Tech Heavy: Uber on the outer, sellers remorse on Elon’s exit and US futures dip ahead of earnings kick off

Tech

Tech

As I madly tap, US futures are slipping lower in anticipation and/or dread of some big name earnings reports and a week which features the same key inflation data (CPI) which tore the pants of the markets last month and made everyone feel silly and then poorer.

After a strong previous session, Nasdaq 100 futures are down 0.4% at lunchtime, AEDT.

In a weirdly welcome change, the Nasdaq Composite finished last week on a pretty strong footing, as less angst-ridden tech investors came out and delivered the tech-laden index its best week of an admittedly crap 2022.

Uninspired but not appalling runs for the Dow Jones and the S&P 500 saw modest to mild losses. Friday’s glamour jobs number – some 372,000 new US jobs for June – eased some of those recession night terrors.

The 0.12% for the Nasdaq was its fifth straight session of gains, also its longest winning streak since Santa last came and gave Elon Musk everything he wanted.*

Last week it was the Nasdaq’s reassuring names and the chipmakers were the focus for rebooting portfolios with familiar names from Amazon (NASDAQ:AMZN) and Meta Platforms (NASDAQ:META) to Salesforce (NYSE: CRM) doing nicely.

The almost 30% crunch from the tech index highs has also slashed the valuations of semiconductor stocks, something people seem to be looking at, since we’re still screwed on that front.

On that note, I don’t do stock suggestions and I can’t pick my nose without getting it all over my face, like egg, so I’m only pointing out that Qualcomm (NASDAQ: QCOM) did well, ending the week up a heap. It’s also well cheaper than a few months ago – and out front of a 5G upgrade thing.

So a fairly positive run into this week, but probs best to start by reminding yourself the Americans aren’t done with the mad, bad volatility and neither of course are we.

I think the watchword for the sessions ahead might be market churn.

Mother of Google, Alphabet’s (NASDAQ: GOOGL) highly-dreaded 20-4-1 stock split on Friday will be a closely watched event in NYC bars after the market close, so Saturday morning for us.

Shareholders on the books from the first of the month will wake up to enjoy 19 additional shares of Alphabet stock for every one they has already got.

Also leading up to Friday, the big American banks are going to try and take centre stage this week, with the majors usually dominating headlines with earnings, but up against some stiff competition.

That won’t be as simple as it used to be with a huge amount of interest in the latest word on inflation the subplot to Friday’s Elon Musk’s bombshell-cliffhanger walk away from his multi-billion plot to own Twitter.

Mere tweets after tweeting he was buying Twitter in a US$45 billion deal, Elon Musk says he wants out.

It’s no surprise – Mr Musk has been expressing buyer’s remorse since he announced the deal.

Twitter are also litigatingly remorseful:

The Twitter Board is committed to closing the transaction on the price and terms agreed upon with Mr. Musk and plans to pursue legal action to enforce the merger agreement. We are confident we will prevail in the Delaware Court of Chancery.

— Bret Taylor (@btaylor) July 8, 2022

MONDAY

Twitter (NASDAQ:TWTR) shares in sharp focus tonight, so too allegations TWTR failed to provide metrics on fake and spammy accounts.

New York Fed boss John Williams joins a conference talking – ‘Last Call on LIBOR: Final Steps to Transition.’

Target Corporation (NYSE: TGT) does an Amazon online-only Deal Days event through July 13

Tesla Inc (NASDAQ:TSLA) will reportedly shut down its mega Giga Berlin-Brandenburg plant for a few weeks. Didn’t it just open?

TUESDAY

Amazon (AMZN:NASDAQ) – annual Prime Day nonsense, runs through July 13.

PepsiCo, Inc. (NASDAQ:PEP) – earnings nonsense before market open.

The US fintech-ish online bank SoFi Technologies Inc (NASDAQ: SOFI) has a big Tuesday ahead. SoFi shareholders to vote at an AGM on if the board can go and do a reverse stock split (which is a manouvre aimed at culling any outstanding shares to boost the stock price).

In more eco data – NFIB’s business optimism read is due.

WEDNESDAY

Delta Air Lines (NYSE:DAL) – earnings read on a good airlines/travel barometer stock.

Fastenal (FAST:NASDAQ) – earnings read on this top 100 Nasdaq stock – a good barometer on industrial supplies. Need something fastened, fast? They’re the best makers of fasteners in town.

US consumer price index (CPI) read – expected to rise to 8.8% from 8.6% on the last one which let’s recall freaked everyone out when it didn’t go to plan last time.

The Beige Book – federal budget balance, weekly mortgage applications.

US Senate – does a hearing on energy prices.

The House of Congress does a hearing on fintech and transparency.

THURSDAY

Bank barometric read – JPMorgan Chase & Co (NYSE:JPM), Morgan Stanley (NYSE:MS), First Republic Bank (NYSE:FRC) etc – earnings drop ahead of market open.

US jobless claims and the producer price index (PPI).

FRIDAY

More earnings US banks – Bank of New York Mellon Corp (NYSE:BK), BlackRock Inc (NYSE:BLK) Citigroup (NYSE:C) Wells Fargo & Co (NYSE:WFC) et al.

Alphabet’s 20-for-1 stock split after the market close.

US retail sales, industrial production, import and export prices, business inventories.

Uni of Michigan’s consumer index.

Finally, although the near-term outlook may be as uncertain as an Uber ride (see below), the brains trust at Truist Financial Corp (NYSE:TFC) have told clients not to worry about the latest crash, healthy returns await in the long run if history repeats and everyone takes a deep breath or two.

New work by Keith Lerner, co-chief investment officer at the North Carolina bank, wants to say that within three years of a crash the S&P 500 has made all its losses back and more – in eight out of nine crashes.

In research going back to 1958, if the index falls 20% or more, Lerner says stocks on average returned around 29% in those eight cases.

“Given the wide range of results,” Lerner wrote in the note to clients, “we are of the view that this is not the time to be aggressive, but we are also not advocating diluting equities for investors who want to invest in their equity.”

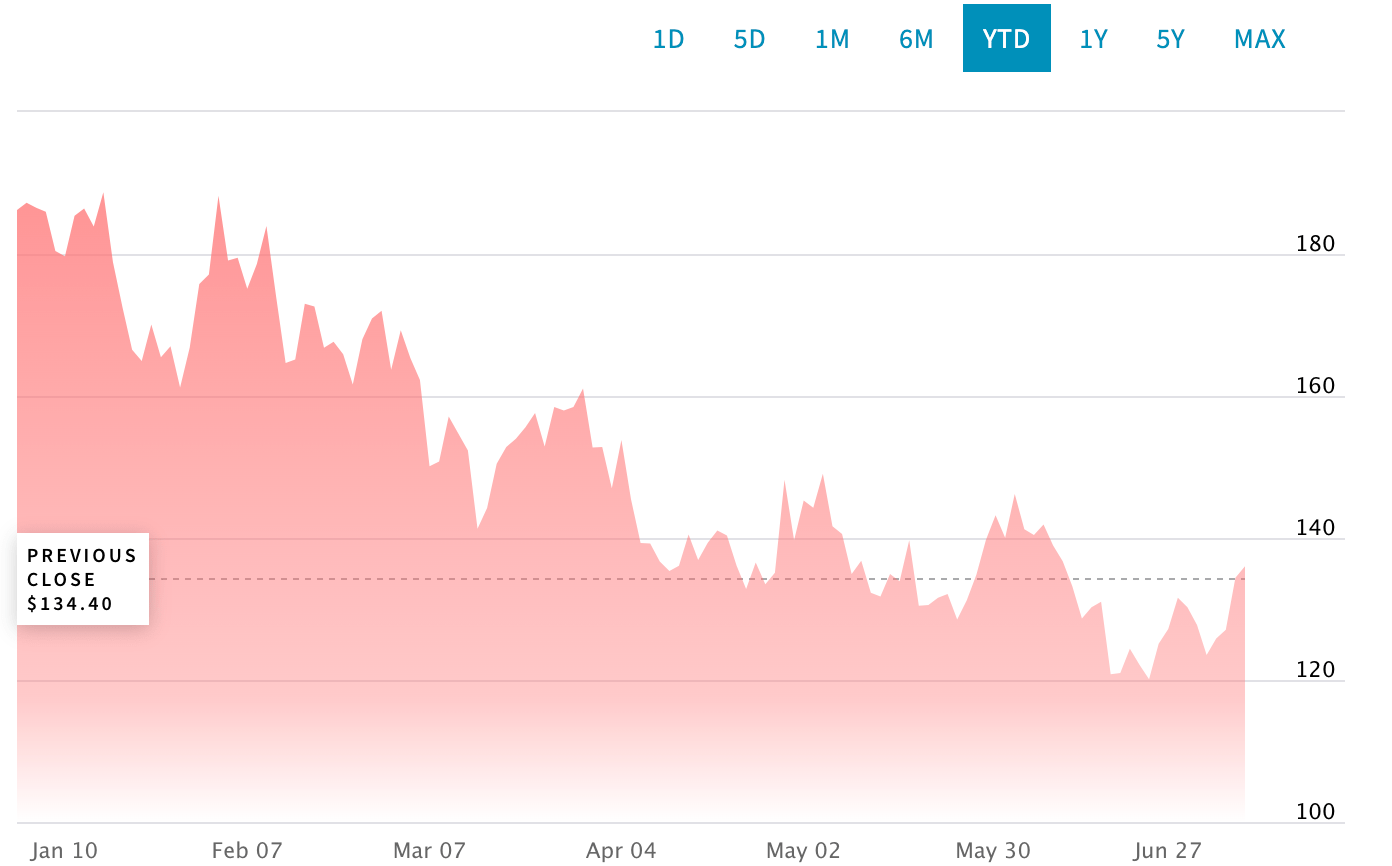

In news which will trouble a lot of people at troubled share-ride business Uber Technologies (NASDAQ:UBER), there’s been a bit of an old leak of old Uber records revealing uber amounts of evidence that the company broke some uber-laws, uber tricked police and uber-exploited violence on drivers to get their way.

Not yet done. Uber apparently secretly lobbied the cream of the corrupt, like prime ministers and presidents, in an effort to break into markets and feed their desire for domination over the heads of taxi companies.

The treasure trove they’re calling the Uber Files were leaked to The Guardian, and shared with the International Consortium of Investigative Journalists.

The trove of more than 124,000 records, including 83,000 emails and 1,000 other files involving conversations, span 2013 to 2017.

Uber says its “past behaviour wasn’t in line with present values” and it is a “different company” today.

It’s even more likely they’ll be a different company when markets open tonight, Sydenham time.