Enjoy today, but one good CPI read doesn’t mean it’s no longer backs to the Wall Street

Via Getty

Wall Street and US President Joe Biden jumped overnight on the release of softer than expected inflation data.

For a session there, the Nasdaq wasn’t so tech-heavy when it literally sprang out of its Nikes, gaining close to 3%.

It ain’t that often we roll out of bed here in Sydenham to find US investors dancing in the streets because domestic consumer prices are a decent 8.5% higher than they were this time last year.

Americans are winners at heart, even when they’re not. So July’s 8.5% was a win for freedom and let’s not strip them of it right away.

After all – for the first time since money became less free, fresh and flowing from the fountain of largesse which was The Federal Reserve Bank throughout the itchy part of the pandemic – here’s a genuine cow leather marked slowdown in the pace of inflation.

Inflation as measured by headline CPI increased 0.0 percent month-over-month in July, well below its elevated June monthly rate of 1.3 percent. Monthly core inflation in July fell to 0.3 percent. 1/ pic.twitter.com/6bVTZq7m1W

— Council of Economic Advisers (@WhiteHouseCEA) August 10, 2022

As an excited US President pointed out early this morning Sydenham time – and I’m going to paraphrase a little – the June 9.1% CPI is a distant memory and we licked that inflation genie good.

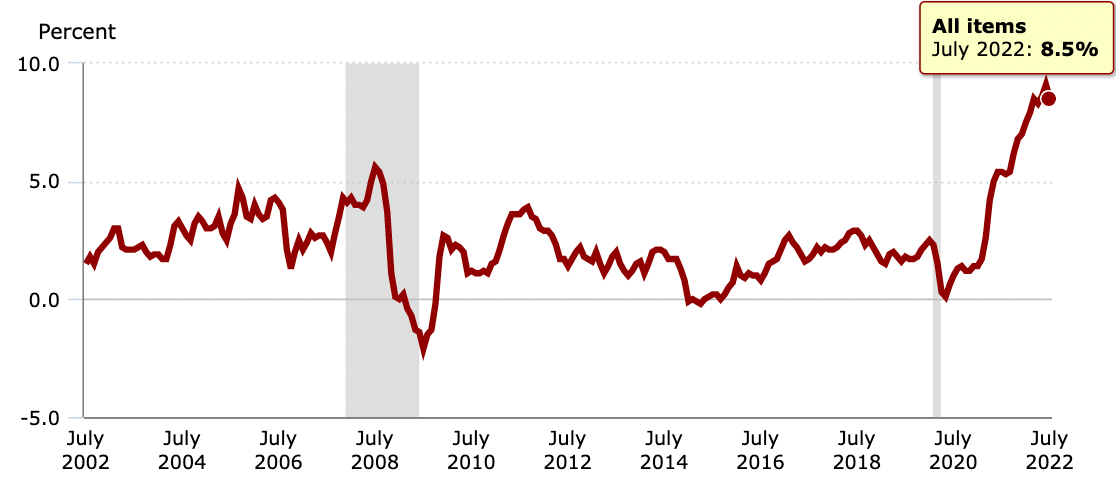

12-month % change, US CPI, all categories

Once again economists got it wrong, as the core reading snuck in under forecasts and also surprised the number crunching munchkins when prices were supposed to jump 0.2% from June, but a significant 5% slide in energy (mainly what we’re calling gasoline) prices offset the higher cost of getting a feed and paying the rent.

While US inflation is still close to a 40-year high, things have been so glum that even a wee easing is enough to spark a run on markets.

The simple equation, flavoured with a lot of relief, is that higher interest rates make money more expensive and we’ve been watching that take a huge toll on shares trading with high valuations.

For US traders starved of good news, they’re going to hold onto this as a win.

Faith in The Fed has been all shook up. The central bank has been desperate in its attempts to make a dent on rampant inflation, and this read could restore a little US confidence that the central bank isn’t just slapping at the air with a wet fish.

Already markets are trimming the chances that Fed members intend to hike rates by 0.75 percentage points when they next meet in September.

Thus the tech names, the growth stocks, the risky assets and the outliers like crypto shot heavenwards on the update, and equally why the safe haven USD and bond yields retreated in concert.

Stocks have rallied pretty well lately, after posting one of the all-time forgettable first-half performances. The Nasdaq is still short about 18% this year, but that’s already about half where it was in the middle of June.

The recent market gains – apparently based entirely off a Wall Street gamble that easing inflation would encourage the Fed to cool its jets – successfully ended Wall Street’s longest bear market since 2008.

But let’s not get carried away, USA

Probably a good time even to bring in a popular French saying, just to throw a cold bucket of water on all this.

Une hirondelle ne fait pas le printemps:

One swallow doesn’t mean Spring has arrived

So we’ll give them this one, but when all the champagne has been popped, it isn’t the win that’s turning the tide on a US and global economy beset by more material worries.

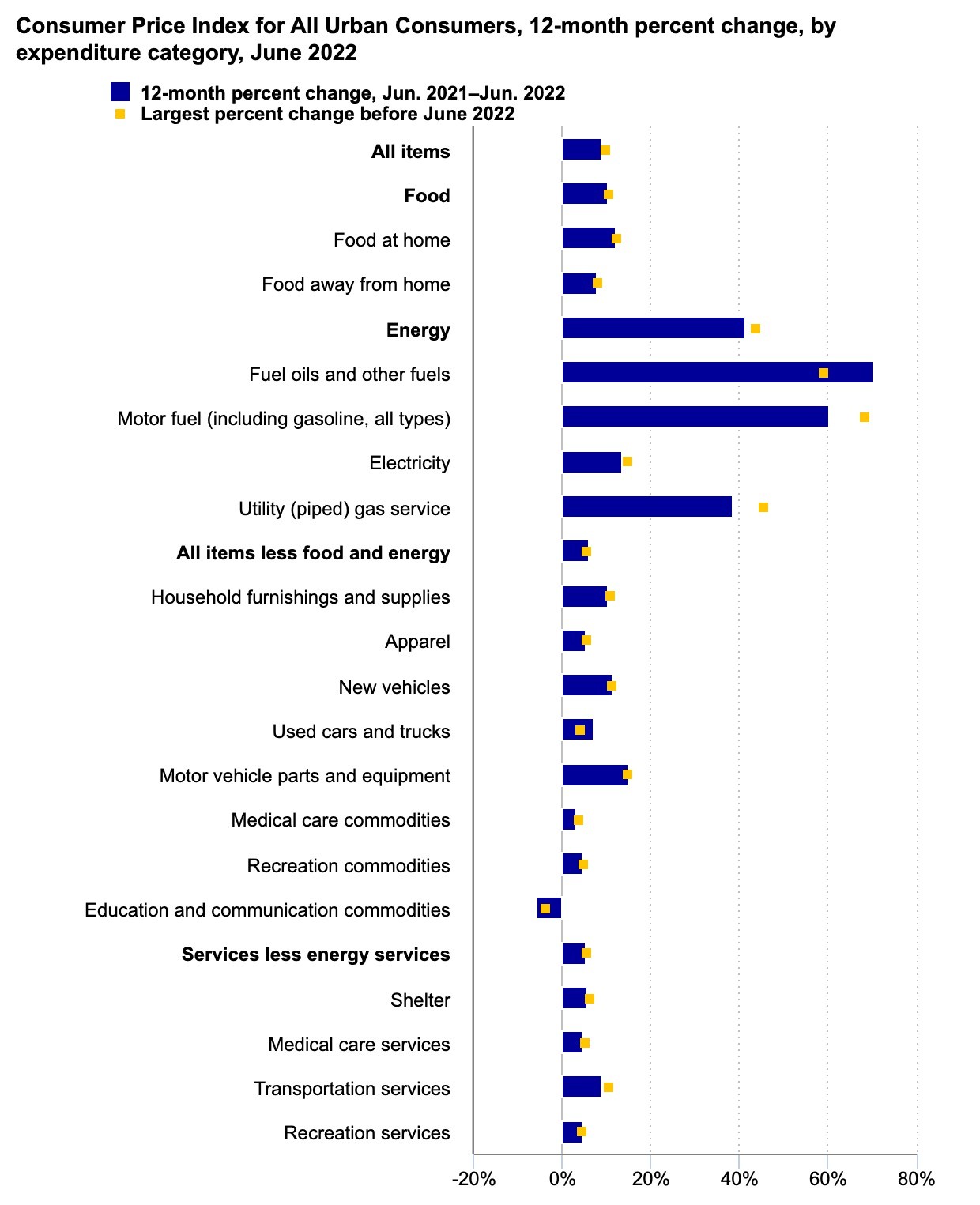

According to the US Bureau of Labour Statistics, the cost of food jumped 1.1% in July – and that was the seventh consecutive monthly increase of 1% or more.

The food at home index rose 1.3% as all six major US grocery store food group indexes rose as one.

The index for non-alcoholic beverages – Vanilla Coke et al – jumped the most, increasing 2.3% as the cost of a coffee rose 3.5%.

These are the kind of everyday things which impact the most people.

Then there’s the bigger pic…

We’re all still at war, both actual and existential. Recessionary forces are gathering across the borders of emerging and advanced economies alike.

The world’s breadbasket remains a battlefield where Russian and Ukrainian neighbours are intent on bombing one another back to the ’70s.

The EU is starved of energy and everyone else can’t afford it. There’s a pandemic or two both on the ground and in the post.

National debt is choking off hope in places like Sri Lanka.

Major economies from Pakistan to Portugal are vulnerable to all of these things, and once the tinsel settles on Wall Street, it will have to tackle the realisation that the Fed can’t or won’t ease up in its inflation fistfight anyway.

The FOMC members have been verbose about needing to see reams and reams and months of evidence which confirm stubborn US prices are really settling down.

More specifically, the Fed wants to see core inflation – a read which takes out the volatile energy and food prices – to consistently decline.

That is not happening.

Stateside, the core consumer price rose 0.3% from June to July.

Second of all, the other read which is stuck in the teeth – toppy US wages.

The job market is tight. The rising cost of living in America is giving weight to the expectation of higher salaries – and so it’s a race to the bottom (in this case the top) leading to more disposable income and, ultimately, higher inflation.

Then there’s China

After a week of really flirting with China over a conflict beyond the commercial, the world’s No. 2 economy remains fragile and very, very unlikely to provide a second hemisphere around which an economic recovery could happily circumgyrate.

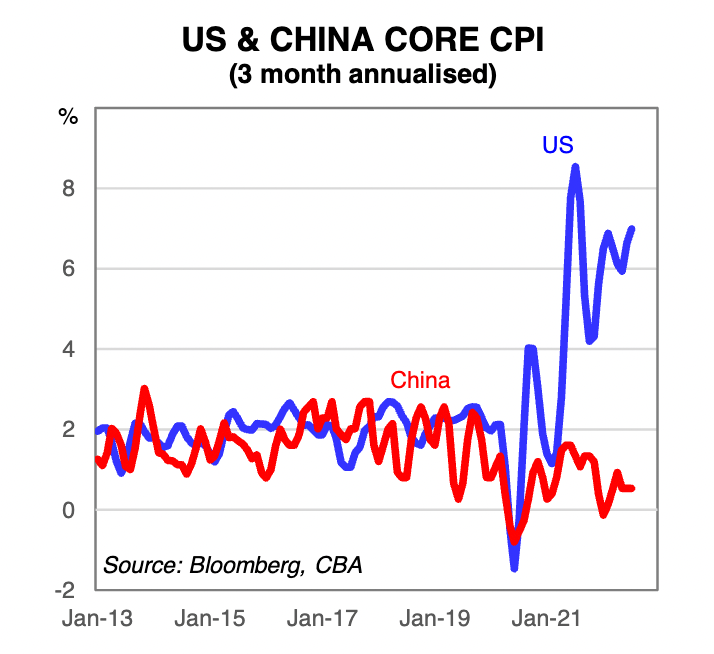

The chasm is clear when comparing China’s headline CPI inflation, which just happened to drop on Tuesday.

While China’s CPI did pick up while core CPI inflation eased on an annual basis in July, as the chart above pretty clearly shows, its underlying inflation is materially weaker than that in the US, and will likely remain so while COVID-19 zero-restrictions continue to stomp on Chinese consumer demand.

CBA’s Belinda Allen says the inflation differential between China and the US implies their central banks will remain divergent on monetary policy.

“We expect the People’s Bank of China to maintain its easy monetary policy stance, though further interest rate cuts are unlikely, and we expect the FOMC to raise the Fed Funds rate well into restrictive territory.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.