Is the semiconductor market about to pick up again and could these small caps benefit?

Tech

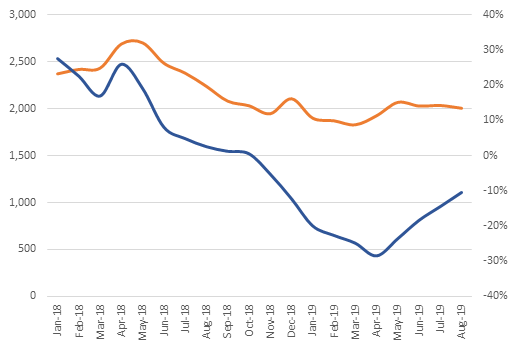

The semiconductor market has had a tough run in recent months. Worldwide sales of semiconductors in the 12 months to August were 16 per cent lower than the prior corresponding period.

Specifically in the Americas, home to global tech giants in computers and electric vehicles, it fell 28.8 per cent. But by other measures, the picture is not as bleak as it may seem, and the market has a brighter future.

Pitt Street Research’s Marc Kennis told Stockhead the market, measured by year on year growth (the blue line in the chart), bottomed out in April and has begun to rise again. Another measure he pointed to was the number of billings for semiconductor equipment in the US — represented by the orange line. While it was not at all time highs, it had not plummeted either.

However, he did not shy away from the decline attributing it to a specific segment of the market: memory.

“You’ve got processors in every shape and size from small ones in your computer to the data centres,” he said.

“The last 12 months have seen a decline in memory sales, but the key is to look at month over month.

“Agencies see a recovery, meaning a return to positive growth late this year and early next year which will represent an uptake in memory space.”

There are 12 semiconductor players on the ASX. The best performer in the long term is Audio Pixels (ASX: AKP) which has gained over 10,000 per cent in 10 years despite still being at the development stage.

Only two are at the fully-operational stage, Revasum (ASX: RVS) and Pivotal Labs (ASX: PVS) but ironically these have been among the largest laggards on a 12 month basis.

The best performer is BlueChiip (ASX: BCT) which makes MEMS chips for tracking biological samples that must be kept in extreme conditions. It’s up 174 per cent in 12 months.

Stocks only at the development phase are taking steps to get them to the next level. BluGlass (ASX: BLG) opened a new laboratory in Western Sydney to test its technology back in August.

Kennis told Stockhead he expected more to begin generating revenue within a few quarters.

| Code | Name | Price | Market Cap | 1Y % Return | 6M % Return | 1M % Return |

|---|---|---|---|---|---|---|

| 4DS | 4DS MEMORY LTD | 0.068 | $77.2M | 11 | -7 | 28 |

| BLG | BLUGLASS LTD | 0.14 | $60.7M | -49 | -15 | 21 |

| KTE | K2 ENERGY LTD | 0.006 | $1.8M | -45 | 0 | 20 |

| BRN | BRAINCHIP HOLDINGS LTD | 0.047 | $62.2M | -67 | -11 | 18 |

| AKP | AUDIO PIXELS HOLDINGS LTD | 18 | $520.5M | 45 | -5 | 6 |

| SLX | SILEX SYSTEMS LTD | 0.385 | $64.8M | 76 | 23 | 6 |

| SE1 | SENSERA LTD | 0.089 | $26.2M | -29 | -17 | 4 |

| BCT | BLUECHIIP LTD | 0.175 | $89.6M | 174 | 107 | 3 |

| WBT | WEEBIT NANO LTD | 0.385 | $27.3M | -60 | 3 | -4 |

| PVS | PIVOTAL SYSTEMS CORP INC-CDI | 1.45 | $161.7M | -49 | 2 | -6 |

| DTZ | DOTZ NANO LTD | 0.045 | $10.6M | -43 | -42 | -10 |

| RVS | REVASUM INC-CDI | 1.29 | $99.7M | -35 | -22 | -13 |

Arguably, the reason Revasum and Pivotal have declined is because they are based in the US where larger semiconductor firms and their clients, particularly smart phone makers, have been hit by the trade war.

This is because, while the US is the largest purchaser, China is responsible for a large part of the supply chain — although firms like Xiaomi and Huawei purchase too.

The trade war and specific restrictions by the Trump administration has made it very tough for American firms to sell to the latter. To put it bluntly, firms cannot deal with Huawai unless they get special approval.

One semiconductor producer, Singaporean-based Hybrionic, said in August the trade war forced it to hold back shipments representing 40 per cent of sales.

But another factor is overbuild in the inventories. Marc Kennis told Stockhead semiconductor makers are well aware of the market contractions but have to ride out the short term pain because the fixed costs are too big to cut back on production.

Another analyst, Malcolm Penn, who is CEO of semiconductor research firm Future Horizons, told a conference last week an overbuild was to blame. But Penn believed a correction was inevitable next year.

“The [industry] fundamentals are sound,” he declared. “In terms of IC [integrated circuit] unit growth, fab capacity and average selling price, they are all in in good shape. It’s the timing of the upswing in the economy that puts it into doubt.

“Rebound is a certainty, but its timing is not.”

Read More:

Intel got rich off semiconductors and these Aussie stocks think they can too

Do analysts believe America’s semiconductor acquisition spree could reach these small caps?