Copper is red-hot, and this IPO wants a piece of the action

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Copper is trading at all-time high prices, with every indication that the red metal is destined to star in a future driven by the need to transition to a low-carbon, green economy.

It seems like every few days the red metal breaks new ground, and it’s the long-term predictions which make for exciting reading for copper plays.

In April, Goldman Sachs released a new report dubbing copper ‘the new oil’, predicting copper prices as high as $15,000 per tonne by 2025 on the back of its importance to the systems which will power the world in a decarbonised world.

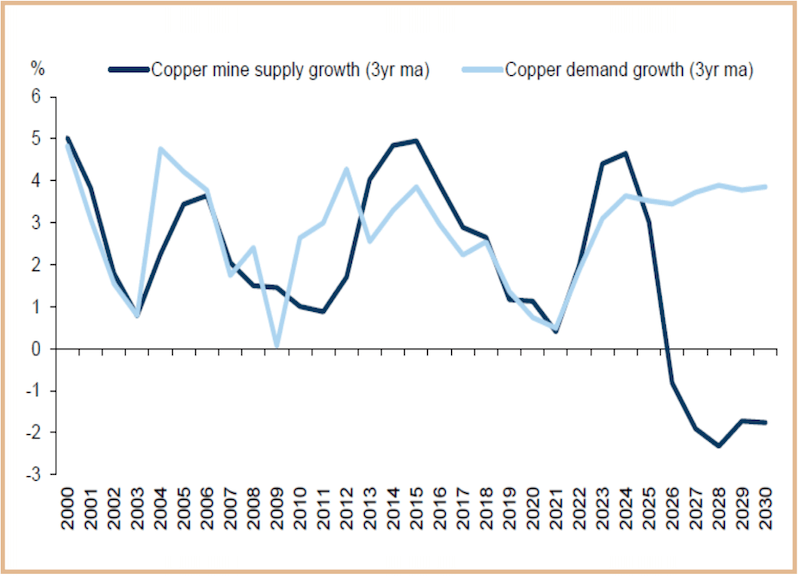

A number of other analysts and banks have followed with bullish long-term predictions of a market which is currently ill-equipped to meet a growing demand outlook.

With investor appetite seemingly catching up to the price movement, it appears to be a great time to list on the ASX with a copper asset – especially one with a prospective mineral resource just months away.

Soon-to-be-listed, provided they meet all ASX acceptance requirements, Resource Base (proposed ASX:RBX) expects to be able to achieve just that. It’s just lodged a prospectus for an IPO focused on copper-gold exploration in Victoria’s Stavely Arc region.

The company intends to aggressively explore the Black Range base metals project, situated on the Stavely Arc, which it is acquiring from Navarre Minerals (ASX:NML) in an all-scrip deal.

Far from an unloved asset, Navarre’s decision to divest the asset comes as it hones its focus on its flagship gold interests.

Resource Base executive chairman Shannon Green told Stockhead the acceptance by the project’s previous owners of an all-scrip deal, as well as the proposed appointment of Navarre CFO, former geologist and stock analyst Paul Hissey to the board of RBX as director nominee, demonstrates the previous owner’s belief in the project.

“Navarre were very careful to ensure the asset was divested to a group they knew would put the foot on the gas and develop it,” Green said.

“From the beginning they wanted to retain a reasonable piece of the asset, and they wanted someone on the board to ensure it was given the capacity it deserves.

“That should send a very positive message to market.”

A little further along

Given the broader thematic around copper it’s not difficult to see why there is a bit of excitement around the Black Range project for Resource Base.

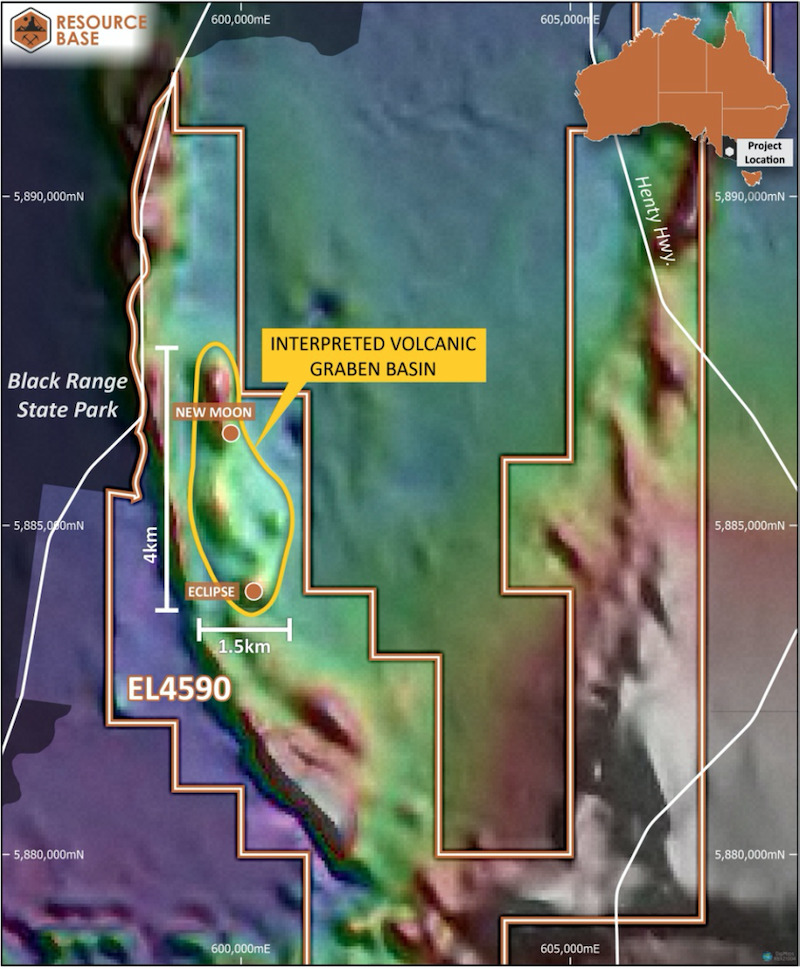

The project offers the opportunity for the company to test the potential of defined volcanic graben along 4km of strike, which is host to a recognised volcanic-hosted massive sulphide system (VHMS).

Within that zone is the Eclipse prospect – an area drilled recently by Navarre in a bid to identify the primary sulphide source of copper mineralisation in the area.

“We’ve got a lot of what you could almost call walk-up drill targets at the project right now, but we’re going to be doing a lot of geophysical work to really make sure that when we start punching holes into the ground they’re in the right place,” Green said.

“With all the historical work that’s been done on the project, we actually have enough existing data there for an inferred JORC compliant resource which is ready to pull together easily and early.

“That will give us a great opportunity for a really good start – there aren’t too many projects where you can go and readily do that so quickly.”

Beyond Eclipse, a further 100km of untested volcanics lie in wait for Resource Base.

There are plenty of pieces already on the table at Black Range, and Resource Base will be aiming to put them all together.

The company has set a target of defining the initial JORC resource for within six months of listing, with the $5-$5.5 million IPO set to fund aggressive exploration and development of the Eclipse prospect.

An aircore drilling campaign is planned for the second half of this year, with reverse circulation and diamond drilling proposed in Q1, 2022.

“We’re in a very safe and secure jurisdiction, and we’ve got a project that’s had quite a bit of work done on it over the years,” Green said.

“Where we see the opportunity is that a lot of that work was not necessarily seamlessly connected together – that’s where we see significant opportunity here.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.