Staff shortages are here to stay, and these 16 HR stocks could be poised to benefit. 16!

Pic: via Getty Images

- Staff shortages are still a thing with 31% of occupations now listed as in shortage

- The Federal Government just established Jobs and Skills Australia and boosted the budget for workplace, skills and training

- HR tech and face-to-face companies are booming off the back of demand for staff

Unless you’ve been hiding under a rock, you’re probably aware there’s a wee bit of a job shortage at the moment.

And if you have been under a rock, well, you should know the situation’s so bad the Aussie Government has just established the Jobs and Skills Australia (JSA) statutory body to deal with it.

Look what you’ve been missing, there under that rock.

The JSA is supposed to provide independent advice on current, emerging and future workforce, skills and training needs – and they’ve got a hefty $12.9m from the Federal budget to get cracking and address labour issues.

Right now, companies across all sectors are scrambling for staff off the back of COVID lockdowns and border closures.

The 2022 Skills Priority List (SPL) released by the National Skills Commission in October 2022 highlights the continued acute shortage of labour, with 286 out of 914 (or 31%) of occupations assessed as “in shortage” (up from 19% in 2021).

Professionals (including IT workers), healthcare workers and trade workers are amongst those roles experiencing the highest demand.

Resources players are feeling the heat, some even advertising for entry level staff at wages over $100K – which is, frankly, insane.

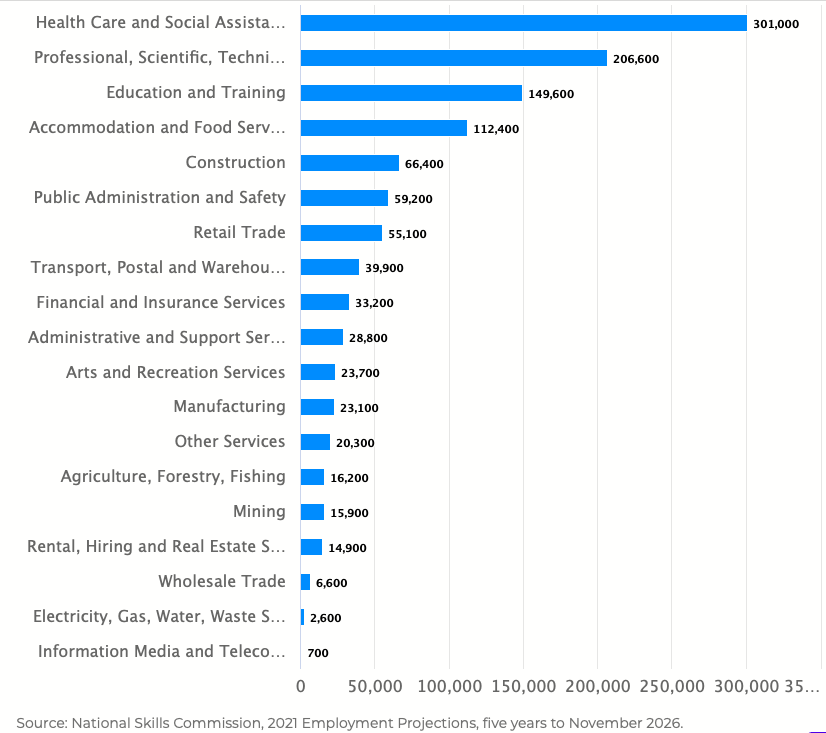

Take a look at the projected employment growth by industry, five years to November 2026.

Last month, the National Skills Commission flagged that an incredible 31% of all Australian occupations are now considered “in demand”.

And with the demand for staff comes an opportunity for human resources (and adjacent) stocks – and there are a few players in the sector who say business is booming.

HR platform Xref (ASX:XF1) is one of them, recently launching a ‘Trust Marketplace’ which it says will help employers rapidly and safely recruit in the global staffing crisis, particularly as talent acquisition becomes increasingly remote and the demand for identity verification and pre-employment checks grow.

The marketplace essentially aggregates a wide range of providers and digital trust products related to employment verification which is delivered to resellers via integrated APIs (application programming interfaces), or accessible by all employers via Xref’s Enterprise Platform.

It provides access to new and innovative trust products such as adverse social media sweeps – handy but also a bit creepy.

It also provides exclusive access to the proprietary qualification data of Australia and New Zealand’s (ANZ) 400,000+ yearly graduates through the new Graduate Verification Service (GVS), which grants access to a proprietary and exclusive centralised repository of tertiary graduate data covering over 20 years of historical records for 47 public universities across ANZ, plus other tertiary providers, such as TAFEs.

The marketplace also enables access to traditional trust products such as ID, employment verifications, rights-to-work, and criminal checks through its real-time identity verification, screening, and compliance platform, Rapid ID.

“Without this tech, qualification checks are typically painstaking, piecemeal, and impracticable,” Xref says.

“It is almost impossible to verify that a candidate is being truthful.

“Using the Trust Marketplace, an employer can rapidly, comprehensively, and reliably vet hundreds of candidates at a time in a cost-effective manner in an instant across multiple categories simultaneously.”

Interestingly, last week Merewether Capital portfolio manager Luke Winchester flagged the company as a potential M&A target “for a larger HR software peer to flesh out their modules if they don’t have adequate reference checking or look to acquire XF1’s blue-chip customer base to potentially cross-sell other services to.”

Over the past 12 months, 1.3 million new users engaged on the platform across 195 countries, and for FY22, the company reported a record year for sales and revenue with a 36% increase in group sales year on year and a 29% increase in group revenue.

XF1 share price today:

Here’s a look at some of the HR Software-as-a-Service stocks:

This company targets teachers and educational organisations, combining recruitment, background checks, onboarding, relief teacher management, and professional development.

Its Verify product provides background screening in the international schools’ sector, Develop provides accredited professional development solutions contextualised to client needs, and Engage provides onboarding software for schools along with contract management.

In the September quarter, Schrole saw a 24% increase in cash receipts to $1.46m and successfully integrated with UK-based Eteach, providing access to two million UK educators and allowing schools to easily advertise roles on Eteach’s job board from the Schrole Connect system through direct API integration.

The company finished the period with a solid cash position of $2.6m cash at bank.

Under its HR services business, the company provides talent recruitment solutions in the form of ApplyDirect and Jobtale and mentoring products under the Art of Mentoring banner.

In the September quarter, AD1 saw strong performance for ApplyDirect with revenue growth of 50% on previous-corresponding-period (pcp) and a contract win with one of the largest GDP contributing industries in Victoria for an initial two-year term.

The Jobtale product also launched, with 79 customers signed up, and was shortlisted as a finalist for the Australian Talent Conference.

Plus, the company picked up Scout Talent Group, talent acquisition software with a proven and resilient ecosystem solving the challenge of talent acquisition for midsized companies, with the transaction expected to be completed in December 2022.

LiveHire’s direct sourcing platform enables clients to attract and engage both permanent employees and contingent workers with its Total Talent and Direct Sourcing solutions.

The company said financial indicators are tracking to plan and enabling investment in North America, with cash receipts of $2.2m for the September quarter, driven by strong new sales from Q4 22.

In the Asia Pacific Region, new sales activity resulted in closing Annualised Recurring Revenue (ARR) for Q1 23 of $5.6m up 2% on Q4 22, and up 31% Year-on-Year (YoY).

LiveHire closed the quarter with a cash balance of $13.9m.

This company is more focused on the employee engagement side of HR because that’s what drives performance and retention.

The company says employee wellbeing is no longer a “nice-to-have” in the workplace — it’s a “must-have”.

Healthy employee wellbeing can lead to higher engagement, better performance, and even increased retention in the long run. Explore our top strategies for improving employee wellbeing https://t.co/DAyI4rJKO2#employeewellbeing #mentalhealth #employeeengagement #hr #hrsoftware

— intelliHR (@intellippl) November 3, 2022

IHR saw the successful Q1 conversion of 20 new mid-market customers, and onboarding of enterprise customer Mitre 10 NZ, resulting in FY23 YTD implementation revenue of $0.15m.

As at 30th September 2022, total contracted ARR was $8.37m from 78,550 contracted subscribed headcount, a 8.7% increase Quarter on Quarter.

The intelliHR platform also recorded Revenue Retention at 116% for the last 12 months, with lost customer revenue (churn) accounting to only 0.6%.

The company says its Parner Channel team gained momentum, with several new ecosystem partners, and new capability expanding integrations.

“Every new ecosystem partner scales our ability to configure our service to the specifics of the customer,” executive chair Matt Donovan said.

“Whether it is connecting intelliHR into the data streams from a customer’s existing tech ecosystem, or helping their HR and IT team upgrade via one of our partners, we empower the way our customer wants to work.

SCL, AD1, LVH and IHR share prices today:

Kinatico (ASX:KYP)

Previously known as CVCheck with the ticker CV1, the company recently changed its name but not its product suite of pre-employment screening and background checks

The company reported revenue of $26.4m for FY22, up 51% YoY, with Q1 revenue of $6.9m up 9% PcP – making for its 9th consecutive positive cashflow quarter.

Q1 FY23 SaaS revenue was $0.7 million, up 23% on pcp.

During the quarter, the company announced a strategic partnership to introduce biometric identity validation, automation, and AI across its operations.

Cash at bank was $11.1m at the end of the period.

The AI recruitment player has officially launched its platform in the September quarter, with the completion of the Shortlistmii module and so far it looks like customer trials have validated the technical capability of the technology to digitise candidate data, match and rank candidates to roles at a level of effectiveness beyond keyword search.

It’s essentially Phase One of HMI’s commercialisation roadmap in the Aussie recruitment industry, which generates revenue of $16.4 billion but has “struggled with innovation and change,” the company says.

MD Andrew Hornby said the AI provides complex candidate-to-job matching and ranking by using accurate semantic matching powered by domain specific knowledge graphs.

“This capability improved on the traditional process of manual candidate database matching that is inefficient and potentially biased,” he said.

Several new master service agreements were signed in the quarter, laying the foundations for continued growth and diversification, particularly into the battery metal resources and agricultural sectors.

This tech recruitment solution had a solid September quarter too, achieving over $750k in cash receipts for the second consecutive quarter.

Q4 FY22 also saw Applyflow achieve an expansion of sales and software as a service (SaaS) customers, up ~20% compared to Q3 FY22 which the company has maintained in Q1 FY23.

Plus, Adecco, a global leader in recruitment, committed to a 12-month SaaS contract with the company.

Applyflow wants to be the platform of choice for white-label job boards and recruitment technology around the globe, and is aiming to build on its blue-chip customer base.

KYP, HMI and AFW share prices today:

Olde fashioned face-to-face recruiters:

GO2 operates in Western Australia, South Australia and Queensland and says it saw another record quarter of cash receipts from customers at $21.63 million, equating to an annualised run rate of $86.5 million.

That’s up from an annualised run rate of $77.5 million in Q1 FY2022 – the first full quarter of revenue incorporating both Hunter Executive (its White Collar division) and Skill Hire, and whilst Skill Hire at the time still had the benefit of significant government contracts.

During the Quarter, the group’s Workforce Development Division started servicing its new contracts for the Federal Government’s Department of Employment and Workforce Relations (DEWR).

And apparently DEWR is already starting to undertake rationalisation among providers as some struggle to perform to the levels outlined in their tender submissions, and GO2 is waiting in the wings to snap up more contracts.

The company said its Advanced Traffic Management contract revenue reached the targeted $22 million per annum run rate towards the end of September – and that the division is expected to continue growing strongly into the busy Christmas/New Year period, with several additional orders already in hand.

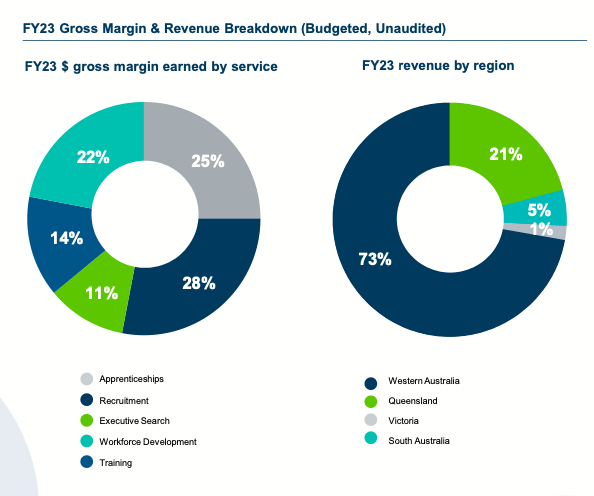

Check out their FY23 revenue split below:

For the September quarter, the company saw revenue of $28,765k decreasing 7% against the comparative quarter in the 2022 financial year (FY22)

Gross profit of $3,425k did increase 2% against the comparative quarter in FY22, which the company put down to the higher gross profit contribution from higher margin permanent placements versus contingent labour;

Overall, Ignite says it’s seeing strong demand for contingent labour resources across all geographic markets and functional verticals.

“The permanent immigration intake is set to increase from 160,000 to 195,000 for the 2023 financial year (FY23), “however with significant backlogs in visa processing, it is expected there will be a significant lag in additional skilled workers joining the labour market,” the company said.

Ignite is confident of opportunities over the medium term for both contingent labour hire and permanent placements with the Federal Budget including a significant projected increase in funding for the National Disability Insurance Scheme (NDIS) – which is expected to grow by +14% a year leading to an annual cost of ~$102bn by 2032.

However, the company says it’s unlikely to translate to a material uplift in the second quarter of FY23.

“Further, the announced $3.6bn cost savings from cutting public service use of external labour, advertising, travel and legal services potentially presents further challenges for the business, although it remains to be seen whether this will more directly impact consulting spend from Big 4 consulting rather than contingent labour hire to fill operating roles,” they said.

“In the Specialist Recruitment division, customer demand for contingent labour is expected to strengthen from current levels during the December 2022 quarter across the company’s government and commercial customers.”

People Infrastructure (ASX:PPE)

This company says that operating conditions continue to be highly positive, given the strength of the employment market and extensive demand from clients.

Not to mention the 2022 Skills Priority List (SPL) released by the National Skills Commission in October 2021 highlights that professionals (including IT workers), healthcare workers and trade workers are amongst those roles experiencing the highest demand – all sectors where PeopleIN has broad reach.

“PeopleIN’s Healthcare & Community vertical is well-placed to address the critical supply shortages within its sector, as delays in visa processing and travel costs improve,” the company said in a recent market update.

“The SPL highlighted 20% of occupations across Community and Personal Services workers are in shortage (8% in 2021).

“PeopleIN’s international recruitment and Pacific Australia Labour Mobility (PALM) scheme capability will enable us to bring onshore more workers into the health, aged care, and disability sectors.”

The Federal Budget boosted the PALM scheme too, with existing aged care pilots increased to a further 500 PALM scheme workers completing their Certificate III in Individual Support (ageing).

PALM participants are set to increase to ~35,000 by June 2023.

The company is also set to benefit from the boost in NDIS funding – which will in turn boost demand for workers in the sector.

PeopleIN has reaffirmed its FY23 earnings guidance with normalised EBITDA of $62m-$66m based on the continuation of current economic conditions.

GO2, IGN and PPE share prices today:

This labour hire and recruiter saw some solid numbers for FY22, with after-tax profit from continuing operations of $11.4 million.

That’s an increase of $2.0 million or 22% on FY21.

And the company spent the year picking up a stake in a range of other recruiters, including 49% in Dardi Munwurro Labour and Traffic Management Pty Limited, a company providing indigenous labour hire in Victoria and 49% in Yalagan Infrastructure Pty Limited, a company supporting indigenous labour hire in New South Wales.

Ashely also acquired a 75% interest in Linc Personnel Pty Limited, a company currently providing labour to the oil and gas sector in Western Australia and the Northern Territory.

This company listed last year and has been going gangbusters since.

In FY22, it reported revenue of $1.33 billion, pro forma EBITDA of $308.0 million and pro forma NPATA of $166.3 million – exceeding Prospectus forecasts by 5% and 7% respectively.

APM works all over the world, and saw numerous contract renewals, awards and extensions across Australia, New Zealand, North America, Singapore, South Korea, Germany and the United Kingdom over the year.

Plus, it’s the largest Workforce Australia provider, nabbing 13% of the new Workforce Australia contracts across 34 employment regions, recruiting 500 additional team members to deliver the contract which commenced 1 July 2022.

And it completed nine strategic acquisitions that “provide critical entry points into the National Disability Insurance Scheme market, allied health sector and other key growth markets,” APM said.

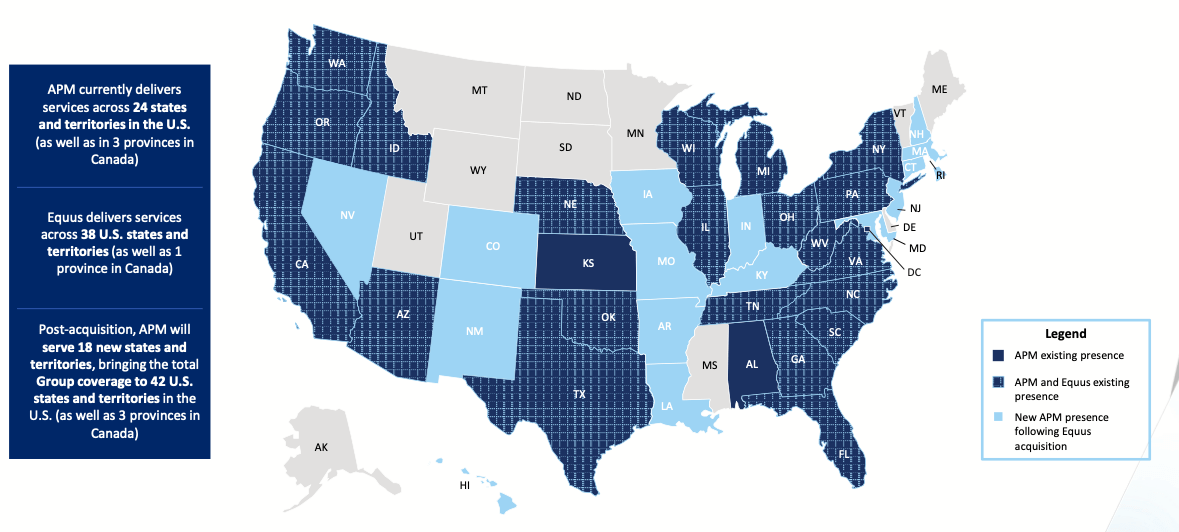

Plus, it recently acquired Equus Workforce Solutions in North America, expanding its service offering from 24 to 42 States and Territories in the US and in Canada.

The company’s core business is the recruitment of ICT professionals and the supply of contracting services to the public and private sectors – and it’s capitalised on strong demand for ICT talent and services as organisations embark on the complex task of building new digital services and integrating them with legacy national systems.

FY22 saw another record result with operating revenue of $63,096,126 (an increase of 49.6%) making it the 8th consecutive year of double-digit revenue growth.

“This result highlights our successful and continuous efforts to capitalise on strong demand for ICT talent and services as evolving technology programs of work continue to be progressed across the country, to meet unprecedented existing and future demand for online connectivity and service delivery,” CEO Elias Hazouri said.

“We are well positioned to capitalise on the consistent demand for ICT talent and services encompassing cloud and cyber security services and products.

“We expect that our clients will continue to seek best of breed quality talent and services to enable their ever-growing secure online services capabilities.”

ASH, APM and HIT share prices today:

Don’t forget these job search providers:

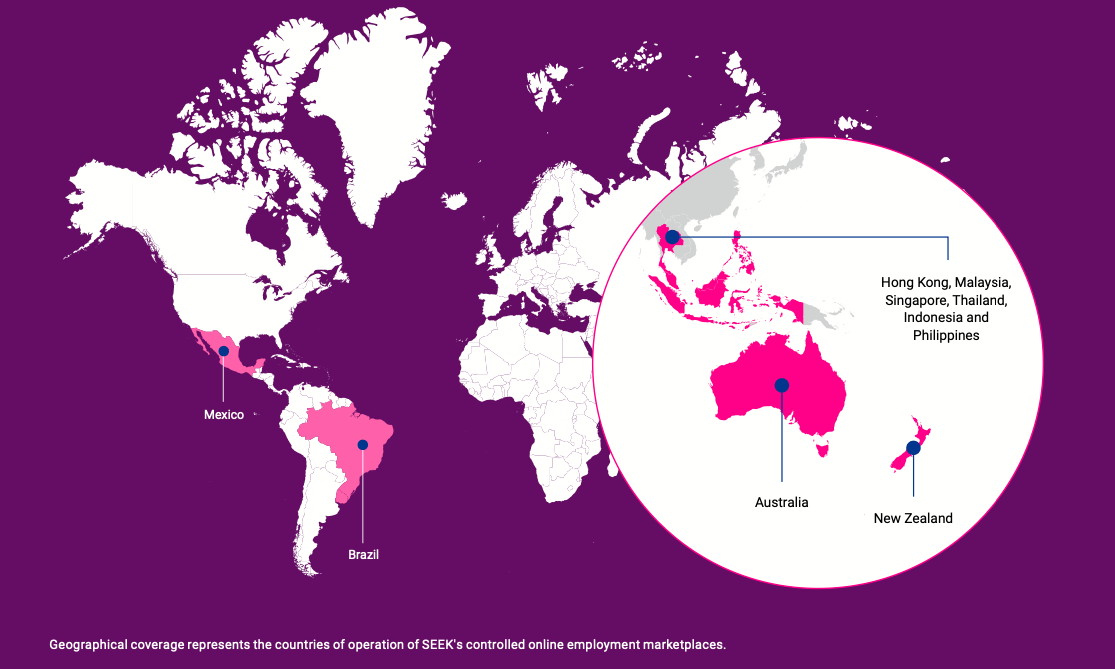

The giant job platform saw FY22 revenue jump 47% to $1,117m, with record job ad volumes in Australia and New Zealand (ANZ) and growth across other key regions as business started to rebuild and grow after the height of the pandemic.

Job ad volumes hit a record high of approximately 325k in March 2022 with corporates and small to medium enterprises (SMEs) leading the activity.

Seek also launched a launch of Talent Search Connect and Company Profiles offering, and integrated the recruiter reputation platform Sourcr.

Under the company’s umbrella is also Jora, an online employment marketplace which has a presence in 36 countries, JobAdder, a talent acquisition suite that simplifies the hiring process for recruiter and corporate talent acquisition teams and Certsy, a platform to securely verify and share work credentials and to complete compliance checks.

This company is kind of like a more relaxed job platform, with a focus on more flexible work options with the goal of “connecting people and businesses who need work done with people who want to work.”

The September quarter saw Airtasker revenue increase 80% on the pcp to $10.5m whilst Gross Marketplace Volume (GMV) grew 82% on pcp to $63.4m.

The company said this was due to a combination of organic performance on the Airtasker marketplaces and the first full quarter contribution from the Oneflare marketplace acquired on 25 May 2022, while the pcp Airtasker marketplaces performance was heavily impacted by COVID lockdowns in Australia.

Interestingly, Airtasker’s marketplaces are at different stages of development around the world.

In Australia it’s at the ‘scaling’ stage, in the UK it’s in the “one to 100” stage during which the goal is to carefully balance supply and demand to drive marketplace activity and grow GMV. In the US, it’s in the “zero to one” stage during which the focus is on creating a steadily increasing flow of job opportunities (posted tasks).

In the UK, the company’s markeplaces saw both demand (posted tasks) and supply (offers made by active taskers) more than doubling on pcp and UK GMV increasing 68% on pcp on an annualised basis whilst revenue increased 133.6% on pcp driven by the introduction of a booking fee which improved unit economics.

And in the US, Q1 posted tasks increasing 4.7x on pcp to 13,000.

“This was a strong result, achieved as we transitioned from an initial focus on four core city-level marketplaces to a focus on the Los Angeles marketplace,” the company said.

At Stockhead we tell it like it is. While Xref is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.