Market Matters: 5 names now the inflation genie is out of the bottle

Experts

Access top stock picks and professional market insights and analysis with daily market updates so that you can easily tailor your investment strategy to your needs. Sign up for a Free 14 Day Trial to learn more and obtain in-depth market reports from top-tier ASX listings.

This series is brought to you by Market Matters. Market Matters tailors your investment strategy by providing access to professional money managers, portfolios, and daily market updates.

Morning all.

This is a market which continues to show resilience, with any selling at an index level being offset by correspondent buying.

A persistent atmosphere of corporate activity has done its part.

When the world’s largest resource company cops a flat out rejection of an $8.3bn all-cash tilt for another copper miner – Oz Minerals (ASX:OZL) – it implies a strong level of confidence in the global backdrop.

And at the expense of BHP (ASX:BHP), that confidence has permeated through the rest of the market so far this week and added a rotational tailwind to reverse some of the recent sector specific performances.

Let’s set the macro-stage.

Tuesday last, the Reserve Bank of Australia (RBA) hiked local rates by 0.5% for the 3rd consecutive month, taking the Official Cash Rate (OCR) to 1.85%.

However there was a noticeable change in the rhetoric with Governor Philip Lowe echoing recent comments from the Fed as central banks clearly start to question if they need to go significantly harder.

We believe the RBA’s next hike in September is likely to be a more modest 0.25% which makes us slightly more dovish than most of the market.

We also estimate rates will “top out” closer to 3%, as opposed to the consensus view which is closer to 3.25%.

Unfortunately both the RBA and the US Fed have been way too slow to start raising (normalising) rates allowing the inflation genie out of the bottle.

Now the central banks are preaching to whoever will listen that they must act aggressively to contain rampant inflation and a potential wage explosion (while at the same time avoiding a recession).

But for us, these declining bond yields (below) are telling us central banks may be pushing too hard and the “R” word will dominate the news in 2023.

We’ve got our eye on 5 ASX stocks which have been demanding our attention over the last few days. Australian residential volumes have remained resilient into FY23 with volumes up 7% in July despite the broad negativity in the Aussie market, so with this in mind there’s a few key listings we’ve been monitoring.

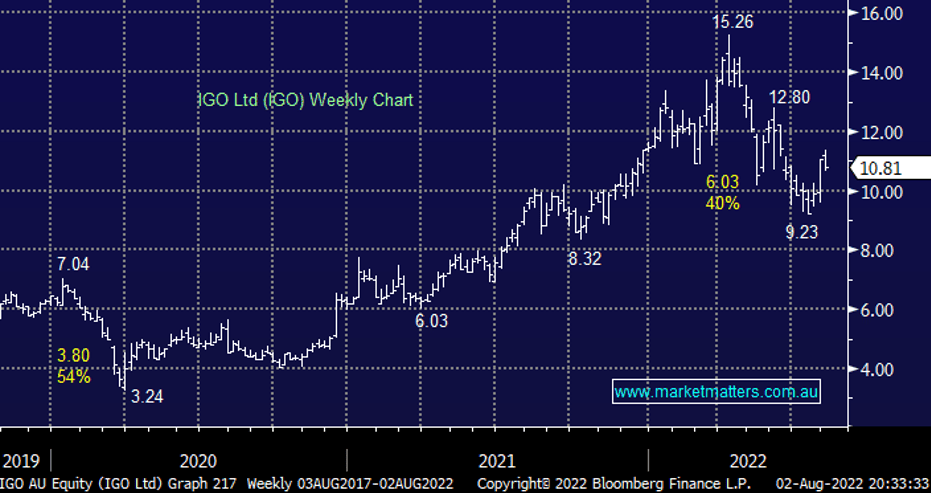

IGO hosted a very well-attended site visit over the weekend, particularly by fund managers – not surprising considering this miner ticks the ESG mandates of many a manager through its nickel and lithium exposure . i.e: prominent battery elements. As a holder and supporter of IGO let’s hope it wasn’t because they’re all long and keen to check on their investment – stocks need new buyers to go up!

We remain a big fan of this $8.2bn Aussie miner but we must remain cognisant this is a cyclical resource stock that will be led by the underlying commodity prices hence we regard it as a classic position that MM may tweak in the future – i.e: sell strength and buy weakness.

Learn more about IGO Ltd. (ASX: IGO)

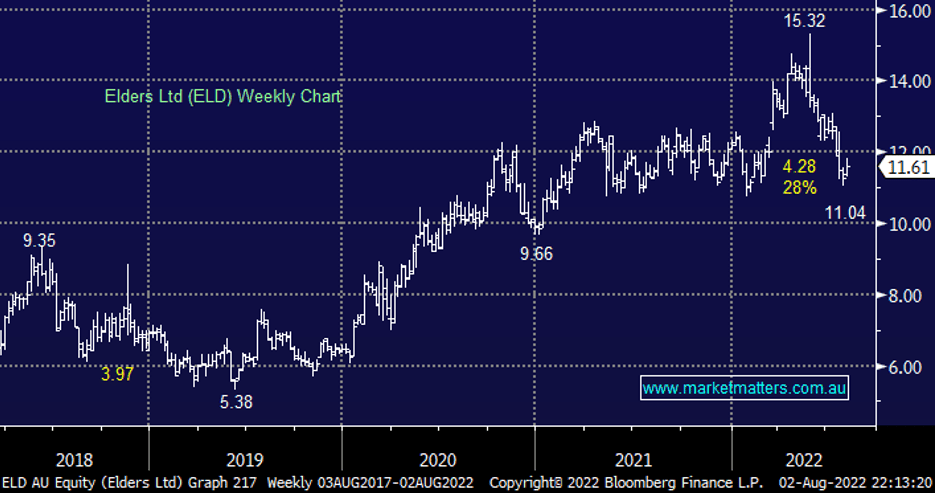

Back in May, agricultural services business Elders beat market expectations with its 1H numbers which took the stock soaring above $15 for the first time in years but unfortunately, it’s since underperformed the market tumbling 28% during the markets 2-month pullback.

We had the Elders CEO in this week and he was a very bullish man – they usually are – but this felt particularly so from a stock perspective.

The market believes FY23 earnings will be lower, however our takeaway was earnings could well be a positive surprise for the market, just at a time when the stock has struggled on concerns of a potentially disruptive foot and mouth outbreak – i.e: the risk/reward looks good below $12 helped by an estimated 5% yield over the next 12 months.

Learn more about Elders Ltd. (ASX: ELD)

To view our 3x additional ASX stock picks sign-up for a 14 day free trial of the Market Matters platform.

We provide access to real-time data and insights shared by professional portfolio money managers with daily market updates so that you can easily tailor your investment strategy to your needs.