Beyond mining: The small caps taking Australia’s multi-billion dollar battery sector further downstream

Pic: Yuichiro Chino / Moment via Getty Images

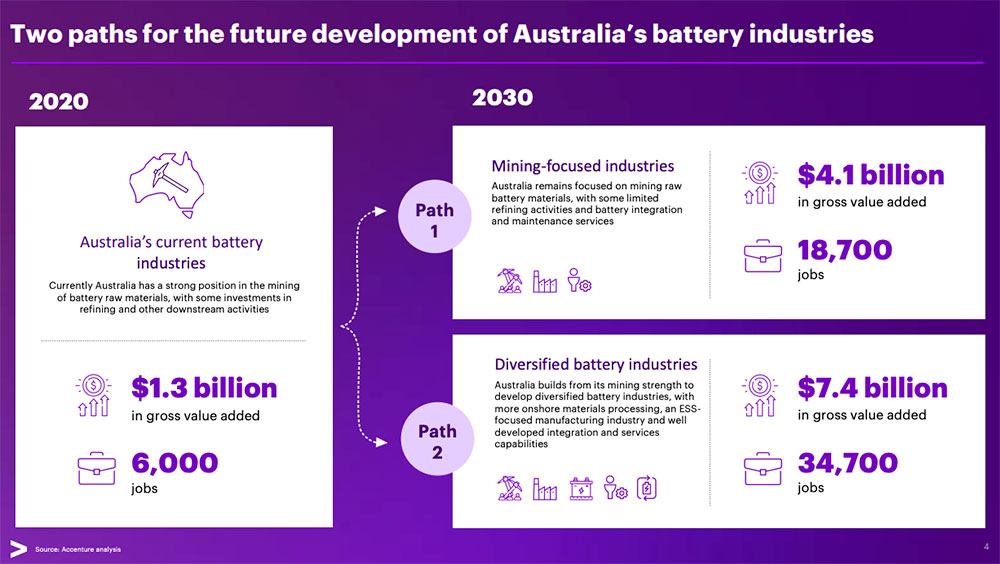

A diversified battery sector could be worth $7.4 billion annually to Australia’s economy and support 34,700 jobs by 2030, according to a new report.

Demand for batteries has grown steadily but is now forecast to go parabolic, increasing 10-fold over the next decade, Accenture says.

Australia’s current battery sector is mostly mining, which contributes an estimated $1.3 billion to our GDP and accounts for 6,000 jobs.

Mining alone will be worth $4.1 billion by 2030 — but the country will be missing out on a lazy ~$3.3 billion a year if we don’t establish downstream sectors, like chemical production, battery manufacturing, and recycling.

“We are already seeing significant investment downstream where value adding opportunities exist, and Australia is on the cusp of reproducing the present generation of battery chemistries from locally sourced materials,” Future Battery Industries CRC chief exec Stedman Ellis says.

“It also has a rapidly maturing domestic market for energy storage systems on grid and off grid.

“This provides prospective opportunities for Australia at every step in the value chain, which could create tens of thousands of new jobs across the country and put billions of dollars into our economy.”

Which small caps are taking Australia’s battery sector downstream?

REFINING TO CHEMICALS

Townsville-based nickel-cobalt company Queensland Pacific (ASX:QPM) is advancing the TECH project towards first production in 2023.

Meanwhile, Australian Mines (ASX:AUZ) and Sunrise Energy Metals (ASX:SRL) need to lock in offtake and financing to move their respective +$1 billion nickel-cobalt chemical projects into development.

QPM, AUZ and SRL share price charts:

ACTIVE MATERIALS

Graphite stock EcoGraf (ASX:EGR) is perfectly primed to take advantage of this avalanche of projected demand with three standalone businesses – mining, downstream processing and recycling.

Renascor Resources (ASX:RNU) says its ‘Siviour’ purified spherical graphite (PSG) project in South Australia will be among the world’s lowest cost producers of an important value-added graphite product — “fundamental to the growth of the EV and renewable energy and battery storage industries”.

EGR and RNU share price charts:

BATTERY MAKING

Magnis Energy Technologies (ASX:MNS) is part of an international consortium called Imperium3, which is looking to develop a lithium-ion battery Gigafactory in Townsville.

It’s one of three large scale Gigafactories Imperium3 has in the works, with its New York location the most advanced.

MNS share price chart:

RECYCLING

Similar to EcoGraf, Lithium Australia (ASX:LIT) wants to make money in three ways — by producing advanced battery cathode powders, selling storage batteries in JV with a Chinese firm, and recycling old batteries through its Envirostream subsidiary.

LIT share price chart

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.