Resources Top 5: The IPO class of 2021 is putting on a show

Mining

Mining

The biggest small cap resources winners in early trade, Wednesday May 19.

There has been a genuine bevy of excellent gold and copper intercepts on the ASX in 2021.

We’re talking about those hits that can re-rerate a company’s share price.

Today, QMines pulled up a highlight 13.4% copper, 6.11g/t gold and 31g/t silver at the ‘Mt Chalmers’ copper project in Queensland.

The stock – which only listed on the ASX earlier this month – is now up ~75% on its IPO price of 30c per share.

This was also QMines’ maiden diamond drilling program at the project, which hasn’t been touched since 1995. Results from seven holes are in, with three holes pending.

“Some outstanding results from our maiden diamond drilling program clearly validate the company’s view that Mt Chalmers has significant development potential,” QMines chairman Andrew Sparke says.

“Mt Chalmers has been dormant for over 25 years with QMines being the first company to drill a hole since 1995.

“The company’s maiden RC drilling program has also now commenced, and we expect to continue delivering results that will lead to a resource update in the near future.”

Recent IPO BPM has tapped that rich ‘nearology’ vein, picking up three projects next to Rumble Resources’ (ASX:RTR) mammoth Chinook lead-zinc discovery.

Nearology puts a spotlight on any explorer that holds ground within cooee of a huge, company-making mineral discovery.

BPM’s three projects – Hawkins, Ivan Well and Rhodes – cover the same rock layer ‘target zone’ as Chinook, BPM says.

Importantly, the ground was pegged prior to the recent Rumble discovery, “delivering a first mover advantage with all surrounding ground now fully pegged”.

BPM is fully funded (~$5.2m) for 15,000m of planned drilling to test targets during H2 2021 at Hawkins, Ivan Well and Rhodes, as well as the Santy and Nepean nickel-gold projects.

This new fan favourite has raised $5.5m to explore the Whiteheads (gold, nickel) and Side Well (gold) projects, as well as the ‘Wellington’ acquisition near Rumble in the Earaheedy Basin.

The 8c per share offer price – a slight discount to the pre-open share price — introduced several new, high quality institutional, sophisticated and professional investors, Great Boulder says.

“This is a strong validation of Great Boulder’s WA gold and base metal asset portfolio, exploration team and strategy,” managing director Andrew Paterson says.

“Investors can look forward to increased exploration activity coupled with strong news flow in the coming months.”

(Up on no news)

Despite a nice +17% bump in early trade, this newly listed Kalgoorlie gold explorer is still trading well below its IPO price of 25c per share.

The drill rigs are turning non-stop at OzAurum’s advanced gold project at ‘Mulgabbie North’, so far delivering high-grade gold hits like 4m at 6.3g/t from 48m to end of hole.

Thousands of metres of assay results are due out in the coming weeks, the company says.

(Up on no news)

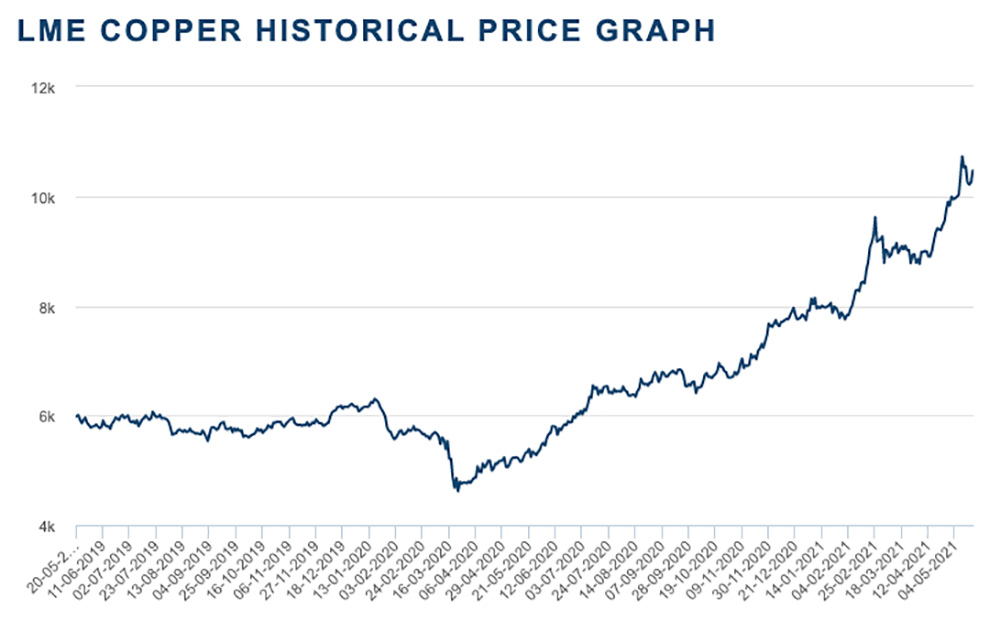

GBM is a small but growing copper producer. Great timing.

The stock also recently finalised a deal with TSX-listed goldie Novo Resources, which paid ~3.7m in shares for 50% of the ‘Malmsbury’ project in Victoria.

“The GBM and Novo teams continue to view Malmsbury as one of the most prospective and underexplored high grade gold projects in the Victorian goldfields, displaying many of the geological characteristics of the Fosterville epizonal orogenic gold deposit located 58km to the north,” GBM managing director Peter Rohner says.

The 2016 discovery of super high-grade gold beneath old workings at Fosterville turned the once struggling operation into one of the world’s best gold mines.

“Partnering with Novo allows GBM to accelerate exploration at Malmsbury while focusing the company’s own expenditure on its district-scale, flagship Mt Coolon epithermal gold project in the Drummond Basin of Queensland,” Rohner says.