Lessons of a Day Trader: Part 2 – How to spot a potential day trade

News

Whilst Bottom Picker has closed the coffee shop in Nelson Bay and gone on holiday, we asked him to put down on paper some of his insights on daytrading.

Following on from Part One last week, here are some pointers from ‘Bottom Picker’ for when you are ready to close your eyes and push the buy button.

Hopefully you are now settled in and have yourself comfortable with all the tools. Sometimes you have to have everything set up and ready to go.

I can shuffle money around instantly, when needed though, sometimes getting credit into a Cash Management Account can take a day and visa versa.

If you have been paying attention, the idea is to walk in with cash and leave in cash.

Trying to avoid ending up in companies that are suspended, is one of the main rules. The volatility in the blue chips offer plenty of opportunity and I have never been caught in one being suspended or in a trading halt.

99% of their announcements are made prior to the market opening and I have never ever seen any of the top four banks hit with a speeding ticket.

The 10-baggers are not for the day traders. Preserving your capital and making it work harder for you is the aim.

We have published 1000s of charts over the last couple of years, showing the ups and downs that you can experience daily.

Remember, you will never beat the professionals but you may be able to beat some of the other traders, especially the ones who panic.

In part one, we established that trading the ASX in the first and last 30 minutes is really almost pure gambling on Red or Black. Timing is everything when you only have a few hours to pick your mark.

So let’s get down to the basics.

– A share can only fall 100%. If you are short, you can only make 100%.

– If you leave a stop loss on an order, someone will always know where you are going to be automatically stopped, as they have to be monitored, so I never use them.

– I use alerts to warn me or please me, so I can then decide on my own terms, what the next action should be.

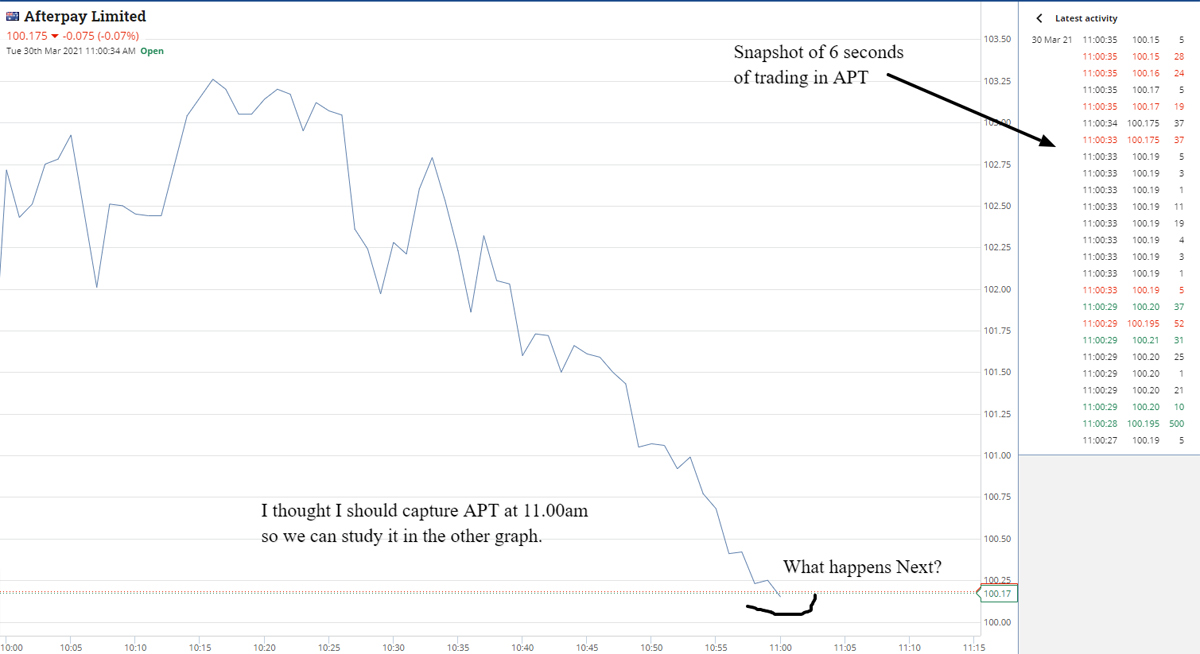

Here is a chart from APT at 11.00am on 30th March 2021

It doesn’t matter what the stock is, it’s the trend you are looking for. This snapshot is one of 1000s of charts that I have put up since starting this column.

11.00am is a crucial time, as it is the cut-off point for margin call sales.

So, what happens next?

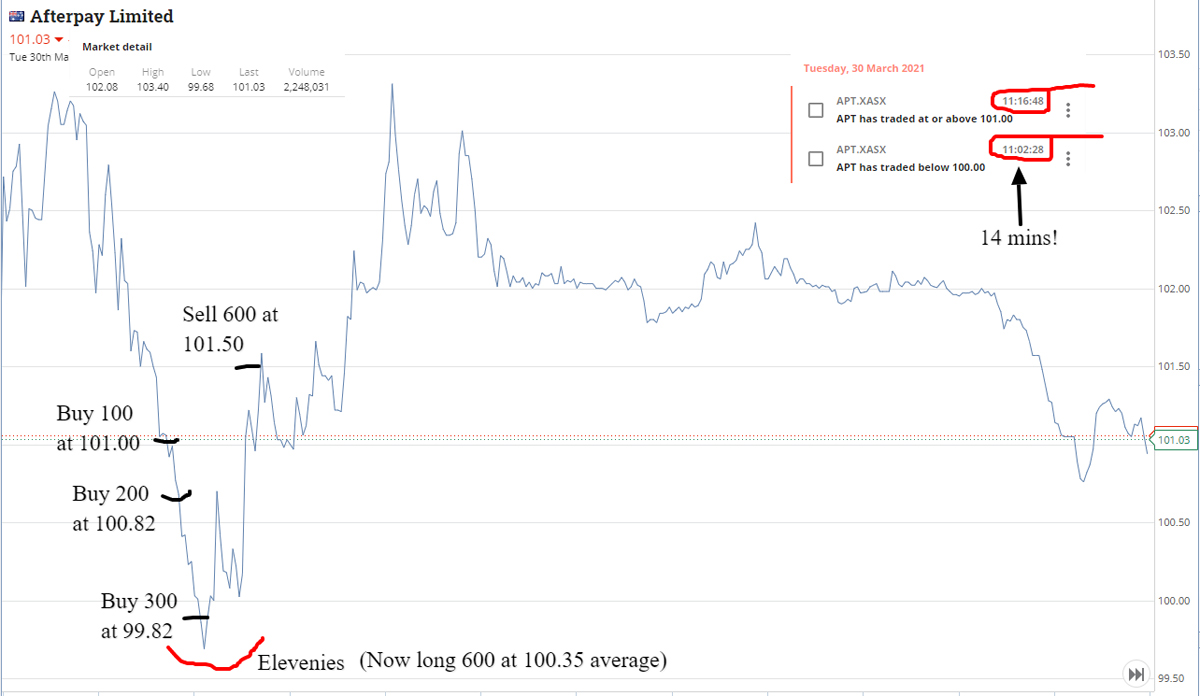

This does:

Again another classic, where it takes three goes to get a better average price, with each time having to lift the amount purchased.

Always keep your powder dry and for me, most times three is my limit. In this case the stock had already fallen from $103.00 to $101.00. Then it falls below that level to $100.82 and then another full dollar to $99.82.

With hindsight, you would have loved to pay $99.82 for the whole parcel but in reality, I thought a $2.00 fall was worth dipping a toe in.

Using the averaging down method got my average entry price down to $100.35, so 65c below the first purchase.

At the last purchase price of $$99.82, I am down $318 and have another five hours of trading left to see what happens.

They don’t always move that fast back up but they clearly looked oversold. I had set up some alerts for higher moves and included them in the image top right.

A loss of $318 ended up being a profit of $690 and 4.5 hours of trading to go and no more capital tied up and sure they went higher but you have to sell them into a rising pattern, not a falling one.

This was just a random example, which just so happened to occur on my birthday last year, which could explain my luck in spotting and putting on some trades but I suspect it was more down to staff/early holders being margined up.

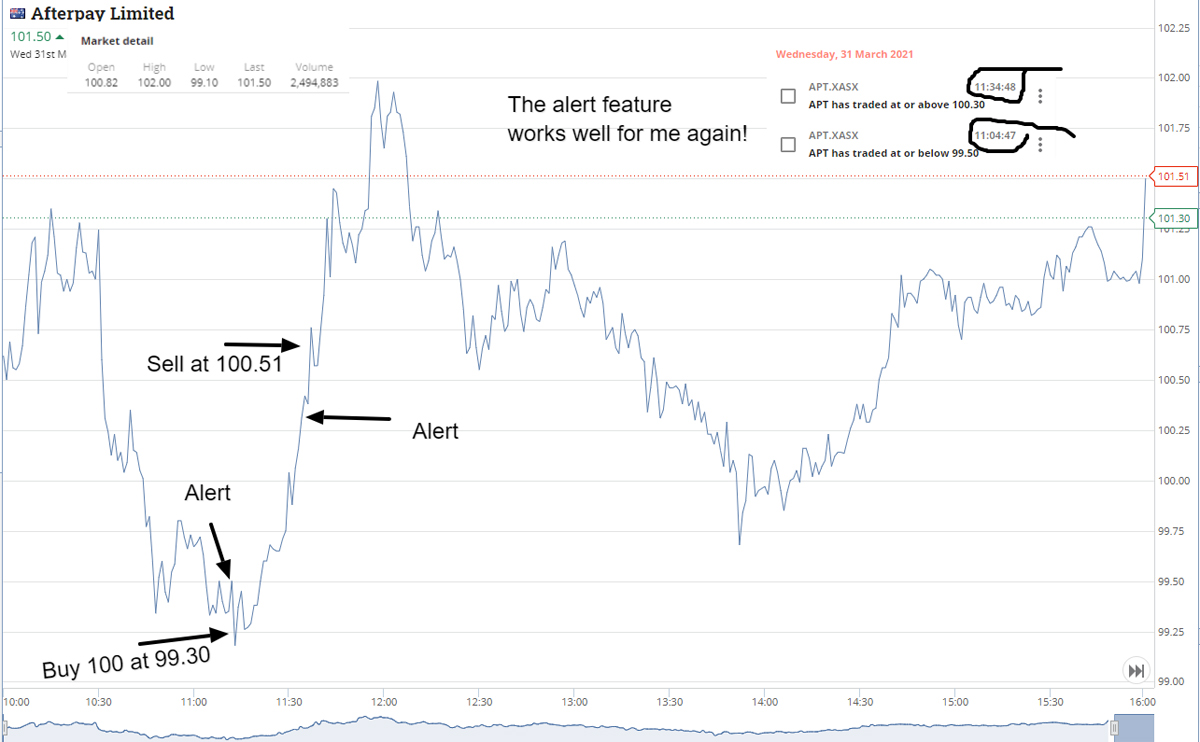

And this is their movement the next day. Note the time again.

An hour in and the same trend.

Next week we will have a look at some of the things you can do if you are in a trading pickle.