Guy on Rocks: All lining up for a freshly greenlit Euro potash play

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Copper closed at US$3.79/lb and is now off 16% from its March 2022 high of just over US$4.50/lb.

Nickel has been the big mover after briefly trading over US$15/lb in the wake of the short sale by nickel producer Tsingshan in March. Nickel is now trading around US$10.25/lb down just under 34% from its recent highs.

No doubt the market is pricing in a recession with three-month copper futures in backwardation, 5 cents below spot prices.

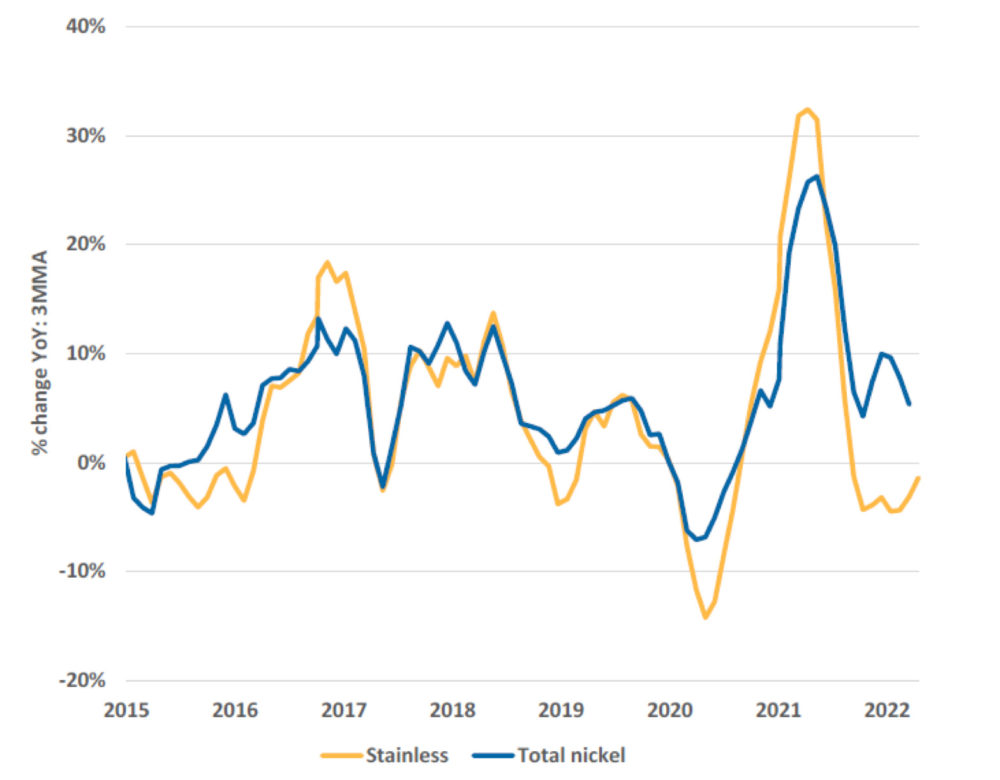

Nickel consumption grew around 17.1% YoY to 2.83mt last year according to Macquarie (Macquarie Resources, June 2022) driven primarily by strong stainless steel production (up 13.5% YoY) and battery production (increasing by 80% YoY to 360kt).

Over January and May 2022 however Macquarie estimates (figure 1) that global stainless steel production fell 3% YoY with China falling 7%. Despite these figures, Chinese exports have increased 15% YoY.

The question is how much further can metal prices fall?

The marginal production costs for the 90th percentile of copper producers according to Wood Mackenzie is just under US$3.62/lb with nickel around US$8.16/lb. So, the simple answer is yes they could fall further but I think there is not far to go before we see the bottom of this cycle.

Gold finished the week flat at around US$1,827/oz despite the G7 adding gold to their sanctions against Russia due to the Ukraine invasion. The United States, Britain, Japan, and Canada announced they would ban imports of new gold produced in Russia. This, according to Grandpa Joe Biden, would deprive Russia of tens of billions of dollars the pariah nation needs to fund its war in Ukraine.

Russia produces just under 10% (ranking second in the world) of the world’s gold worth around US$15 billion per annum, with the London Bullion Market banning six refineries from the Good Delivery List back in March of this year. Last year just under 30% of Russian gold was exported to the UK.

However, the bank is likely to have limited impact as the sanctions only apply to the G7 nations. As we have seen previously, it appears that Russia has found it relatively easy to find other markets for its commodities; for example India has been a big buyer of oil since the Ukraine war broke out.

Energy is likely to dominate the air waves for some time to come with Europe 40% dependant on Russian natural gas. Biden didn’t have time to meet with key oil executives last week, opting instead to take a meeting with an offshore wind partnership.

It appears that, despite the energy crisis, there is no US domestic support for oil and gas production. US domestic refining capacity remains at a low since 2014 with no new refineries having been constructed since 1977!

Ironically the Energy Information Agency was unable to publish any data last week as it was having power issues!

On recent economic news, PMI came in at 52 (estimates were for around 56) suggesting we are approaching zero growth (50) while the VIX Index-figure 3 (a real time index that measures volatility on the S&P 500 over the next 30 days) closed at 27.4, still implying high levels of volatility.

Russia has failed to meet its US$100 million interest payments on 27 May 2022 with around half of its US$40 billion debt dominated in dollars and euros. While it was willing to pay, the current sanctions made it impossible to pay international creditors. This is the first time in over 100 years since the Bolshevik Revolution of 1918, that Russia has defaulted on its debt.

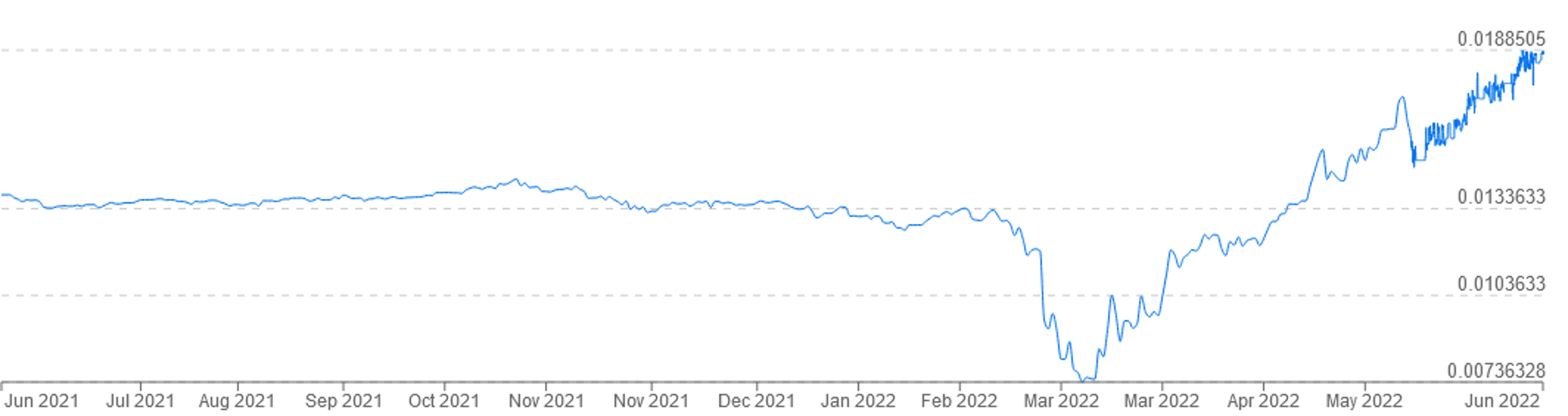

There is some irony around the sanctions that seem to be hurting the world economy with soaring energy prices while the target of the sanctions appears to be thriving – the Russian rouble has appreciated strongly against the USD in recent months (figure 4). The Russian bear is thriving!

I first mentioned Highfield Resources (ASX:HFR) in February 2021 (figure 5) around the 60-cent mark and the Stockhead faithful were rewarded with a solid run on the share price up past A$1.20/share before the music stopped.

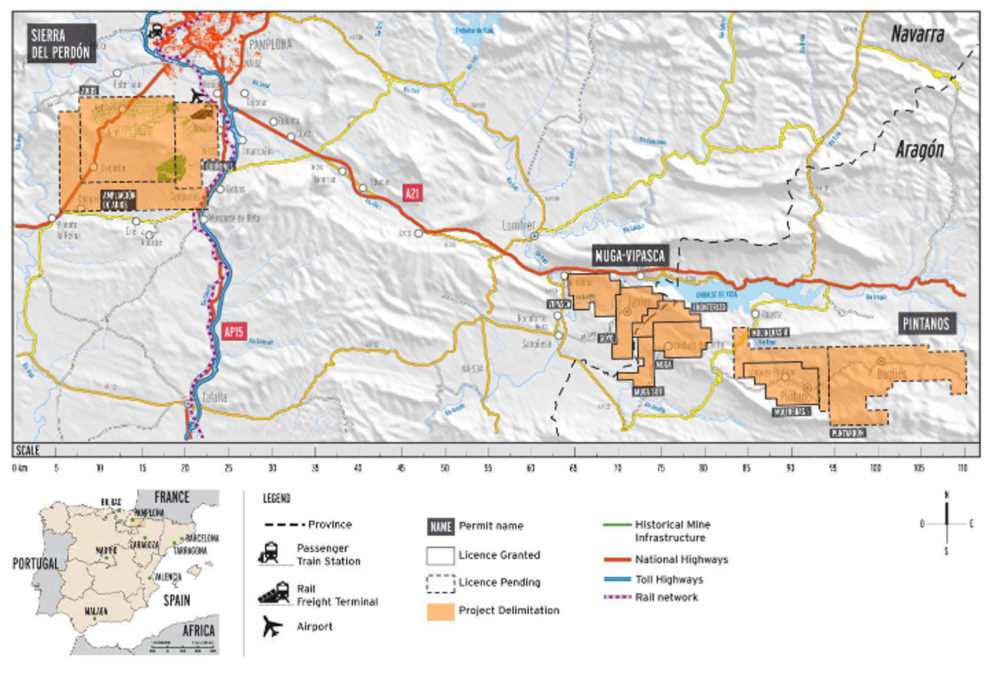

The long-awaited construction licence for the Muga project mine gate and the declines has finally been awarded from the local authority – the Townhall of Undués de Lerda in Aragón (HFR ASX Announcement, 24 June 2022). The combined licences cover an area of 250 square kilometres and are situated in the Ebro potash producing region based in Northern Spain (figure 6).

The initial on-ground preparatory works are expected to commence in the next few days at the mine gate.

Following the grant of the mining concession in 2021, these two licences are essential for the construction of the Muga project.

The updated December 2021 Feasibility Study numbers are compelling.

Sensitivity analyses using flat real spot prices for the life-of-mine returned a post-tax NPV8 of $4.2 billion and an 42% internal rate of return based on a 1 million tonnes per annum of Muriate of Potash over a 30-year mine life.

Phase 1 capex is $612 million with Phase 2 an additional $313 million. HFR is currently in the hunt for approximately $450 million in debt finance to complete Phase 1.

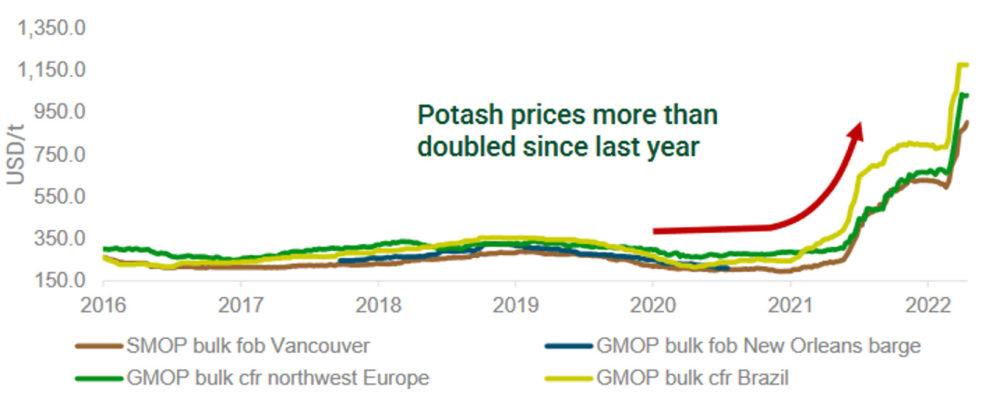

The good news is that potash prices (figure 7) have moved up sharply in the last 12 months and this should give the feasibility a big lift. The recent supply disruptions, with Belarus-Russia accounting for 47% of the European (38% of global consumption) market, are likely to keep prices moving up for the short to medium term.

At a market capitalisation of just over $300 million, HFR has the wind in its sails with supply disruptions and rising potash prices likely to propel it well above recent highs of $1.28 in April 2022.

Good timing to be developing a potash project with real scale.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.