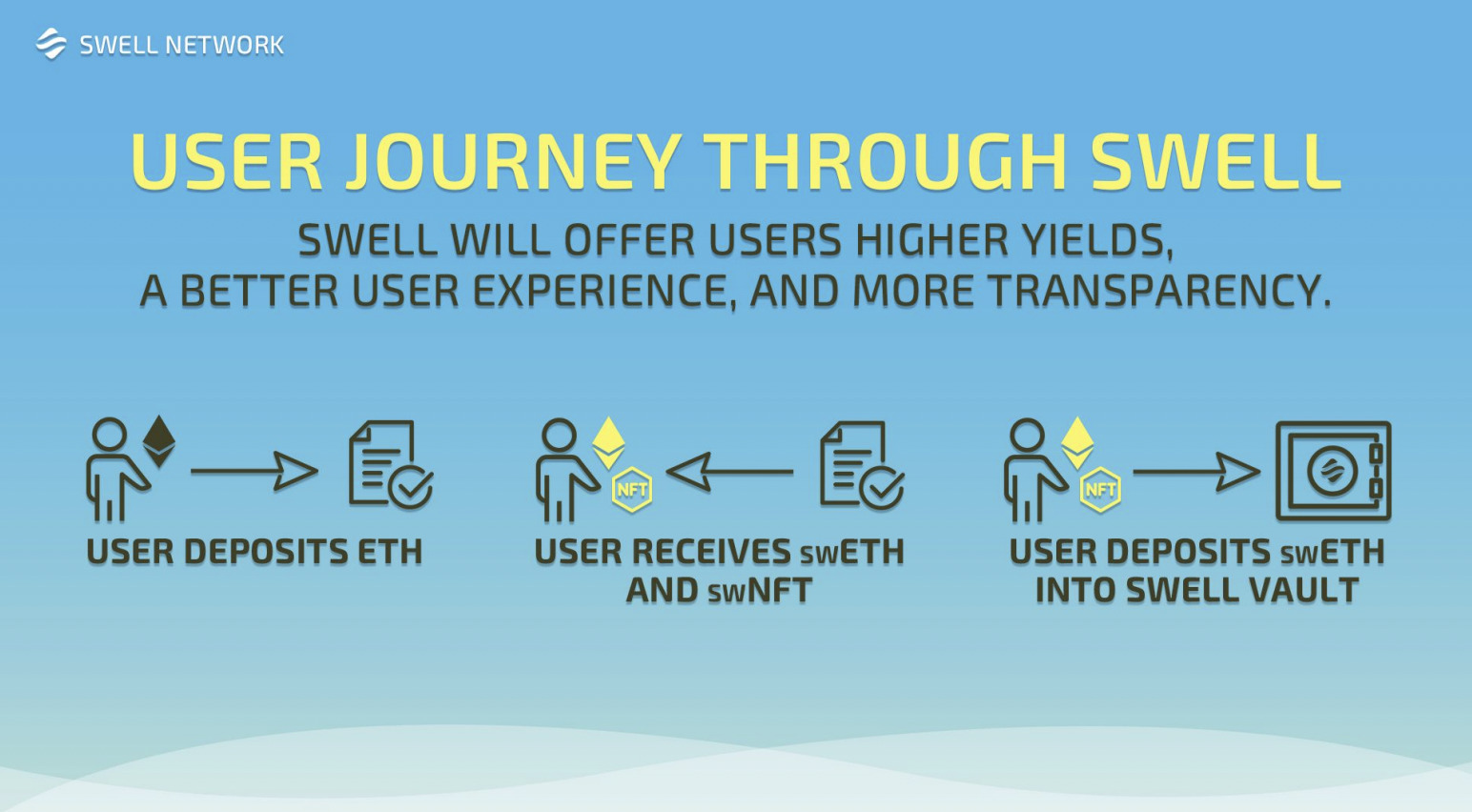

Liquid stakers on Swell receive a 1:1 staked ETH token called Swell Ether (swETH). In addition to the derivative token, the user also receives a minted financial NFT called Swell NFT (swNFT).

Unlike some liquid staking protocols, the derivative swETH is not an interest-bearing token; it is only a receipt for your ETH staked into the ETH2 staking contract. The swNFT is essentially a “container” that collects your staking rewards and tracks your staked ETH on the Ethereum post-Merge blockchain.

“Ultimately for stakers, Swell will provide a more engaging and user-friendly experience through Swell ETH and Swell NFTs,” says Angliss.

Stakers with a bit more technical know-how and the right hardware can instead set themselves up as a node operator and earn yield on their ETH through Swell that way.

Taking the “permissionless” validator node-operation route would normally require 32 ETH minimum (that’s more than US$55k at the time of writing). On Swell, like Rocket Pool for instance, just 16 ETH is required for this staking method, although Swell will likely be decreasing this in future, says Angliss.

Standard liquid staking with Swell (which you can think of as a staking-as-a-service method, just not custodial like you’d stake with Binance, for example) requires virtually no minimum amount.

Swell’s competitive advantage

As Angliss details in an extremely comprehensive report, the Swell Network has some distinct advantages it’s bringing to the DeFi table post Merge. And it’s challenging current ETH staking solutions with some pretty interesting innovations and benefits. Some of those being:

• Catering for all post-Merge staking participants, including liquid stakers, permissionless node operators and verified node operators. (See the Angliss report for more info.)

• Financial NFTs. As mentioned, liquid stakers receive a derivative asset 1:1 when staking – swETH. They also receive a swNFT asset that represents a user’s staked position. “It contains all of the metadata required to calculate staking rewards when you withdraw,” writes Angliss.

“It is important as it represents tangible proof of a user’s stake with a validator node. By having the staked position represented as an NFT, users have more flexibility when using swETH in the DeFi ecosystem.”

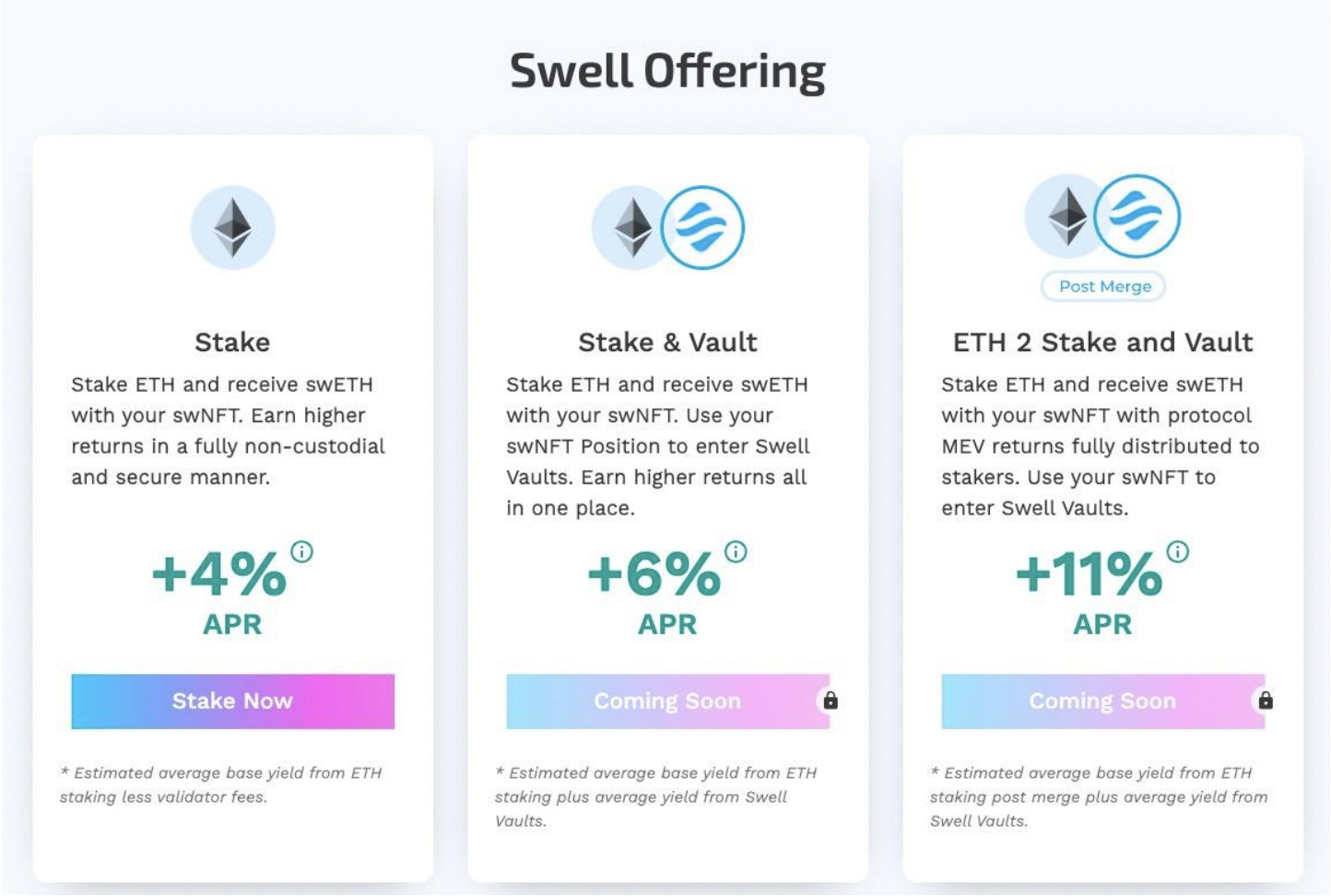

• Swell Vaults. This one’s a big deal as it helps stakers maximise their yield. As Angliss notes, once users have their swETH derivative asset, they can take it and stake it in a Swell Vault located on the Swell platform. That capital will then be staked into specific Izumi Finance and Aura Finance liquidity pools, which will accumulate yield for the user, compounding through trading fees.

When withdrawing their positions, depositors receive their initial swETH tokens deposited plus the additional swETH earned as yield for providing liquidity. Bonus!

• Transparency. When users stake on Swell Network, they can see the exact validator they are staking with on the Beacon Chain (which is the post-Merge Ethereum blockchain) at all times.

According to Angliss, other decentralised liquidity staking solutions don’t have this level of visibility on a user’s staked ETH. Instead, they spread a staker’s ETH across a number of validator nodes. Also, stakers get to select their node operator, and their ETH is bound with that node operator.

A few more Swell things to know

Raise: In March, Swell Network completed a $3.75 million seed round led by DeFi-focused investment fund Framework Ventures, IOSG Ventures and Apollo Capital, as well as Maven 11 and a host of angel investors including Mark Cuban, Kain Warwick (Synthetix) and plenty more.

Angliss reveals that Apollo Capital also participated in Swell Network’s liquidity round, which involved pledging ETH to stake with Swell Network in return for the option to purchase more Swell DAO Tokens. This raised the equivalent of about $5 million.

Team: Swell Network is a 13-strong Aussie-founded project, based in Sydney. Co-founders Daniel Dizon and Lecky Lao are both long-time crypto natives, with the former having worked as a solidity engineer on two highly accomplished DeFi protocols – Synthetix and dHedge. (Check out our coverage on dHedge in another recent Apollo’s Moonshots.)

Public sale: There will be a public sale launch scheduled in September or October open to retail investors, however, the public sale platform is yet to be released. Keep an eye out on Swell Network’s official Twitter account for details.

According to the Apollo analyst, “Swell Network’s native token, the Swell DAO Token (swDAO), will be essential to the protocol’s governance as holders of the swDAO will be able to engage in voting and generate proposals for the Swell Network.”

“Swell Network is considered by Apollo Capital an ‘essential infrastructure’ on Ethereum 2.0 as its products and services contribute to the security and consensus of the Ethereum PoS network,” added Angliss.

At the time of writing, the author of this piece holds various different cryptocurrencies, including Bitcoin and Ethereum. None of the views expressed in this article should be taken as financial advice.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.