EcoGraf’s Andrew Spinks on why graphite is the battery sector’s biggest supply risk

Pic: Tyler Stableford / Stone via Getty Images

The EV industry is set to drive 700% growth in natural graphite demand by 2025.

In Europe alone, the 24 gigafactories announced so far will be pumping out enough batteries for 9-10 million EVs a year. Every one of those EVs will require about 27kg of purified natural graphite.

EcoGraf (ASX:EGR) is one of only a few Aussie graphite stocks left standing strong after the last graphite boom went bust around 2017.

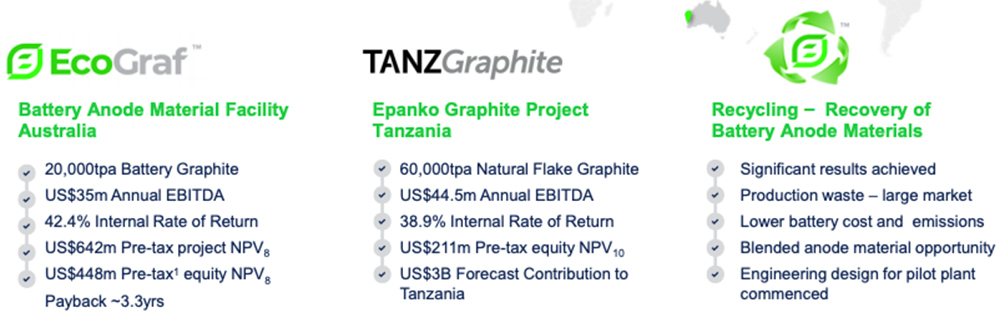

The company kept working hard. Now it’s perfectly primed to take advantage of this avalanche of projected demand with three standalone businesses – mining, processing and recycling.

The staged 5,000tpa to 20,000tpa Purified Spherical Graphite (PSG) processing plant in Perth – designed to be cheaper and ‘greener’ than current processes — will be the first of its kind outside China. PSG is a value-added product used to make the battery anode.

The company is targeting commencement of construction of the fully funded first phase facility by the end of the year. A second 20,000tpa PSG facility is also planned for Europe down the track to meet forecast demand.

We asked EcoGraf managing director Andrew Spinks why investors should look closer at this battery metals pioneer.

What was the graphite sector like when EcoGraf started out in 2014, compared to now?

“You could argue graphite led the battery metals boom, before lithium,” Spinks says.

“It started off like any resource boom; lots of risk capital, excitement around drill rigs, mining licence applications. Stocks were doubling on offtake agreements.

“There were over 150 graphite companies between the ASX and the TSX at the time. It’s thinned out a lot since then.

“It hasn’t been an easy ride in the graphite space — there’s been a few challenging moments — but the demand outlook for graphite is enormous.

“That early risk capital has matured into longer institutional funds wanting to support strategic companies into development. That’s where we sit at the moment.

“Graphite is now the biggest supply risk I see for [the battery sector].

“If you look at the global demand figures for Purified Spherical Graphite (PSG), China produces all of it, about 180,000t.

“It all comes from China. They consume ~130,000t and the rest is exported.

“If the Chinese stopped exporting PSG, the whole [ex-China] lithium ion battery supply chain would stall for another 3-4 years until new supply lines were established.

“Our Kwinana/ Rockingham facility will be the first facility outside China to produce PSG material for the lithium ion battery market, going initially into South Korea and Japan.”

For ASX graphite stocks there has been a tangible shift in focus from mine development towards downstream processing. Why?

“Miners see less than 5% of the total value in the graphite [anode] supply chain,” Spinks says.

“We expect to make about $1.50/kg [margin] on the downstream versus 50c/kg from the ‘Epanko’ mining operation.

“The value opportunity going downstream is quite significant and we want to capture that.”

You say EcoGraf invested years and many millions of dollars on your propriety downstream process. Does that sort of time, expertise and IP create hurdles for other companies looking to jump on the bandwagon now?

“I think the groups that commenced the journey back in ~2013 are really the ones that are going to be successful like us, Talga (ASX:TLG), Syrah Resources (ASX:SYR), for example,” Spinks says.

“The groups that have committed time and capital early will share the market.

“That’s also because product qualification with customers is a really tough, slow process in this market.

“This is a very precise product. Having strict criteria around specification is really important, because it affects the safety of the batteries.

“Any changes in supply arrangements could lead to potential safety issues. It’s not a market where you can just start out tomorrow – you have to put the work in.”

How does your cost profile compare to the Chinese?

“We are cost competitive. Our strategy for the last five years has been to develop a process flow sheet that delivers a cost-effective alternative to China,” Spinks says.

“China’s the biggest market — the only market — and I don’t think people will buy our materials if it costs more than China.

“Our cost competitiveness comes from the removal of the hydrofluoric (hf) acid, which is expensive and very toxic to handle.

“Removing the hf out of our process flow sheet has also given us a competitive advantage where we can locate the facility here in Kwinana, in Germany, the US, anywhere.

“This is a very clean, green ESG-friendly process, which really fits with this new demand we are seeing.”

Milestones you would like EcoGraf to hit in 2021?

“Debt financing the 60,000tpa Epanko flake graphite mine in Tanzania is a big one,” Spinks says.

“The commencement of [anode plant] construction which we are targeting by the end of this year.

“We also have the recycling — we are working on finalising the pilot plant for treating larger quantities of carbon anode materials.

“And strategic partnerships. We are working with some really interesting customers we hope will culminate in collaboration and supply arrangements.”

When you say interesting, do you mean household names?

“Really big customer names, yes. They could change the way we are seen by the market and would give us a lot of credibility.”

To recap — why should investors take a closer look at EcoGraf?

“The EV transition is going to need a huge amount of graphite,” Spinks says.

“The World Bank estimates 53% of raw materials needed in the transition to clean energy is graphite.

“We have two development ready projects: the downstream and the mine, and the additional benefit of the recycling business which will be important.

“They are standalone, which means they don’t rely on each other [to succeed].

“And we are green. It’s easy to say you are green but delivering into that is something we have been focussed on the past five, six years.

“For major institutional groups, ESG is becoming a strong thematic.

“I’ve been in this business for 30 years. And the other week, [for the first time] we had a conference call with a major fund that was just interested in hearing our environmental credentials.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.