The Ethical Investor: ESG taking a beating in 2022 is exactly what we need, says Janus Henderson

News

News

Sustainable or ESG investing has faced some stiff headwinds this year.

The Russia-Ukraine conflict, rising inflation, and central banks’ hawkish stance have created a lot of uncertainty to the markets.

Sectors typically not associated with ESG, such as energy, defence, tobacco and commodities, have all overperformed at the expense of the renewables sector.

Energy stocks in particular have been some of the biggest winners this year, as oil and gas prices rise due to the the geopolitical conflict.

But according to Hamish Chamberlayne, Head of Global Sustainable Equities at Janus Henderson (ASX:JHG), these are all part of the shake up we needed to have.

“We see this as a natural correction and a logical outcome of the excesses of the ESG bubble that formed in markets last year,” Chamberlayne said.

Chamberlayne saw 2021 as the year when investors were starstruck by all things ESG. This led to a strong upward momentum for stocks, any stocks, that had an ESG “story” behind them.

The bubble was particularly apparent with demand for risky vehicles like SPACs, ‘shell companies’ formed to raise money through an IPO to buy another company, often with an ESG angle.

“We put SPACs in the same category as highly speculative crypto and meme stocks,” said Chamberlayne.

Despite the current challenges for ESG, Chamberlayne says they are actually reinforcing the medium-term trends the Janus funds are focused on.

“While these challenges are negative for ESG and sustainable investing in the short term, we believe higher oil and gas prices will accelerate the adoption of products and services from companies providing sustainable solutions,” he said.

An obvious example, Chamberlayne explained, is the renewable energy sector. As oil and gas prices rise, the number of renewable projects that can generate acceptable returns increases.

“More broadly, we are witnessing greater demand for many renewable projects.”

But change takes time, and energy intelligence group Wood Mackenzie pointed out that it will take until 2028 for free cash flow from the existing renewables project pipelines to turn positive.

Another example where the current energy turmoil could drive uptake in sustainability investments is electric vehicles (EV), where higher gas prices will make electric vehicles more attractive to consumers.

A recent consumer report found more Americans are considering buying or leasing an electric car, with 15% of drivers saying their next car would be an EV.

Bloomberg has predicted that 25% of new car sales in the US could be electric by the end of 2025.

When it comes to higher inflation and interest rates, which is currently worrying markets, Chamberlayne says that it should be viewed as a move back towards normalisation.

“From a relative perspective, the increase in interest rates is significant given the starting point of close to zero, but taking a step back, interest rates are still at multi-decade lows.

“We therefore continue to see these levels as representing favourable conditions for growth,” he said.

But according to global asset manager, Alliance Bernstein, instead of being a hedge for inflation, ESG investments are actually inflationary themselves.

Bernstein pointed to several 2021 surveys which showed that customers are willing to pay more for ESG-friendly products.

For example, a survey which covered 17 countries and more than 10,000 respondents found that 34% of consumers reported they’re willing to pay more for sustainability. This willingness is most pronounced among younger generations.

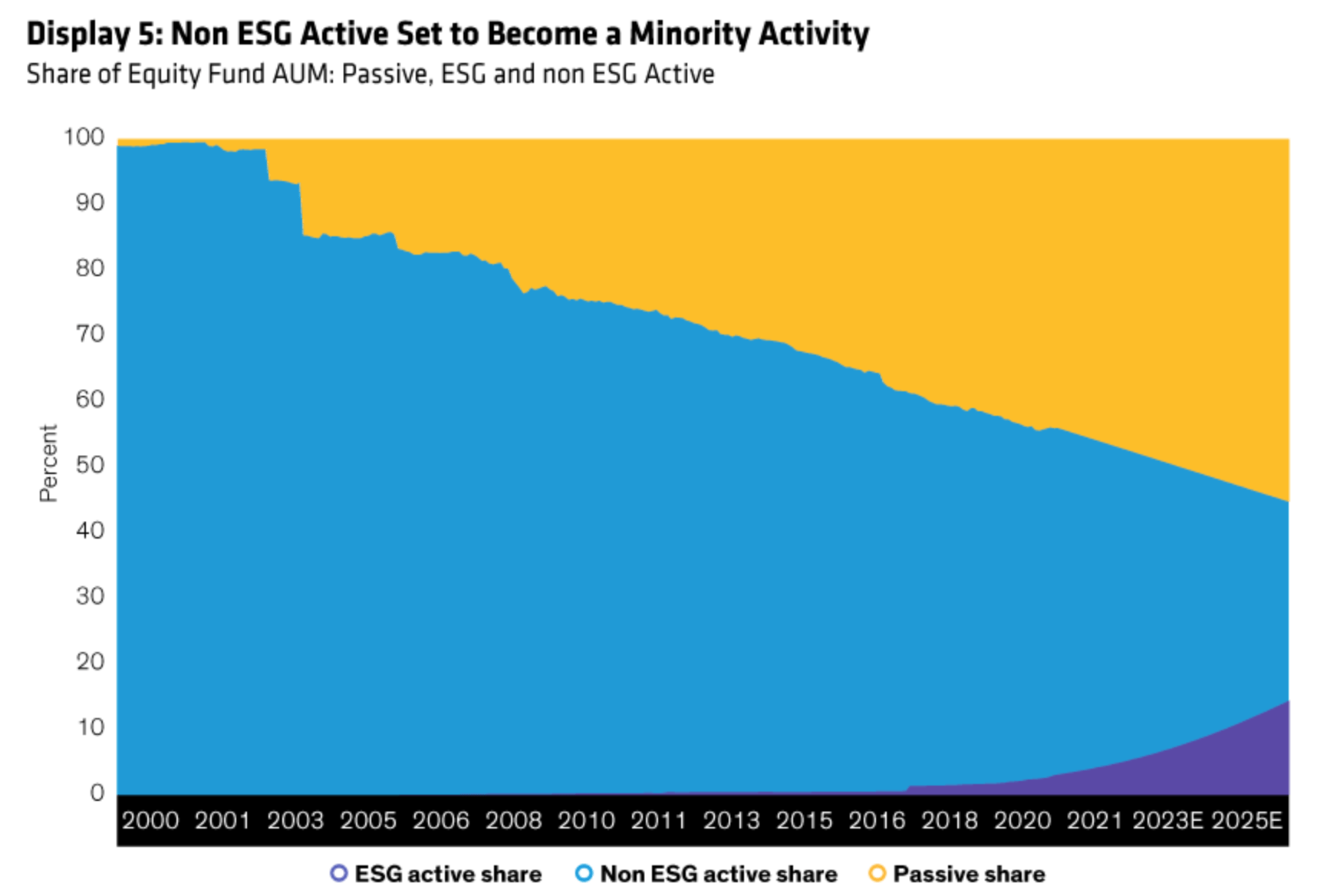

But in a significant revelation, Bernstein said that in the long term, the active investing industry will soon become essentially dominated by ESG investing.

The share of non-ESG active investing has fallen below 50% in the second half of 2021, a decline that Bernstein believes will continue.

Chamberlayne believes the current market volatility provides an opportunity for long term ESG investors.

He says that today’s problems – supply chain fragility, reshoring manufacturing, and energy independence – play into the very sustainability trends that we all should be focused on.

“We therefore see volatility as an opportunity to take advantage of a market shaped by short-term fear. This has meant adding to names where we have conviction in the long-term thesis,” Chamberlayne said.

According to him, the sustainability challenge will be captured by four mega trends: resource constraints, population growth, climate change, and ageing populations.

The world is severely resource constraint because natural capital resources are being damaged and depleted before they can be replenished.

Our global population is projected to increase to almost 10 billion by 2050, and at that time, one in six will be over the age of 65.

And last but not least, climate change will arguably be the greatest environmental and social challenge the world has ever faced.

As reported by Stockhead’s green expert, Jessica Cummins:

EVOLUTION ENERGY MINERALS (ASX:EV1)

The graphite play revealed that thermal purification has achieved an ‘exceptional’, industry leading purity level of 99.9995% C as a battery precursor – easily exceeding the required purity level as a precursor to battery grade spherical graphite.

Thermally purified Chilalo graphite also exceeds the specifications required for nuclear-grade graphite, which sells for around US$30,000 per tonne.

EV1 managing director Phil Hoskins says the successful purification results indicate that Chilalo graphite is highly amenable to a range of value-added applications in advanced battery systems, including lithium-ion battery anodes.

Woodside has revealed a US$9.9m ($13.16m) equity investment in an India-based bio-engineering company, String Bio, the developer of a patented process that can recycle greenhouse gases (GHG) into products such as feed for livestock.

Woodside is exploring the potential of String Bio’s carbon-to-products technology to support its decarbonisation efforts, targeting abatement of methane emissions at its operational sites.