Canada Unearthed: How do the top TSX resources stocks of 2023 stack up against their ASX peers?

Like the ASX, the Canadian bourse has traditionally been a prolific breeding ground for exploration and mining stocks.

Despite fears it is turning into a low volume “ghost town of trading” there are huge pockets of value to be found exclusively on the Canadian bourse.

All up, 19 resources stocks on the TSX and TSXV have posted gains over 200% in 2023, according to IRESS data. Five have posted gains over 500%.

This compares favourably to the ASX, where just nine stocks have made gains of over 200%, and five over 500%.

But there’s something fascinating when you dig deeper… Canadian investors love gold stocks even more than the Aussies.

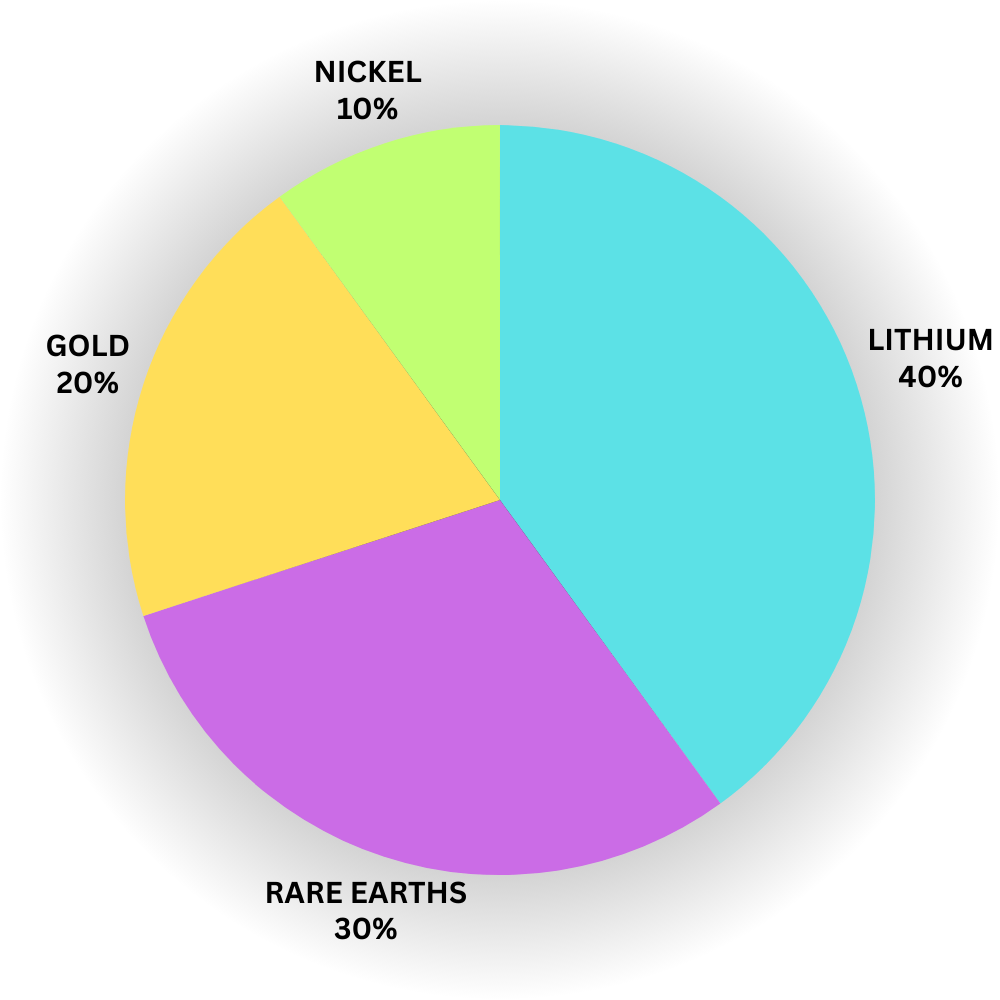

ASX: FAVOURITE COMMODITIES 2023

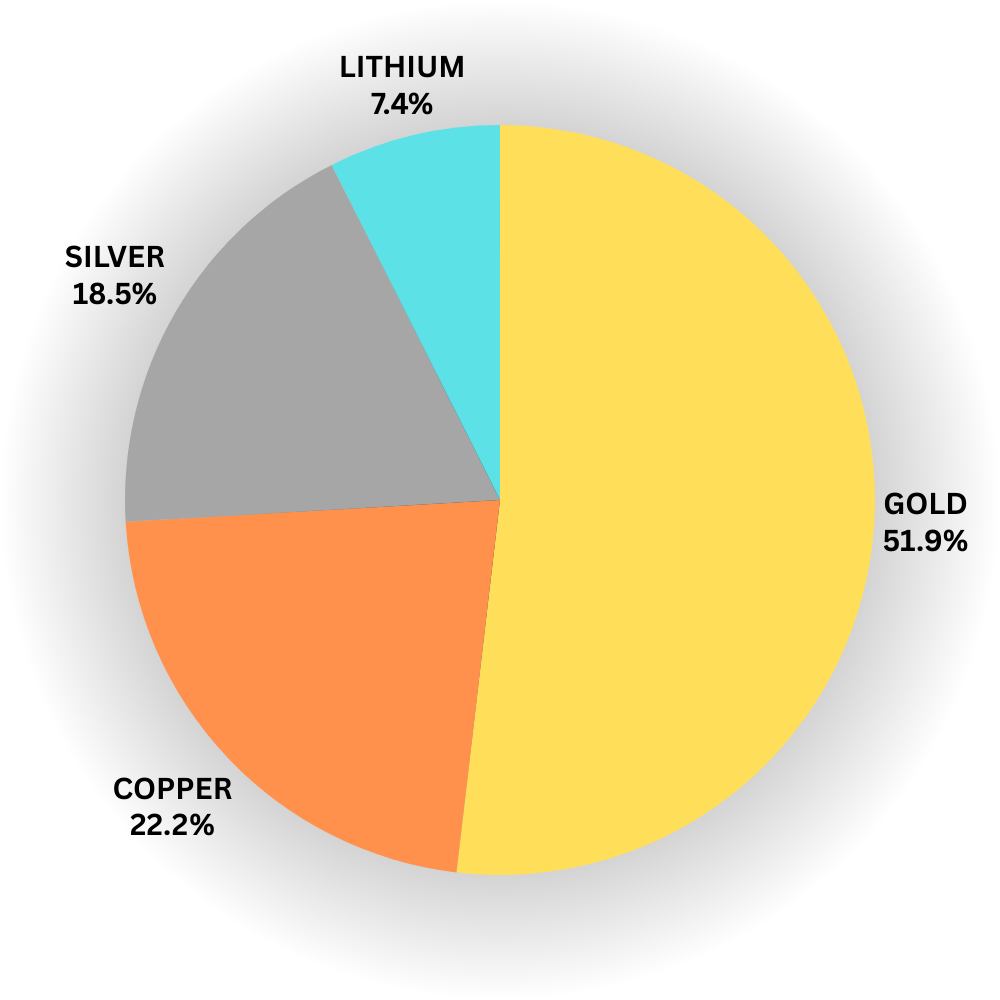

TSX/TSXV: FAVOURITE COMMODITIES 2023

While ASX investor have been piling into lithium and rare earths stocks, it is monster gold, silver and copper discoveries which dominate the Canadian winners list in 2023.

How do these Canadian champions stack up against Aussie high flyers like Wildcat Resources (ASX:WC8), Viridis Mining (ASX:VMM) and WA1 Resources (ASX:WA1)?

(Can you invest in TSX shares? Of course – Eddy Sunarto has all you need to know about that here.)

TSX/TSXV TOP RESSIE WINNERS FOR 2023

| CODE | COMPANY | YTD% | MARKET CAP | COMMODITY |

|---|---|---|---|---|

| RML | Rusoro Mining Ltd. | 750% | $250,125,000 | GOLD |

| BIG | Hercules Silver Corp. | 638% | $266,210,601 | SILVER, COPPER |

| FDR | Founders Metals Inc. | 595% | $62,095,470 | GOLD |

| HMR | Homerun Resources Inc. | 550% | $31,187,536 | SILICA |

| BFM | Bedford Metals Corp. | 512% | $6,395,472 | GOLD |

| MON | Montero Mining and Exploration Ltd. | 414% | $7,343,022 | GOLD |

| CN | Condor Resources Inc. | 411% | $69,141,356 | GOLD, SILVER, COPPER |

| WINS | Winshear Gold Corp. | 409% | $26,354,551 | GOLD |

| TBK | Trailbreaker Resources Ltd. | 368% | $14,304,868 | GOLD, COPPER |

| TCO | Transatlantic Mining Corp. | 350% | $7,797,592 | GOLD, SILVER, COPPER |

| GHML | Golden Horse Minerals Limited | 300% | $22,336,620 | GOLD |

| FIN | European Energy Metals Corp. | 300% | $12,304,886 | LITHIUM |

| MSR | Minsud Resources Corp. | 285% | $132,913,462 | COPPER, GOLD, SILVER |

| LGC | Lavras Gold Corp. | 226% | $51,788,271 | GOLD |

| BAY | Aston Bay Holdings Ltd. | 225% | $13,290,118 | COPPER, ZINC, GOLD |

| RSM | Resouro Strategic Metals Inc. | 223% | $35,484,382 | TITANIUM, RARE EARTHS, GOLD |

| CDA | Canuc Resources Corporation | 210% | $23,880,923 | SILVER, GOLD |

| NOAL | NOA Lithium Brines Inc | 210% | $35,013,931 | LITHIUM |

| SMT | Sierra Metals Inc. | 223% | $164,083,337 | COPPER |

HERCULUS SILVER (TSXV:BIG)

Herculus’ namesake project in Idaho is well trod, with over 28km of historical drilling along a 3.8km strike.

But the company says old timers neglected the projects’ full potential by focusing the shallow high-grade open pittable silver resource.

In the first deep drillhole below this shallow, +100g/t silver Hercules made a major porphyry discovery, with assays including 45m at 1.94% copper.

Major New Porphyry Copper Discovery!

Hercules Intersects 185 Meters of 0.84% Cu, 111 ppm Mo and 2.6 g/t Ag, including 45 Meters of 1.94% Cu in First Deep Hole Drilled at Hercules

Find out more: https://t.co/3Lb4zQkpcE$BIG.V #Silver #Copper #Molybdenum

— Hercules Silver (@HerculesSilver_) October 10, 2023

The stock exploded, then legged up again a month later when mining major Barrick snapped up 12.3% stake for C$24m.

FOUNDERS METALS (TSXV:FDR)

Founder acquired the historical Antino gold project in the small South American country of Suriname in March this year.

It is surrounded by some monster mines, including Newmont’s 7Moz Merian mine and Zijin’s 13.7Moz Rosebel operation.

Founders rerated after its maiden drill program returned consistent shallow results like 9m at 11g/t and 12m at 8.7g/t, culminating in a highlight 15.5m at 30.72g/t.

High grade mineralisation runs for 575m and remains open all over the joint, the company says.

MINSUD RESOURCES (TSXV:MSR)

MSR has a two main projects in Argentina: Chita Valley (copper-moly-gold-silver) and La Rosita (gold-silver).

Chita Valley is a porphyry system with a current resource of 386 million pounds of copper (175,000t) which is subject to an earn in with mining giant South32 (ASX:S32).

S32 (50.1% ownership) is spending C$9.1m this year to drill 21,700m to expand resource and test other targets.

So far, drilling has expanded the ‘Chinchillones’ porphyry-epithermal system with monster hits like 786m at 0.43% Cu, 0.23g/t Au, 15.78g/t Ag from 456m to 1,242m (open at depth).

This includes a high grade 166.3m at 1.35% Cu, 0.54g/t Au and 26.63g/t Ag.

A resource upgrade is being planned, the company says.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.