TECH HEAVY: A week of reckoning is beckoning as Tesla, Twitter and Netflix show their cards

Tech

Tech

Wall Street enjoyed a run of decent gains on Friday piggy-banking US retail sales and a few solid corporate earnings.

The Dow Jones Industrial Average closed 2.2% higher, the S&P 500 up 1.9% and the olde tech-heavy Composite Index added 1.8%.

This week the states have a lot on their plate to digest following the record inflation numbers of last week which have only just moved through Wall Street’s lower colon.

US corporate earnings to be dominated by names like Goldman Sachs (NYSE:GS), Bank of America Corp (NYSE:BAC), IBM (NASDAQ:IBM), Netflix Inc (NASDAQ:NFLX), Tesla (NASDAQ:TSLA) and Twitter (NASDAQ:TWTR).

There’ll be a certain amount of anxiety to go with the already baked in anxieties around war, famine, rising prices and scant energy.

That’s because there’s a data dump of global PMIs to sift through before the awful reality of a repeat 75 basis points rate hike by the US Federal Reserve the week after.

Nasdaq futures have firmed 0.8% after lunch in Sydney.

Of the 35 or so US companies already reported earnings on the S&P 500, four out of five have beaten analyst expectations, according to data provided by Refinitiv.

Analysts have however, revised down their aggregate YoY Q2 profit growth forecasts from 6.8% at the beginning of the quarter, to 5.6%.

Despite the Friday rally, it was two out of three in the red the big three Wall Street indices.

Recession fears have dominated. Traders remain a little awed at the prospect of an aggressive play from the Fed which could bend the US economy into then kind of knot that brings on negative growth.

Nevertheless, for lovers of fine tech, the US earnings season will climb into high gear on Wednesday when Tesla reports after the market close.

The EV maker, plagued as it is by an errant CEO with a penchant for focusing on unrelated businesses and by woeful supply chain reliability is still on its feet even with haunt the lockdowns in China foiling production targets.

Elon’s EV adventure still has The Street expecting another humming quarter of business.

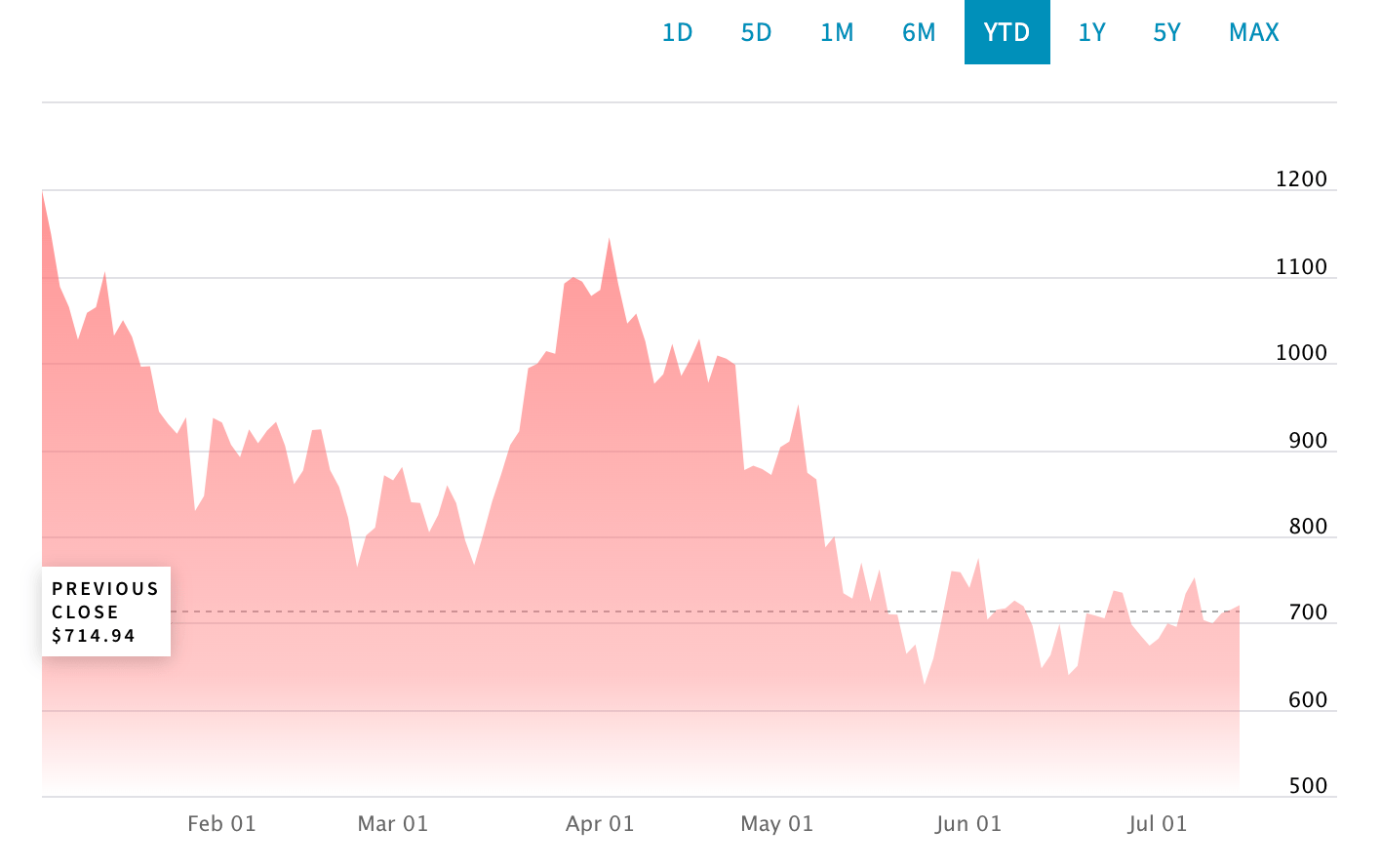

But if you’ve met the stock over the past year, valuation would still be a bit of a worry – the competition is arriving, the rotation out of growth has begun and rising interest rates probably aren’t as much of a worry as the way the boss swings from one interest to another.

Tesla has thrived while the world worried its way through the pandemic, that much is certain.

A complex supply chain fared comparatively well, as disruptions skewered other car manufacturers – not Tesla – Elon’s electricity somehow kept growing throughout, transforming a vision into a reality, all the more impressive with the calamitous impact of COVID-19 as a backdrop.

No pandemic lasts forever, though.

Tesla could only muster 254k vehicle deliveries in the second quarter, way below analyst estimates, thanks to factory shutdowns in China and parts shortages.

Deliveries were still up about 25% on the same time last year, but wheels are loosening if not quite coming off as the economy wobbles.

And there’s really more interest anyway in the latest word on Elon Musk’s bombshell-cliffhanger walk away also from his multi-billion plot to own Twitter.

Elon’s toy is set to release 2Q earnings at 8 a.m. ET on Friday, which will be Saturday in the AM for us. This must be the biggest earnings for Twitter to have ever tweeted about. The stalemate with Elon Musk has been a distraction but one Musk will use to his advantage if these numbers blow.

Twitter’s user metrics are likely to get the evil investor eye, given Elon’s ongoing hoo-ha concerning TWTR possibly understating the spam count.

Consensus estimates expect revenue of $1.32 billion, up 23.8%. And no, they won’t be doing an earnings call with the pending court case over the pending acquisition. Get out of Zoom free card, that one.

My fav television channel will report its 2Q results after market closes on Tuesday in the states. After a super-dooper loss in net subscriber additions over a torrid first quarter, the streaming home of Derry Girls announced several measures to stem the rot, but they included culling quality in-house productions.

Later in the week, we’ll also be getting a look at the books of Johnson & Johnson, Lockheed Martin, United Airlines, Union Pacific, Verizon and a gaggle of other companies.

MONDAY

Earnings: Bank of America, Goldman Sachs, IBM, Synchrony Financial, Prologis, Charles Schwab

Business leaders survey

NAHB survey

TIC data

TUESDAY

Earnings: Johnson & Johnson, Netflix, Truist Financial, Interactive Brokers, J.B. Hunt Transport, Cal-Maine Foods, Ally Financial, Lockheed Martin, Hasbro, Halliburton

US Housing starts

The Fed Vice Chair Lael Brainard speaks

WEDNESDAY

Earnings (it’s a big hump day): Tesla, Biogen, Nasdaq, Alcoa, Northern Trust, United Airlines, Discover Financial, Equifax, FNB

Existing home sales

THURSDAY

Earnings: AT&T, Travelers, D.R. Horton, Blackstone, Union Pacific, American Airlines, Snap, Mattel, Dow, SAP, Nokia, Roche Holdings, Domino’s

Initial jobs claims

Philadelphia Fed manufacturing read

FRIDAY

Earnings: American Express, Verizon, HCA Healthcare, Norsk Hydro, Cleveland-Cliffs

S&P Global manufacturing PMI

S&P Global services PMI