AI will make your children better investors than you

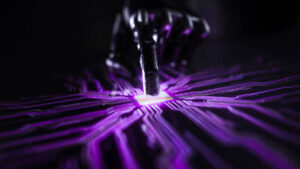

Pic: Getty Images

Wealth Within founder and chief investment analyst Dale Gillham said AI-powered investing tools meant the next generation of investors were “poised to leave traditional investing in the dust”.

“This is the first generation of really tech-savvy kids … your child will out-invest you, and not just by a little,” Mr Gillham said.

“I’m seeing a whole different breed of kids coming out now – 17, 18, 19-year-olds wanting to get ahead because they know they’re not going to be able to get their first home unless they get their shit together earlier.

“AI democratises financial knowledge.”

AI could dig deep into statistical data to predict future trends “so you’re getting into different stocks that haven’t been on the radar of anybody else”, Mr Gillham said.

“I’m seeing AI helping people do portfolio management. They’re more likely to ask that than ask their parents,” he said.

Investment platforms, apps and video games are quickly embracing more AI, and financial experts say while its ability as a research tool already surpasses humans, it lacks the human experience and emotional intelligence that makes a good investor.

Too much trust?

Mr Gillham said recent research had found more than 40 per cent of Gen Z and millennials said they trusted AI to manage investments, “which is about three times what baby boomers do”.

However, this trust could be dangerous. A US report published by MIT in June found that people who relied too much on AI advice became less critical of their own decision-making, Mr Gillham said.

He said US investment apps such as RobinHood and Greenlight were gamifying investment for children and young adults, and more AI was being injected into them.

Rising Tide senior financial planner Rebecca Pritchard said many children and young adults were already becoming better financially educated than their parents.

“This current generation and the new generation coming through have adopted ETFs and investing in general in a way that hasn’t been seen before,” Ms Pritchard said.

“Kids are on track or are already better investors than their grandparents or parents.

“That ETF style, regular savings, dollar-cost averaging, direct debit style of investing is predicated on not thinking, and I don’t think AI is going to directly change that behaviour.”

Ms Pritchard said AI did “create an enormous amount of scope to spot opportunities and manage risk as well”.

Teaching tool

Ms Pritchard said AI could help parents explain financial concepts to their children in simple terms, and could be a powerful investment behaviour coach. “As humans, we are the biggest problem with investing generally, rather than markets,” she said.

But Ms Pritchard has some scepticism, because once everybody was using AI, its investment competitive advantage would be diluted.

“I would be really nervous, unless you absolutely know your stuff, to believe that your AI is better than somebody else’s,” Ms Pritchard said.

People should also beware of sharing personal information with AI, she said. “Privacy is important and AI is not governed by the same consumer protections.”

Baker Young managed portfolio analyst Toby Grimm said younger generations wanted to use AI, but he was not using it for investment decisions or stock selections.

“It’s a very useful tool but you have to understand its limits at this point in time,” Mr Grimm said.

“I don’t think it’s at the stage where it will replace investment experience for decision-making on a wide scale.”

Mr Gillham said he expected to see a proliferation of apps and games to gamify investing. A big risk was that young investors would let AI do all the work for them.

“While AI is very powerful, it basically has no EQ. It just takes data,” he said.

“AI can help with research but in my mind it won’t really substitute critical thinking, which humans can do, because the AI is not going to know that the gardener, cleaner or pool guy are all talking about bitcoin, or a taxi driver was giving you stockmarket tips – that’s a sure-fire way to think ‘yep, the stockmarket is peaking’.”

Mr Gillham said if AI controlled much of the market, and was learning from itself and watching other AIs, “you are going to get a huge problem because they’re only checking themselves”.

“If everybody’s doing exactly the same thing, the market won’t work because everybody’s buying or everybody’s selling,” he said.

“AI is never going to replace an educated individual who understands investing. Investing and trading have lasted centuries because they’re skills you sharpen, not shortcuts you take.”

This article first appeared in The Australian as AI will make the next generation of investors better than their parents

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.