Mining in Mongolia: The ASX stocks with boots on the ground in the mineral rich country on China’s doorstep

Mining

Mining

Mongolia isn’t just the home of Ghengis Khan and nomadic tribes who hunt with eagles. The country is fast becoming a mining powerhouse, as global players hunt for resources in the stable jurisdiction with access to Europe and China.

You may as well call it Mine-golia. Ha!

(Ed: She’s here all week…)

Seriously though, the country’s mineral wealth includes copper, coal, gold, silver, iron ore and zinc to name a few.

Mining accounts for 20% of the nation’s GDP, which has grown at an average rate of 7.2% per year since the advent of large-scale mining in 2004.

And mining accounts for around 80-90% of exports, which mostly go to China. That means companies that operate there have a strategic advantage when targeting that market.

Despite selling around 90% of its gold exports to Switzerland, China is still the major market for Mongolian minerals.

As of February 4-10, the country exported a total of 806,700 tons of coal, 124,500 tons of copper concentrate, as well as 165,200 tons of iron ore and concentrate from the beginning of the year.

Bituminous coal and copper concentrates accounted for 36.6% and 48.1% of total exports to China respectively, and in January alone trade with China reached US$520.4 million – which is around 47.5% of Mongolia’s total trade turnover for the month.

Despite China’s ambitious goal to reduce consumption, it’s still importing a lot of coal from Mongolia currently.

Before the pandemic, Mongolia used to export over 30 million tonnes of coal annually, but last year it exported 16,138 thousand tonnes.

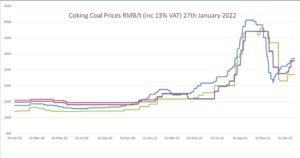

This sounds like its winding down, but even with the decline in the volume of mineral exports, the income from export in 2021 was equal to those of previous years because of high commodity prices.

For instance, the country exported 36.2 million tonnes of coal and earned US$2,803 million in 2018, exported 36.6 million tonnes of coal and earned US$3,079 million in 2019, and exported 28.6 million tonnes and earned US$2,127 million in 2020.

But in 2021 it exported 16,138 thousand tonnes and of coal and still earned US$2,779 million.

The same goes with copper prices and demand: Mongolia exported 1,447 thousand tonnes of copper concentrate and ore in 2017 and earned US$1,613 million from it. Last year the country sold 1,283 thousand tonnes and earned US$2,900 million.

Plus, China is the world leader in manufacturing lithium batteries, and continues to outpace the globe in demand for EVs.

It also dominates megafactories, with 89 of 123 of the world’s megafactories in the pipeline.

And then there’s the general ESG shift in investment which some experts say will lead the shift from coal to copper.

Mongolia’s Ministry of Mining is working to entice explorers to the country by digitising the issuance of mineral exploration licences to allow companies to electronically apply and receive responses within a month.

So, it makes sense that the Government is gearing up to make exports easier, with plans to build a separate railway from the massive Tavan Tolgoi coil mine to expedite coal deliveries through the South Gobi corridor.

The commissioning of the 416km long Zuunbayan–Tavan Tolgoi Railway is expected in March 2022, and the 281km railway from Zuunbayan to Khangi\Mandal is expected to be completed in 2023 – and will remove a significant bottleneck that currently exists in the railway from Sainshand to Zamyn-Uud\Erlian.

Added to this, Chinese rail authorities intend to extend the Erlian border checkpoint after the 2022 Lunar New Year celebrations, boosting Mongolian export capacity through Zamyn-Uud.

And the Tavan Tolgoi–Gashuua Sukhait railway will be completed in July 2022, with the construction of the much shorter Gashuua Sukhait to Grants Mod railway that will deliver Mongolian coal directly into China to start May 2022.

Just last month, the Mongolian Government and the mining giant settled a long-running dispute over the $6.93 billion expansion project for the Oyu Tolgoi copper-gold mining project.

The Oyu Tolgoi mine is expected to be among the top five largest copper mines in the world by 2030.

Operations will soon start on the underground portion, with first production expected in the first half of 2023.

It’s expected to produce around 500,000 tonnes of copper per year on average from 2028 to 2036 from the open pit and underground, and an average of around 350,000 tonnes for a further five years, compared to 163,000 tonnes in 2021.

And it could account for as much as 30% of Mongolia’s GDP, with the Government owning 34% of the project.

Rio controls the rest through its 51% stake in Toronto-listed Turquoise Hill Resources (NYSE:TRQ) and operates the mine.

As part of the deal, Turquoise Hill will waive $2.4 billion in debt owed to it by the Mongolian government.

Interestingly, the original agreement called for the construction of a new coal-fired power plant to supply electricity to the mine, but this was back in 2009 before the ESG boom we’re seeing today. Rio says the plan is now to source wind power for the project.

Earlier this month the $15m market cap company delivered an update on its Mongolian portfolio which highlighted several positive aspects of recent exploration in the country’s world-class porphyry region – right on China’s doorstep.

CEO Sam Spring said 2021 activities had identified a new intrusive system, Shuteen North, with initial work generating three new porphyry targets and one epithermal gold-base metal target with “significant scale potential”.

Kincora’s portfolio in total covers three large-scale and underexplored porphyry systems, and is located in the Southern Gobi copper-gold belt.

At the most advanced project – the Bronze Fox mining licence – an independently defined 1.3-1.5Mt copper metal equivalent exploration target has been defined with plans to convert this to a JORC resource.

Spring told Stockhead that Oyu Tolgoi was a good demonstration of the largely untested geological potential of the belt, but also the various significant advantages the Southern Gobi provides from an exploration and development perspective.

“For example, it only took five years for Oyu Tolgoi to go from discovery to initial production from the open pit, which is pretty remarkable, particularly relative to many other copper jurisdictions,” he explained.

“This helps demonstrate many of the favourable attributes of the Southern Gobi desert, which is sparely populated and one of the world’s fastest growing mining and infrastructure regions, noting over 27Mt of coal was exported to China in 2020.”

He also said that despite the relatively limited modern systematic exploration in the Southern Gobi, the discovery of Oyu Tolgoi, plus part development of Tsagaan Suvarga and exploration success at Kharmagtai, helps illustrate the geological prospectivity of the belt.

“It is estimated to already host over 85 million ounces of gold and over 50 million tonnes of copper,” he said.

Looking forwards, the company is planning to spin-out its Mongolian portfolio, with a larger $7.5-10m IPO (up from $5m) and subsequent listing on the ASX of Resilience Mining Mongolia (ASX:RM1).

In December last year the $34m market cap explorer announced it had grown its ‘Kharmagtai’ porphyry resource to a massive 3 million tonnes of copper and 8Moz of gold.

This covers only ~30% of the 8km long mineralised complex, and positions Kharmagtai as one of the largest undeveloped copper assets held by a listed junior globally, XAM says.

There are a few other things that set the project apart.

“The higher-grade zones (>0.8% CuEq) have grown from approximately 58Mt in the previous estimate to just on 100Mt with this update,” CEO Dr Andrew Stewart said.

“This could be a real game-changer for project economics, with better defined and larger high-grade zones, setting the project apart from similarly sized orebodies, with the higher-grade component potentially unlocking project scenarios that could pave the way to put Kharmagtai into production.”

“A significant increase in gold to copper ratios has resulted in a greater than 80% increase in contained gold, which means higher by-product credits that will be reflected in lower all-in sustaining costs.”

Stewart also commended the resolution between the Government and Rio and Turquoise Hill.

“This demonstrates Mongolia’s commitment to being a stable and business friendly mining jurisdiction, and it significantly reduces uncertainty for future mining projects,” he said.

The coal explorer is looking to develop the Ovoot coking coal deposit which contains a JORC 2012 compliant total Coal Reserve of 255 Mt of high-quality (fat) coking coal.

And Aspire welcomed the recent resolution of the Oyu Tolgoi agreement and underground development approval.

The company said the circumstances of Aspire and its OCCP are vastly different to that of Rio and Turquoise.

“Nevertheless, Aspire sees this as a watershed moment in revitalising the attractiveness of Mongolia as a standout destination for foreign investment combined with its excellent geological prospectivity and its strategic location in Asia,” the company said.

The plan is to truck the coal to a company owned terminal facility in Erdenet, and then deliver to customers in China and Russia via the existing Mongolian rail network.

The $42m market cap company is also pretty happy about recent developments in Mongolia’s rail network plans, which it says will “significantly enhance the capacity of Mongolia to export to China.”

“Chinese border officials have recently been encouraging Mongolian iron ore and coal exporters to use containers through the Zamyn -Uud\Erlian border which we expect will also be extended to the Khangi\Mandal border once the railway connection has been completed,” Aspire said.

The company is also planning to export coking coal to markets accessible through the Russian rail system to the north.