Pan Asia accelerates lithium drilling following strong results

Pic: Tyler Stableford / Stone via Getty Images

Pan Asia is accelerating work to define a JORC resource at its Reung Kiet lithium project in Thailand after drilling returned very encouraging results.

Assays from the 13 diamond holes drilled to date at the Bang I Tum and Reung Kiet prospects intersected extensive pegmatite dyke-vein swarms up to 100m wide that contain lithium mineralisation associated with lepidolite.

Notable results are 11.3m grading 0.74% lithium oxide from 19.2m, 10.7m at 0.98% lithium oxide and 4.2m at 1.3% lithium oxide.

Pan Asia Metals (ASX:PAM) adds that tin and tantalum mineralisation, which are potentially valuable by-products, occur in association with the lithium along with rubidium and caesium.

Managing director Paul Lock said the intersection widths and lithium grades at both prospects position the company well and warrants the move to a double drilling shift to expedite the definition of a JORC resource.

“Using the global peer group of lithium projects as a guide, lepidolite is the only style of lithium mineralisation with an extensive suite of by-products,” he added.

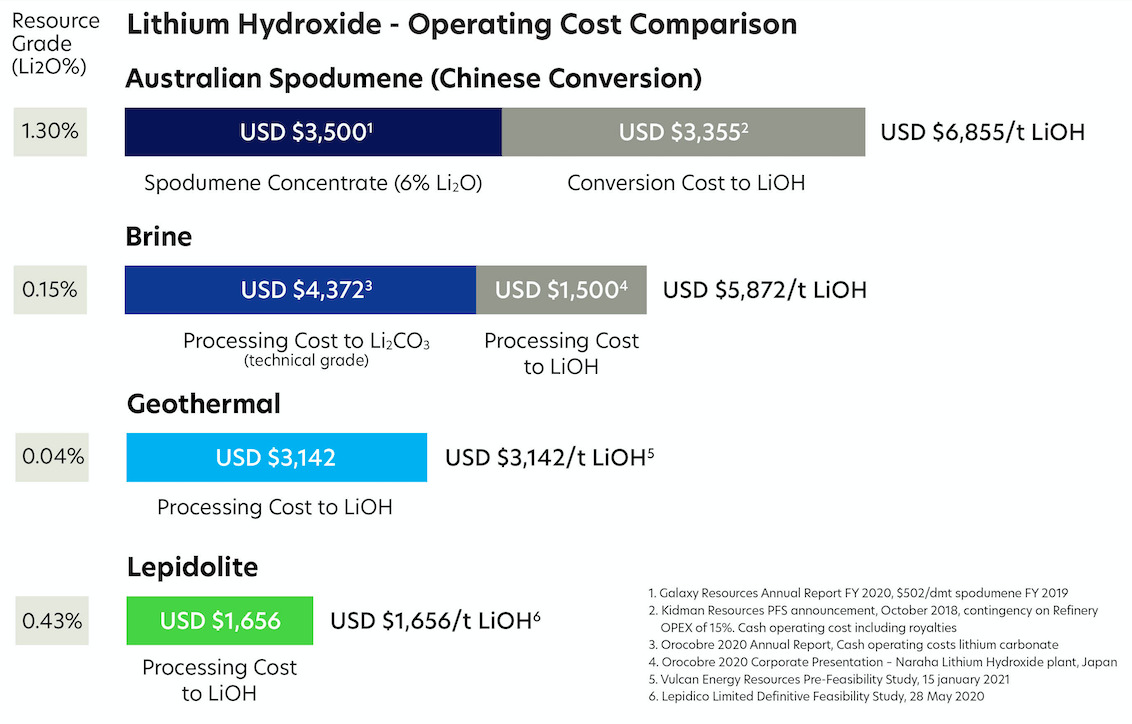

“Peer group studies indicate that these by-products can reduce the overall cost of lithium carbonate and or lithium hydroxide manufacturing, so much so that they can place lepidolite style projects at the bottom of the operating cost curve.

“This is Pan Asia Metal’s objective, to identify and develop projects which have the potential to be placed at or near the bottom of the cost curve and which provide PAM the option to move past the mine gate and value add. The drilling results at Reung Kiet suggest such goals are realistic.”

Reung Kiet lithium project

Reung Kiet is near Phuket within a known tin mining region, where exploration to date has defined consistent high grade lepidolite in pegmatites across a strike of more than 2.5km.

It includes a 500m long and 125m wide open cut tin mine where mining of weathered pegmatites extended up 25m below surface to the top of hard rock.

Pan Asia previously identified a prospective zone at least 1km long in association with extensive lithium values in trenching, rock-chips and soil anomalies, which is now being supported by drilling.

Highlighting the low cost nature of lepidolite projects, Lepidico (ASX:LPD) had noted in its definitive feasibility study in May last year that its Karibib project in Namibia had estimated operating costs of about US$1,656 ($2,141) per tonne of lithium carbonate equivalent (LCE) and all-in-sustaining costs of US$3,221/t of LCE.

Reung Kiet could better this given its potential to be bigger than Karibib, the higher grades from rock chips and drilling, and proximity to both industrial inputs and markets.

The company is aiming to define a maiden resource in the second half of 2021.

Pan Asia Metals share price today:

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.