Resources Top 5: Right on Cue… Cyprium Metals makes high-grade copper-gold hit

Dom took being "on the ball" way too literally. (Getty Images)

- It’s a shallow, high-grade copper-gold find for CYM at the Heeler prospect near Cue, in WA

- Battery metals hunter Belararox is up, leading into its “Copper in Americas” presso

- ADG, PL3 and FL1 all also double-digit flying at time of publishing

Here are some of the biggest resources winners in early trade, Tuesday February 20.

Cyprium Metals (ASX:CYM)

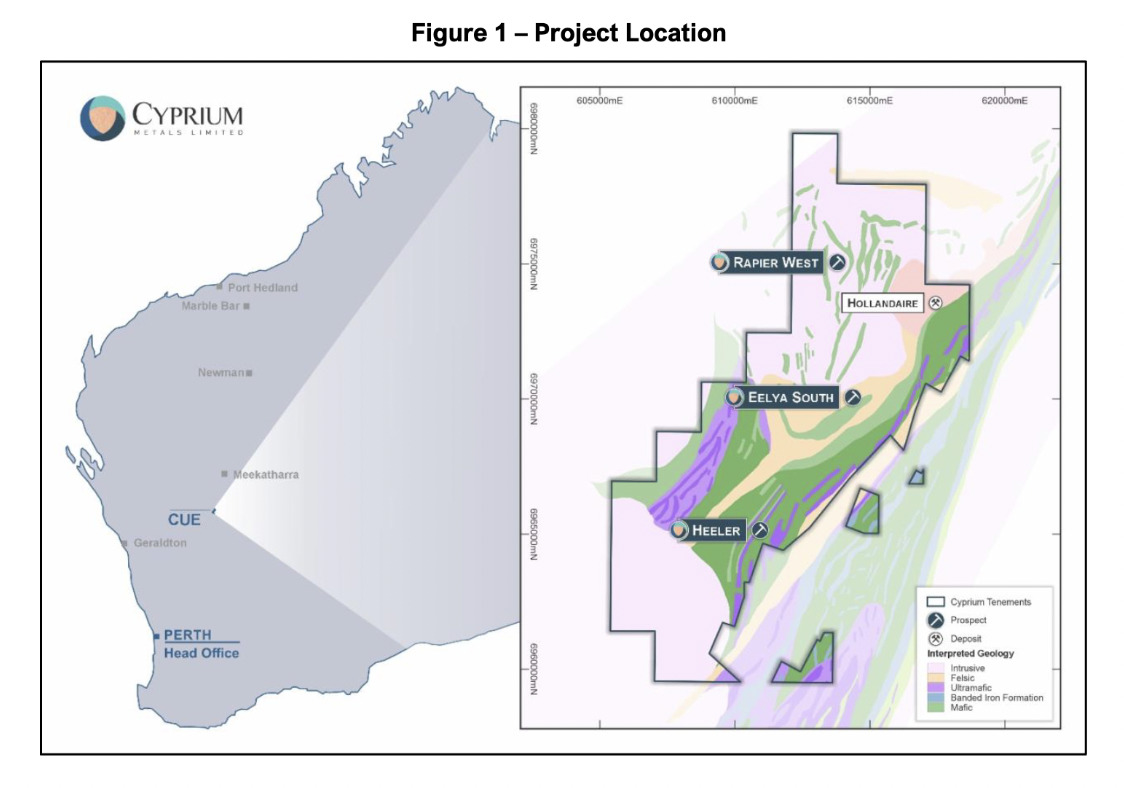

WA-focused copper explorer and developer Cyprium has made a shallow, high-grade copper-gold discovery near Cue at the Heeler prospect, which is about 10km southwest of the company’s Hollandaire copper-gold deposit in WA.

Heeler is a joint venture prospect operated by Cyprium, with 80% of the rights to base metals owned by CYM and 20% by Ramelius Resources (ASX:RMS).

The discovery includes a drill intercept of 15m at 3.26% Cu, 0.70g/t Au, 7.4g/t Ag, 151ppm Co from 70m downhole in hole number 24CURC004. This included 7m at 5.04% Cu, 0.81g/t Au, 11.4g/t Ag, 197ppm Co, 0.11% Ni from 71m.

And a second intercept in the same hole saw 3m at 1.09% Cu, 0.44g/t Au from 108m.

Mineralisation is open to depth and along strike in both directions within a “lightly tested” copper soil anomaly that extends 2.5km.

“While the company remains focused on delivering a robust plan for Nifty, we continue to maintain our outstanding portfolio of exploration assets,” said executive chairman Matt Fifield.

Nifty, by the way, is the company’s flagship copper project, in WA’s Pilbara region. But Fifield says, regarding Heeler, it’s “a great reminder of the prospective value within the company’s earlier-stage assets in the Paterson and Murchison provinces.”

CYM share price

Belararox (ASX:BRX)

Perth-based battery and renewables mineral exploration company Belararox is on the up today, to the tune of about 17% at time of writing.

Why? Fair question. It might be an investors’ top-of-mind thing, what with the company delivering its “Copper in the Americas” investor presentation today.

Belararox's (ASX:BRX) Managing Director Arvind Misra will present at the "Copper in the Americas" Investor Call. The event is hosted by ProjectBank & sponsored by Peak Asset Management, the online investor call will be held today | https://t.co/zws6EdO5n3 #copper $BRX pic.twitter.com/3tYrSY7c5H

— Belararox Limited (@Belararox) February 19, 2024

One of BRX’s major operations is the Toro – Malambo – Tambo TMT project, located in the Valle del Cura region within the San Juan province in Argentina.

It’s an extensive 32,000ha project with potential for large scale base metal mineralisation and untested porphyry targets.

Situated in an underexplored gap between two world-class metallogenic belts – the El Indio and Maricunga in the Central Andes, it’s an area rich in precious and base metals including high-profile advanced copper-gold porphyry projects.

The Andean copper belt is host to over 40% of the world’s copper production.

BRX share price

Adelong Gold (ASX:ADG)

Minnow goldie Adelong (at a mere $3.5m market cap) is double digits to the good, probably based on a boardroom appointment that has some investors somewhere excited enough to fork out for a few more ADG shares.

The news is, the company has appointed one Ian Holland to a big kahuna role of managing director, effective March 1.

Holland is a highly experienced mining executive, reads the announcement, “with a strong track record of operations management and value creation to the company who has successfully transitioned an exploration project to production and will be charged with accelerating the development of the Adelong Gold Project.”

All of that is important to ADG investors, but no doubt especially that last part.

With 25 years in the mining/exploration biz under his belt, Holland was most recently the MD of Navarre Minerals (ASX:NML). He was responsible for acquiring the Mt Carlton Mine and Cush Creek project and transitioning that company from explorer to producer.

Adelong Gold chairman Ian Hastings said: “Ian will bring a level of mining expertise to the company, significantly enhancing its efforts to reopen the Adelong Gold Mine and commence production. Studies already completed by the company demonstrate the viability of the project, which is even further enhanced at the current gold price.”

ADG share price

Patagonia Lithium (ASX:PL3)

Explorer Patagonia Lithium is on the hunt for the white stuff (and niobium, REEs) in the lithium triangle in Argentina – with a prospect in the Salta Province there and two in the Jujuy Province.

All up, the company has two lithium brine projects in Argentina and four projects in Brazil focused on carbonatites and ionic clays for rare earths, pegmatites for lithium and niobium in nelsonites (micas) closely associated with dolomite carbonatites.

News? Direct from the boardroom, yes.

The company’s board has appointed Richard (aka Rick) Anthon as non-executive director, which is a big deal for PL3 because:

• Anthon has significant directorial experience in the lithium sector in Argentina with major lithium producer Allkem, formerly Orocobre.

• And he has, notes the company, “strong corporate and legal expertise and [was] one of the key players in the Livent/Allkem merger to create Arcadium Lithium.

PL3 share price

First Lithium (ASX:FL1)

First Lithium is celebrating an expansion of its Blakala project, hitting thick high pegmatites in four drill holes, with intercepts such as 19.0m ar 1.85% Li2O from 41.0m, including 15.0m at 2.04% Li2O from 44.0m.

Stockhead has more… a lot more… on this > here.

FL1 share price

At Stockhead we tell it like it is. While BRX and Fl1 are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.