Aussie DeFi project Maple Finance soars 27% as TVL hits US$217m

Coinhead

Australian crypto project Maple Finance has surged to a new all-time high this afternoon after announcing it had hit surpassed US$200 million in total value locked.

At 4.45pm AEST, the MPL token was trading for US$27.71, up 27.4 per cent from yesterday and up fourfold from its value in July.

Maple co-founder and CEO Sidney Powell attributed the surge to yesterday’s announcement that its two lending pools had surpassed US$217 million in value.

“Demonstrated traction,” he messaged. “We hit that from a starting pool of $17m in May.”

Top crypto institutions like Alameda Research, Amber Group and Wintermute have borrowed from the pools, Maple said.

“We are proud to be building the capital market infrastructure for the digital economy,” the Melbourne-headquartered decentralised project tweeted.

“We are tremendously grateful for the support of our users & community in reaching this milestone! This is just the first of many on our journey to grow the digital economy.”

“We’ll see you soon at $500M.”

Powell told Stockhead the Maple team had grown to 21 roles, and was hiring for five more.

According to Coingecko, the MPL token is the No. 510 crypto with a market cap of US$69.9 million.

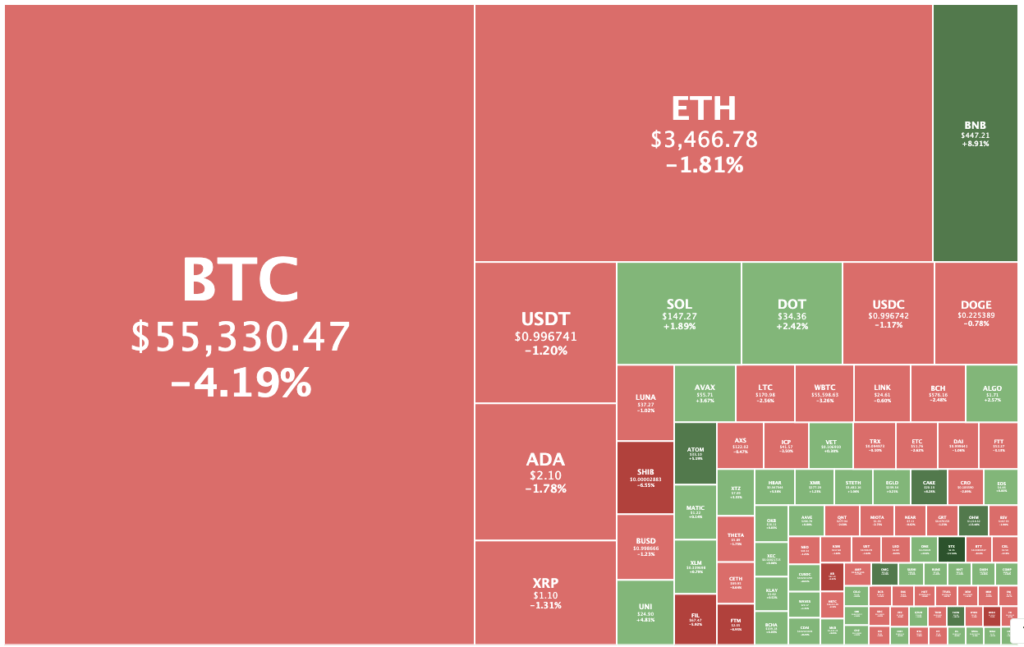

Overall, the total crypto market was little changed from yesterday, edging just 0.1 per cent higher to US$2.4 trillion.

Bitcoin was trading for US$55,524, down 4.1 per cent, while Ethereum was changing hands at $3,469, down 1.7 per cent.

Binance Coin and Uniswap were the only tokens in the top 20 to post appreciable gains, rising 7.4 and 6.2 per cent, respectively

Out of the top 100, Stacks has been the biggest gainer, climbing 17.1 per cent to US$2.34, followed by Olympus (OHM), which was up 13.5 per cent to US$1,210.

Launched in March, Olympus DAO is now the No. 52 crypto, according to Coingecko. It’s been described as a kind of crypto-native “central bank,” issuing free-floating OHM tokens backed by a basket of decentralised assets.

On the flip side, Filecoin had been the biggest loser, dropping 6.5 per cent to US$64.75, followed by Fantom and Arweave.