2022: the year real nickel stood up?

Pic: Getty

Base metals were mixed overnight as nickel led the laggards, shedding almost 2.5%.

Nickle in a pickle? No. Not really.

The analysts at Fitch Solutions have done some solid background on nickel pricing and production for the utterly transformational years ahead. So here’s the latest real deal on nickel.

China, Elon and BHP

First up, the next few months should see the fruits of Chinese stainless-steel juggernaut Tsingshan’s 2021 promise to ramp up battery grade nickel production for both 2022 and 2023.

Electric vehicles may be the future buzz for nickel, but stainless steel is the current driver… although, in truth, this was all said and done before Elon Musk’s vertical approach, following Tsingshan down the ore-to-battery processing route, finally sparked the global giants of the auto-industry into action.

Fitch reckons demand from the global and suddenly lively electric battery industry, “will underpin rising nickel prices,” which in turn should sustain steady mine production growth for years.

Keeping up with the…

On this front, it’s always good to peek over the fence and see what the industry’s Kardashians are doing and keep up with them.

In this case, BHP has been busy pouring its attention on a straight-to-battery nickel business, already helping test out Toyota’s next-gen EVs at the iron ore giant’s Nickel West set up. But let’s get on to Toyota et al in a jiffy.

Fitch expects the key mining hubs of Indonesia and the Philippines to start coping with Covid this year, ending disruptions and helping drive some very punchy growth in nickel ore production later in 2022 and well into 2023.

Beyond the near-term things start to get fairly disco — where exponential demand and steadily higher prices for an increasingly versatile metal will be sustained by “persistent annual production deficits.”

Big in Denpasar

For now, with New Caledonia’s reported 25% of global supply remaining offline and under the brilliant but possibly insane care of Tesla, the most fragile part of the global nickel mine supply pipeline is in Indonesia.

Fitch warns: should there be delays to development of downstream processing facilities nickel ore could end up stranded, a risk which might effectively reduce the incentive for miners to boost output.

Enter Justin Werner’s Indonesian-based Nickel Mines’ (ASX:NIC), where the Angel Nickel Rotary kiln-electric furnace (RKEF) project was earlier today bestowed the gift of, “material corporate tax relief,” as Angel approaches maiden commissioning.

These concessions include a few crackers, like waiving income tax for a decade. Followed up by a 50% discount for the following two years.

Nice.

Angel Nickel is an Indonesian-HQ’d Penanaman Modal Asing – or PMA – that’s an Indonesian investment entity where 100% foreign share ownership is totally allowed. For NIC, in this case, it’s about 80%.

After rising almost 2% in early trade, shares in Nickel Mines closed flat.

With battery-grade Class 1 nickel looking at a major demand boost from the green transition, the other main obstacle to supply is sufficient Class 1 product.

Indonesia currently mainly supplies Class 2 nickel ore.

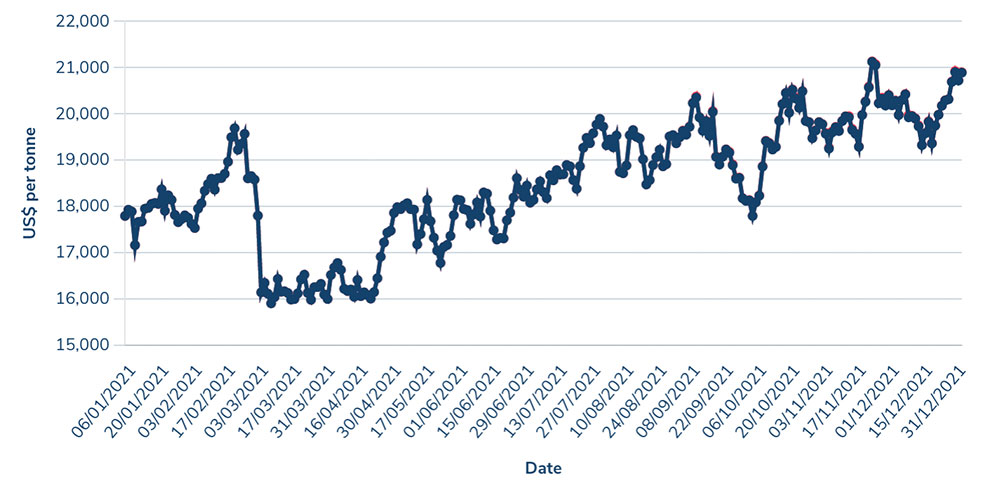

Fitch Solutions’ nickel prices timeline:

- 1H22: We expect refined nickel prices to weaken during the first half of 2022 as the acute market tightness that developed over October-November 2021 continues to ease.

- Note to self: Prices have already fallen from the multi-year highs reached in October and we expect this consolidation to persist over the coming months.

- 2023-26: We forecast a steady uptrend in the value of nickel, with prices likely to reach new record highs by the end of this period.

- 2027: We forecast nickel prices to peak as new refined nickel production capacity in Indonesia should start to rapidly narrow the global refined nickel production deficit.

The thinking out of Fitch is that stronger production growth will also likely be supported by some clever technical advances which will fast track making lower-grade Class 2 nickel ore – abundant in Indonesia – into higher grade Class 1 nickel, the sort so coveted by the battery industry.

“This will help to alleviate the bottleneck in nickel supply likely to develop over the next four or so years as global production of batteries for the electric vehicle industry surges,” Fitch concludes.

And it will surge, Serge

So, Kudos to Mr Musk. While the giants of the global automobile world slept or hibernated or sat around waiting for chips to grow on trees (but not in Taiwan), Tesla has been monopolising the news cycle on everything to do with electric vehicles, ever.

But it’s starting to look like those silent metal giants – the ones that actually sell cars like GM, Toyota and Volkswagen – haven’t been slumbering all this time at all, it turns out they’ve been… skulking.

Watch and learn

General Motors just launched its all-electric Chevrolet Silverado, which Wedbush analyst Dan Ives reckons will kick off an olde school land grab, “the start of a massive slate of electric vehicles coming from the Detroit stalwart over the next 12 to 18 months.”

“With the Tesla trillion dollar plus valuation… and growing EV appetite among investors for new innovative EV stories, the vertical integration capabilities of GM and conversion of its massive customer base to electric vehicles over the coming years represents a transformational opportunity for GM looking ahead.”

So now the ‘legacy’ makers see the game is afoot, the battery metals industry, well, it’s going to get very, very real for local nickel plays.

Here’s the new 2024 Electric Chevrolet Silverado.

– 400 mile range

– 10,000 pounds of towing

– Zero to 60 in ~4.5 seconds

– Pass through truck bed *into* the cab

– Four wheel steering

– Fully loaded version coming 2023 (MSRP $105,000)

– Basic package ~ $39,000

What do you think? pic.twitter.com/FXX82wXgQv— JerryRigEverything (@ZacksJerryRig) January 5, 2022

Home and away

Before Christmas, Poseidon Nickel (ASX:POS) updated the market on its ‘Fill the Mill” strategy by fast tracking the restart of the Black Swan nickel op in Western Australia, putting the company in pole position for a bigger mining inventory to support the restart of the processing plant.

Then there is IGO’s (ASX:IGO) $1.1 billion cash takeover of Western Areas (ASX:WSA), announced late last year which should lift IGO’s production profile from 25,000-27,000t of nickel metal a year to 41,000-44,000tpa.

It could also potentially revive plans IGO shelved several years ago into a downstream nickel sulphate plant to rival BHP for local nickel offtake. That is a big deal for Nickel West, which is currently the natural home for nickel sulphide ore from local miners like Mincor (ASX:MCR).

The rejuvenated WA producer Panoramic Resources (ASX:PAN) is officially generating cash again from the Savannah operations, recently delivering a maiden 11k/t shipment of nickel-copper-cobalt concentrates to China. A second 8,00t -10,000t shipment is pencilled in for February.

And then there’s the next crop of mine discoverers. Like Azure Minerals (ASX:AZS), who’s share price isn’t the only thing to have grown since it hit paydirt in its very first drillhole at the Andover project in October 2020.

The size and scale of Azure’s company making Andover nickel-copper discovery in WA — 16.2% owned by famed prospector Mark Creasy — increased at a rapid rate in 2021.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.