Crowd goes wild: Schrole soars 11% on positive December quarter results

Pic: Getty Images

Investors have reacted favourably to Schrole Group’s latest quarterly report with the price jumping 11% intra-day yesterday on positive key metrics, strong cash receipts growth, positive operating cashflow and a strong outlook

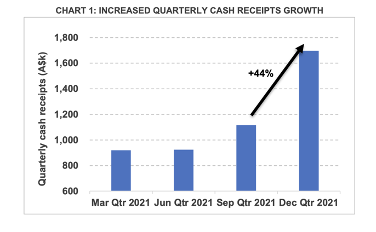

Global SaaS and ed-tech company, Schrole Group (ASX:SCL) has reported its cash receipts have blossomed, up an impressive 44% in the December quarter, as Schrole’s growth investments in an expanded sales and account management team and an expanded Schrole HR SaaS suite are now gaining traction.

The momentum is on as cash receipts 44% to ~$1.7 million for the December quarter 2021 compared with the September quarter and were up 5% on the previous corresponding period (pcp) of December 2020.

The increase on pcp is significant because from July 1, 2021, Schrole only reports 50% of the cash receipts from customer renewals, as opposed to 100% in 2020. This is due to the wind-down of its now terminated agreement with International Schools Services (ISS).

Positive cashflow

Schrole reported positive cashflow of $277k, its highest positive cashflow quarter since September 2019.

The positive cashflow is a significant improvement on September 2021, which reported operating cash outflow of $729.

Strong balance sheet

Schrole reports a strong balance sheet of ~$5 million for the December quarter, after significant investments were made in Schrole’s HR product suite expansion and increased staffing levels.

Expanded SaaS product suite

The company’s flagship full SaaS product suite called “Schrole HR” (Human Resources), now comprises five Human Resources SaaS offerings, including Schrole Connect and Events, Verify, Engage (to be released Q1 2022), Cover, and Develop.

Demand for Schrole Events continues to grow, with 1700 participants registered and attending its inaugural two-day online recruitment event in late October targeting the Southeast Asian market.

A full pipeline of recruitment events has been scheduled through until April.

Schrole Connect 3.0, the company’s flagship recruitment SaaS module, was also released during the quarter with new functionality and enhanced existing features.

The company is on track to release Engage 1.0, with 51 schools currently in beta testing. Engage is considered a significant product release for Schrole, with its potential to increase customer lifetime value and provide further sales opportunities throughout the year.

Growing customer base

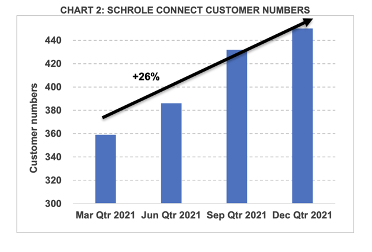

Schrole highlights growing customer numbers as significant for increasing future potential revenue opportunities across its expanded Schrole HR SaaS suite.

Customer numbers for Schrole Connect increased 4% from 432 to 451 in the December quarter and are up 26% since the March 2021 quarter.

Schrole Community numbers have risen by 18.5% year-on-year from ~168k in December 2020 to ~199k in December 2021.

Software margins rose slightly to 37% in Q4, up from 34% in Q3.

Strong outlook

New and upcoming product releases are growing the company’s sales pipeline, while its expanded sales and account management team is achieving traction.

First sales have been achieved in new geographies with expectations of further growth and continued strong renewals. Schrole already has a network of ~190,000 teachers and educationsl organisations within its Schrole Community.

The company’s sales pipeline is growing with several high-profile schools and school groups, now previously customers, undergoing free product trials or in contract negotiations.

The company is benefiting from the global environment and a move to increasingly seeking online in a post COVID-19 world.

Managing director Rob Graham said he remains optimistic for the company’s growth outlook. He said the December quarter results showcase the first results of investment in expanding its SaaS product range and growing the sales and account management team.

“We are also growing our leading indicators of shareholder value such as customer numbers, SaaS product range and software margin, “ Graham said.

“As we increase customer numbers, we are also increasing our potential customer value, with increased opportunities for up-sell across our full Schrole HR SaaS suite.”

He said its sales and account management team have generated sales in Europe and are working through a strong and growing customer pipeline.

“Our team is focusing on quality customer service, upselling and cross-selling to current clients and targeting new geographies and penetrating new strategic target markets.”

This article was developed in collaboration with Schrole, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.