Vector FINALLY given the all-clear for its big Congo gold acquisition

Mining

Mining

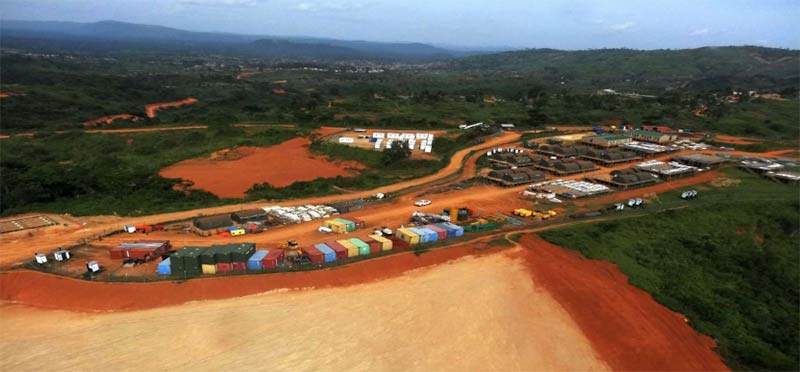

After a few speed bumps, gold explorer Vector Resources has finally acquired a 60 per cent share in the mammoth Adidi-Kanga gold project in the Democratic Republic of Congo (DRC).

Vector (ASX:VEC) chairman Gary Castledine called the process “exhaustive” but “one well worth the wait” as the junior looks to make the leap into production.

Vector has a pretty aggressive development strategy mapped out, which includes completing a definitive feasibility study in the next nine months before launching immediately into development.

Miners can undertake up to four different types of studies to see whether or not a resource can be mined economically.

These are – in order of importance — scoping, preliminary feasibility (PFS), definitive feasibility (DFS) and bankable feasibility (BFS).

Adidi-Kanga has a JORC (2012) resource estimate of 15 million tonnes at 6.6 grams per tonne of gold for 3.2 million ounces all up.

A deposit grading above 5 grams per tonne is usually considered pretty high grade.

Former owner – global gold producer AngloGold Ashanti – sank more than $722 million into the project between 2005 and 2013.

The miner had even started mine construction before suddenly pulling the pin on development as part of a company-wide restructure.

After locking in a $49 million project funding deal in October last year, Vector news flow dried up.

The company requested a trading halt on Dec 31 “pending an announcement” on the project – which has been extended twice thus far.

Company chief financial officer Andrew Steers told Stockhead the acquisition process took longer than expected.

“It’s a massive project for what is a pretty small company at the moment [which is] probably part of the reason it took so long,” he said. “Convincing people that we were the right management team and the right project team [for the job].”

“Then we headed into the [DRC] elections which slowed things down a bit – so yes, it definitely took longer than we expected.”

Vector shares remain in suspension pending the result of the waiver application to the ASX, which should be sorted by close of business next Wednesday.

This is because Vector shareholders approved the issue of about $7 million worth of shares to seller MGI more than three months ago.

Vector told investors that if the ASX doesn’t approve the waiver, the company will seek shareholder approval ASAP – but either way, it won’t impact the acquisition.