The ASX readies for a new copper play as Askari opens $6m Lachlan Fold IPO

Pic: John W Banagan / Stone via Getty Images

The ASX is getting a new Lachlan Fold Belt copper hunter with Askari Metals set to open its $6m IPO this week.

With the price hitting yet another record high, now is definitely the time for copper plays to be making their mark.

Last Friday the price of the red metal smashed its 2011 record, but it didn’t stop there, hitting a fresh high of $US10,725 ($13,677) a tonne on the London Metal Exchange on Monday.

And experts predict plenty more upside to come, labelling copper ‘the new oil’ and forecasting highs of $US15,000 a tonne largely thanks to the commodity’s importance in electronics and the green energy transition.

Goldman Sachs reckons the red metal will reach that level by 2025, but Niv Dagan, executive director at boutique investment firm Peak Asset Management, is confident it will get there much sooner.

“We are extremely bullish on copper and see it above $US15,000/tonne over the next 12 months,” he told Stockhead.

“Global EV demand, stockpiling combined with depleted inventories, will be the key catalyst.”

Peak Asset Management is the lead manager for the IPO, which is priced at 20c per share.

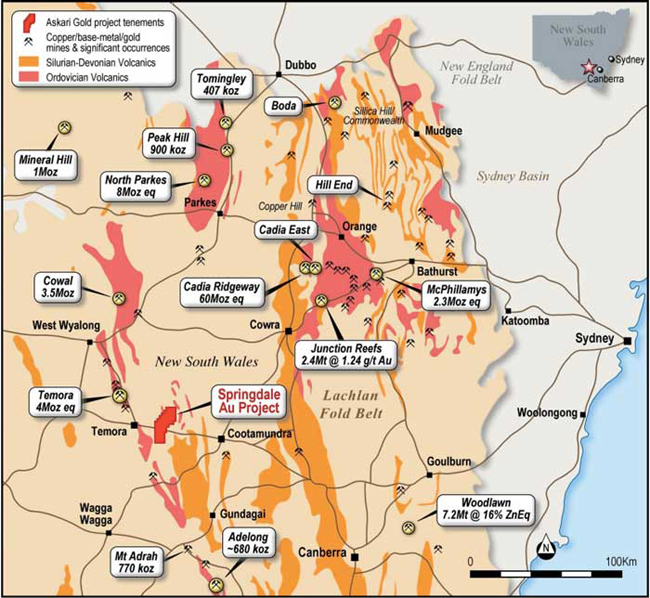

Askari Metals is a copper and gold focused exploration and development company with a portfolio of five fully owned projects located in New South Wales’ Lachlan Fold Belt (LFB) and Western Australia.

The LFB is one of Australia’s hottest mining addresses right now, with Alkane Resources’ (ASX:ALK) discovery of a large porphyry gold-copper system in September 2019 igniting an exploration frenzy in the region.

Of course it also helps the LFB hosts some big name mines like Newcrest Mining’s (ASX:NCM) 50 million oz, low-cost operating Cadia mine.

Askari’s goal is to list on the ASX by early July this year with an enterprise value of $2.77m.

Each of its five projects has had previous exploration success, the company says, with diamond drilling identifying high-grade copper and gold and “significant exploration upside potential”.

The Springdale copper-gold project in the LFB in particular has witnessed significant historic production. Limited drilling has been carried out below the old workings, but it is located in the right neighbourhood for big copper-gold porphyry discoveries.

Springdale sits along strike of the Junee copper-gold porphyry project held by DevEx Resources (ASX:DEV) and to the east of the Temora copper-gold deposits owned by Sandfire Resources (ASX:SFR).

Askari plans to undertake an induced polarisation survey and drilling at the project.

The company’s Callawa copper project in a proven copper-gold district of Western Australia, meanwhile, lies to the west of Rio Tinto’s (ASX:RIO) headline grabbing Winu project and is northwest of Metals X’s (ASX:MLX) large Nifty copper mine.

Previous rock chip samples returned grades of up to 28.7 per cent copper at surface. Historic rock chip samples showed grades of up to 19 per cent at surface with over 2km of prospective strike.

Askari’s IPO follows a number of successful listings this year including fellow LFB hunter Kincora Copper (ASX:KCC), which lit up the boards at the end of March, and QMines (ASX:QML), which made its grand entrance last week.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.