Who Made the Gains? Here are the top ASX resources stocks for August

Pic: yogysic, DigitalVision Vectors/ Via Getty Images

- 13 resources stocks made gains of over 100% in August – a huge jump from June (1) and July (3)

- Rare earths and lithium stocks dominated top 50

- Copper explorer Cobre backed up July’s sector-leading 231% gain with another 435% in August

In August, the ASX 200 rose 0.6% for second straight monthly gain. Over the same period, our S&P/ASX 200 Resources [XJR] index gained 5.3%.

The local bourse still finished the month on a downer as everything got sold down, a trend which continued into September.

Still, at the smaller end of the bourse, it is all about sentiment.

“The vast majority of our mining and resource stocks are not paying dividends and they never will,” Far East Capital analyst Warwick Grigor says in a recent note.

“Therefore, their performance is going to depend on the general flow of money into or out of the sector, depending upon a wide range of influences.

“Trading these stocks is far more emotional than rational, so over-analysis is not going to be very productive.

“Individual company news flow is more important with new stories always being more inspirational than tired stories with share registries that are populated by stale bulls.

“No matter how depressed the market may be, there will always be a few new stories that will stand out.”

>>>Read the top 7 ASX small cap resources stories below

All up, 13 resources stocks made gains of 100% or above in August – a huge jump from June (1) and July (3), and the biggest total since March.

Like March, most of these were battery metal/critical mineral plays.

(Read our in-depth analysis of the best and worst performing metals here.)

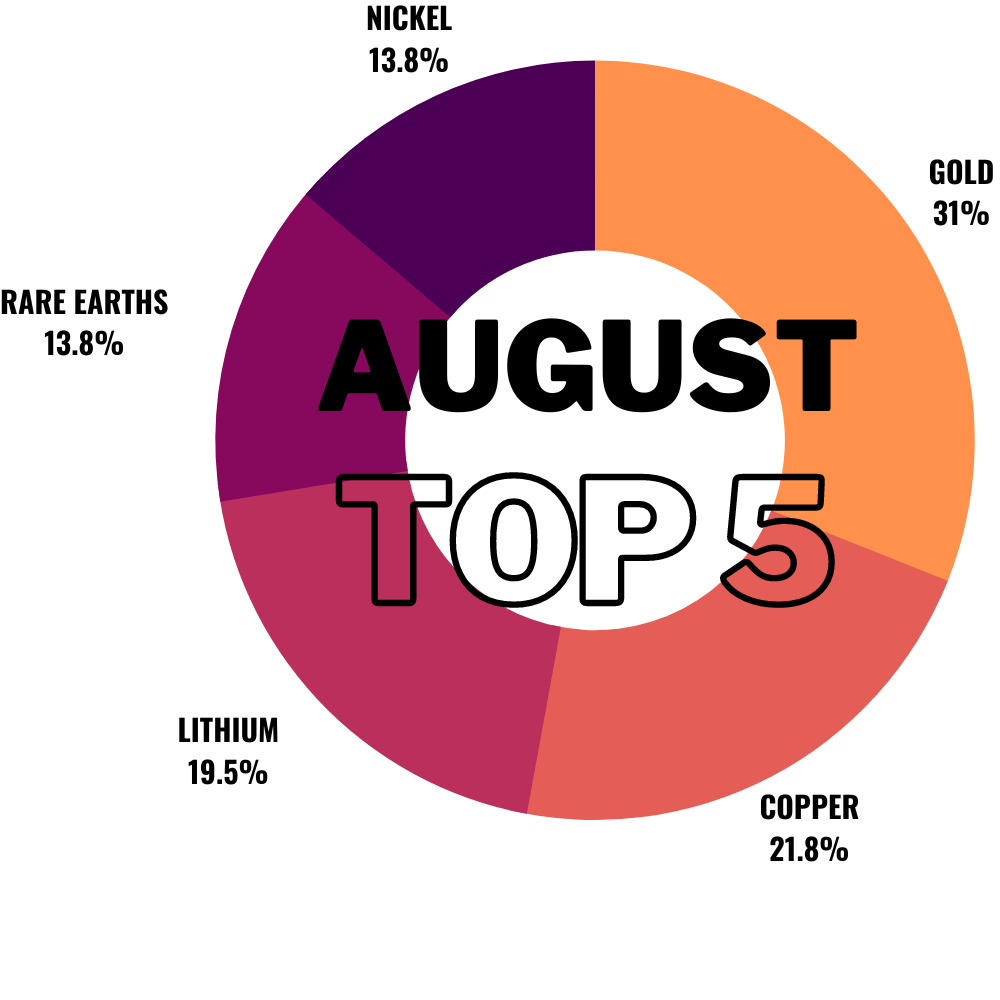

Here’s a breakdown of the five most popular commodities for August:

Here are the top 25 ASX resources stocks for the month of August >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

| CODE | COMPANY | AUGUST RETURN % | PRICE | MARKET CAP | COMMODITY |

|---|---|---|---|---|---|

| CBE | Cobre | 435% | 0.46 | $92,965,510.10 | copper, silver, nickel |

| AQC | Australian Pacific Coal | 284% | 0.365 | $18,426,955.65 | coal |

| RAS | Ragusa Minerals | 222% | 0.245 | $31,517,796.66 | lithium, kaolin, gold |

| IR1 | Irismetals | 197% | 1.115 | $67,870,050.00 | lithium, gold |

| LNR | Lanthanein Resources | 188% | 0.046 | $44,289,976.22 | rare earths |

| ASN | Anson Resources | 173% | 0.355 | $364,908,878.93 | lithium |

| MAG | Magmatic Resources | 170% | 0.17 | $43,262,755.66 | copper, gold |

| DRE | Dreadnought Resources | 115% | 0.14 | $425,744,697.14 | rare earths, nickel, copper, PGE |

| KFM | Kingfisher Mining | 108% | 0.5 | $17,122,500.50 | rare earths |

| AM7 | Arcadia Minerals | 107% | 0.29 | $13,542,388.68 | lithium, copper, gold |

| AMM | Armada Metals | 100% | 0.13 | $6,500,000.00 | nickel, copper |

| NTL | New Talisman Gold | 100% | 0.003 | $9,381,676.09 | gold, silver |

| ODM | Odin Metals | 100% | 0.028 | $16,305,641.38 | copper, zinc, gold, silver |

| LIN | Lindian Resources | 96% | 0.265 | $224,811,958.45 | rare earths |

| WC1 | West Cobar Metals | 95% | 0.195 | $5,996,264.63 | shell co |

| TAS | Tasman Resources | 92% | 0.023 | $15,436,502.12 | copper, gold, investments (CNJ, EDE) |

| CNJ | Conico | 90% | 0.055 | $79,877,789.42 | PGE, copper, gold nickel |

| BRX | Belararox | 89% | 0.69 | $21,617,713.80 | zinc, copper, lead, gold, silver |

| PGD | Peregrine Gold | 86% | 0.78 | $30,202,813.68 | gold, lithium |

| WCN | White Cliff Min | 82% | 0.02 | $13,072,067.24 | lithium, rare earths |

| NYM | Narryer Metals | 80% | 0.18 | $5,024,250.00 | rare earths, nickel, copper, PGE |

| IMI | Infinity Mining | 75% | 0.21 | $12,075,000.00 | lithium |

| MRL | Mayur Resources | 71% | 0.12 | $28,985,239.56 | cement, lime |

| DTM | Dart Mining | 71% | 0.125 | $16,907,520.00 | lithium, gold |

| MMG | Monger Gold | 71% | 0.41 | $16,416,400.00 | lithium |

| DAF | Discovery Alaska | 70% | 0.078 | $17,490,306.44 | lithium, gold |

| MCT | Metalicity | 67% | 0.005 | $17,293,530.03 | lithium, gold, copper |

| MOH | Moho Resources | 67% | 0.04 | $6,645,190.56 | nickel, copper, PGE, gold |

| RR1 | Reach Resources | 67% | 0.005 | $9,550,253.20 | rare earths, gold |

| SPD | Southern Palladium | 59% | 0.96 | $41,355,193.92 | PGE |

| HAV | Havilah Resources | 58% | 0.395 | $125,072,487.95 | copper, cobalt, gold, rare earths |

| PBL | Parabellum Resources | 55% | 0.31 | $12,909,175.31 | rare earths |

| DYL | Deep Yellow | 54% | 1.165 | $852,451,555.05 | uranium |

| ALY | Alchemy Resources | 54% | 0.02 | $19,061,481.14 | lithium, copper, gold |

| ADD | Adavale Resources | 53% | 0.037 | $16,182,800.93 | nickel |

| TG1 | Techgen Metals | 52% | 0.205 | $9,062,725.28 | copper, gold, silver |

| DEV | Devex Resources | 52% | 0.41 | $147,416,162.56 | uranium, gold, copper, nickel, PGE |

| RDT | Red Dirt Metals | 51% | 0.59 | $179,687,111.34 | lithium |

| AOA | Ausmon Resources | 50% | 0.009 | $7,715,604.09 | cobalt, lead, zinc, rare earths, lithium |

| SBR | Sabre Resources | 50% | 0.006 | $16,738,386.05 | uranium, nickel |

| AUQ | Alara Resources | 49% | 0.067 | $47,531,759.01 | copper, gold, zinc |

| 1VG | Victory Goldfields | 49% | 0.275 | $10,575,990.43 | rare earths, gold |

| DM1 | Desert Metals | 48% | 0.37 | $17,756,972.66 | rare earths, copper, nickel |

| AHK | Ark Mines | 48% | 0.295 | $10,180,480.39 | iron ore, nickel, cobalt, gold |

| LRS | Latin Resources | 47% | 0.115 | $224,307,789.11 | lithium, gold |

| WR1 | Winsome Resources | 47% | 0.265 | $35,805,208.41 | lithium |

| GCY | Gascoyne Resources | 47% | 0.36 | $153,372,691.44 | gold |

| FXG | Felix Gold | 45% | 0.145 | $12,059,127.71 | gold |

| CY5 | Cygnus Gold | 45% | 0.29 | $42,683,741.35 | lithium, gold, nickel |

| SPQ | Superior Resources | 44% | 0.059 | $100,372,004.66 | copper, gold |

August Top 5 ASX resources stocks

This plucky, not-so-little-any-more copper explorer backed up July’s sector-leading 231% gain with another 435% in August.

All up, CBE rocketed +1,400% from 3c to 46c in the two months ending August 31. Outstanding stuff.

The catalyst has been ongoing exploration success at the Ngami copper project in Botswana, where mineralisation “continues at depth as well as laterally along more than 4km of proven strike”, says boss Martin Holland.

“Given the significant copper results and strong exploration potential of the project, the company has mobilised a second drill rig to site with plans underway to deploy additional rigs to the project by year end in order to unlock this exciting copper discovery at Ngami,” he said August 30.

The reaction by investors shows that the ASX, despite volatility in global markets, still offers upside on the back of genuine discoveries.

AUSTRALIAN PACIFIC COAL (ASX:AQC)

Last month a Nathan Tinkler-backed consortium announced plans to buy perpetual struggler Australian Pacific Coal and its Dartbrook project.

It proposes to subscribe for 19.97% of AQC shares at $0.30 per share for a total of $3.78m. It would then refinance the company’s debt and buy the rest of the stock for up to $0.30 per share “to allow existing shareholders to take the opportunity to liquidate their investment, should they wish to do so once the refinancing has been completed”.

But that not the end of it, with coal trader and operator M Resources – largest shareholder in Bowen Coal (ASX:BCB) and significant shareholder in Stanmore Resources (ASX:SMR) – attempting to one-up Tinkler with a 36c per share bid.

Game on.

RAS acquired the early-stage Northern Territory lithium project back in May.

At the time, chair Jerko Zuvela said the acquisition would see the company create a ‘supergroup’ project area comparable to neighbours Core Lithium (ASX:CXO) and Lithium Plus (ASX:LPM).

A couple of weeks ago, initial desktop review works indicated there was high-grade lithium-gold across the site with rock chip samples returning 5.46% Li20, 2.27g/t gold, and 4.59g/t gold.

RAS has completed planning of an initial drilling program and, since then, the share price has gone wild.

It attracted a speeding ticket from the ASX late in the month.

“Given the results announced on this date, with drilling preparation works progressing, there has been a significant level of interest of upcoming works and results from the project,” the company said in response.

IR1 is now the largest holder of lithium mining claims in South Dakota, after increasing its footprint at the Black Hills project by 290% to ~42,287 acres.

“The company now has a great mix of drill-ready targets and extensive prospective corridors over known lithium bearing LCT pegmatites,” executive technical director and head of exploration Chris Connell said August 18.

“I am currently on site, directing and supervising the staking and exploration activities over an area that is exhibiting regional scale lithium potential.”

LANTHANEIN RESOURCES (ASX:LNR)

Last year, the explorer formerly known as Frontier Resources secured a couple of WA rare earths and high purity alumina projects to complement the recent acquisition of the ‘Murraydium’ ionic clay (IAC) hosted rare earths project in South Australia.

The Lyons rare earths project adjoins the Hastings Technology Metals (ASX:HAS) world-class ‘Yangibana’ deposit, which is set to be the next REE producer outside of China by 2023.

The company is now prepping for a maiden drill program at Lyons, which is set to kick off early September.

The drill program will hit high priority targets located within the Gifford Creek Carbonatite Complex, host to Yangibana and Dreadnought Resources’ (ASX:DRE) multiple discoveries.

Former geologist and experienced stockbroker Guy Le Page believes LNR’s Lyons and Edmund tenements are ‘better-than-average’ nearology plays with prospects on the tenements characterised by outcropping ironstones of >2.5km strike length.

READ: Lanthanien Resources: the rare earths junior with big potential

SPECIAL MENTIONS: Anson Resources and Deep Yellow

Anson Resources (ASX:ASN) is on a hot streak.

In August, ASN increased resources at the Paradox lithium brine project in southern Utah by 324% to 788,300t of lithium carbonate equivalent (LCE), paving the way for development.

Then, the share price hit all-time highs after a non-binding deal was inked with global direct lithium extraction (DLE) leader Sunresin to develop a full-scale commercial lithium plant at Paradox.

The Paradox Definitive Feasibility Study (DFS) will be released soon. ASN is targeting stage 1 production of 10,000tpa battery grade carbonate.

Meanwhile, a succession of positive uranium news flow over the past 12-18 months has experts and industry insiders saying it is a matter of ‘when’ not ‘if’ uranium has its own ‘lithium moment’.

If you believe the bulls, a boom is a near certainty.

One of the first beneficiaries could be Deep Yellow (ASX:DYL), which acquired fellow mine developer Vimy and now has two advanced projects on the books; Tumas in Namibia and Mulga Rock in WA.

In February 2021, a PFS was completed on a 3mlb per annum open-pit mining operation at Tumas, with a DFS due later this year.

Meanwhile, 91Mlb Mulga Rock is the only uranium project in WA to reach “Substantial Commencement”, which opens the pathway to development.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.