This irresistible slice of UBS humble pie is all you need to know about how big Square’s Afterpay deal is

Tech

Tech

Throughout the post-COVID surge in the Afterpay (ASX:APT) share price, the analyst team at UBS bank stayed notably bearish relative to the market consensus.

Back in February, when APT recorded half-year sales of $9.8bn and its stock was trading above $130, UBS thought it was worth more like $30.

Over the course of the year its valuation on the BNPL leader crept up (slightly), to just over $40.

A central tenet of UBS’ house view centred around how aggressively it thought the market was pricing for Afterpay’s future sales growth.

For context, yesterday APT reported full-year sales of just over $20bn.

To justify its price well north of $100, UBS calculated that APT would need to increase that number to $170bn by 2025.

But as an analyst, it’s hard to predict when Jack Dorsey is going to step off the yoga mat and blow traditional DCF (discounted cash flow) analysis out of the water with a ~$40bn share-based acquisition:

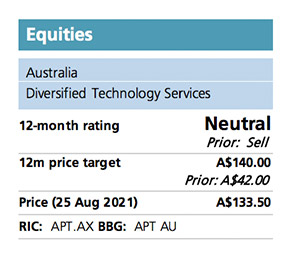

The bright red Sell rating has been replaced by a Neutral tag (still not a Buy).

That said, they still see some “residual risk” from the transaction, stemming from regulatory complexities around the global merger of two large tech companies.

Square Inc‘s cash app has around 70m users in the US, while there are more than 10m US users on the APT platform.

With increased anti-trust scrutiny in the US on large tech mergers, the Square Inc/Afterpay deal “may attract regulatory scrutiny” that is not currently being priced in by the market,” UBS said.

The analysts also raised the idea that Square Inc could have built and rolled out a BNPL solution by itself for $100m or less, rather than dropping ~40bn on Afterpay.

Regardless, the provisional deal has been announced. So like the rest of the market, UBS’ “focus has now turned to the proposed acquisition by Square”.

“We now assume the proposed acquisition as our base case valuation and hence upgrade to a Neutral, $140 price target,” UBS said.