Guy on Rocks: ‘The golden rule’ as Basel III takes effect

Experts

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Gold finished at US$1,780/oz, up US$15 for the week in the face of a weaker US dollar.

Gold bugs will be interested to know that as of 28 June 2021, the Basel III agreement takes effect (a set of international regulations concerning bank capital adequacy, stress testing and overall market liquidity-figure 1), whereby gold will be now considered to be an illiquid asset for central banks.

Gold must be held as a physical in the institutions own vaults. The current practice is to lease or borrow gold, a practice that will be less attractive under Basel III.

So, the net effect is that central banks will be encouraged to raise their respective physical reserves as gold attains the status of a Tier 1 asset.

Other precious metals had a strong week with Platinum up almost 7% to close at US$1,102/ounce and Palladium up over 7% to finish the week at US$2,572/ounce.

Copper had a 1.5% rebound last week, closing at US$4.25/pound, up 6 cents on Friday speculation about the US$1.2 trillion bipartisan US infrastructure deal passed in the US senate last week.

Four-month copper futures were back into contango (where the futures price is higher than the spot price), so traders are a little more bullish on this news.

Interestingly, one of the proposals to pay for the infrastructure package was to sell off a portion of the strategic petroleum reserve in the order of US$6 billion, or 0.5 percent of total US reserves. A further US$6 trillion has been earmarked for climate change, education, paid leave and childcare benefits.

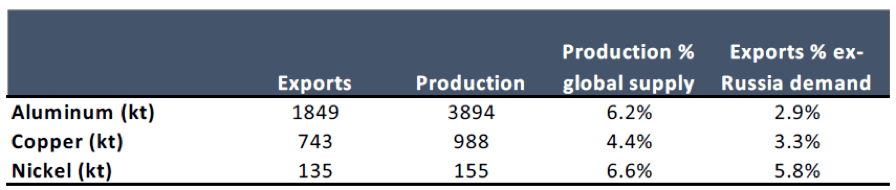

In further signs of countries attempting to mitigate their supply risks, there were reports that Russia is considering levying a US$2.3 billion export tax for steel products, nickel, aluminium and copper.

The rationale is to protect its defence and construction industries from rising commodity prices. This amounts to a reasonable percentage of their annual production (table 1).

We have seen taxes used in the past in an attempt to blunt rising prices, f however these have often served to have the opposite effect!

The uranium bulls will be pleased to know that Japan restarted another reactor (Mihama No 3 Reactor in Fukui prefecture-1st one in three years) making a total of 10 operating in Japan today compared to 56 in 2011 at the time of the Fukushima incident (not disaster as erroneously reported in the popular press).

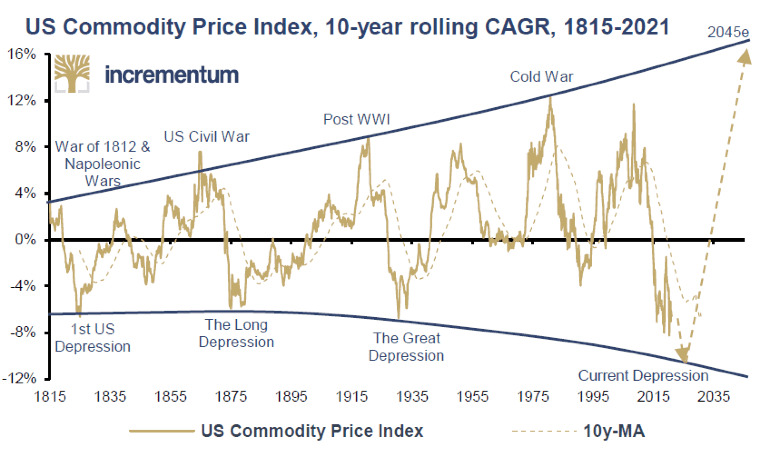

On a final note, there’s some interesting data (figure 2) on the compound annual growth rate (CAGR) of commodity prices from 1815 to the present day.

It appears that commodity price returns are due for a more sustained rebound, driven by an outlook of negative real interest rates and over-indebted economies which could ultimately see a devaluation of currencies as a last resort to reduce debts.

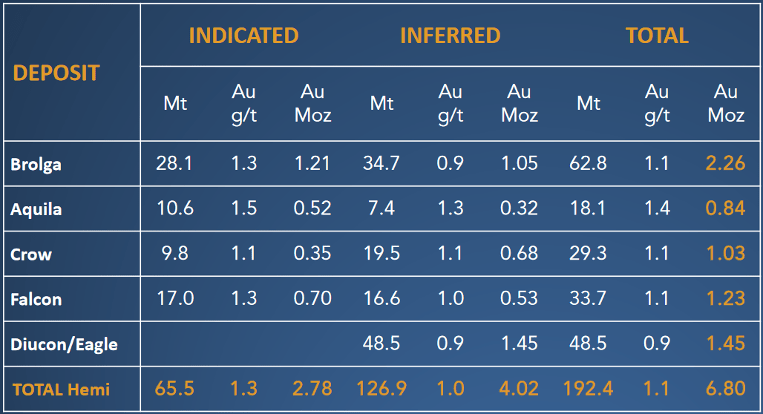

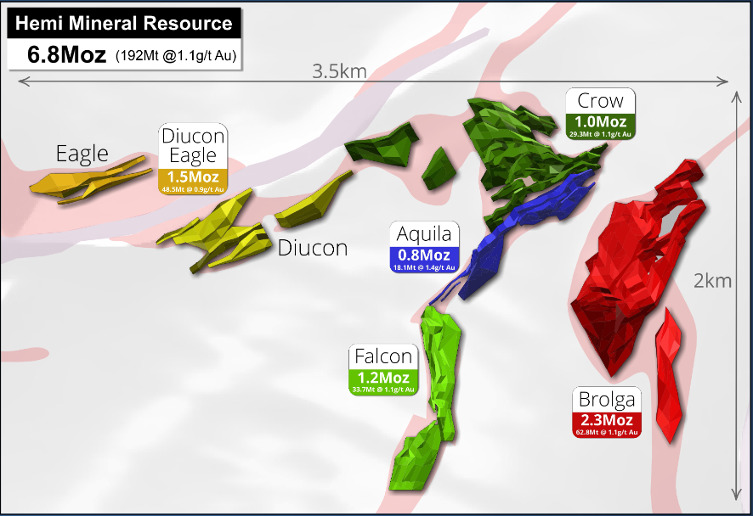

The long-awaited De Grey Mining (ASX:DEG) maiden JORC resource (table 2, figure 4) at Hemi (Western Australia) was published last week (ASX Announcement, 23 June 2021) coming in at a total Inferred and Indicated JORC Resource of 192.4 metres @ 1.1 g/t Au for 6.8 million ounces (0.30g/t gold cut-off above 370 metres; Table 2).

While the headline number was more or less in line with expectations, I was more interested in the potential for higher-grade, near surface mineralisation that would enable a faster capital payback and obviously significantly enhance project economics.

I noted that at a higher cut-off grade of 0.7g/t gold in the top 370 metres, the resource still comes in at 114Mt @ 1.5 g/t gold for 5.6Moz which is an excellent result.

Fortunately, the ounces per vertical metre were impressive with the deposits (figure 4) remaining open along strike and down dip.

Given the grade and broad widths there is more scope to see some fairly deep open cuts beyond 250 metres vertical depth. Mineralisation at Brolga is up to 300 metres in width at surface boasting an impressive Indicated resource inventory of 28Mt @ 1.3 g/t gold.

All eyes will be on the September 2021 Scoping Study, but I am thinking that an 8-10Mt operation producing in the order of 300-350Koz of gold per annum is possible, assuming a recovery of around 90-92% based on reserves of approximately 4 Moz of gold.

Canaccord Genuity are suggesting an $800 million CAPEX with C3 costs in the order of $1,050/ounce based on production of 340,000 ounces per annum, which by numbers should give you an after tax NPV5 (net present value) in the order of $1.2 million.

This values the exploration acreage and residual ounces that aren’t part of the initial mine plan at around $350 million, which is probably not unreasonable given the exploration upside and JORC Resource quality.

There has been some speculation about the risk associated with the use of POX, Albion® and/or BIOX® processes however it appears that any pressure oxidation will be at atmospheric pressures and 30-40% of the ore will report to a Carbon-In-Leach circuit anyway.

Plenty of exploration upside (particularly at the Diucon/Eagle Prospects) with 12 drill rigs operating and over 100 personnel on site. Environmental, hydrology, heritage and infrastructure studies are well underway.

At an enterprise value of $1.57 billion, this implies an EV/ounce of $230/ounce of gold, so the stock isn’t a cheap play (based on this yardstick measure).

However, given the proximity to production using discounted cash flow analyses (ie net present values) gives us a better idea of valuations at or near the commencement of production, so an NPV5 in the order of $1.2 billion implies a premium of 25% to the current market capitalisation.

However, on a Net Asset basis (NPV + other assets e.g. residual resources not part of the mine plan) it equates to $1.2 billion plus a value of around $130/ounce of gold for the 2.72m residual ounces of gold that haven’t made it into the mining study (or $350 million) which gets us to around $1.55 billion (the current market capitalisation at $1.29 per Share).

As I suggested — not cheap, but DEG represents good leverage to any gold price upside. Not to mention the potential to rapidly increase the current resource inventory. As they say you get what you pay for.

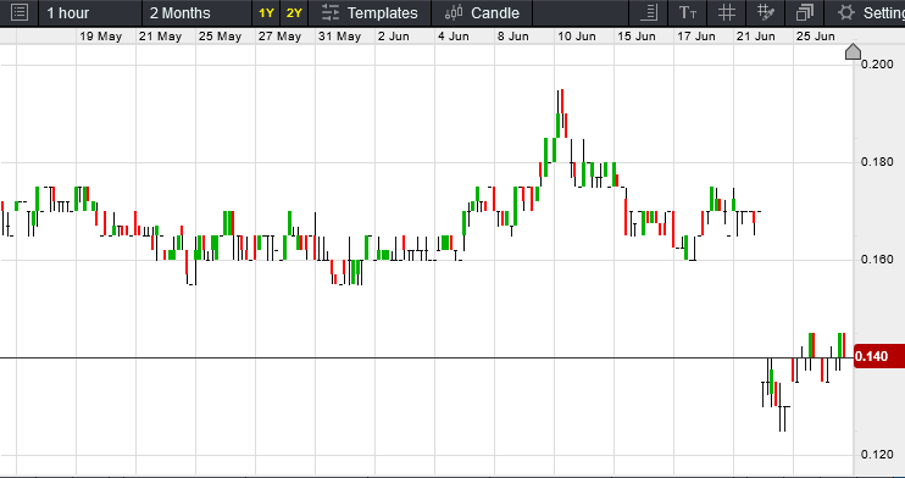

Continuing with our battery metals’ theme, one to put on the radar is Arafura Resources (ASX:ARU) which finished the week a little soft at 14 cents (figure 5) after completing a $40 million equity raising at 12 cents through Sydney based institutional broker Petra Capital.

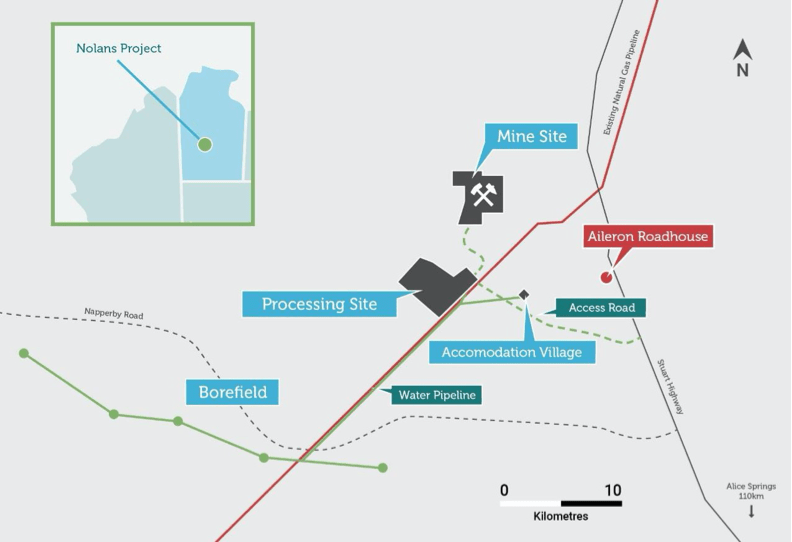

Funds are to be applied towards engineering and design activities at their Neodymium-Praseodymium Project situated in the Northern Territory (figure 6) just as demand for NdFeB magnets is increasing.

Logistics are excellent with the Stuart Highway situated 10km to the east, water 25km to the south-west, and the Alice Springs to Darwin railyard.

The project (May 2021 DFS) boasts a $1.4 billion NPV8 with a CAPEX of around $1 billion and generates annual EBITDA of approximately $354 million over a 38-year mine-life, producing 4,440 tonnes of NdPr oxide per year (or 5-10% of projected world supply).

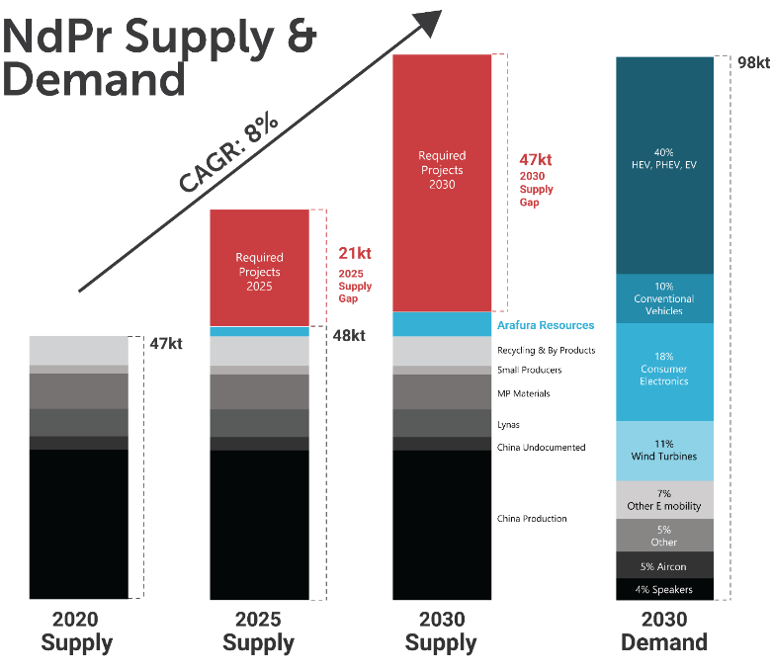

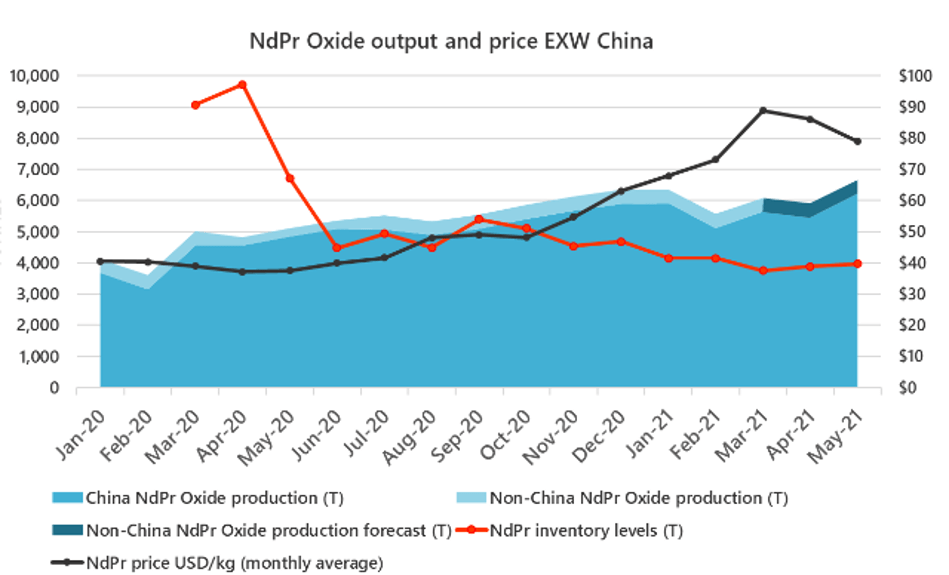

Operating costs are estimated at US$24.75 NdPr oxide. The internal rate of return (IRR) is a little skinny at just over 18%, however the recent strength in rare earths prices (and bullish outlook – figure 7) and further optimisation of the existing process flow sheet have the potential to improve the project economics.

It is noteworthy that China’s import of rare earth ore increased 174% in March 2021 with the average import price rising 23.1%.

Chinese stockpiles were also down 60% in 2020. The average 2021 year-to-date NdPr oxide price is US$79/kg3, up >105% compared to 2020 (figure 8).

Offtake discussions are ongoing with a broad spectrum of international players, as are project funding discussions.

The price tag has a “b” after it so there is significant financing risk attached to the project. The challenge is to hold on to as much of the project as possible at the production stage. Around 20-30% would be a good result from here.

It is hard to value unfunded rather exotic and high CAPEX projects like this, but at an Enterprise Value of around $120 million and short-term funding put to bed, I think there will be some trading opportunities as we approach a REE supply crunch in the coming years.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.