Pilbara explorer Tando doubles on ASX debut; active zinc and gold projects in train

Mining

Mining

It’s a case of being in the right place at the right time for Tando Resources (ASX:TNO), which doubled its issue price after listing on the ASX last Friday.

Tando shares hit a high of 42c on Friday compared to an issue price of 20c. The shares were trading around 38c on Monday morning.

The Pilbara-focused zinc, copper and gold explorer — which raised $4.5 million in an oversubscribed initial public offering — is ready to hit the ground running with three significant projects, Tando managing director Bill Oliver told Stockhead.

Perth-based Tando is taking advantage of 10-year high base metal prices as well as the current investor appetite for conglomerate gold in the Pilbara.

“We are well-funded, we have robust projects exposed to the right underlying commodities and we are in the world’s best exploration jurisdiction so it’s up to us to get active and start testing these projects,” Mr Oliver said.

“We have got three very good projects with significant upside — one advanced and two greenfield — which are adjacent to reputable exploration teams looking to test with the drill-bit in coming weeks.

“It gives investors a number of share price catalysts over the next three to six months.”

Strong track record

Mr Oliver knows the Pilbara and ground-floor project entry better than most people.

He’s worked as a geologist in the region for the likes of Rio Tinto and BC Iron and has a strong track record in project identification and evaluation.

Mr Oliver is also chairman of Celsius Resources which has experienced a six-fold share price increase.

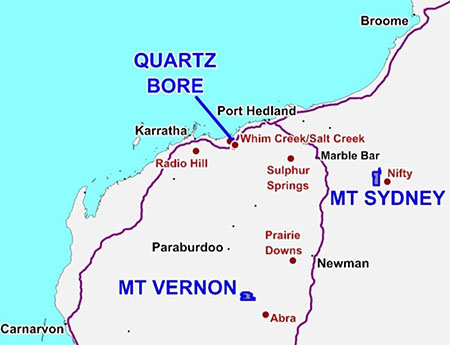

After listing, Tando will initially target its advanced Quartz Bore project, which lies next door to Venturex Resources’ Whim Creek and Salt Creek zinc-copper deposits.

Mr Oliver knows the area well and spotted potential at the brownfield project early on.

“I knew we could get moving really quickly on this project,” he said.

Zinc grades over 10 per cent

“It’s had 12,000 metres of drilling so there are plenty of targets to follow up with the potential to define a zinc JORC resource fairly quickly if the drill-bit data stacks up.

JORC compliance refers to the mining industry’s code for reporting exploration results, mineral resources and ore reserves, managed by the Australasian Joint Ore Reserves Committee.

“It’s got great zinc grades including grades over 10 per cent zinc which is the benchmark for high grade zinc now. Having that high grade really helps.”

At Quartz Bore’s main prospect, Balla Balla, high-grade zinc and copper mineralisation is present in historical drilling over 600 metres. The mineralisation is open along strike and at depth.

Drilling at Quartz Bore aims to validate historical drill results which will support a maiden mineral resource estimate. Drilling will also test along strike and down-dip from historical drilling.

New targets

The exploration strategy will also aim to identify new targets at Quartz Bore. Drilling is due to start within a month of listing.

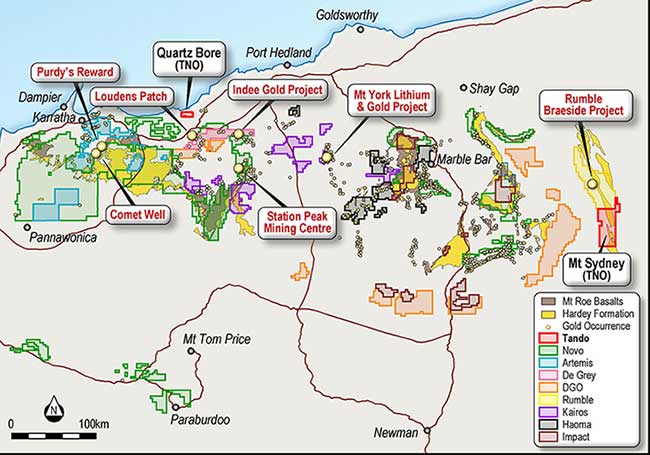

Tando also owns two highly prospective greenfields zinc‐copper projects located along strike from notable base metal projects in the Pilbara.

Its Mt Sydney project lies along strike from Rumble Resources’ soon-to-be-drilled (late November 2017) Braeside lead, zinc and silver project in the east Pilbara.

The drilling is eagerly awaited because it has been examined by renowned geologist Brett Keillor.

“Rumble have done the trail-blazing work,” Mr Oliver said. “Brett has done an amazing job of identifying the potential in that area.

“Mt Sydney has got the same lithologies, the same rocks and the same structures as Braeside. They go onto our ground and we are going to follow very similar steps to Rumble to test them.”

Tando will carry out an airborne electromagnetic survey over Mt Sydney in the first two-to-three weeks after listing. Results are expected in early December.

Conglomerate-hosted gold

While Tando’s priority is zinc, it is also on the look-out for signs of conglomerate-hosted gold mineralisation across its projects.

The Mt Sydney project sits over the Hardey Formation, a sedimentary unit at the base of the Fortescue Group which is a key target for conglomerate-hosted gold mineralisation.

Early exploration including geophysics will be carried out to see if there are any signs of gold prospectivity.

The Hardy Formation has recently attracted significant attention from investors following on from regional activities by the likes of Novo Resources, Artemis Resources and DeGrey Mining.

Tando also owns the Mt Vernon project which lies along strike from Galena Mining’s Abra base metal deposit, regarded as one of the biggest, undeveloped lead deposits in the world.

The project is prospective for zinc and copper mineralisation with historical exploration identifying a number of surface geochemical anomalies.

Tando’s initial work is already underway with a review of historical exploration and targets and is already underway.

This special report is brought to you by Tando Resources.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.