Bargain buys or just busted? Here are the 10 biggest tech losers in the June sell-off

Pic: CRobertson / iStock / Getty Images Plus via Getty Images

- 114 tech stocks were trading down for the month of June

- 11 stocks flatlined and only 22 were in the green

- The biggest losers were iSYNERGY, Icetana and Eroad

Wowzers. Even by tech stocks standards, June was a bit of a shocker, with the sector down 7.56% for the month.

On our list, a total of 114 stocks were in the red, 11 failed to move the needle, and only 22 were in the green.

Tech stocks are super sensitive to interest rates, and record inflation and global rate hikes have made it an uphill slog so far this year. Couple that with the annual flood of nervy investors looking to dump their loss-making turkeys before the end of financial year, and well, let’s just say tech stocks are going cheap right now.

But there are steady tech performers – typically those with strong cash flows and earnings. And last month Goldman Sachs analysts Kane Hannan, Chris Gawler and Benjamin Rada Martin said in a research note that software stocks especially can hold steady in “inflationary environments”.

“In the context of challenging macro, we note AU peers generally traded well through the GFC, with solid revenue growth and limited negative revisions,” they said.

So could any of these tech players on our list be a bargain buy – or are they just busted?

Here’s how ASX tech stocks are tracking for June:

Tech stocks missing from our list? Shoot a friendly mail to [email protected]

| Code | Company | Price | % Year | % Six Month | % Month | Market Cap |

|---|---|---|---|---|---|---|

| SLX | Silex Systems | 2.04 | 123% | 68% | 61% | $434,546,917.32 |

| RD1 | Registry Direct | 0.016 | -10% | -41% | 33% | $6,688,710.48 |

| AD8 | Audinate Group Ltd | 7.53 | -5% | -15% | 19% | $586,496,962.80 |

| DTC | Damstra Holdings | 0.1125 | -87% | -68% | 17% | $28,346,602.68 |

| IRE | IRESS Limited | 11.73 | -10% | -8% | 14% | $2,232,756,551.67 |

| MOB | Mobilicom Ltd | 0.043 | -23% | -9% | 13% | $13,843,278.79 |

| CXZ | Connexion Telematics | 0.01 | -38% | -17% | 11% | $8,810,317.80 |

| SPZ | Smart Parking Ltd | 0.18 | -8% | -23% | 9% | $65,222,305.19 |

| CPU | Computershare Ltd | 24.81 | 46% | 26% | 9% | $14,761,182,265.20 |

| VGL | Vista Group Int Ltd | 1.52 | -31% | -25% | 9% | $353,286,020.90 |

| ZMM | Zimi Ltd | 0.13 | -49% | -33% | 8% | $7,186,117.51 |

| DSE | Dropsuite Ltd | 0.19 | 0% | -12% | 6% | $122,736,256.56 |

| TZL | TZ Limited | 0.115 | 17% | -8% | 5% | $25,611,433.11 |

| SKO | Serko | 3.4 | -50% | -46% | 4% | $414,226,791.60 |

| HSN | Hansen Technologies | 5.225 | -16% | -1% | 3% | $1,068,290,500.20 |

| NXT | Nextdc Limited | 11.21 | -5% | -12% | 3% | $5,237,826,461.21 |

| AVA | AVA Risk Group Ltd | 0.185 | -13% | -19% | 3% | $43,733,373.30 |

| TNE | Technology One | 10.715 | 18% | -16% | 3% | $3,514,986,419.92 |

| CF1 | Complii Fintech Ltd | 0.077 | 31% | 22% | 3% | $27,857,276.32 |

| RDY | Readytech Holdings | 3.06 | 24% | -20% | 2% | $329,491,913.52 |

| RKN | Reckon Limited | 1.235 | 57% | 31% | 2% | $137,653,220.88 |

| NTO | Nitro Software Ltd | 1.3225 | -59% | -45% | 2% | $331,626,142.72 |

| APVS | APPLIED VISUAL SCI INC | 0 | -100% | 0% | 0% | $107.03 |

| AR9 | Archtis Limited | 0.15 | -38% | -19% | 0% | $39,570,481.05 |

| BIQ | Buildingiq Inc | 0.016 | 0% | 0% | 0% | $16,889,284.51 |

| BTH | Bigtincan Hldgs Ltd | 0.505 | -54% | -49% | 0% | $298,269,083.16 |

| DXN | DXN Limited | 0.006 | -40% | -33% | 0% | $8,827,889.02 |

| NOR | Norwood Systems Ltd. | 0.013 | -13% | -19% | 0% | $4,420,620.98 |

| SE1 | Sensera Ltd | 0.015 | -67% | 0% | 0% | $6,209,946.65 |

| SYT | Syntonic Limited | 0.001 | 0% | 0% | 0% | $5,735,609.39 |

| UUV | UUV Aquabotix Ltd | 0.002 | 0% | 0% | 0% | $4,836,124.62 |

| VIG | Victor Group Hldgs | 0.03 | 0% | 0% | 0% | $17,166,800.16 |

| WOO | Wooboard Tech Ltd | 0.001 | -67% | -50% | 0% | $3,822,162.74 |

| EVS | Envirosuite Ltd | 0.1625 | 81% | -23% | -2% | $207,068,819.10 |

| IFM | Infomedia Ltd | 1.68 | 14% | 14% | -2% | $642,553,603.11 |

| CWL | Consol Financial Hld | 0.037 | -3% | -3% | -3% | $4,655,628.53 |

| RUL | Rpmglobal Hldgs Ltd | 1.635 | -7% | -26% | -3% | $390,745,252.80 |

| CPT | Cipherpoint Limited | 0.0175 | -45% | -40% | -3% | $6,202,102.60 |

| DTZ | Dotz Nano Ltd | 0.305 | -12% | -27% | -3% | $133,399,300.20 |

| AKP | Audio Pixels Ltd | 17.52 | -32% | -20% | -3% | $502,800,575.76 |

| 3DP | Pointerra Limited | 0.23 | -52% | -42% | -4% | $159,284,457.94 |

| SMP | Smartpay Holdings | 0.57 | -30% | -17% | -4% | $145,353,827.43 |

| ALU | Altium Limited | 27.15 | -25% | -38% | -5% | $3,761,330,149.92 |

| DTL | Data#3 Limited | 4.665 | -15% | -21% | -5% | $742,419,579.85 |

| DDR | Dicker Data Limited | 11.41 | 6% | -23% | -5% | $2,034,571,739.76 |

| DUG | DUG Tech | 0.455 | -66% | -20% | -5% | $55,517,991.42 |

| JCS | Jcurve Solutions | 0.06 | 3% | 2% | -6% | $19,700,606.34 |

| IKE | Ikegps Group Ltd | 0.625 | -43% | -19% | -7% | $99,664,807.50 |

| EOL | Energy One Limited | 5.1 | -22% | -18% | -7% | $140,428,867.20 |

| NVU | Nanoveu Limited | 0.013 | -72% | -63% | -7% | $3,338,339.84 |

| BLG | Bluglass Limited | 0.025 | -16% | -23% | -7% | $33,166,812.28 |

| ELS | Elsight Ltd | 0.395 | -1% | 10% | -8% | $59,349,901.03 |

| BVS | Bravura Solution Ltd | 1.4525 | -59% | -41% | -9% | $375,014,543.02 |

| ASB | Austal Limited | 1.835 | -11% | -5% | -9% | $664,009,712.59 |

| WTC | Wisetech Global Ltd | 37.89 | 20% | -36% | -9% | $12,747,080,697.12 |

| ID8 | Identitii Limited | 0.05 | -43% | -52% | -9% | $9,438,066.38 |

| FCT | Firstwave Cloud Tech | 0.048 | -31% | -33% | -9% | $78,130,634.29 |

| GTI | Gratifii | 0.019 | -32% | -37% | -10% | $16,493,656.88 |

| OCL | Objective Corp | 13.73 | -9% | -30% | -10% | $1,357,637,929.76 |

| CAG | Caperangeltd | 0.215 | 16% | 0% | -10% | $20,405,284.72 |

| NEA | Nearmap Ltd | 1.065 | -41% | -30% | -11% | $573,930,838.10 |

| ADA | Adacel Technologies | 0.85 | -9% | -32% | -11% | $68,105,813.54 |

| WBT | Weebit Nano Ltd | 2.26 | 31% | -20% | -11% | $370,453,455.95 |

| PRO | Prophecy Internation | 0.8 | 43% | -38% | -11% | $58,872,747.20 |

| XRO | Xero Ltd | 77.4 | -43% | -45% | -12% | $12,350,308,666.00 |

| EML | EML Payments Ltd | 1.2975 | -64% | -59% | -12% | $517,243,932.36 |

| XTE | Xtek Limited | 0.365 | -11% | 62% | -12% | $38,235,692.72 |

| APX | Appen Limited | 5.75 | -59% | -47% | -12% | $740,678,136.00 |

| PPH | Pushpay Holdings Ltd | 1.155 | -30% | -7% | -12% | $1,306,304,935.59 |

| GTK | Gentrack Group Ltd | 1.325 | -31% | -33% | -12% | $132,633,284.52 |

| CDA | Codan Limited | 6.9 | -61% | -27% | -12% | $1,293,320,135.25 |

| CDA | Codan Limited | 6.9 | -61% | -27% | -12% | $1,293,320,135.25 |

| LVE | Love Group Global | 0.07 | -28% | -48% | -13% | $2,837,391.83 |

| K2F | K2Fly Ltd | 0.17 | -45% | -38% | -13% | $29,442,215.85 |

| CLT | Cellnet Group | 0.026 | -53% | -68% | -13% | $6,089,865.85 |

| KYK | Kyckr Limited | 0.049 | 14% | -18% | -14% | $26,342,392.60 |

| CT1 | Constellation Tech | 0.006 | -63% | -14% | -14% | $8,091,602.04 |

| SPA | Spacetalk Ltd | 0.058 | -63% | -66% | -15% | $13,190,075.69 |

| IOD | Iodm Limited | 0.23 | 5% | -33% | -15% | $139,627,803.12 |

| TNT | Tesserent Limited | 0.115 | -53% | -32% | -15% | $150,982,011.12 |

| SBW | Shekel Brainweigh | 0.11 | 10% | -41% | -15% | $16,558,250.00 |

| AMO | Ambertech Limited | 0.27 | 20% | -19% | -16% | $26,038,549.32 |

| LNK | Link Admin Hldg | 3.79 | -24% | -31% | -16% | $1,964,742,052.23 |

| DRO | Droneshield Limited | 0.185 | 16% | 3% | -16% | $80,020,267.23 |

| EIQ | Echoiq Ltd | 0.105 | 0% | -32% | -16% | $42,402,434.87 |

| AND | Ansarada Group Ltd | 1.5 | 33% | -26% | -17% | $134,003,352.00 |

| BCT | Bluechiip Limited | 0.025 | -34% | -49% | -17% | $14,964,094.90 |

| LNU | Linius Tech Limited | 0.005 | -74% | -77% | -17% | $9,797,581.56 |

| VR1 | Vection Technologies | 0.055 | -4% | -61% | -17% | $65,485,533.35 |

| LME | Limeade Inc. | 0.26 | -65% | -46% | -17% | $64,645,312.65 |

| SNS | Sensen Networks Ltd | 0.07 | -53% | -52% | -18% | $46,231,135.96 |

| SOR | Strategic Elements | 0.14 | -36% | -47% | -18% | $58,631,983.65 |

| QHL | Quickstep Holdings | 0.385 | -25% | -11% | -18% | $27,973,223.46 |

| VOR | Vortiv Ltd | 0.018 | -52% | -36% | -18% | $9,598,203.46 |

| SP3 | Specturltd | 0.04 | -43% | -56% | -18% | $4,252,211.20 |

| AHI | Adv Human Imag Ltd | 0.13 | -89% | -85% | -19% | $18,342,432.02 |

| XF1 | Xref Limited | 0.38 | 25% | -41% | -19% | $70,412,589.82 |

| AO1 | Assetowl Limited | 0.002 | -63% | -44% | -20% | $2,358,194.64 |

| AXE | Archer Materials | 0.575 | -37% | -49% | -20% | $147,837,988.17 |

| FZO | Family Zone Cyber | 0.2875 | -52% | -50% | -20% | $254,796,872.14 |

| EOS | Electro Optic Sys. | 1.54 | -65% | -35% | -20% | $232,407,912.66 |

| SOV | Sovereign Cloud Hldg | 0.23 | -61% | -69% | -21% | $30,656,905.25 |

| WSP | Whispir Limited | 0.78 | -68% | -59% | -21% | $97,718,663.90 |

| DLT | Delta Drone Intl Ltd | 0.011 | -50% | -59% | -21% | $3,298,749.30 |

| BRN | Brainchip Ltd | 0.845 | 61% | 28% | -22% | $1,508,638,686.72 |

| OEC | Orbital Corp Limited | 0.225 | -73% | -41% | -22% | $20,474,256.15 |

| CCR | Credit Clear | 0.36 | -31% | -13% | -23% | $105,651,367.18 |

| MP1 | Megaport Limited | 5.51 | -69% | -70% | -23% | $916,104,292.80 |

| CAT | Catapult Grp Int Ltd | 0.7575 | -63% | -51% | -23% | $175,103,196.82 |

| PPS | Praemium Limited | 0.49 | -55% | -66% | -23% | $253,947,521.00 |

| KSS | Kleos | 0.4 | -57% | -46% | -23% | $72,302,979.78 |

| FFT | Future First Tech | 0.026 | -58% | -21% | -24% | $19,224,391.05 |

| SEN | Senetas Corporation | 0.026 | -46% | -46% | -24% | $31,558,686.30 |

| HTG | Harvest Tech Grp Ltd | 0.08 | -74% | -63% | -24% | $50,647,682.70 |

| 360 | Life360 Inc. | 2.84 | -52% | -70% | -24% | $555,125,690.34 |

| NXL | Nuix Limited | 0.755 | -69% | -66% | -25% | $252,265,261.23 |

| OOK | Ookami Limited | 0.135 | -92% | -21% | -25% | $5,460,300.05 |

| YOJ | Yojee Limited | 0.053 | -70% | -68% | -25% | $62,087,934.54 |

| BCC | Beam Communications | 0.205 | -15% | -50% | -25% | $17,716,493.81 |

| 4DS | 4Ds Memory Limited | 0.074 | -49% | 14% | -26% | $106,761,802.27 |

| WHK | Whitehawk Limited | 0.072 | -52% | -40% | -27% | $17,307,080.92 |

| PX1 | Plexure Group | 0.135 | -79% | -71% | -27% | $47,733,621.17 |

| SIS | Simble Solutions | 0.008 | -72% | -60% | -27% | $3,418,662.42 |

| LVT | Livetiles Limited | 0.045 | -71% | -48% | -27% | $41,535,958.77 |

| FCL | Fineos Corp Hold PLC | 1.29 | -64% | -71% | -28% | $450,332,549.67 |

| MX1 | Micro-X Limited | 0.125 | -61% | -52% | -29% | $59,989,054.58 |

| ELO | Elmo Software | 2.245 | -50% | -55% | -29% | $201,902,397.76 |

| FBR | FBR Ltd | 0.019 | -50% | -55% | -30% | $47,718,513.65 |

| EPX | Ept Global Limited | 0.059 | -71% | -55% | -31% | $11,094,789.98 |

| RVS | Revasum | 0.28 | 0% | -55% | -32% | $29,656,663.12 |

| JAN | Janison Edu Group | 0.45 | -49% | -66% | -32% | $102,486,019.58 |

| PPK | PPK Group Limited | 2.06 | -86% | -78% | -32% | $196,436,444.60 |

| IRI | Integrated Research | 0.375 | -81% | -69% | -34% | $67,270,730.28 |

| PTG | Proptech Group | 0.225 | -73% | -56% | -34% | $28,147,167.72 |

| XRG | Xreality Group Ltd | 0.03 | 76% | -42% | -35% | $13,058,612.17 |

| DUB | Dubber Corp Ltd | 0.625 | -80% | -77% | -36% | $187,526,122.26 |

| TYM | Tymlez Group | 0.019 | 58% | -42% | -37% | $19,787,303.20 |

| AJX | Alexium Int Group | 0.02 | -57% | -72% | -38% | $12,905,131.80 |

| PVS | Pivotal Systems | 0.195 | -87% | -77% | -38% | $31,088,606.25 |

| NVX | Novonix Limited | 2.3 | 3% | -73% | -38% | $1,151,704,744.53 |

| DTI | DTI Group Ltd | 0.012 | -38% | -60% | -40% | $5,382,616.97 |

| NET | Netlinkz Limited | 0.03 | 36% | 88% | -40% | $101,243,200.89 |

| IXU | Ixup Limited | 0.04 | -78% | -70% | -41% | $34,278,889.18 |

| ERD | Eroad Limited | 1.275 | -77% | -74% | -46% | $147,284,082.96 |

| ICE | Icetana Limited | 0.017 | -80% | -79% | -50% | $3,245,011.77 |

| IS3 | I Synergy Group Ltd | 0.031 | -33% | -31% | -60% | $8,322,304.21 |

Who are the 10 biggest losers?

The $8.32m market cap affiliate marketing solutions player was the biggest loser for June, down 60% for the month.

The company basically provides advertisers with performance-based marketing solutions and access to a variety of affiliate programs to help them harness the value of consumer data.

In April, they announced a partnership with the University of Western Australia to develop two new technologies – a Universal Digital Asset Payment Infrastructure, and a Social Media Sentiment Analytics and Prediction Platform.

IS3 is also planning to expand its VTRAK marketing platform, integrating it with the Rewalty Loyalty platform to create an integrated ecosystem for merchants, customers and affiliates that combines ordering, loyalty and affiliate programs.

This means businesses will be able to host on the IS3 Marketplace and offer products and services, as well as customised rewards for customers and affiliates for their contribution to the network.

Trading down 50% for the month was AI surveillance analytics players Icetana.

The company has customers including shopping centres, prisons, and telecommunications operators and says its AI can detect security issues before they happen – you know, like prison breaks and whatnot.

In the March quarter the $3.24m market cap company said that annualised recurring revenue (ARR) increased 72% YoY to $1.4m, with its largest customer MAF Propert in Dubai extending its software licence.

Quarterly revenue was at $545K, up 45$ YoY.

“The quarter has focused on the completion of our next generation product release which is cloud-capable and built on a contemporary technology stack allowing far greater flexibility in the future,” CEO Matt Macfarlane said.

“Our first customers on this product will be added during the June Quarter.”

The next gen product will provide secure and stable CCTV streaming to any AWS or Azure cloud-hosted infrastructure.

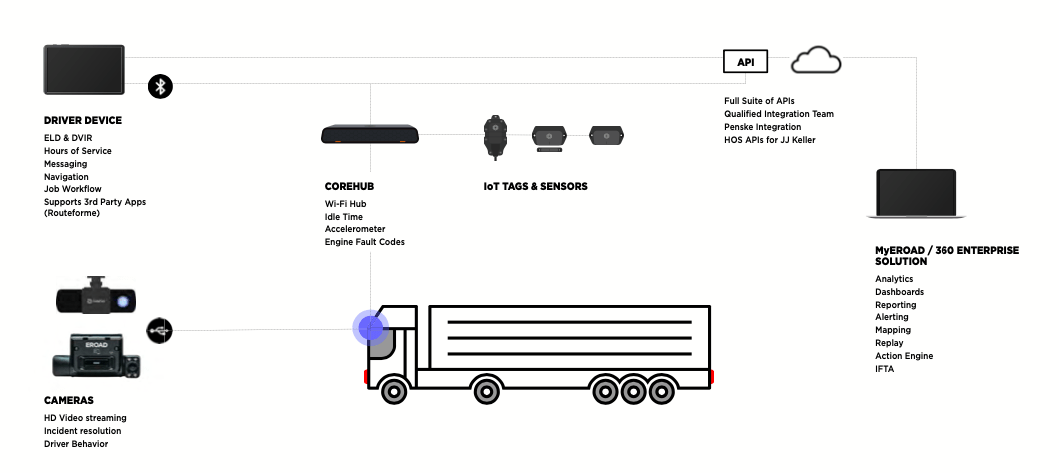

Trading down 46% for June was fleet management tech company ERD, which has a swathe of products covering paperless inspections to dashcams, fleet maps, driver identification and even idling reports to reduce fuel and maintenance costs.

The company delivered revenue of $114.8m in FY22, and anticipates FY23 revenue to come in between $150 – $170m, and EBIT to between -$5m and breakeven.

ERD also expects revenue to increase to at least $250m by FY25.

Interestingly, earlier this month Bell Direct market analyst Sophia Mavridis flagged the company as her top pick in the tech sector.

Mavridis said the company has a strong track record of average revenue per user (ARPU), as well as revenue growth.

“Upcoming product launches are significant opportunities to expand ARPU. EROAD has extremely attractive unit economics and internal rate of return of new contracted units.

“The company also has material growth opportunities in Australia and North America and are successful in a large and growing addressable market.”

Bell Potter view EROAD to have considerable growth opportunity and has therefore retained their Buy recommendation, however, have reduced their price target to $3.40 following its earnings coming in lower than its expectation.

The company has a market cap of $147.28m.

The $34.27m market cap data analytics player was trading down 41% this month.

In April the company completed the proof of concept for a US online sports betting initiative with GeoComply Solutions and Conscious Gaming called ‘PlayPause’ using IXUP’s encryption-based data collaboration technology.

Essentially, the product can securely identify users that are ineligible to place sporting bets.

It’s directed at solving emerging probity-related industry challenges with respect to responsible gaming and sports integrity, arising from the rapid growth and legalisation of online sports betting on a state-by-state basis across the USA.

“Now that we’ve completed our necessary proof of concept testing, we will be accelerating our commercialisation activities for a US market launch as soon as possible and we are presently finalising our product pricing and associated business model,” CEO Marcus Gracey said.

“We also anticipate that the important sporting relationships currently being developed with major USA based sporting leagues as part of this project, may also provide additional opportunities for IXUP’s dataPOWA sports sponsorship business in due course.”

Down 40% for June was Netlinkz, whose virtual secure network (VSN) Network-as-a-Service (NaaS) solution allows for secure data transmission.

If you’re wondering what NaaS actually means, think of it like a company renting networking services from cloud providers so they don’t have to build or maintain their own networking infrastructure.

Anyways, so in the March quarter, the company reported revenue of ~$3.9m despite the impact of the Chinese New Year and the Winter Olympics – with China being Netlinkz’s primary growth market.

The plan now is to prepare for Global NaaS for VSN rollout, with the negotiation for the first support centre in the Middle East and North Africa (MENA) region underway, and pricing for subscription-based model finalised.

Cash at the end of the quarter was $5.3 million, and in May Netlinkz executed a $10m loan facility thanks to a company owned by non-executive director Grant Booker.

“This facility provides Netlinkz Limited with extremely competitive financing as it seeks to take advantage of opportunities arising to accelerate its growth, worldwide,” chairman Steve Gibbs said.

The company has a market cap of $101.24m.

IS3, ICE, ERD, IXU and NET Share prices today:

Also down 40% is DTI Group, who develop surveillance, video analytics (CCTV) and passenger information systems for transit agencies (buses and trains) vehicle operators, vehicle manufacturers, and law enforcement agencies, with customers including Alstom Transport India, Metro Trains Melbourne, Brisbane City Council and Siemens Mobility.

DTI says there’s an opportunity pipeline of over $250 million relating to work that is expected to be awarded over the next five years, including approximately $34 million expected to be decided by EOFY.

But it’s been a bit of a bumpy road (pun intended) for the company while people avoided public transport over the pandemic – which led to delays in awarding contracts in H1 FY22.

Added to this, in its March quarterly the company said the global shortage of semiconductors and electronic components continues to impact the delivery times for some hardware products – but expects these constraints to ease towards the end of 2022.

The company has a market cap of $5.38m.

$1.15b market cap tech company Novonix was down 38% for June.

It’s a company with its hands in many pies, including lithium-ion battery making, PUREgraphite manufacturing and battery tech speed R&D.

Earlier this month, it announced with Emera Inc (TSX:EMA) subsidiary Emera Technologies Limited the delivery of a microgrid battery prototype for its residential pilot program – BlockEnergy – in Florida which will connect homes in a shared energy network, enabling rooftop solar power to be stored and dispersed through smart distributed controls.

This new battery will be applied in the full commercial system targeted for availability in 2023, with testing of the microgrid battery prototype anticipated later this year.

During the March quarter, Novonix signed a deal with Phillips 66 to produce anode material for lithium-ion batteries in North America, along with an agreement to supply graphite anode material to KORE Power’s US operations.

Also down 38% for June was PVS, who make gas flow monitoring and control technology used while making semiconductors – which require precise flows of gas to shape the underlying wafer on which the circuits are built.

They’re one of the companies benefiting from semiconductor demand, with a backlog (i.e. confirmed orders not yet shipped) at 31 March 2022 was US$5.9 million versus US$3.9 million in Q4 2021.

Though the $31.08m market cap company did see an increase in cash payments for product manufacturing which it says “reflect the increased investment into inventory to meet expected product demand in future periods”.

PVS says global fab equipment spending is expected to hit anew high of US$107 billion in 2022, and that over 83% of equipment spending in 2022 will stem from capacity increases at 150 fabs and production lines, with the foundry and memory sectors representing the bulk of the capacity increase.

ALEXIUM INTERNATIONAL (ASX:AJX)

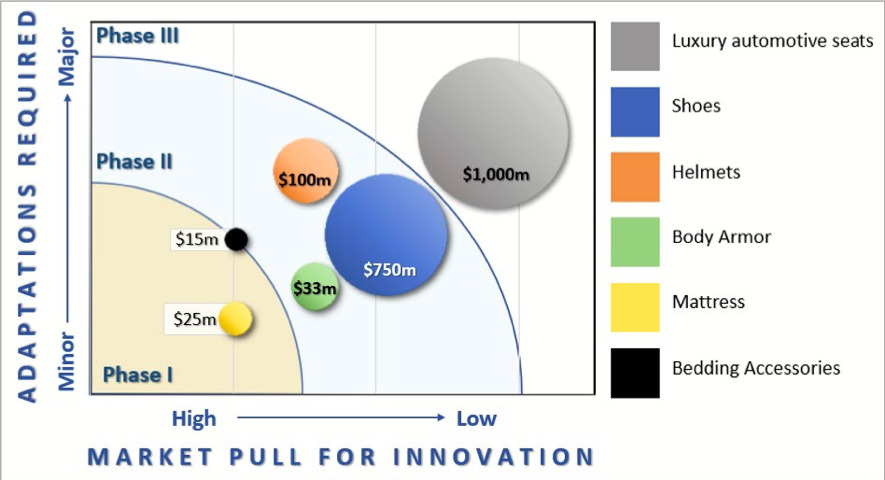

This flame retardant tech company was down 38% for June, and while they’ve been historically focused on the bedding market, the plan is to branch out into the body armour, helmet and shoe markets. More on the shoes in a minute.

Alexium said in its March quarterly that in H2 FY22, global macroeconomic conditions have suppressed economic growth expectations which has been observed across the US bedding/mattress market, but the company has further increased its market share “which will support a significant rebound in bedding revenue once the economy recovers.”

Luckily, body armour demand is “largely insulated” from general consumer spending, and in the Q3 customers completed testing and approved Eclipsys for incorporation in their body armour products.

“With an additional 30 prospective customers evaluating Eclipsys for body armour, we believe that this is a significant global commercial opportunity for Alexium in the current economic environment,” the company said.

“Leveraging our progress with body armour and the endorsement of our technology by law enforcement, first responders and military, we will be progressing the application of Eclipsys to adjacent markets, including helmets, footwear, and clothing.

“Alexium will continue to update shareholders as material developments occur but does not expect commercialisation to have yet been achieved by the end of 1H FY23.”

The company has a market cap of $12.90m.

Down 37% for June was TYMLEZ, which essentially provides data for companies to monitor their progress towards and compliance around sustainability targets underpinned by blockchain technology.

In March the $19.78m market cap company announced a strategic partnership with the HBAR Foundation Sustainable Impact Fund, plus a US$1 million (approx. $1.4 million) grant.

The companies have integrated the TYMLEZ Platform and the open-source Guardian on Hedera, which leverages TYMLEZ’s ability to offer verified, encrypted carbon relevant data to develop the secure, trusted and scalable, carbon reporting solutions for ESG compliance, Guarantee of Origin (GO), and Voluntary Carbon Market (VCM) ecosystems.

There’s also a pilot underway with the Queensland Government, where the platform will use Behind-The-Meter (BTM) energy monitoring devices to capture site-wide energy usage.

The pilot also allows tracking of actual carbon footprints, so strategies can be implemented to reduce their output or to generate offsets.

DTI, NVX, PVS, AJX and TYM Share prices today:

At Stockhead we tell it like it is. While iSYNERGY is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.