Ready Player One: Which ASX gamer is actually making money

Pic: nespix / iStock / Getty Images Plus via Getty Images

Online gaming is a fast-growing market attracting more and more investors — but it’s early days for ASX gamer stocks — with only one making money at the moment.

Only mobile gamer Animoca Brands (ASX:AB1) has reported significant customer receipts this past quarter. And though the loot boxes are piling up, its share price is down 16 per cent this quarter.

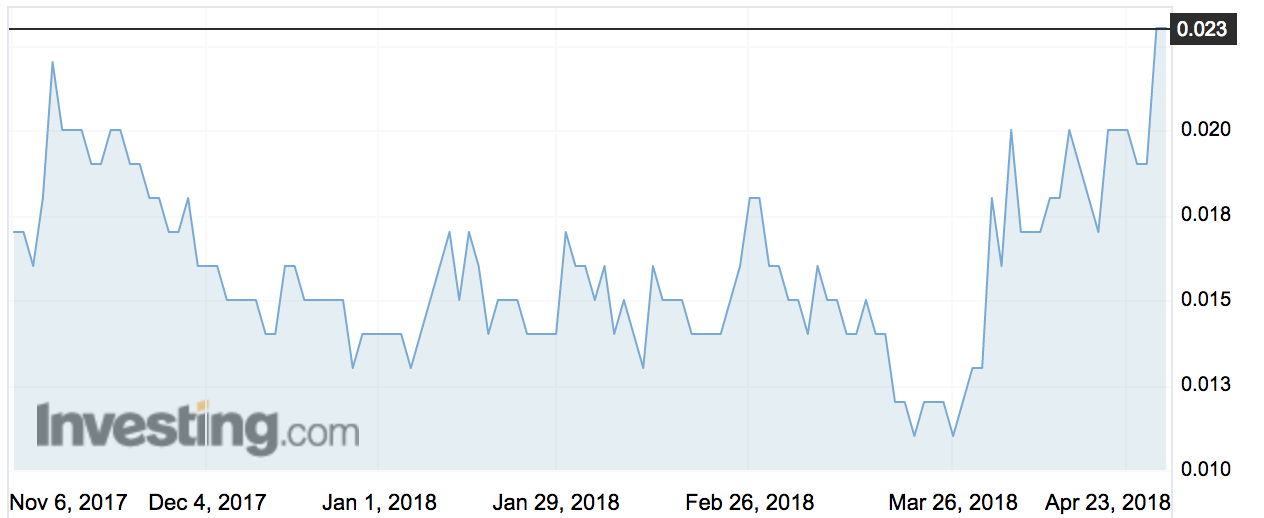

eSports Mogul (ASX:ESH) is signing up gamers — it now has 300,000 — but it’s still trying to work out how to monetise. Its shares are up 38 per cent this quarter however.

HT&E (ASX:HT1) — the former APN News & Media which has a nascent eSports gaming unit called Gfinity — is also seeing its shares rise though gaming revenue is yet to flow.

eSports Mogul and HT&E hope competitive video gaming will evolve into a lucrative spectator sport.

“eSports is on track to be a $US1.5 billion industry by 2020 as it emulates the business models of major league sports, complete with sponsorships, advertising, media rights, ticket sales and merchandise,” Morgan Stanley said in a January research note.

Other game publishers work towards a “software-as-a-service” businesss model — away from single sales to recurring-revenue models.

They’re building on subscriptions, in-game purchases and franchises like Animoca’s Crazy Defense Heroes.

| ASX Code | Company | Sales Mar quarter | Sales Dec quarter | Three-month price change | Price Apr 30 | Market Cap |

|---|---|---|---|---|---|---|

| HT1 | HT&E (Gfinity gaming division) | gaming not broken out | gaming not broken out | 0.392330383481 | 2.36 | 713.6M |

| KNM | KNEOMEDIA | $94,000 | $8000 | -0.425 | 0.069 | 38.5M |

| AB1 | ANIMOCA BRANDS | $3.4m | $934,000 | -0.157142857143 | 0.059 | 31.7M |

| ESH | ESPORTS MOGUL | $1000 | 0 | 0.375 | 0.022 | 21.2M |

| ICI | ICANDY INTERACTIVE | $298,000 | $170,000 | -0.64375 | 0.057 | 18.0M |

| EM1 | EMERGE GAMING | 0 | 0 | -0.181818181818 | 0.018 | 11.2M |

Animoca money maker

Animoca looks like it’s throwing off cash everywhere.

But it has slashed its headcount in Hong Kong by 40, bringing staff costs down to just under $1 million.

This quarter it did make $3.4 million in receipts from games like CryptoKitties in China — the blockchain phenomena that began taking over the world earlier this year — and Crazy Defense Heroes.

The latter — a tower defence and card-collecting mobile game — was downloaded 260,000 times in its first week, generating $202,000.

Gaming the news

eSports’ latest quarterly cashflow statement and its accompanying activities report make very different reading.

eSports reported its online gaming platform Mogul Arena had hit an all-time high of 300,000 users. Monthly competitions were being launched in Asia and one of the biggest e-games in the world — League of Legends — was now live on the platform.

But the March cashflow statement shows the gamer banked only $7000 in customer receipts for the quarter. While it has $1.4 million to play with, eSports is planning to spend half that this quarter as it further invests in the market.

While eSports Mogul has a big audience, it’s still working on monetising those 300,000 users.

Right now users compete for free to win a $50,000 prize pool playing games such as first-person shooter CS:GO and real-time strategy Dota 2.

The company says it’s been focusing on finding and keeping users over the last quarter while it works on monetisation strategies — and an expansion into Latin America by July.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

The sale of this month of German-based esports company Challengeme Esports netted $280,000 up front which it says will keep everything ticking over until that strategy is finalised.

The deal also included a $45,000 payment deferred for two years and $140,000 of shares in US-based Unikrn Inc.

Hitting the major league in eSports

Emerge Gaming (ASX:EM1) raised $5 million to buy privately held eSports play Gaming Battle Ground.

There’s not much going on in its accounts yet — a cash burn of $22,000 and a pre-raise bank balance of $29,000 was all that could be found in there.

But they say the new Arcade X subscription platform has already attracted MTN South Africa (and crucially its 31 million subscribers).

They’ve done a profit-sharing agreement with MTN and will be able to market to those users.

HT&E (ASX:HT1) – formerly known as APN News and Media – has plans to launch a national competitive gaming league with founding teams from most major cities.

Gaming the school system

KNeoMedia (ASX:KNM) follows a different model — making educational games targeted towards special education students in the US.

Its flagship game KneoWorld is set in a futuristic world where students take part in numeracy, literacy, science, arts and memory tasks through a gaming setting.

Feedback is sent to teachers to monitor performance and allow for further targeting.

KNeoMedia had a rapid ramp-up from the December quarter’s $8000 in receipts to last quarter’s $94,000.

They have $3 million in cash and reckon they can get their cash burn right down to $450,000 this quarter, as they eye off extra cash and partnerships in the US.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.