‘Predictability and consistency’: Dicker Data says the company is prepared to ride the next big tech boom

Dicker Data has been one of the best tech stocks on the ASX. Picture Getty

- Dicker Data has been one of the best tech stocks on the ASX

- The company has produced returns over the years, and predict that it’s just getting started

- Stockhead reached out to Dicker Data’s executive and COO, Vladimir Mitnovetski

If one of your New Year’s resolutions is to worry less about your investments, Dicker Data (ASX:DDR) could be one of those stocks you can set and forget – based on its past performance.

Over the last decade, the DDR share price has risen by an astounding 1,200%. It’s also up 300% in the last five. Not only that, Dicker has been paying dividends in each of the those last 10 years.

But there’s more. The company now says that its best years are still ahead, and believes that it’s about to ride the next big tech boom.

“We are in the midst of the digital age, an era defined by tech advancements transforming the way we live, work and interact,” says Dicker Data’s executive and COO, Vladimir Mitnovetski.

“Technology has now become a very big thing everywhere. It used to be just tech companies doing technology, but now every single company is a tech company.”

The wholesale distributor of computer hardware and software has its finger on the pulse of local and global tech demands, representing more than 80 of the world’s Tier-1 tech vendors, and more than 10,000 IT resellers.

The company focuses on the commercial and enterprise segment of the market, targeting businesses in Australia and New Zealand.

Mitnovetski says Dicker Data’s huge success is due to combining the company’s execution capabilities with being at the right place at the right time.

“A lot of big things happened in the last 15 years within the tech space. We had adoption of the cloud technologies globally, and a new wave of 5G enterprise networking,” explained Mitnovetski.

“As a result, we had data centres built all around the world to accommodate for that incredible wave of cloud adoption.”

“But all that complexity needs simplification, and that’s why there’s been such a huge demand for IT distributors like Dicker Data.”

The IT distributor model

Mitnovetski says that in IT, the distributor is the only place where you can have everything under one roof – like data centre infrastructure, enterprise networking, and personal computing.

“We also do lots of cloud products and services, software, data backup, data analytics, and so forth. So we build and bundle them all together for our clients, we’re a one-stop shop.”

Another big factor driving the company’s success, according to Mitnovetski, is the fact that all businesses these days aim to be more productive, ie; they all want to become more efficient and effective in what they do.

“The big thing now is digital transformation, every organisation wants to transform, and they’re all trying to get ready and being as digitally ready as they possibly can,” he said.

“And to make sense of all that, you need a distributor, because this can’t be done by a single vendor or a single partner.

“You need a centralised depository of all this technology, and that’s why a distributor like us has become so in demand,” said Mitnovetski.

Dominant position

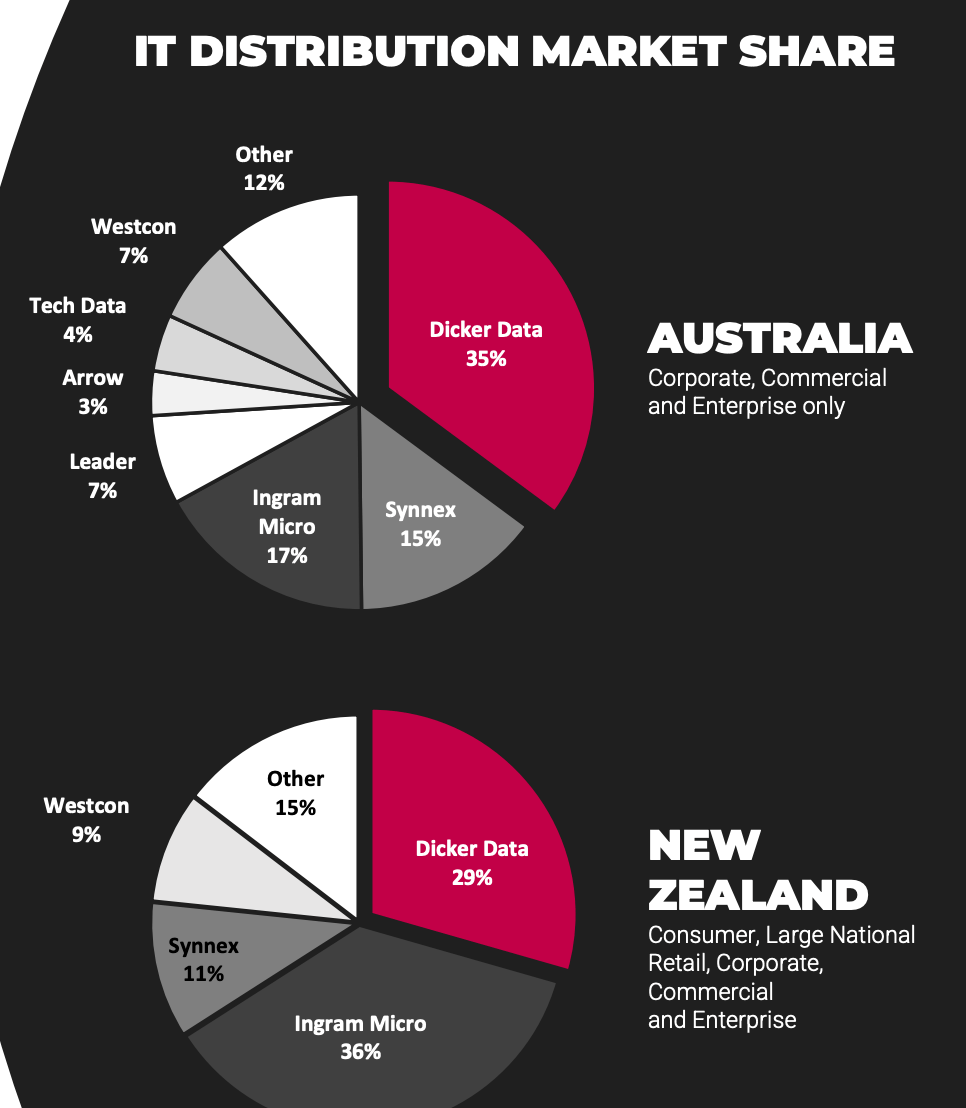

Founded in 1978 by the charismatic founder David Dicker, Dicker Data has continued to grow its share of both the Australian and New Zealand IT market, commanding a dominant number one position in Australia.

The company also believes it now has the platform to become number one in New Zealand following the acquisition of Exeed.

Dicker Data’s market focus is on the the small and medium sized resellers, which in turn are servicing small businesses.

“This year, we’re going to do over $3 billion in revenue, and 80% of that is coming from small and medium type of businesses,” said Mitnovetski.

The company’s vendor partners are some of the biggest names in the industry, including Microsoft, Hewlett Packard, Cisco, Dell Technologies and Lenovo.

“Those are our top five vendors, and the top four would probably give us around 50% of our revenue.

“But our business is very diverse, and we’ve become a one-stop shop for a lot of the small guys,” Mitnovetski said.

“So no matter what they need, they can come to us and we will design the solution and work with the end user.

“We will then quote the solution, but we’ll never transact with the end user, we will always do it with our partner. So that’s our role.”

Cybersecurity, AI are the next big things

Cybersecurity meanwhile is at the top of the agenda for every organisation in Australia and New Zealand.

Dicker Data has made several strategic vendor appointments to address this cybersecurity opportunity, with plans to further expand its product range in FY23.

The complexity of cybersecurity is creating a large opportunity for the company as its partners increase their reliance on Dicker Data to help them solve their end-customer challenges.

“Cybersecurity is a big thing, and is a huge growth area and opportunity for us as well, because while we have some really good cybersecurity vendors, there’s still a couple that we’re missing.

“So that would be my job to make sure that we bring them all under Dicker Data’s roof in the next couple of years,” said Mitnovetski, adding that artificial intelligence (AI) will also become one the hottest areas for the company in the future.

Mitnovetski says stability and predictability are the traits investors should have gotten used to when it comes to Dicker Data’s stock.

“We know how to control our destiny, because we’re not at the mercy of a large customer or a large vendor anymore.

“This is reflected in the way that we diversified our portfolio, and the way that we service our thousands of customers.

“And by the way, we are signing hundreds of new customers every month. So that gives me a good strong feeling that predictability and consistency are going to continue driving our business for many, many years to come.”

Dicker Data share price today:

OTHER ASX STOCKS IN A SIMILAR SPACE

Data#3 Project Services help customers align business and technology strategies by leveraging its strong relationships with world-leading vendors.

Listed on the ASX since 1997, Data#3 reported revenues of $2.5 billion in FY23, and has more than 1,400 employees

Headquartered in Brisbane, it has facilities across 12 locations in Australia and Fiji.

The company works within the healthcare, education and government industries.

Vendor partners include Adobe, Cisco, Dell and HP.

Activeport is a software-focused company delivering network management and orchestration solutions (MANO) for three broad markets: telecommunication, IT and Managed Service Providers, and enterprise.

In July, Activeport and Radian Arc expanded their relationship that will accelerate artificial intelligence (AI) deployment within the teleco industry.

The collaboration aims to leverage Radian Arc’s AMD-based GPU platform, already installed in a rapidly expanding network of 50+ telco customers worldwide, to offer GPU-as-a-Service (GaaS) for AI.

This will enable telcos and their enterprise customers to easily deploy AI models within their networks, resulting in unique low-latency AI solutions.

Netlinkz is a networking vendor that provides cloud network solutions.

The Netlinkz VSN solution is a NaaS (Network-as-a-Service) proposition that is user-centric, creating a per-user private network that is optimised regardless of the client’s location.

In October, Netlinkz said it has executed a convertible securities facility agreement to raise up to $10 million with US investor, Obsidian Global.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.