Confessions of a Day Trader: WOW WOW WOW WOW WOW WOW WOW

Aftermarket

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Lendlease came out with their results and opened down 90c at $6.60, so they were the biggest major faller popping up for me today.

Get stuck into them three times on the premise that all the bad news is now out. When you see their chart, you will see their rally in their last hour of trading.

My manic child opened up at $284 and then fell to $281.26 within 5 mins of opening. I thought I got set on an at least $1.00 rebound but alas, it was not to happen.

Then AGL were down in the doldrums a bit, so geared up a little bit and waited before they came back to life.

A mixed day and had to wait till 4.10pm, so also a long day!

Up $975.

Recap

Bought 2,000 LLC @ 6.43

Bought 500 CSL @ 281.74

Bought 2,000 LLC @ 6.35

Bought 5,000 AGL @ 8.55

Bought 2,000 LLC @ 6.26

Sold 6,000 LLC @ 6.46 ($680 profit)

Sold 500 CSL @ 281.03 (-$355 loss)

Sold 5,000 AGL @ 8.68 ($650 profit)

Well it’s my kind of market today, though I had to double down a couple of times to find a bounce and in the last few mins to go, I go all in.

BHP came out with their figures and they weren’t too hot but the stock held up remarkably well before having a bit of a crack towards the end of the trading day.

CBA also held up OK, and ANZ took a tumble, so took advantage of that. Went in too early and with ‘Harry Hindsight’ left a bit too early. See chart. Split up the selling, just to excite things up a bit.

NHC were a big faller and having followed them before, I could sort of second guess their pattern.

Up $2,345 and the market becoming a bit erratic, which I suspect (and hope) will follow through to tomorrow.

Recap

Bought 5,000 NHC @ 4.50

Bought 2,000 NEU @ 20.55

Sold 2,000 NEU @ 20.70 ($300 profit)

Bought 5,000 ANZ @ 27.49

Sold 5,000 NHC @ 4.54 ($200 profit)

Bought 5,000 ANZ @ 27.41

Sold 5,000 ANZ @ 27.52 ($350 profit)

Sold 5,000 ANZ @ 27.54 ($450 profit)

Bought 3,000 BHP @ 45.55

Bought 3,000 BHP @ 45.42

Sold 6,000 BHP @ 45.63 ($885 profit)

Bought 6,000 BHP @ 45.34

Sold 6,000 BHP @ 45.40 ($360 profit)

Normally I love making money trading bank shares, as it can make up for the interest rates they rip me off on with my Cash Management Accounts.

So, when we get a trading opportunity to go for one of the duopoly supermarket players, I just can’t contain myself.

The double whammy of trading figs out and CEO resigning just lit a fire under my little trading thumbs.

I just figured out that, if there are only two supermarkets in Australia and both are listed, that even I could throw my CV into the ring and have a chance.

So, to the trading Gods, thank you for giving me Woolworths today.

I even made more money than the amount of points that I have accrued on my Woolworths Rewards Card.

If only I could get them added to my trading account!

Plus $4,180. Happy Days!

Recap

Bought 5,000 WOW @ 33.95

Bought 2,000 CBA @ 115.31

Bought 5,000 WOW @ 33.41

Sold 2,000 CBA @ 115.82 ($1,020 profit)

Sold 10,000 WOW @ 33.72 ($400 profit)

Bought 5,000 WOW @ 32.66

Bought 2,500 FMG @ 26.96

Bought 2,500 FMG @ 26.84

Bought 2,000 CBA @ 114.95

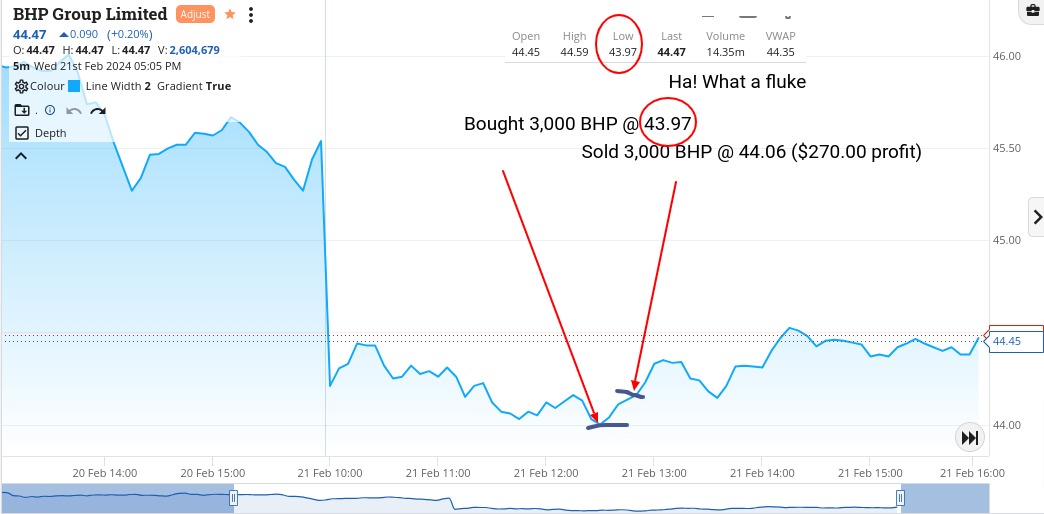

Bought 3,000 BHP @ 43.97

Sold 3,000 BHP @ 44.06 ($270 profit)

Sold 2,000 CBA @ 115.08 ($260 profit)

Sold 5,000 FMG @ 26.97 ($350 profit)

Sold 5,000 WOW @ 32.99 ($1650 profit)

Bought 1,000 PME @ 93.65

Sold 1,000 PME @ 93.88 ($230 profit)

This reporting season is playing out very well for me, as I have another cracker of a day.

The volatility has allowed me to up my gearing, though I suspect next week it will be throttled back a bit.

WOW, CBA and finally Nine Entertainment all had a starring role to play today’s episode of market trading 101.

Below $33.00 and it seems WOW becomes a cracker as does the $114.00 level for CBA.

Nine just became a late developer for the book and just came good again for me before their close.

Up $3,490 and still loving it.

Recap

Bought 5,000 WOW @ 32.90

Bought 2,000 CBA @ 114.06

Sold 5,000 WOW @ 33.18 ($1,400 profit)

Bought 2,000 CBA @ 113.51

Bought 5,000 WOW @ 32.95

Sold 5,000 WOW @ 33.06 ($550 profit)

Sold 4,000 CBA @ 114.00 ($860 profit)

Bought 2,000 CBA @ 113.81

Bought 10,000 NEC @ 1.700

Sold 2,000 CBA @ 113.97 ($330 profit)

Sold 10,000 NEC @ 1.720 ($200 profit)

Bought 10,000 NEC @ 1.685

Sold 10,000 NEC @ 1.700 ($150 profit)

Started out OK and then finally got my comeuppance as CBA and WOW came back to bite me at the end of the 4.10pm session.

Ended down $585. WOW finished the day at $32.78 which was also their low for the day, so that is ready where I copped it today.

CBA’s range was $114.57 to $115.88 and last at $114.83, so I made the mistake of being too geared up with my stock size.

Oh well, I have the weekend to tweak my strategy for next week, though this week was a cracker of a week, except for today.

Up $10,405 gross or $9,258 net for the week, thanks mainly for the ASX reporting season and the volatility that comes with it and also for WOW giving me a POWWOW, with their double whammy of trouble.

Recap

Bought 5,000 FMG @ 27.78

Bought 500 CSL @ 283.59

Sold 5,000 FMG @ 27.85 ($350 profit)

Sold 500 CSL @ 284.00 ($200 profit)

Bought 2,000 CBA @ 115.04

Bought 2,000 CBA @ 114.77

Bought 5,000 WOW @ 32.95

Sold 4,000 CBA @ 114.83 (-$290 loss)

Sold 5,000 WOW @ 32.78 (-$850 loss)