Wolfram at the door: Why China has a tungsten fight on its hands

Pic: Getty

Slipping under all the hoopla surrounding lithium and rare earths and new metals and such is a quietly prospective deal struck between Australia’s only operating primary tungsten producer – Queensland-based EQ Resources (ASX:EQR) – and a cunning mining-tech firm up in Brisbane called Plotlogic.

The agreement, rich in breakout technology (although quiet on the money front), is of more than just national significance.

Because, alongside its monopoly of various rare earths, China’s current stranglehold over the critical mineral makes reviving a domestic tungsten industry – and building out a national tungsten resource – a strategic imperative the government is already getting behind.

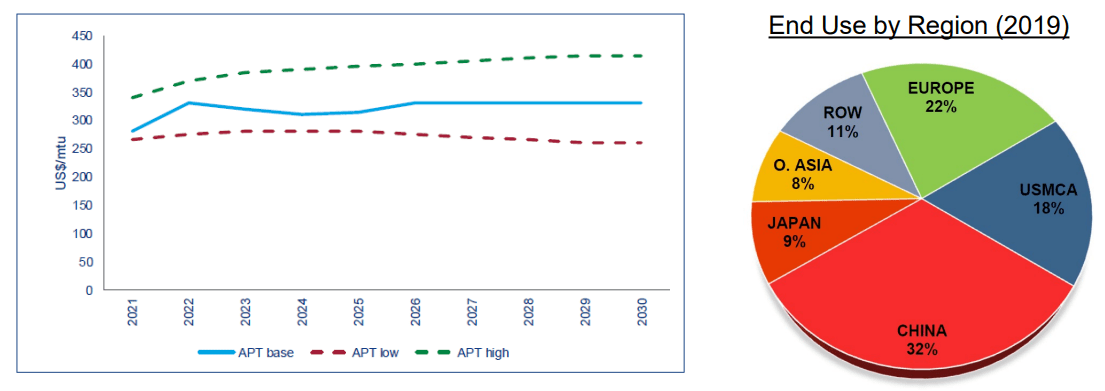

But, for the nonce, consumption outside of China remains under enormous pressure.

The combined total exports of tungsten products between January to October last year dropped by a full third according to data from China’s Nonferrous Metals Industry Association.

By dominating both supply and demand, China is able to impose itself on pricing and global supply, something the government under Xi Jinping has been happy to do to maintain and exert its control over many of the minerals and metals now considered critical.

“China’s government regulated its tungsten industry by limiting the number of mining and export licenses, imposing quotas on concentrate production, and placing constraints on mining and processing,” the U.S. Geological Survey said in its most recent mineral commodities report.

Meet some Tungsten

But first, here’s a few things you probably didn’t know about tungsten.

Otherwise known by its much cooler name – Wolfram – tungsten is one of the toughest things found in nature, tougher even than the Brisbane Broncos (ASX:BBL).

In fact, it’s the second hardest mineral on the planet, so while it might be vulnerable to Chinese control, it’s almost indestructible.

Pure tungsten is a lustrous silver-grey, giving it an approximate atomic weight of George Clooney’s hair.

That is to say it has terrific mass. And not unlike George, it’s incredibly dense and almost impossible to melt.

And yet, get yourself some tungsten as a fine powder and suddenly it’s extremely incendiary and has the unwelcome habit of spontaneously combusting.

What else? Tungsten contains five stable isotopes and 21 other highly unstable isotopes.

It’s found with great difficulty. It’s rare as hell. And it exists almost exclusively and somewhat inconveniently as a compound interlocked with other elements.

So getting it out of the ground without destroying everything is a very tricky business.

I love to have a beer with tungsten

Tungsten and its various alloys are absolutely essential to the way we’re going about living.

So, for example, if your day has anything to do with transport, aircraft, mining or automobiling, then tungsten is your puppy.

Then, there’s always this:

And it’s really a thing.

It’s called ‘Kinetic bombardment’ also known terrifyingly known as Rods from God.

Around 100,000 tonnes of pure Tungsten gets sucked up and used globally each year. China – our largest and most fractious (we’re in a trade war) economic partner currently controls well over 80% of production.

For now, China’s also the biggest consumer and faces considerable limitations on mining and exporting anyway, even without the inconvenience of a global pandemic and deteriorating geopolitical and commercial ties, but its reticence is already heavily impacting global supply.

It’s been something of a logistical pickle and has been severing the fingernails of metals analysts and policy wonks alike for some time now.

Enter Plotlogic

Ok. So Australia has barely mined a drop of tungsten since around 1990. Not just because of the exorbitant costs involved, but as mentioned, it’s been a horrible mess to get this stuff out of the ground and onto your plane.

But that could all change now because of Aussie-made tech that Plotlogic’s founder and CEO Dr Andrew Job says can revolutionise the industry and secure Australia’s position at the forefront of a new and critical industry.

The incredible Dr Job

While industry was at the pub, spit-balling over how nice it would be if AI and sensor technologies could provide real-time, high-precision orebody understanding and then dreaming about how that might drive a step-change in mining operational efficiency and resource sustainability, Andrew was at the University of Queensland doing a doctorate on it.

After more than a decade in the mining industry, Dr Job knew there was work to do.

He started Plotlogic in 2018, determined to develop a more frictionless mining-tech business which creates all kinds of value through real-time ore characterisation systems. Value through efficiency, simplicity, accuracy and – critically – across safety and security. Mining systems which ensure health for both the mine environment and its workers and for the country in a rapidly shifting geopolitical climate.

Re-lodeing Carbine

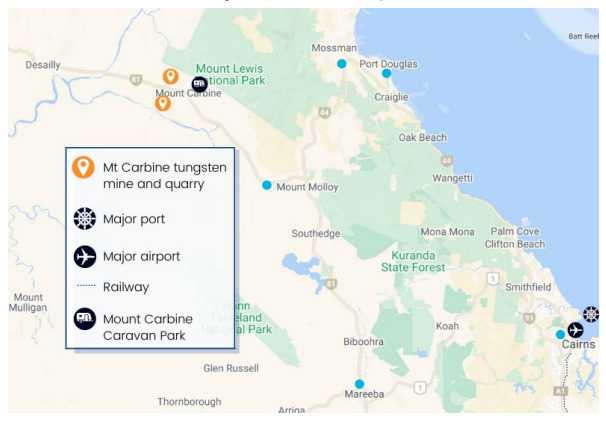

EQ Resources’ Carbine project up near Cairns is the first tungsten mine to partner with Plotlogic.

In this instance, Plotlogic’s tech will combine advanced imaging and artificial intelligence (AI) to characterise ore in real time.

It creates and analyses huge streams of data which can deliver reliable, real-time decision making.

So instead of pockmarking Cairns in a million different drill holes and then manually testing, re-drilling and ballpark mapping ore deposits, Plotlogic can scan an area, decipher the different elements and produce a map of the ore deposits almost instantly making mines much more efficient.

For tungsten, the tech can solve the key issues facing the industry here – how to clean up old mine sites, reduce the onerous environmental and cost burdens and meet demand from increasingly ESG-conscious customers who are desperate for open, quality supply from stable jurisdictions.

At Carbine, EQ Resources’ will initially use the tech to scan the site’s reputed mountains of tailings enabling recovery of tungsten and the clean up of the previously moth-balled projects.

EQ was able to deploy the tech with eager assistance from the Federal Government’s Advanced Manufacturing Growth Centre and the development at Carbine is being watched with global anticipation.

A growth phenomenon

Unsurprisingly there’s a market for this outside of tungsten. China itself is desperately looking for cleaner extraction processes as its domestic commitments to somehow retrace the environmental sacrifices the Communist Party has made over the last 30 years of breakneck economic development.

Plotlogic’s tech can also be used across the broader mining sector – for gold, for iron – if there’s an orebody which needs identifying without blowing up the countryside then Plotlogic’s going to be an option.

This time last year the firm was pre-revenue. Now, it’s workforce is near 50 and looks like doubling by Christmas.

With three of the world’s four biggest miners – BHP, Anglo-American and Glencore – among its customers and with a revenue pipeline of well over $90 million, the potential benefits a tech like this can offer a country like Australia… well, it’s pleasantly unsettling.

Tunsten stocks on the ASX

The VMS operated Mount Lindsay is already classified by the Aussie Government as a Critical Minerals Project with an advanced Tin-Tungsten asset, enhanced by the recent discovery of two new skarn zones – one within the Renison Mine Sequence in the Mount Lindsay area and the other along strike from Mount Lindsay’s main tin deposits.

It’s also one of the largest undeveloped tin projects in the world, containing more than 80,000 tonnes of tin metal and within the same mineralised body a globally significant tungsten resource containing 3,200,000 MTU (metric tonne unit) of tungsten.

Group 6 Metals – G6M (ASX: G6M)

Group 6 has commenced construction on site at the Dolphin Tungsten Mine (highest-grade tungsten deposit of significant size) in the western world. The Company is fully funded to proceed with redevelopment of the mine with its targeted $88 million in financing secured.

Before Christmas, G6M chair Johann Jacobs told Stockhead’s Emma Davies:

“We have been engaged with Gecko Systems from Ballarat for some three years on the detailed design of the processing plant…. They will undertake the procurement and construction of the processing plant and – based on their timeline – commissioning should start in first week of January 2023.”

Thor Mining PLC is an exploration and development company with an exciting copper development project with resource estimates, and a gold project which has produced exciting early results. Thor also holds an advanced tungsten/molybdenum project ready for development.

Investors were seeing bright prospects in the tungsten metal sector Thursday, with the share price of another tungsten company Tungsten Mining taking off in early trade.

The company announced last week the completion of a pre-feasibility study underwriting its proposed 6 million tonnes per year mine at its Mt Mulgine project in WA.

Pan Asia Metals (ASX:PAM) has been fairly committed to accelerating work to define a JORC resource at its Reung Kiet lithium and Khao Soon tungsten projects in Thailand.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.