Guy on Rocks: With the red metal about to break out, this copper stock is a bargain

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

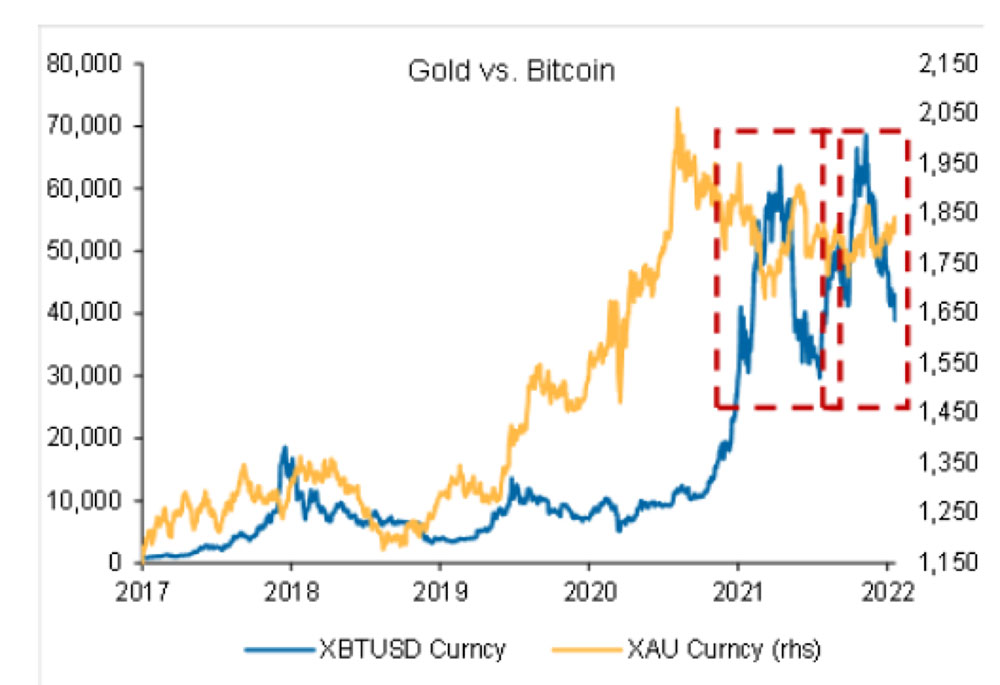

While gold appears to have formed a base around US$1,800 an ounce, Bitcoin has dropped over 20% in January and is now trading around US$41,000 per token or 23% from its record highs in November 2021.

A Goldman Sachs analyst last week in an interview with Kitco reflected “it is important to remember that risk-aversion is a major driver of investment interest in gold vs. assets such as equities and, to an even larger extent, vs. Bitcoin. In our view, gold is a risk-off inflation hedge while Bitcoin is a risk-on inflation hedge”.

The analyst considers gold represents a better hedge in the face of the possibility of slowing growth and declining valuations with gold a more effective exposure.

While Bitcoin had modest returns last year, taking into consideration risk-adjusted returns, Bitcoin underperformed the broader market.

Interestingly gold and Bitcoin appear to be negatively correlated figure 1.

The analysts noted that although Bitcoin saw record nominal returns last year, the market’s risk-adjusted returns underperformed the overall market.

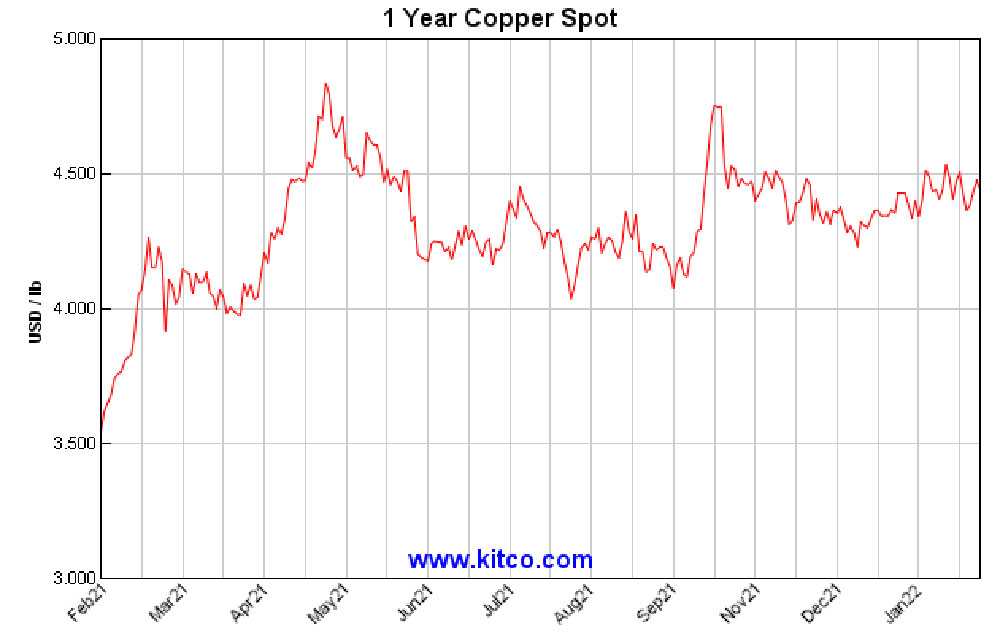

Its business as usual on the copper (figure 2) front, with chaos the order of the day as Chile’s Senate looking like it might go right off the reservation as it approved (last Tuesday) to nationalise copper and lithium mines.

Furthermore, it is also considering annulling mineral operations that infringe on indigenous land. Well, if the copper price needs a lift you can bet your arse the Chilean Senate will provide that ammunition.

The royalty situation is also looking really special with the Senate proposing an additional US$3.52/lb and the Lower House US$4.32 on top of an existing US$3.22/lb royalty.

I am not sure if the half-wits in the Chilean Government have any idea what they are doing but the golden goose looks like it is about to head down the “S” bend.

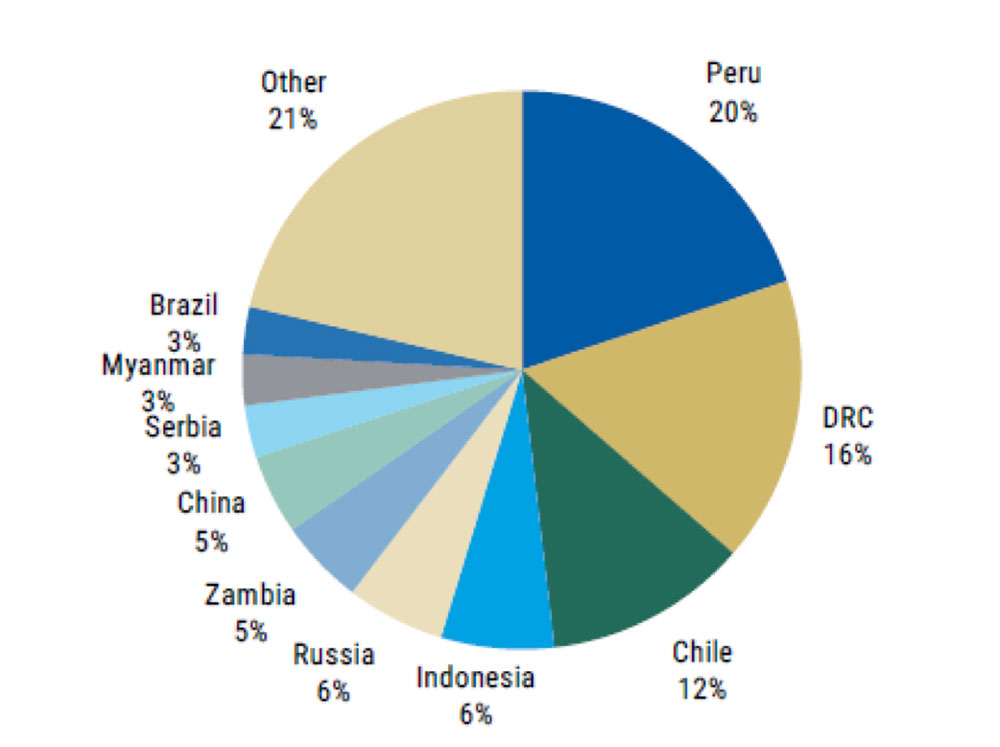

All good news for the copper bulls of course with 12% of global copper production at risk (Figure 3)…

And finally, rising costs seem to be biting the major copper producers according to Morgan Stanley (Morgan Stanley Research 31 January 2022) with costs between 5% and 32% higher than consensus.

Antofagasta is reporting 2022 cash costs 27% above consensus due to unfavourable production mixes, inflation pressures, and higher input costs (particularly sulphuric acid).

Freeport McMoRan reported cash costs of $1.29/lb, above the October estimate of $1.26/lb on nonrecurring labor-related charges at Cerro Verde but sees a further increase to $1.35/lb for 2022.

First Quantum reported that “cost increases and delays on most current capital project works associated with shipping, steel price, fuel costs, and labour with the latter often an impact of COVID-19 constraints.”

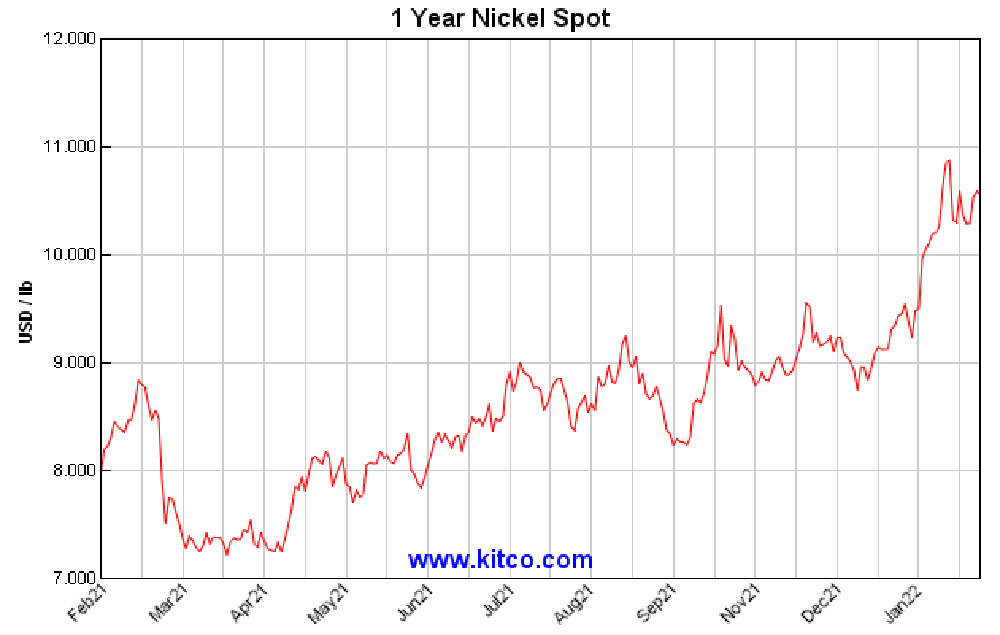

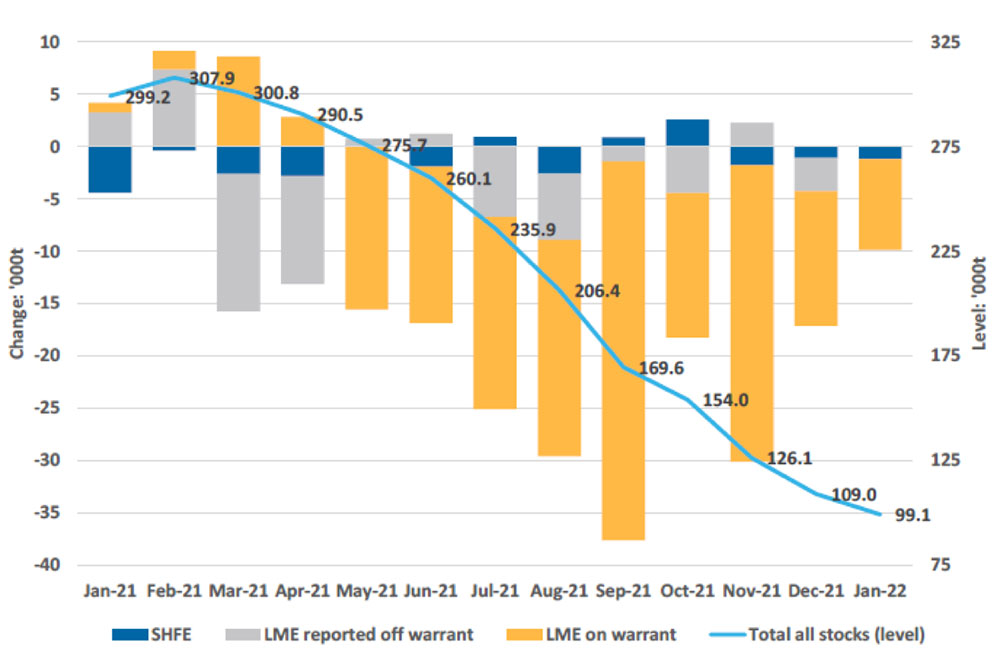

LME nickel prices have been very strong this month (despite weakening demand in China) as LME official cash prices hit $24,000/t in late January 2022, up over 20% from a month earlier.

Technical position squeezes, fears of Russian nickel supply, logistical/transportation bottlenecks, low LME inventories, and supply disruptions in Indonesia continue to keep pressure on nickel supply (figure 5).

The change in battery composition is likely to underpin nickel for the medium to long term with producers looking to favour the use of higher nickel-content batteries (to reduce costs and to increase driving range).

The move to high nickel/low-cobalt chemistries in EV sales last year meant that the nickel content grew by 125% YoY while cobalt content grew by only 55% YoY.

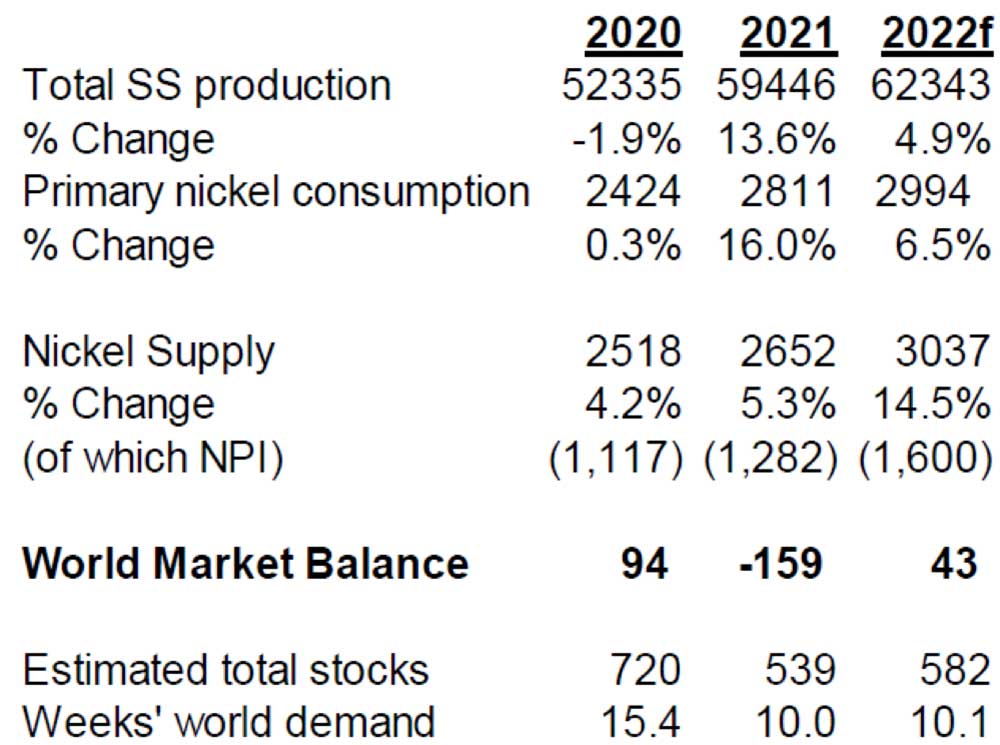

Having said that I question whether the batteries with lower cobalt content will have the required stability. Who knows how the supply demand balance is going to pan out in 2022 but table 1 seems to paint a finely balanced scenario.

2022 has started at a frenetic pace with some big moves in the junior and mid-cap space.

Sandfire Resources (ASX:SFR) have splashed out US$1.865 billion to acquire the Minas de Aguas Teñidas S.A. mining complex from Mubadala Investment Company and Trafigura.

MATSA has a 12-year resource life and produces ~100-120ktpa CuEq (from a 4.7Mt p.a. plant) production (FY22) and is situated in the prolific Iberian Pyrite Belt (Spain). This will bring SFR’s total FY 2022 production to around 170-194kt CuEq.

Funding will be via a $1.248bn fully underwritten equity raising consisting of:

Meanwhile the junior iron ore producers are looking a little better with spot iron ore prices lifting to US$146/tonne after a brief stint under US$100/tonne.

As the genius who writes this column pointed out, there are too many doomsday preppers involved in forecasting iron ore prices, most of whom are overly pessimistic.

Good news for GWR Group (ASX:GWR) who is back in full production at the C4 mine at their Wiluna iron ore operation following their shut down in late 2021.

Interestingly, the recent shipment was at a fixed price which contrasted to Fenix Resources’ (ASX:FEX) more complex contracts that are periodically adjusted for among other things, shipping and demurrage charges, and historical iron ore spot price movements that saw realised FOB price drop to US$56/dmt in the December Quarter.

Mind you with shipping costs falling and a rebound in spot prices FEX is set for a much-improved quarter.

Not surprisingly we are seeing plenty of activity in the nickel space with BHP’s decision to invest an initial US$50 million (up to US$100 million) in the Kabanga nickel mine (Tanzania).

Tesla has completed a supply agreement with Talon Metals’s nickel project (Minnesota, USA), and Elon Musk is behind Prony Resources, which is aiming to turn around the Goro Mine (New Caledonia) which has suffered from years of underperformance.

Nickel Mines (ASX:NIC) is planning to open the Angel project in Indonesia in the 3-4Q 2022 and Poseidon Nickel (ASX:POS), is looking to restart the high-grade Silver Swan mine and Black Swan by March 2023.

IGO Limited (ASX:IGO) is settling on its acquisition of Western Areas’ (ASX:WSA) in a friendly $1.1 billion merger which is due for completion in April 2022.

Mincor (ASX:MCR), is planning to restart its Kambalda nickel operations late this year and Panoramic Resources (ASX:PAN), also restarted operations at the Savannah mine in late 2021.

Together with a number of juniors I have covered here with aggressive exploration programs such as Estrella Resources (ASX:ESR), Azure Minerals (ASX:AZS) and Kingsrose Mining (ASX:KRM), there is plenty to look forward to this year.

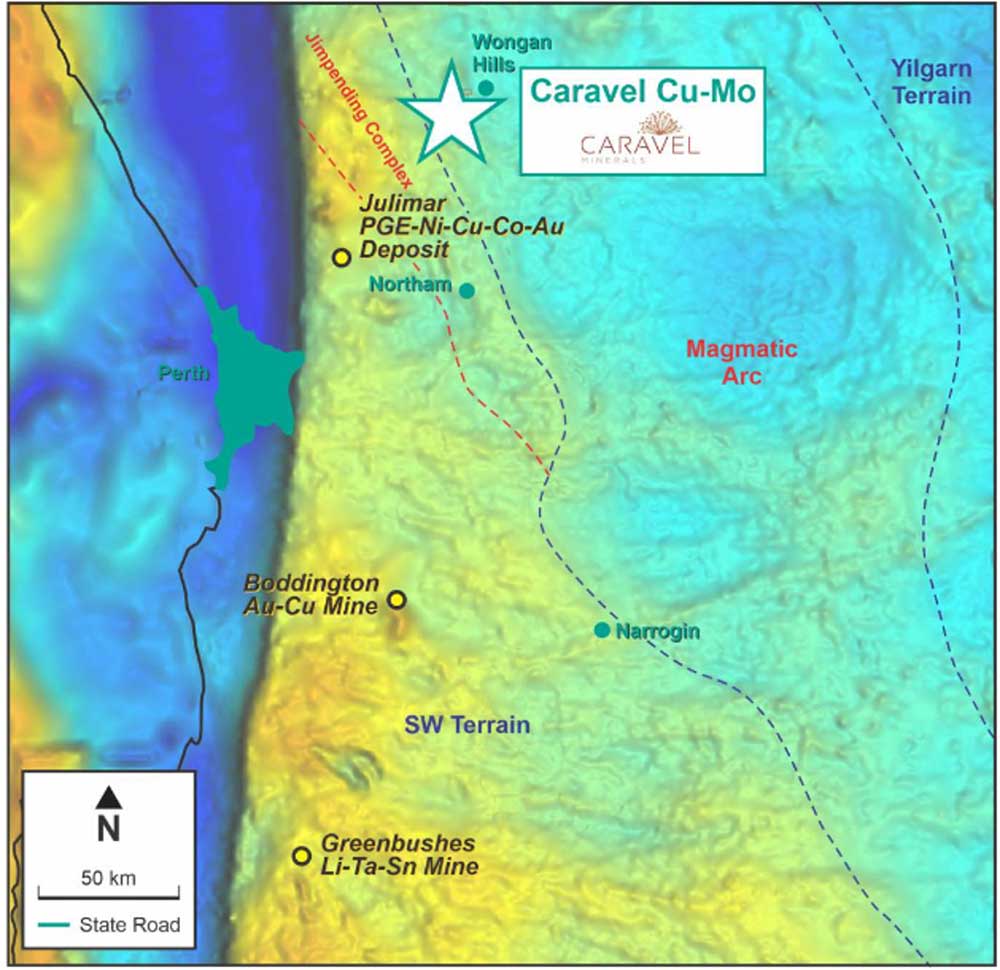

Caravel Minerals (ASX:CVV) is a Perth based exploration company that has 100% of the Caravel Cu-Mo project located near Wongan Hills in Western Australia, around two hours north of Perth.

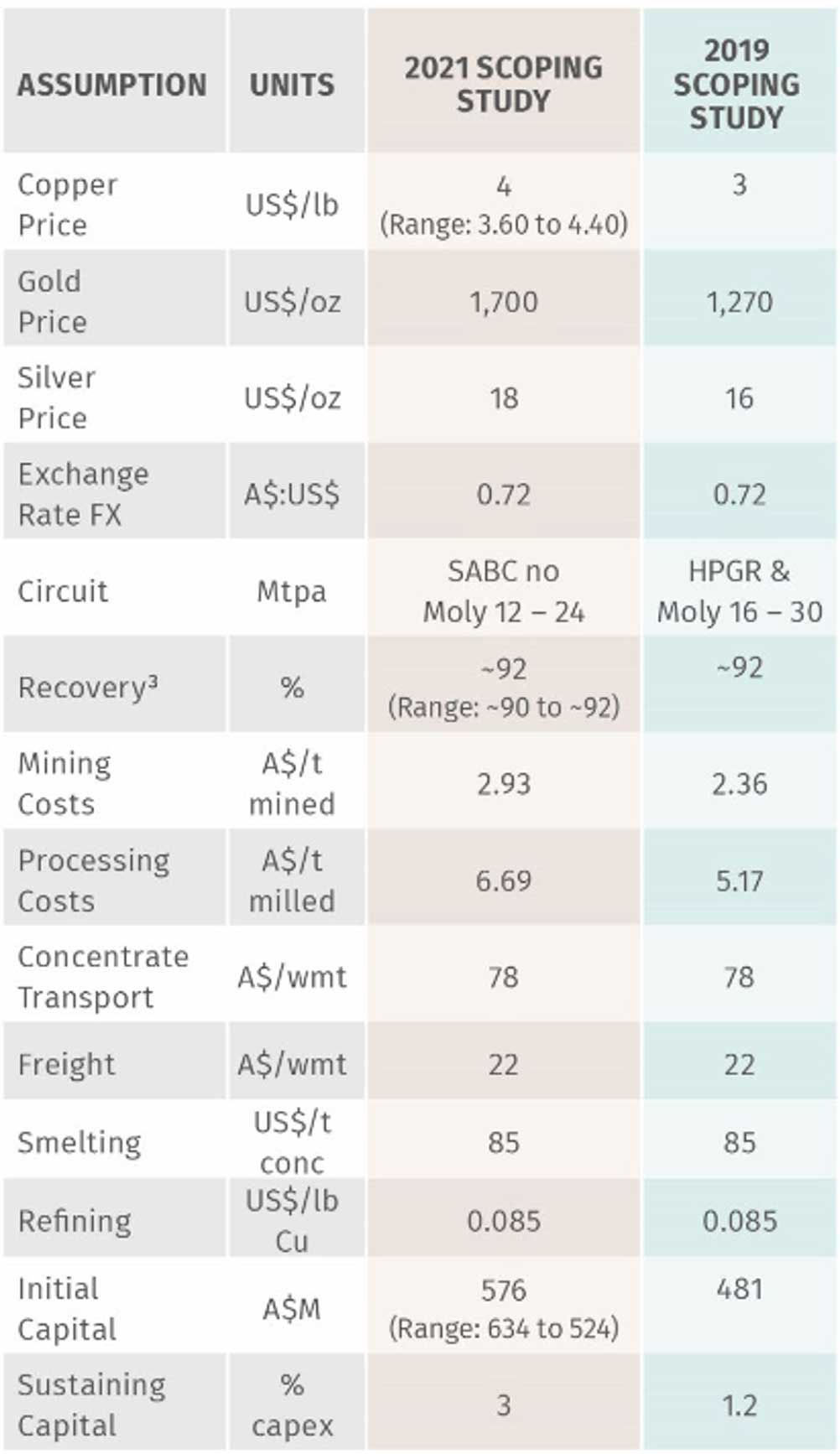

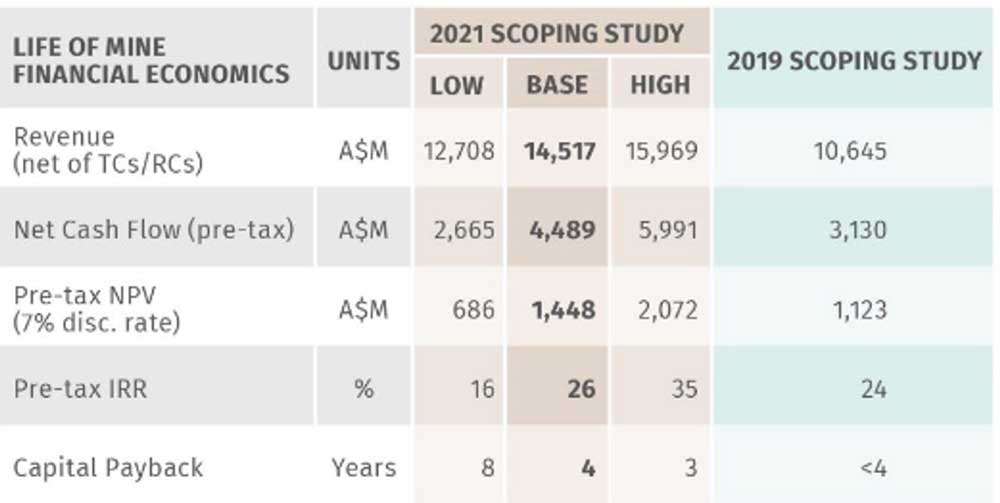

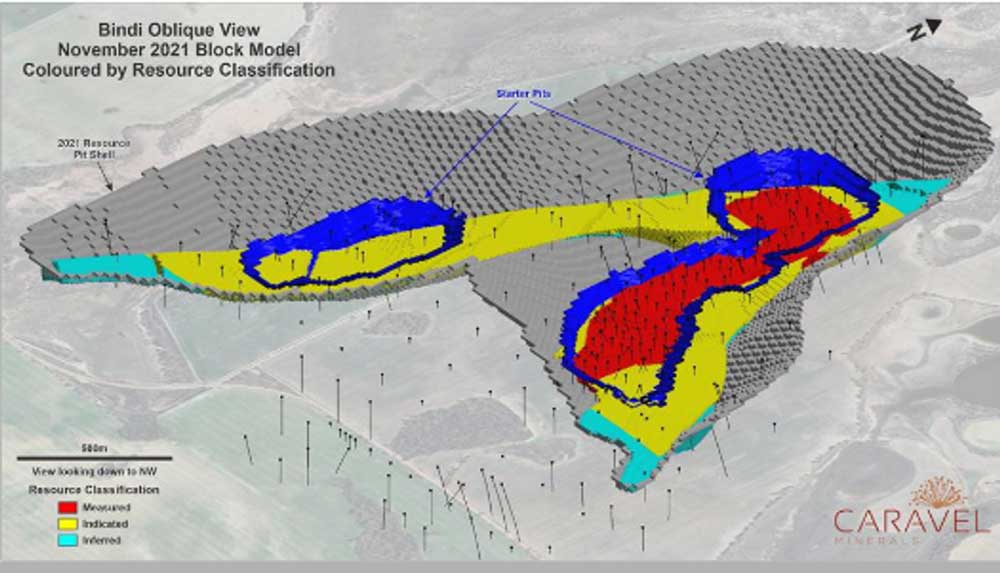

The 2021 Scoping Study (Tables 2 and 3) put out a remarkably robust set of financial metrics based on a 1.18 billion tonnes @ 0.24% Cu and 48 ppm Mo for 2.84Mt of contained copper (0.1% Cu cut-off).

With CAPEX in the order of $600 million the 28-year operation produces ~5Kpta copper (in concentrate) from years 1 to 5 and ~55Ktpa copper (in concentrate) from years 6 to 28. The project returns a whopping pre-tax ~$1.44b NPV7 (base case) with a four-year payback.

There is further upside from exploration upside and commodity price/exchange rate movements that are already heading in the right direction.

C1 costs are $1.90 per pound giving a gross margin of around $3.00/lb assuming a concentrate with 70% of contained metal payable.

The deposit, while low grade, not only has the benefit of strong copper prices but also has a very low stripping ratio (0.4 to 1 in the first five years), a 50Mt+ high-grade core and excellent infrastructure including heavy haulage road access direct from site to Bunbury port grid power, optic fibre communications link.

Cleared freehold land and Native Title has also been settled.

A pre-feasibility study is due out in this half and an enterprise value of approximately $110 million I think this is a bargain, particularly with the red metal about to break out of its current trading range around US$4.40 to US$4.50/lb.

Assuming the PFS numbers come in with similar financial metrics, I am going to stick my beak out and project a 20% of post-tax NPV is possible, or something in the order of $200 million/50+ cents per share. Put that in your pipe and smoke it….

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.