Buying a first home in a collapsing market, or: How to catch a falling knife and not bleed out, with your host Eliza Owen

Experts

Experts

With but a momentary pause ahead of the next central bank rate hike in early September, Australia’s woefully indebted households and their awfully expensive houses are helping to add some genuine momentum to a property downturn which some analysts – possibly drunk with power – are saying could bottom out at a -20% fall.

That’s unlikely. But if Dr Shane O at AMP Capital is calling the bottom at -15%, then we’d best brace for impact.

But not all will. There’s opportunity in volatility, they say.

In July, Australian home values were -2.0% lower than the peak in April 2022. On top of price slides, there’s a veritable giga-pool of data screaming about a slowing in the residential property market.

The market hardest hit is where sellers have the most to lose…. and, yes, that’d be in beautiful Sydney, where sea lions sunbathe under the Opera House, and home values have taken a near 5% dive in just the past three months.

The rest of the country is relatively unscathed by all this in comparison, with the near $10 trillion national market down by just 2% sans the Harbour City.

Further falls are kinda inevitable as the Reserve Bank, which meets again in just under two weeks, raises borrowing costs at the fastest pace they possibly can without actually breaking any laws.

Properties are taking longer to sell, vendors are gradually lowering their prices, and reduced appetite for finance means there is less buyer competition amid a larger number of properties available for sale.

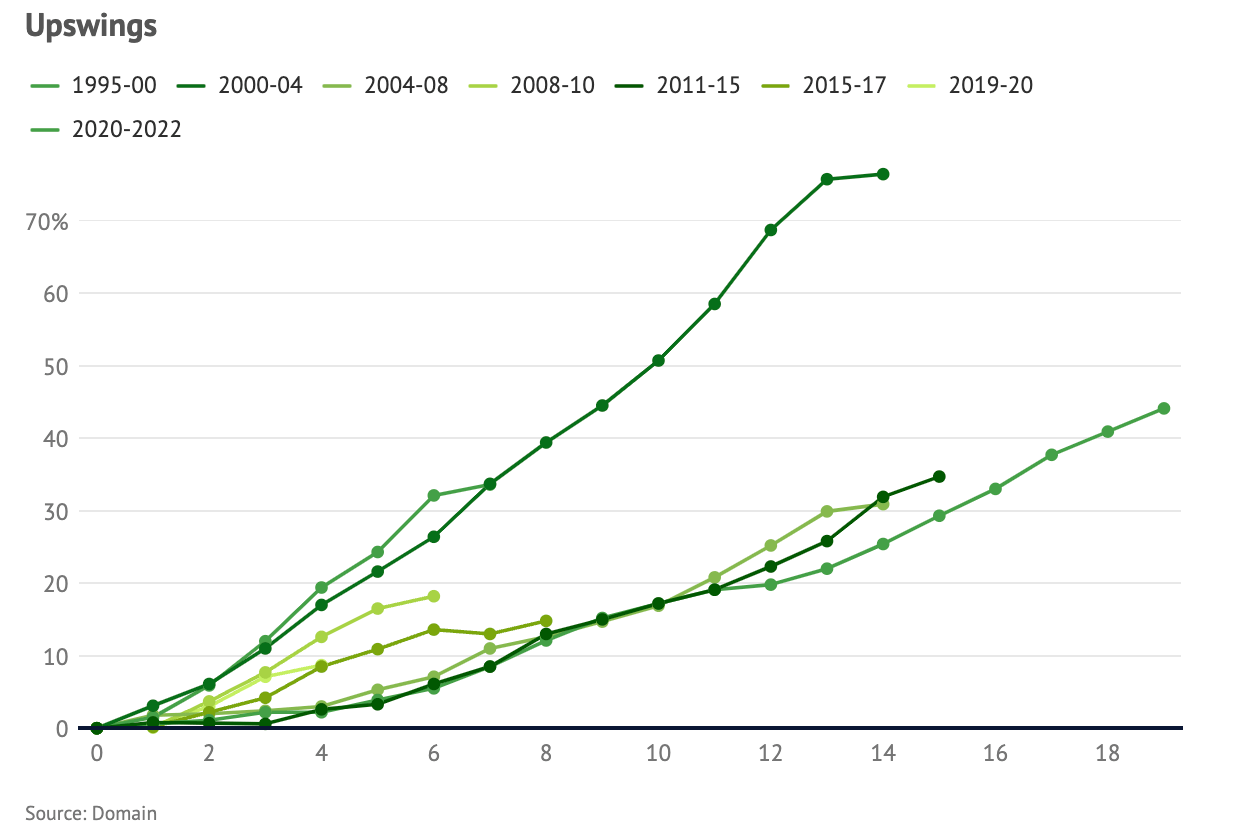

Domain has done some number crunching too – going through circa 30 years of data finding that in previous Aussie-made property booms, combined cap city house prices on average rose just shy of a full third (32.7%). According to Domain, the upswing lasted an average 33 months.

In previous downswings, house prices on average fell just 3% and the downswings on average lasted nine months.

For those considering purchasing their first home, we asked CoreLogic’s brilliant, yet relentless Queen of Numbers, Eliza Owen:

Does this mean it is a good time to buy a first home?

And she replied:

While buyers may aspire to purchase at the bottom of the cycle and then sell at the top, ultimately, it’s notoriously difficult to time the market perfectly. Further to this, most buyers and sellers will generally work towards a more practical timetable based on their personal situation and housing requirements or investment strategy. Even when prices fall, it’s not a straightforward decision to get into the market.

So in this stunning two-part series we go round the block with Eliza as she explore some of the ‘pros’ and ‘cons’ when buying property in a falling market.

In many parts of the country, dwellings are generally cheaper now than they were in early 2022, before the RBA started lifting the cash rate, which led to rising mortgage interest rates.

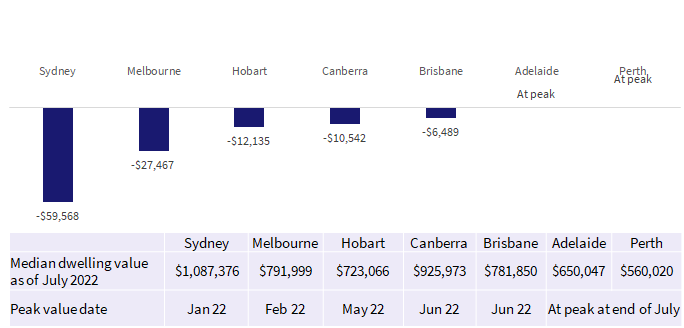

Below is a great pic which my people made showing capital city median dwelling values circa July 2022, (as well as how far median home values in capital city markets have fallen this year).

I have chosen to express this fall on the chart in Aussie dollar terms on the median value. I deemed it appropriate. You may highlight the various declines, if you choose, via an audio representation (either a whistle or perhaps a bomb SFX as I have instructed Christian to provide here).

(Ed: The music of Tom Petty will also suffice!)

Figure 1 highlights Adelaide and Perth are yet to show monthly declines, while there have been more substantial falls in Sydney and Melbourne. Perth and Adelaide have been relatively resilient to rate hikes until recently, however the trend in CoreLogic’s daily home value index has started to show these markets flattening out through August too, ahead of likely declines in value in the coming months.

Change in indexed median value

Falling property values may make it easier for some of you people to access a home loan. There. I said it.

In fact, for those clever and surprisingly adult young adults who’ve somehow already been saving through the upswing, well then, these savings could represent a larger portion of the home price as property values ease, enabling these forward thinking and dare I say it progressive buyers to lay down a larger deposit than they may’ve needed back at peak property market.

Lower property prices also reduce transaction costs, such as stamp duty, and may see more properties qualify for first home buyer schemes that have price caps.

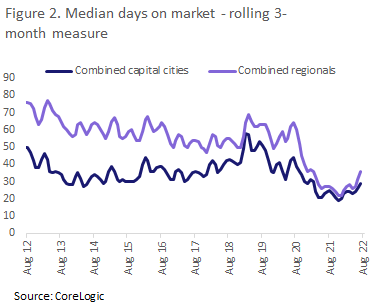

As Christian recently pointed out in an article probably titled Properties are taking longer to sell, dude! (Ed: I would never) one can see that on the national level, the average time a home spends on the market jumped to 32 days in the three months to July.

This is up from a recent low of just 20 days in the three months to November (see below). For most broad capital city and regional markets, properties are taking longer to sell now than this time last year. That’s a good sign and speaks to demand.

As properties take longer to sell, buyers have more time to organise their finance, complete due diligence on properties, and check out what other properties are on the market. Similarly, as homes take longer to sell, vendors typically become more flexible on their pricing expectations.

We can see this in growing vendor discounts which have moved from 2.9% in November last year to 3.8% over the three months ending July.

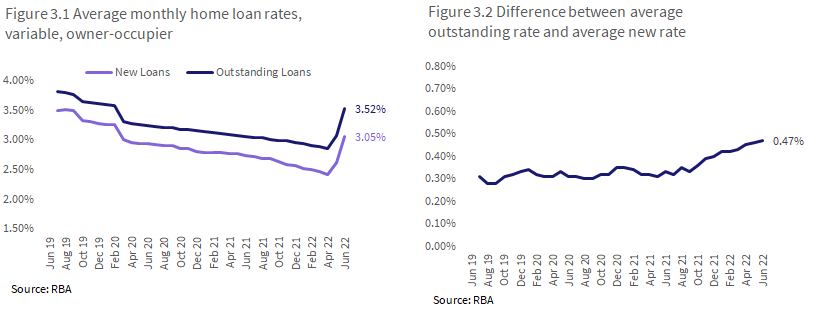

One of the major downsides of trying to buy a home now, as opposed to a lifetime… I mean four months ago, is that mortgage rates are darn-well higher, and darn it if they’re not likely to continue rising further. (Ed: She means they are). However, average new variable rates are typically lower than what existing mortgage holders are paying, with rates still lower than they were in 2019.

Pretty pics featuring two kinds of purple below shows average variable mortgage rates for new and existing owner occupied loans, as well as the gap between the two series over time.

The gap between rates on average new and existing loans is 47 basis points – a series high, we had a party at the CoreLogic Sydney office. I got bored and counted the purple Smarties. They’re the yummiest.

Anyway, what these numbers are telling us is your lender wants to be as competitive as poss in a rising rates environment – same work, more income AND they can win new customers in a softening market.

It’s an undeniably tough time for renters at the moment. I used to rent. I used to have a life. The two could be directly correlated.

Anyhoo. Rent listings are around one third below the previous five-year average. Our great Aussie rental vacancy rate is floundering at a record low 1.2% and – wait for it – CoreLogic’s rent value index rose a record 9.8% in the past year. That means upcoming lease renewals are going to be replete with the smudged ink of higher leases.

It may actually be scientifically impossible for a landlord to not increase rents in this stage of the cycle.

While this is going to sound crazy… it’s possible not everyone has money saved for a deposit. Now, those of you that do may be tempted into home ownership just to avoid rising rents. Or as we at CoreLogic like to call this move: ‘The out of the rent uncomfortably hot frying pan market into the home ownership oven of unyielding pain.’

Australians typically prefer home ownership to renting, and recent ABS data darn well shows owner-occupiers are generally more satisfied with their living conditions. I’ve certainly found it both more satisfying and less stressful breaking my own stuff. As rents rise and property values fall, this may trigger more home buying decisions from renters trying to get out of Dodge.

Thanks for tuning in Ladies and Gents. Tomorrow, we continue our rock around the block with CoreLogic’s Eliza Owen as she reveals all the Cons to Buying a First Home in a Falling Market.