WoodMac fun police crash the copper party but bulls rolling with record prices

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

The fun police have arrived to crash the copper party, with a WoodMac article this week dampening the mood amid the base metal’s irreverent climb to record prices.

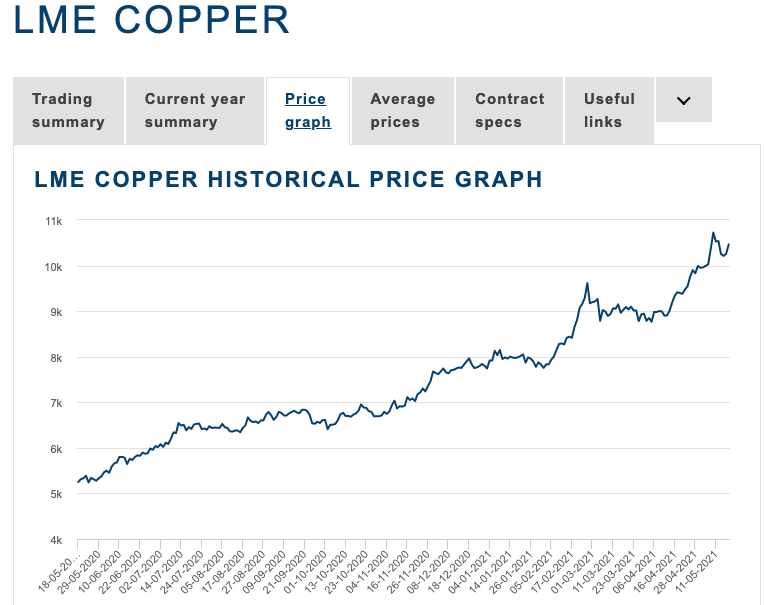

Copper prices have been on an absolute tear over the past two months, pushing above the $US10,000/t barrier earlier in May to reach levels not seen in a decade.

The base metal’s high level of heat and electrical conductivity has made it a prized input in a host of modern technology. Copper and copper alloys are abundant in essential infrastructure and goods from air-conditioning and architecture to cars, coins, aircraft and much more.

But it is the volume of copper required for the burgeoning “green energy” sector in electric vehicles, batteries, solar energy and wind turbines that has fueled excitement about a structural shift that will place copper producers and explorers firmly in the driving seat.

Enter the fuzz – Wood Mackenzie senior VP of metals and mining Julian Kettle – who queried this week whether high prices can be sustained.

Could aluminium be a spanner in the works?

In particular, Kettle noted the role substitution of copper with aluminium played in containing prices during the last copper “super-cycle”.

“Despite this justification for higher prices … the apparent race to the top in terms of ever-higher copper price forecasts pays scant regard to the history of material competition,” he wrote.

“While aluminium’s conductivity is some 40% below that of copper it does possess attractive properties – not least its density, which is just 30% of that of copper.

“This means that an aluminium cable is around 52% of the weight of a copper cable with the same conductivity, a property offering handling and installation benefits.

“Too many forecasts ignore the fact that aluminium is a serious competitor to copper in a number of high volume applications, including high- and mid-voltage power cable, busbars, transformer windings and motor windings.”

According to Kettle, ever higher prices could accelerate this hunt for alternatives.

“In conclusion, even if what we believe are fanciful forecasts of US$15,000-$20,000 per tonne for copper prove prescient, without commensurate aluminium prices of US$5,000-7,000 per tonne copper would see massive demand destruction, which would be accompanied after some time lag by supply growth,” he said.

It should be noted the WoodMac copper prices view runs contrary to those expressed by a number of investment banks and traders, including Goldman Sachs and Trafigura, who have expressed support for the commodity’s further climb to $15,000/t by 2025.

The new oil?

“I think if you go back six months ago or a year or two ago, it was a bit more theoretical. Now we can really see that the policy initiative is driving rapid growth in those sectors. So, I think that’s really important,” he said last week.

“But I think the other reason why now is the time to really sort of focus on copper is the fact that the supply side is not reacting.

“Over the last 12-18 months we’ve not seen a single, new major copper project being approved. So, despite this very powerful green demand narrative, despite also very high copper prices, it’s a complete state of inaction from the supply side.”

With these dynamics playing out in the background, he is tipping a “progressive path” to the mid-teens.

“So, into 2022 we see copper prices averaging around $12,000 dollars per ton. From today’s price at around $10,000/t. But then into 2024, rising to $14,000/t as an average and then $15,000/t as an average,” Snowdon said.

“So, really to achieve that average price path, it’s quite possible that copper will rally to the mid teens or mid high teens by the middle of the decade.”

Copper’s key role in the future-facing renewables sector has even led to its coining as “the new oil”.

Is copper’s future electric?

Known as Dr Copper for its reputation as an indicator of global economic health, copper prices have more than doubled in the past 12 months, outstripping post-pandemic gains on major indices like the Nasdaq 100.

That role electrification and the growth of “green energy” will play in copper demand over the next decade is a generally accepted paradigm.

Snowdon and others believe the global nature of the shift in thinking means copper prices will not necessarily be linked to Chinese infrastructure spending the way they were in the last minerals boom.

“Because when you look at the regional breakdown of where that significant growth in green demand is going to come from, it’s not a China story,” he said.

“China will represent around a third of the 5 million tons of growth that we’re projecting for this decade. But the US and Europe will both represent around a quarter each.

“That’s a very different demand environment to what we’ve seen over the past 20 years for copper.”

And Goldman Sachs’ stance has found support elsewhere.

GS not alone on renewables stance

“The fact that Chinese stimulus is already being dialed back on a year-over-year basis underpins a widely-held view in the market that copper prices should also trend lower,” JP Morgan global head of FX strategy Samuel Zief and US equity strategist Jonathan Linden wrote earlier this month.

“The median Bloomberg price forecast expects copper to end 2022 10-15% lower versus today’s spot level.

“However, there is another view in the market that we find ourselves drawn to that foresees a more supportive environment for copper going forward.

“J.P. Morgan Investment Bank estimates that overall green transition applications of copper will increase demand threefold by the end of the decade, ultimately accounting for roughly 15% of total copper demand by that time.”

By 2025, the share of overall demand from green products is estimated to climb more than 50% on 2020 levels from 6.3% to 9.6%.

That comes in at about 2.5 million tonnes a year. At GS, Snowdon says that could rise to 6Mtpa, or a 20 per cent market share, by 2030.

Zief and Linden share the same concerns as Snowdon on the supply side of the equation.

“Given our global macro outlook, unappreciated incremental demand from decarbonization efforts globally, and tight supply outlook, we believe copper likely remains higher for longer and provides support to an array of investment opportunities,” he said.

The new juniors

If the party does keep rolling who could be placed to fill this supply gap?

Mega-majors Rio Tinto and BHP have stolen the limelight with their Winu and Oak Dam discoveries in recent years, but a number of juniors are working hard to take it back.

New ASX entrant QMines (ASX: QML) was all the rage yesterday with stunning grades from its maiden drilling campaign at the Mt Chalmers Copper Project in Queensland sending its shares flying.

That hit came in at an eye-watering 13.4% copper, 6.11g/t gold and 31g/t silver.

The stock – which only listed on the ASX earlier this month – is now up ~75% on its IPO price of 30c per share.

It was also QMines’ maiden diamond drilling program at the project, which hasn’t been touched since 1995. Results from seven holes are in, with three holes pending.

stockname share price today:

Traditionally focused on graphite, Battery Minerals (ASX:BAT) received a small bump from shareholders on Tuesday with news it had begun drilling at its Stavely-Stawell copper-gold project.

That is not too far from Stavely Minerals (ASX: SVY) Thursday’s Gossan discovery, a copper find that gave the Chris Cairns-led explorer a serious rerating a couple years ago.

A host of companies are also jostling for positions in the Lachlan Fold Belt in New South Wales on the back of Alkane Resources (ASX: ALK) Boda discovery, including new floats looking to take advantage of the renewed fervour for the region and copper plays.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.