US-China tech trade war fries semiconductor stocks

The American semiconductor sector took a hit on Wall Street overnight and some ASX semiconductor stocks are feeling the pinch too.

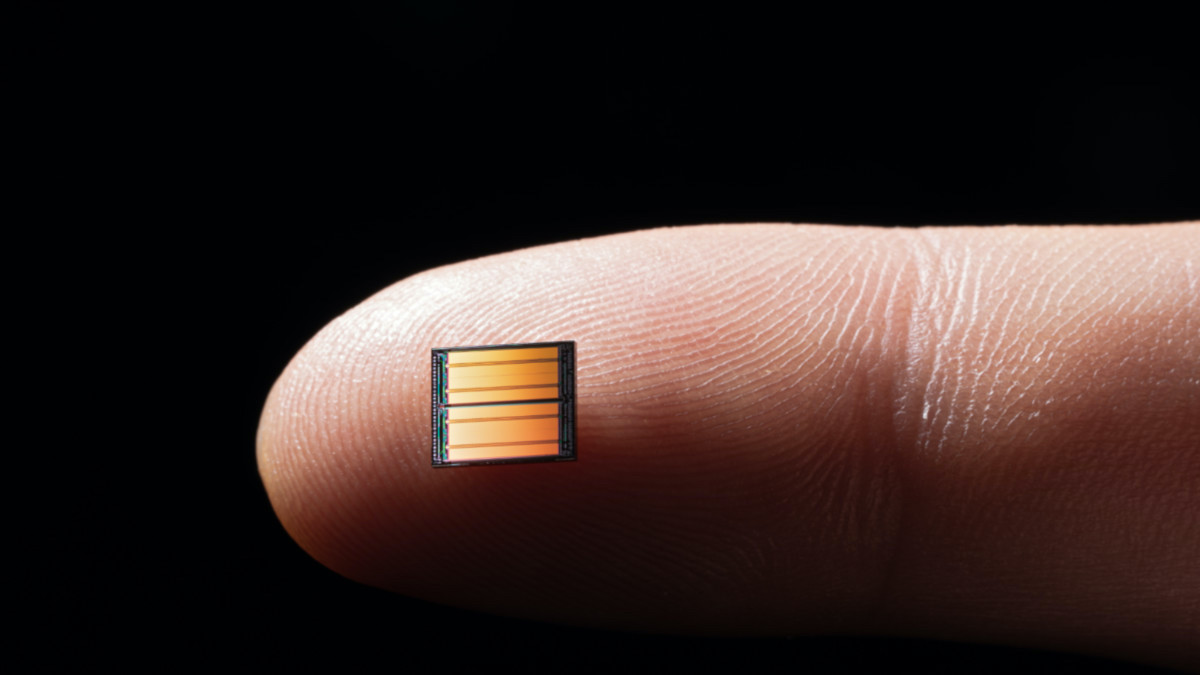

While semiconductors are just a material that conducts electricity, the term is used broadly to refer to technologies that use the material, particularly computer chips.

Overnight the Philadelphia Semiconductor Index fell 5.7 per cent. This was more than double the fall of the Dow Jones and wiped US$100 billion ($137 billion) off the former index’s value.

This followed reports from Bloomberg earlier in the morning that China was taking steps to ramp up its own semiconductor industry.

While firm plans are yet to be announced by the Chinese government, Bloomberg reported moves would involve broad support for the next generation of semiconductors through to 2025.

The move is intended counter restrictions imposed by the Trump administration, including bans on Chinese tech firms from buying American parts.

Semiconductor companies had borne the full brunt of the US-China trade war for several months before COVID-19. While investors appeared to put it aside for some months, the fears are firmly back on the table.

National Securities Corp analyst Arthur Hogan said escalating tensions were now his biggest fear.

“It’s not around the alleged phase-one trade talks and China buying more of our agricultural products, but it’s much more around what we’re actually doing in real life – we’re starting a technologic cold war,” he said.

“When the two largest economies in the world go head to head, it’s hard to rationalize what good comes from this.”

Have ASX stocks been hit?

The ASX is home to just over a dozen semiconductor stocks.

Today most stocks fell although only K2 Energy (ASX:KTE) – which is only in the industry as an investee in NASDAQ-listed Atomera – has fallen by over 10 per cent.

In the last 12 months the average gain is substantially high at 132 per cent.

But there is a great gap between the best and the worst, with 4 stocks going double or better and 4 stocks losing 30 per cent or more.

Here are the ASX’s semiconductor stock and their yearly and daily performance:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price (I) | 1 Year % Return | % Return 10am-10.30am 4/9/20 | Market Cap |

|---|---|---|---|---|---|

| BRN | BRAINCHIP HOLDINGS LTD | 0.47 | 1150 | -6 | $733.8M |

| DTZ | DOTZ NANO LTD | 0.2 | 335 | 0 | $63.5M |

| KTE | K2 ENERGY LTD | 0.019 | 300 | -17 | $7.5M |

| WBT | WEEBIT NANO LTD | 0.77 | 111 | -8 | $74.6M |

| SLX | SILEX SYSTEMS LTD | 0.58 | 81 | -4 | $101.1M |

| AKP | AUDIO PIXELS HOLDINGS LTD | 23.8 | 45 | -2 | $642.6M |

| 4DS | 4DS MEMORY LTD | 0.047 | -10 | -2 | $61.6M |

| BLG | BLUGLASS LTD | 0.08 | -18 | -5 | $85.0M |

| PVS | PIVOTAL SYSTEMS CORP INC-CDI | 1.07 | -30 | 0 | $130.5M |

| SE1 | SENSERA LTD | 0.055 | -33 | -8 | $19.0M |

| BCT | BLUECHIIP LTD | 0.062 | -62 | -2 | $34.4M |

| RVS | REVASUM INC-CDI | 0.25 | -82 | 0 | $16.2M |

The biggest winner is Brainchip (ASX:BRN) which is up over 1000 per cent this year. It’s Akida chip is AI-based and doesn’t need server backup to keep learning.

The company has really taken off since early July when it announced it had completed the wafer fabrication stage and could progress to the assembly stage.

Another is tracking tech stock Dotz Nano (ASX:DTZ) which has rolled out its technology. A particular focus that has excited investors is its push to stop counterfeit face masks.

The strugglers

On the other end of the spectrum there have been losers and it’s more than just trade tensions – if they can be blamed at all.

Bluechiip (ASX:BCT), which also makes tracking technology but for medical samples needing to be kept sub-zero temperatures, plunged in July when its biggest customer unexpectedly walked away.

San Francisco-based semiconductor manufacturer 4DS Memory (ASX:4DS) plunged earlier this year when it was hit by California’s restrictions.

Its share price hasn’t fully recovered even though it renewed its joint development agreement with HGST and was awarded more patents.

Although fellow Californian stock Revasum (ASX:RVS) was allowed to continue to operate, it struggled with a significant drop in revenue.

Its revenue for the first half of this year was down 57 per cent and system sales dropped 65 per cent compared to the prior corresponding period.

The company listed 2 years ago at $2 per share and now sits at 25 cents. It recently announced the exit of its CEO Jerry Cutini.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.