Who Made the Gains? Here are the top ASX miners and explorers for August 2023

Pet rocks: good, clean, wholesome fun. Pic via Getty Images

- August wasn’t quite as good as June or July for resources stock pumpage

- The month saw plenty of gainers, but just four standout +100 percenters

- Lithium, rare earths and gold featured prominently among the month’s winners

Beacause our crack resources team was digging deep for bulk stories in Kalgoorlie at the Diggers & Dealers forum at the time, we didn’t quite get to July’s gainers at this stage one month ago.

But… we can tell you there were NINE 100%+ stonkers that month in the mining resources sector.

August, however, while nowhere near as spectacular as June (13) or July, kept at least some level of form for basic materials – while most of the rest of the local bourse sectors had a rough month.

Four 100%+ standouts caught the eye in terms of pure value-holding percentage gains across the month, with many others chopping about below that, but on noteworthy narratives.

Those top gainers were: Raiden Resources (ASX:RDN); Viridis Mining and Minerals (ASX:VMM); Loyal Lithium (ASX:LLI) and Wildcat Resources (ASX:WC8).

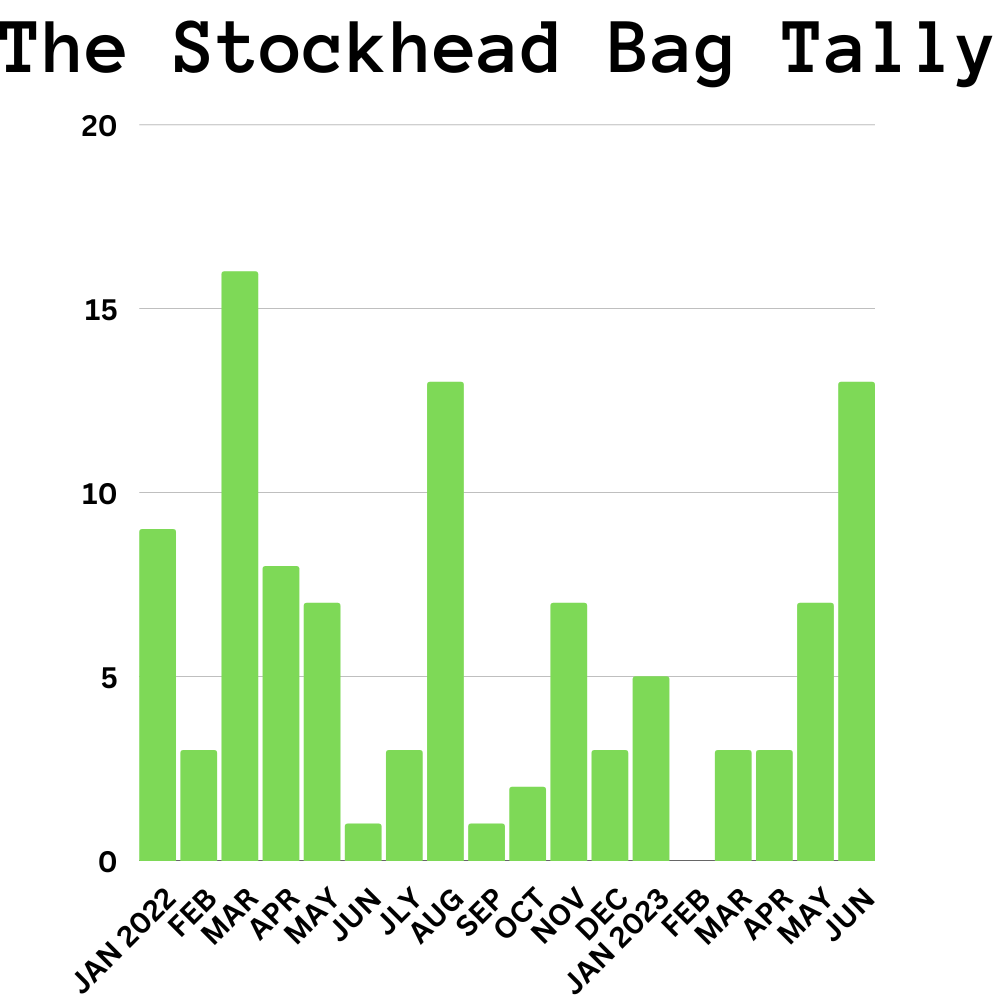

And they make up the month’s ‘Bag Tally’ (+100% gains) – Stockhead’s unscientific measure of speccy resources sentiment on the ASX in any given month.

Here’s how the Bag Tally has tracked over the past 20 months. (Note, table needs updating to include July’s 9 bags and August’s 4):

Here are the top 30 ASX resources stocks for the month of August >>>

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | AUGUST RETURN % | SHARE PRICE | MARKET CAP |

|---|---|---|---|---|

| RDN | Raiden Resources Ltd | 300% | 0.03 | $49,326,454 |

| VMM | Viridismining | 140% | 0.6 | $16,250,346 |

| LLI | Loyal Lithium Ltd | 130% | 0.735 | $52,527,205 |

| WC8 | Wildcat Resources | 127% | 0.375 | $242,946,907 |

| NMR | Native Mineral Res | 87% | 0.056 | $7,406,459 |

| RHK | Red Hawk Mining Ltd | 74% | 0.785 | $126,636,433 |

| OKJ | Oakajee Corp Ltd | 73% | 0.026 | $2,194,705 |

| KNB | Koonenberrygold | 64% | 0.054 | $4,090,848 |

| OAR | OAR Resources Ltd | 63% | 0.0065 | $15,678,814 |

| ACM | Aus Critical Mineral | 61% | 0.3225 | $8,473,406 |

| AW1 | Americanwestmetals | 59% | 0.295 | $104,554,313 |

| ARV | Artemis Resources | 56% | 0.028 | $45,527,633 |

| GCX | GCX Metals Limited | 54% | 0.043 | $8,360,041 |

| FTL | Firetail Resources | 52% | 0.125 | $12,031,250 |

| MPG | Manypeaksgoldlimited | 50% | 0.3 | $11,276,090 |

| EL8 | Elevate Uranium Ltd | 48% | 0.445 | $122,260,221 |

| LU7 | Lithium Universe Ltd | 47% | 0.044 | $18,260,529 |

| FME | Future Metals NL | 45% | 0.048 | $19,007,386 |

| MBK | Metal Bank Ltd | 44% | 0.049 | $13,547,790 |

| AKM | Aspire Mining Ltd | 41% | 0.11 | $48,733,151 |

| RDM | Red Metal Limited | 39% | 0.1 | $28,243,050 |

| ZNC | Zenith Minerals Ltd | 37% | 0.13 | $42,285,706 |

| LAM | Laramide Res Ltd | 37% | 0.69 | $877,095 |

| CRS | Caprice Resources | 36% | 0.045 | $5,020,548 |

| AZS | Azure Minerals | 36% | 2.52 | $1,058,708,051 |

| CII | CI Resources Limited | 33% | 1.4 | $154,300,778 |

| CAV | Carnavale Resources | 33% | 0.008 | $26,668,414 |

| ERW | Errawarra Resources | 33% | 0.16 | $9,680,640 |

| OAU | Ora Gold Limited | 33% | 0.008 | $37,528,868 |

| SIH | Sihayo Gold Limited | 33% | 0.002 | $24,408,512 |

August ASX Top 3

RAIDEN RESOURCES (ASX:RDN): +300%

August may not have seen huge gains across the local bourse in general, but it was a big, big month for this growing Pilbara-digging lithium player.

And yes, that’s partly/largely a nearology narrative feeding off the continued success of the Mark Creasey-backed Azure Minerals and its nearby, headline-stealing monster lithium hit at the Andover project, which spun heads earlier last month.

So then, what happened specifically for RDN in August? Plenty, but here are a few standout highlights that sent the share price moving in the right direction…

• The company announced its decision to acquire new lithium acreage in WA’s Pilbara, earning in on five new tenements alongside Western Exploration.

The outcropping pegmatites are noted across a 4km long field with individual lithium-bearing pegmatites outcropping over a strike of 200m and up to 6m wide at surface.

Notably, the 20 rock chip samples returned a top result of up to 2.22% Li2O.

• Like Azure, Raiden has a star shareholder investor of its own – Tolga Kumova, who has committed $297k to a wider $6m placement raise for the company in order to accelerate the company’s Pilbara lithium hunt.

The lithium hunter says it will use the funds chiefly to progress exploration work and drilling at its portfolio of lithium projects located in the Pilbara region of Western Australia. That, and to potentially upgrade its 85% interest in lithium-gold acreage held by Arrow Minerals (ASX:AMD) to 100% interest.

• Major lithium exploration is now planned at Raiden’s Andover North and Andover South, Mt Sholl and Arrow projects.

@LtdRaiden (#ASX: $RDN) is pleased to announce that the current #mapping and rock #sampling program across the Andover South Project areas, has defined significant outcropping #pegmatites up to 30 metres in width.

Read the full release here: https://t.co/0hU6F2clUn pic.twitter.com/3cn0JCowWc

— Raiden Resources Ltd (@LtdRaiden) August 23, 2023

Current RDN share price

VIRIDIS MINING AND MINERALS (ASX:VMM): +140%

Viridis kicked off the month stonking 100% up the daily charts to all time highs after announcing the acquisition of a significant, high-grade, widespread ionic clay (IAC) rare earths deposit in the Poços De Caldas Alkaline Complex, Minas Gerais, Brazil.

And things got better from there. Not much better, mind, because that was already pretty damn good, but let’s just say the ball was received and it was run a bit further up the sideline.

Regarding the rare earths project, though, Viridis entered into a binding agreement to acquire 100% of the rights to the REEs comprising the Colossus project, consisting of 41 licences (including two mining licences) covering 56km2 “within South America’s largest known alkaline complex”.

Viridis Mining and Minerals Limited $VMM pleased to announce

“Viridis Secures Major Expansion of The Colossus Rare Earth Project”

ASX Announcement:https://t.co/OIAXFWdvcj#Viridis #VMM #RareEarth #Project #Land #Expansion #Brazil pic.twitter.com/lUnqlDokar

— Viridis Mining and Minerals Limited (@Viridis_VMM) August 13, 2023

Further good news throughout the rest of August regarding Colossus came midway through the month when an additional 3,453ha (34.5km2) of licences were secured from the seller Varginha Parties, representing a 61% increase in land position the Brazilian tenure.

Following this, the company reported that initial metallurgical work has confirmed the Colossus project as a true ionic adsorption clay project with, according to executive chairman Agha Shahzad Pervez, “Tier-1 potential”.

And, news just in…

Viridis Mining and Minerals Limited $VMM pleased to announce

“Drill Contract Awarded for Maiden Exploration at Colossus”

ASX Announcement:https://t.co/iD7Yva1nRv pic.twitter.com/H6NoqgMLyI

— Viridis Mining and Minerals Limited (@Viridis_VMM) September 3, 2023

North American-focused lithium players can’t stay out of the news at the moment, for good reasons. Loyal Lithium is one of them and it had a barnstorming month.

Freshly relisted after a four-month trading halt, LLI kicked off the first week of August with the news it has initiated a comprehensive exploration program at its recently acquired Hidden Lake project in lithium-rich Canada.

The Hidden Lake project is in the emerging Yellowknife Lithium Belt in the glacial, northwest part of the country.

Some 315 untested individual pegmatite outcrops have been identified by the company, in addition to four other main spodumene-rich dykes, which have a drill and channel tested cumulative strike length of 2,250m and remain open along strike and depth.

Also in Canada, in Quebec’s James Bay hotspot no less, lies the company’s Trieste lithium project, where an inaugural field program began this month targeting high-priority areas 14km east of Winsome Resources’ (ASX:WR1) Adina lithium project, which has recorded a significant lithium mineralised pegmatite intercept.

And not much sooner than that began that multiple spodumene-bearing pegmatite dykes were discovered at the project.

$LLI.ax has discovered spodumene-bearing pegmatite dykes at its Trieste Lithium Project in James Bay #Lithium District, in a ‘significant breakthrough’ marking the first occurrence on the belt outside of spodumene-bearing pegmatites of Winsome Resources.https://t.co/NrqorojYjS

— Loyal Lithium Limited (@LoyalLithium) August 18, 2023

Loyal Lithium remains the single largest landholder within the highly prospective Trieste Greenstone Belt, with a land position of 251 km2.

Not only that, but LLI continued its form with a significant lithium find at its Scotty project in Nevada, and rounded off its August news with the discovery of six additional spodumene zones at Hidden Lake.

$LLI.ax is pleased to announce that it has discovered another 6 spodumene bearing zones at its Hidden Lake project in the NWT, Canada. This is in addition to the 2.25KM interpreted strike of of previously known spodumene bearing dykes on the project. #lithium pic.twitter.com/IlgRmpRrIM

— Loyal Lithium Limited (@LoyalLithium) August 22, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.