Weekly Small Cap and IPO Wrap: A week when inflation got weak and may’ve hit peak

Via Getty

- This week the ASX Emerging Companies (XEC) index up circa 3.1%

- US Futures slightly higher late in Sydney trade

- Is this the week of “peak US inflation” ?

The S&P/ASX Emerging Companies (XEC) index has gained about 2.8% this week, closing out the Friday session (at 3.30pm) looking pretty flat.

The benchmark fell on Friday, but has lifted 0.7% for the week.

US futures inched higher early on Friday arvo, after the Dow Industrial Average and The S&P 500 ended overnight looking pretty flat too.

The Dow Jones, The S&P 500 and The Nasdaq 100 were between 0.1% and 0.25% higher at 3.30pm Sydney time.

Local markets made another bit of a surprise comeback this week, encouraged by Wall Street’s midweek freak on the weak US inflation data.

Strong gains in Materials and Resources shares were lifted by improving metals and iron ore prices. And these were more or less offset by equally distinct falls in Technology, REIT and Property as well as the Healthcare sectors.

Oil prices rose partly due to US supply disruptions and increased demand forecasts on the back of higher gas prices. Metal and iron ore prices also rose.

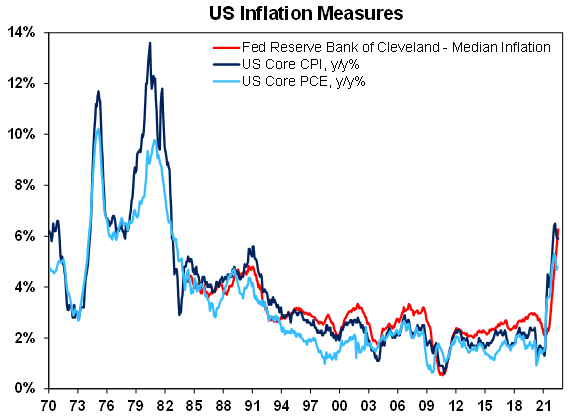

Hints of “peak inflation” in the US

It was another week dominated by inflation reads, but in a welcome change it was a week of weaker-than expected-inflation reads.

The world’s largest and most fractious economies, the US and China while concurrently raisng fears of global conflict, concurrently raised hopes that the global monetary tightening cycle may soon end.

That view however – in the words of Seema Shah chief global strategist at Principal Global Investors, – is “hopelessly optimistic.”

U.S. headline CPI eased from 9.1% to 8.5% in July, helped by a recent softening in energy prices.

“Peak inflation may be behind us, but CPI will remain uncomfortably high as sticky shelter and services inflation continue to put upward pressure on prices. It will be some time before the Fed feels sufficiently comfortable to pause rate hikes.” Shah said.

China’s inflation issue is trifling compared to its rival. China’s headline CPI rose from 2.5% to 2.7% in July, lower than expected but its highest level in two years.

“Even so, rising food prices imply that inflation may rise further over coming months, potentially pushing it above the People’s Bank of China’s 3% target, limiting the space for rate cuts,” Shah added.

ASX IPOs This Week

These guys didn’t turn up, but it’s possible they will next week… who knows what IPO’s lurk in the heart of the ASX.

IPO: $12m at $0.20

This nickel explorer is aiming to turn prospective nickel, cobalt and copper projects in Sweden into mines to satisfy demand from the electric vehicle and energy storage industries.

Australia Sunny Glass Group (ASX:AG1)

IPO: $7.5m at $0.35

This Australian-based holding company, through its subsidiaries, operates a glass production and supply business for structural building facades.

ASX SMALL CAP LEADERS:

Here are the best performing ASX small cap stocks for August 8 – August 12:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| PGD | Peregrine Gold | 0.89 | 112% | $31,395,328 |

| DXN | DXN Limited | 0.01 | 100% | $16,184,463 |

| RAS | Ragusa Minerals Ltd | 0.15 | 92% | $20,746,466 |

| SHG | Singular Health | 0.175 | 75% | $9,793,360 |

| KFE | Kogi Iron Ltd | 0.005 | 67% | $8,087,889 |

| KOR | Korab Resources | 0.033 | 65% | $9,910,350 |

| BRX | Belararoxlimited | 0.49 | 63% | $14,568,459 |

| ARV | Artemis Resources | 0.045 | 61% | $66,639,887 |

| AUK | Aumake Limited | 0.008 | 60% | $6,171,575 |

| LPM | Lithium Plus | 0.67 | 60% | $32,125,104 |

| IR1 | Irismetals | 0.64 | 56% | $33,986,250 |

| 1VG | Victory Goldfields | 0.24 | 55% | $9,999,118 |

| SLZ | Sultan Resources Ltd | 0.145 | 53% | $11,659,814 |

| BNR | Bulletin Res Ltd | 0.16 | 52% | $49,740,487 |

| AHK | Ark Mines Limited | 0.31 | 51% | $10,180,480 |

| ALT | Analytica Limited | 0.0015 | 50% | $6,920,702 |

| AWV | Anova Metals Ltd | 0.015 | 50% | $22,471,413 |

| GTG | Genetic Technologies | 0.0045 | 50% | $36,935,861 |

| EGR | Ecograf Limited | 0.475 | 48% | $189,140,053 |

| LDX | Lumos Diagnostics | 0.077 | 48% | $14,483,545 |

| ANP | Antisense Therapeut. | 0.1125 | 48% | $66,879,398 |

| KTA | Krakatoa Resources | 0.074 | 48% | $19,993,175 |

| CPN | Caspin Resources | 0.735 | 48% | $46,430,772 |

| 1MC | Morella Corporation | 0.025 | 47% | $157,533,992 |

| ICN | Icon Energy Limited | 0.022 | 47% | $16,604,940 |

| MI6 | Minerals260Limited | 0.38 | 46% | $83,600,000 |

| ISU | Iselect Ltd | 0.275 | 45% | $66,023,857 |

| CDD | Cardno Limited | 0.605 | 44% | $24,608,218 |

| ST1 | Spirit Technology | 0.095 | 44% | $66,472,358 |

| WR1 | Winsome Resources | 0.28 | 44% | $37,831,918 |

| PH2 | Pure Hydrogen Corp | 0.365 | 43% | $140,272,117 |

| TMR | Tempus Resources Ltd | 0.081 | 43% | $12,006,722 |

| CTT | Cettire | 0.99 | 42% | $360,270,118 |

| MOQ | MOQ Limited | 0.071 | 42% | $21,722,833 |

| ECG | Ecargo Hldg | 0.017 | 42% | $9,228,750 |

| MNS | Magnis Energy Tech | 0.4575 | 41% | $354,170,991 |

| EMH | European Metals Hldg | 1.005 | 41% | $101,746,816 |

| E2M | E2 Metals | 0.175 | 40% | $34,848,157 |

| ODM | Odin Metals Limited | 0.021 | 40% | $9,326,887 |

| BDM | Burgundy D Mines Ltd | 0.21 | 40% | $71,729,330 |

| IMR | Imricor Med Sys | 0.42 | 40% | $56,000,971 |

| HAV | Havilah Resources | 0.355 | 39% | $88,647,779 |

| SIS | Simble Solutions | 0.018 | 38% | $7,264,658 |

| SOP | Synertec Corporation | 0.18 | 38% | $60,751,295 |

| FFF | Forbidden Foods | 0.13 | 37% | $10,224,148 |

| AZL | Arizona Lithium Ltd | 0.1025 | 37% | $264,541,812 |

| HCH | Hot Chili Ltd | 0.935 | 36% | $109,889,590 |

| GO2 | Thego2People | 0.015 | 36% | $5,286,297 |

| RGL | Riversgold | 0.038 | 36% | $34,701,115 |

| AME | Alto Metals Limited | 0.084 | 35% | $44,901,151 |

Korab Resources (ASX:KOR) is up 65% this week and appears to be the pinup poster child, definition of how the world suddenly feels about magnesium this week.

As our Jess pointed out earlier today this long time citizen of Struggle Street has moved quickly to profit from positive investor sentiment towards the raw material.

The greater part – circa 85% of the world’s 1 million tonnes per annum magnesium supply comes out of China, which also exports a sizeable volume.

Late last year, the global magnesium market was turned on its head when the low-cost Chinese producers slashed output by ~50% due to ongoing energy sector reform.

Prices went through the roof. In an earnings call, Volkswagen’s head of purchasing said a shortage was expected.

Korab is currently engaged in a scoping study evaluating the economics “of an environmentally friendly production method to produce sustainable, zero-carbon, green magnesium metal together with several additional sellable bonus products” at its Winchester magnesium project in the Northern Territory.

READ: Magnesium demand could double in just 8 years. These ASX stocks are hoping to catch the wave

The real adventures of Lithium Plus (ASX:LPM) began in July, when it announced its 10,000m drilling program at the flagship ‘Bynroe’ lithium project, which shares a border with Core Lithium’s (ASX:CXO) ‘Finniss’ mine development.

The company focused on the ‘Lei’ and ‘Cai’ prospects where there is “strong potential to delineate a maiden high-grade resource”, LPM said at the time.

Today, a thick interval of 43m of pegmatite from 191.9m has been intersected, where the initial phase-1 hole was positioned to target down-dip expression of lithium mineralisation around 50m below the discovery RC hole.

The second diamond drill hole at Lei is underway.

“We are pleased with the samples from our maiden diamond hole at the Lei Prospect, which have visibly validated the historical spodumene-bearing pegmatite system at depth and provide us confidence that we may have a significant lithium discovery at Bynoe,” executive chairman Bin Guo says.

Consumer and insurance services firm iSelect’s (ASX:ISU) set the day on fire by entering into a Scheme Implementation Agreement (SIA) with Innovation Holdings Australia (IHA).

On the back of the news, iSelect’s share price sky-rocketed well over 75%.

IHA is ISU’s biggest shareholder and after sitting on a 26% stake, decided it was time to go the full house, snapping up 100% of the company instead.

ASX SMALL CAP LAGGARDS:

Here are the least performing ASX small cap stocks for August 8 – August 12:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| IVO | Invigor Group Ltd | 0.012 | -37% | $1,838,398 |

| MEB | Medibio Limited | 0.001 | -33% | $4,134,735 |

| IBG | Ironbark Zinc Ltd | 0.02 | -31% | $26,142,048 |

| TTB | Total Brain Ltd | 0.04 | -31% | $5,348,845 |

| BYI | Beyond International | 0.31 | -31% | $19,014,460 |

| AQX | Alice Queen Ltd | 0.003 | -25% | $6,348,544 |

| CLE | Cyclone Metals | 0.003 | -25% | $18,350,211 |

| DMG | Dragon Mountain Gold | 0.015 | -25% | $5,905,075 |

| EMT | Emetals Limited | 0.009 | -25% | $7,650,000 |

| T3D | 333D Limited | 0.0015 | -25% | $4,566,445 |

| ANL | Amani Gold Ltd | 0.0015 | -25% | $47,386,882 |

| SHP | South Harz Potash | 0.082 | -25% | $45,222,868 |

| TCG | Turaco Gold Limited | 0.06 | -24% | $25,663,000 |

| ZMM | Zimi Ltd | 0.072 | -24% | $5,618,237 |

| MYG | Mayfield Group Ltd | 0.25 | -24% | $22,646,474 |

| VOL | Victory Offices Ltd | 0.028 | -24% | $4,419,744 |

| TRM | Truscott Mining Corp | 0.037 | -24% | $5,841,210 |

| NMR | Native Mineral Res | 0.1 | -23% | $5,022,100 |

| TIA | Tian An Aust Limited | 0.23 | -21% | $22,518,296 |

| WRM | White Rock Min Ltd | 0.083 | -21% | $15,977,561 |

| SMX | Security Matters | 0.205 | -21% | $36,500,537 |

| LNU | Linius Tech Limited | 0.0055 | -21% | $13,508,198 |

| CFO | Cfoam Limited | 0.004 | -20% | $2,935,363 |

| KEY | KEY Petroleum | 0.002 | -20% | $3,935,856 |

| MBK | Metal Bank Ltd | 0.004 | -20% | $10,431,273 |

| SPX | Spenda Limited | 0.0115 | -18% | $38,179,941 |

| CAD | Caeneus Minerals | 0.005 | -17% | $23,303,025 |

| CBE | Cobre | 0.15 | -17% | $24,811,052 |

| CT1 | Constellation Tech | 0.005 | -17% | $7,356,002 |

| OAR | OAR Resources Ltd | 0.005 | -17% | $10,855,189 |

| SIX | Sprintex Ltd | 0.05 | -17% | $13,735,134 |

| TD1 | Tali Digital Limited | 0.005 | -17% | $7,395,783 |

| AR1 | Australresources | 0.395 | -17% | $102,349,004 |

| ICI | Icandy Interactive | 0.083 | -17% | $110,381,777 |

| OM1 | Omnia Metals Group | 0.145 | -17% | $3,723,600 |

| LBY | Laybuy Group Holding | 0.091 | -17% | $23,953,005 |

| SWP | Swoop Holdings Ltd | 0.4375 | -17% | $61,763,249 |

| JXT | Jaxstaltd | 0.021 | -16% | $7,194,142 |

| CST | Castile Resources | 0.13 | -16% | $31,945,482 |

| HMI | Hiremii | 0.047 | -15% | $4,975,756 |

| LVH | Livehire Limited | 0.255 | -15% | $75,237,391 |

| BID | Bill Identity Ltd | 0.076 | -15% | $19,620,641 |

| MMM | Marley Spoon | 0.29 | -15% | $87,587,400 |

| PSC | Prospect Res Ltd | 0.115 | -15% | $55,471,135 |

| CG1 | Carbonxt Group | 0.11 | -15% | $23,093,842 |

| TYM | Tymlez Group | 0.022 | -15% | $21,766,034 |

| MVP | Medical Developments | 2.03 | -14% | $142,610,114 |

| ADX | ADX Energy Ltd | 0.006 | -14% | $20,959,556 |

| BUY | Bounty Oil & Gas NL | 0.006 | -14% | $9,593,507 |

| DDT | DataDot Technology | 0.006 | -14% | $7,463,217 |

Austral Resources (ASX:AR1) have just come out of a trading halt following an oversubscribed $17M raise. Earlier this week Austral released a maiden mineral resource for the Enterprise deposit within its Eastern Succession tenements in Queensland. The resource is Inferred with 580K tonnes at 1.3% copper.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.