White Cliff ramps up cobalt efforts next door to heavyweight Glencore

Mining

Mining

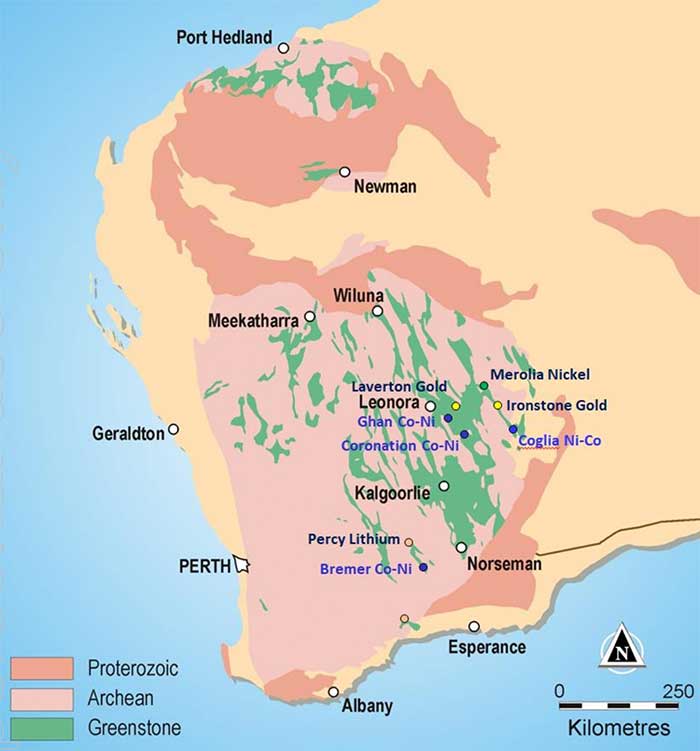

White Cliff Minerals has begun drilling for higher grade cobalt and nickel at its Coglia Well project in Western Australia.

The advantage the company (ASX:WCN) has is that it can drill out a substantial resource for a very modest spend because of the type of deposits it has put its foot on.

They are nickel laterite, which are formed on ultramafic rocks and found nearer to surface, meaning they are easier and less costly to drill.

“You can drill 5000m for about $200,000 and that gets you quite a lot of bang for your buck for these types of deposits,” managing director Todd Hibberd told Stockhead.

The higher cobalt and nickel grades encountered in 2016 drilling suggest there is substantial shallow oxide mineralisation that may be economic.

The 3000m program will test the grade, scale and extent of the known mineralisation prior to a major drilling campaign to define JORC-compliant cobalt and nickel resources.

JORC refers to mining industry standards for reporting exploration results and mineral resources, defined by the Australasian Joint Ore Reserves Committee.

Drilling will cover 6.8km of strike of the Coglia orebody. The mineralised structure extends for a further 8km to the south within White Cliff tenements and across the tenement boundary to the Irwin Hill cobalt and nickel deposits owned by Glencore.

The first cobalt results are expected in early to mid-April and White Cliff is aiming for a resource by the end of the year.

Right next door to Glencore

The company’s Ghan prospect is right on the doorstep of Swiss heavyweight Glencore’s operating Murrin Murrin nickel-cobalt mine and processing facility. The Coronation Dam and Coglia Well prospects are also in the same neighbourhood.

“The grades are quite good and there is the potential for us to drill the projects out to a substantial scale resource and then possibly be able to sell that ore into the Murrin Murrin facility,” Mr Hibberd said.

“No deal has been done, but we’ve certainly had discussions with them.”

Cobalt and nickel are key materials used in electric cars and lithium ion batteries.

Electric cars will dominate at least 80 per cent of the global market by 2050, according to Morgan Stanley’s recent On The Charge report.

Demand for electric cars will help drive demand for cobalt eight-fold by 2025, says Morgan Stanley. Nickel’s use in batteries is set to increase rapidly over the next 5-to-10 years.

High value ore

White Cliff is targeting high grades of 0.1 per cent cobalt and 1 per cent nickel. At current prices that would fetch just below $US220 per tonne and is equivalent to a gold grade of 5 grams per tonne.

Glencore is fast running out of high-grade ore at Murrin Murrin, which may provide an opportunity for White Cliff.

“The thesis is that if the grades are much higher than Murrin Murrin, the extra value of the ore feeds straight through to their bottom line,” Mr Hibberd said.

“Their processing cost doesn’t change on the grade of the material they feed, but their profitability does.”

Topping up the coffers

The company is in the process of raising $1.65 million via a rights offer that is underwritten up to $1 million by well-regarded Perth stockbroker CPS Capital.

This will give it sufficient capital to fund further exploration of its priority cobalt and nickel targets as well as continue exploration at its Aucu gold project in the Kyrgyz Republic.

Value proposition

White Cliff has a market value of about $12 million and the company believes rapid resource growth will drive its market capitalisation higher.

“We believe that by drilling out some of these projects we can demonstrate value that puts us up with our cobalt nickel peers,” Mr Hibberd said.

By way of example, Australian Mines has a market value of around $280 million on a resource of about 140,000 tonnes of total cobalt equivalent contained metal.

CleanTeQ, meanwhile, is valued at over $800 million with a resource of about 230,000 tonnes of total cobalt equivalent contained metal.

Cobalt here to stay

A supply deficit has driven up cobalt prices from $US60,000 per tonne in 2017 to over $US84,000 currently.

The commodity is expected to still be in short supply in 2025.

Ninety-eight per cent of the world’s cobalt is the by-product of nickel and copper production and 60 per cent comes from the Democratic Republic of Congo, which has been blacklisted by some end-users over ethical issues surrounding the mining of the commodity.

Australia, which is viewed as an ethical tier one jurisdiction, has the second highest reserves of cobalt.

This special report is brought to you by White Cliff Minerals.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.