Who Made the Gains? Here are the top ASX miners and explorers for June

Pic: Jun Zhang, iStock / Getty Images Plus

- In June, 13 explorers made gains of 100% or more — a 2023 record

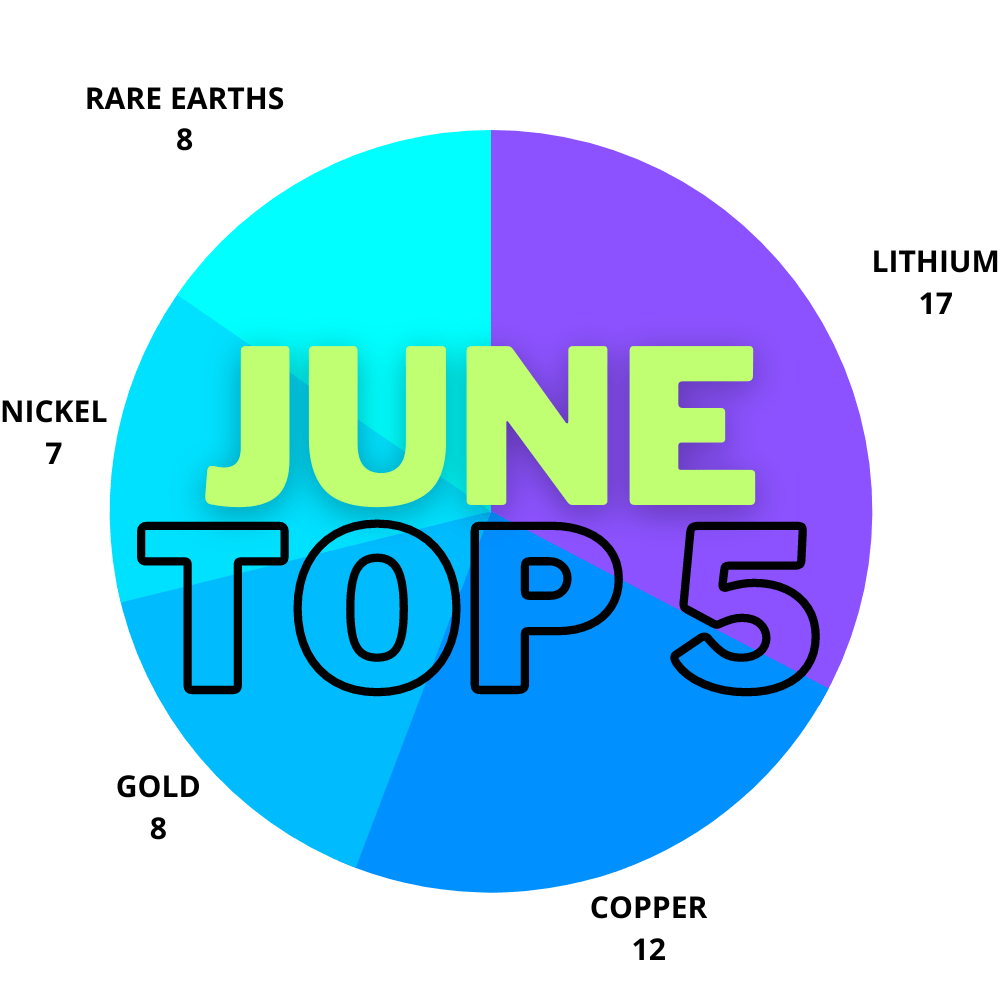

- Lithium and copper the most popular commodities, followed by gold nickel and rare earths

The first five months of 2023 had not been kind to the speculative end of the bourse but, with over a dozen exploration stocks making gains of 100% or more in June, maybe things are looking up.

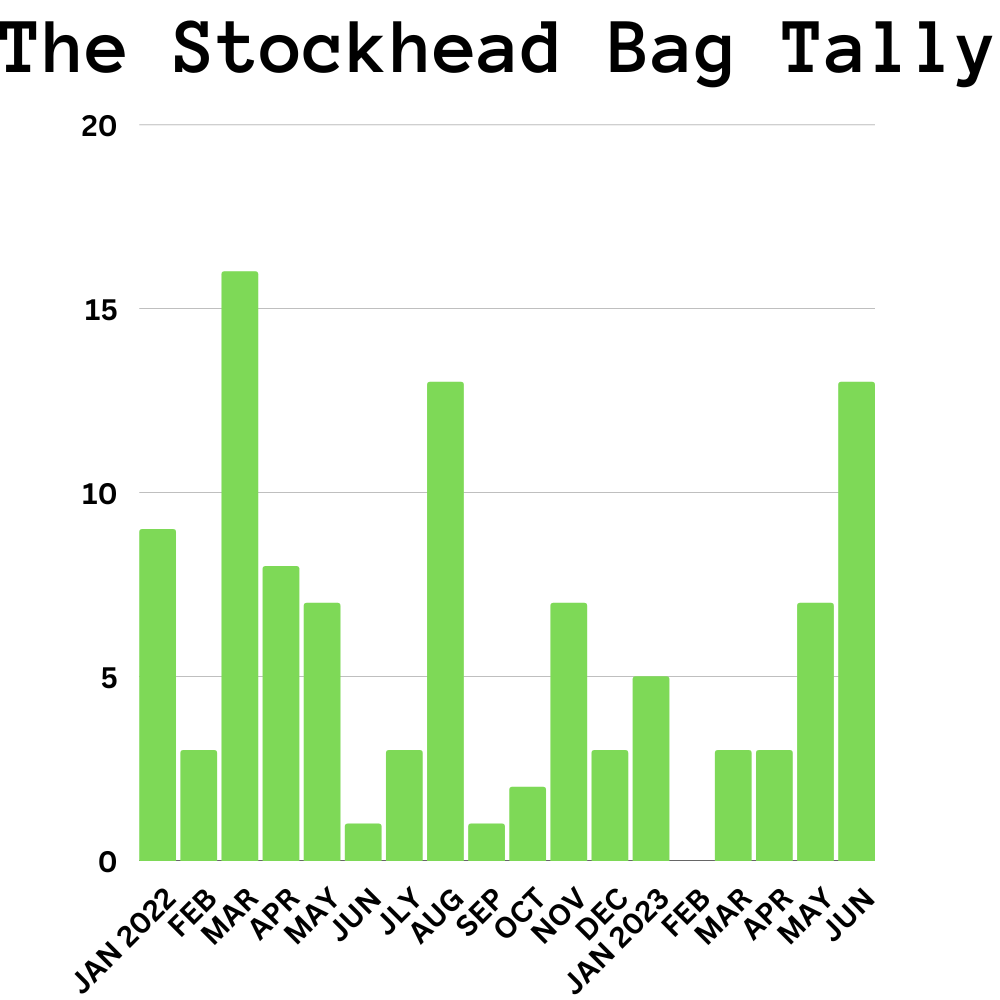

The ‘Bag Tally’ (+100% gains) is Stockhead’s unscientific measure of speccy resources sentiment on the ASX in any given month.

In June, 13 explorers made gains of 100% or more.

That’s the Tally’s best result since August last year, and the equal second-best result since records began (way back in January 2022).

We even beat out our mining and exploration-heavy cousins over at the TSX.V, which only had seven, +100% gainers last month.

Here’s how the Bag Tally has tracked over the past 18 months:

Maybe sentiment is on the rise. Most metals prices certainly are, which you can read more about here:

• Lithium, uranium, iron ore and coal emerge as winners as base metals also post solid June

• Gold fails to fire as threat of interest rate hikes hurt outlook

• Rare earths and nickel prices stagnate— Stockhead (@StockheadAU) July 4, 2023

When it comes to most popular commodities in our top 30, lithium is still king. Rare earths remain trendy, while quality junior copper stocks are beginning to make a ripple in the top 30.

Here’s a breakdown of the five most popular commodities for June:

Here are the top 30 ASX resources stocks for the month of June >>>

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | JUNE RETURN % | SHARE PRICE | MARKET CAP | COMMODITY |

|---|---|---|---|---|---|

| SLM | Solis Minerals | 693% | 1.11 | $66,322,240 | LITHIUM, COPPER |

| GRE | Green Tech Metals | 363% | 0.555 | $23,259,821 | LITHIUM, COPPER, ZINC |

| TNC | True North Copper | 362% | 0.245 | $63,661,155 | COPPER |

| AZS | Azure Minerals | 220% | 1.505 | $587,305,288 | LITHIUM, NICKEL |

| G88 | Golden Mile Res Ltd | 152% | 0.053 | $17,457,644 | NICKEL, COBALT, RARE EARTHS, GOLD |

| RDN | Raiden Resources Ltd | 150% | 0.01 | $20,552,689 | LITHIUM |

| AW1 | American West Metals | 150% | 0.16 | $42,585,859 | COPPER |

| ALV | Alvomin | 125% | 0.315 | $20,460,659 | RARE EARTHS, COPPER, ZINC |

| GMN | Gold Mountain Ltd | 114% | 0.0075 | $14,774,495 | LITHIUM, COPPER |

| EMC | Everest Metals Corp | 111% | 0.19 | $24,592,291 | LITHIUM, GOLD |

| AHN | Athena Resources | 100% | 0.006 | $6,422,805 | IRON ORE |

| CMD | Cassius Mining Ltd | 100% | 0.034 | $16,888,759 | LITHIUM, LIMESTONE |

| REZ | Resourc & En Grp Ltd | 100% | 0.024 | $11,995,339 | NICKEL, GOLD |

| REC | Recharge Metals | 90% | 0.37 | $39,066,255 | LITHIUM |

| ERW | Errawarra Resources | 89% | 0.185 | $11,193,240 | LITHIUM, NICKEL, COPPER, GRAPHITE |

| MM1 | Midas Minerals | 83% | 0.33 | $25,707,294 | LITHIUM |

| MQR | Marquee Resource Ltd | 73% | 0.045 | $14,881,838 | RARE EARTHS, LITHIUM |

| LRS | Latin Resources Ltd | 73% | 0.32 | $824,878,292 | LITHIUM |

| RR1 | Reach Resources Ltd | 69% | 0.011 | $30,305,557 | LITHIUM, RARE EARTHS, COPPER |

| BM8 | Battery Age Minerals | 68% | 0.53 | $39,335,626 | LITHIUM |

| MI6 | Minerals260 Limited | 66% | 0.79 | $184,860,000 | LITHIUM, RARE EARTHS, NICKEL, COPPER, PGE |

| M3M | M3 Mining | 63% | 0.155 | $6,355,221 | GOLD |

| AUE | Aurum Resources | 63% | 0.15 | $3,750,000 | GOLD |

| ADD | Adavale Resource Ltd | 63% | 0.026 | $13,508,118 | NICKEL |

| WYX | Western Yilgarn NL | 63% | 0.13 | $6,455,476 | NICKEL, LITHIUM |

| XAM | Xanadu Mines Ltd | 62% | 0.081 | $132,663,759 | COPPER |

| OAU | Ora Gold Limited | 60% | 0.004 | $15,747,701 | GOLD |

| HAW | Hawthorn Resources | 58% | 0.145 | $46,902,186 | LITHIUM, IRON ORE |

| ENR | Encounter Resources | 57% | 0.455 | $179,964,230 | RARE EARTHS, COPPER, GOLD |

| NWM | Norwest Minerals | 55% | 0.048 | $13,326,456 | RARE EARTHS, COPPER, GOLD |

June ASX Top 3

SOLIS MINERALS (ASX:SLM) (TSX.V: SLMN)

Lithium’s dual listed ‘flavour of the month’ announced the purchase of the Jaguar lithium project in Brazil late May.

At Jaguar – located in Bahia state — the company says there are rock chips grading up to 4.95% Li2O along a 1km long, 50m wide spodumene-rich pegmatite body.

It then raised $8.1m at a modest ~7% discount to the last traded price, with big brother and fellow Brazilian lithium play Latin Resources (ASX:LRS) increasing its investment in SLM to 17.79% as part of the placement.

Drilling is already underway. It also has a lithium project in northern Brazil called Borborema and several additional acquisitions in the pipeline.

GREENTECH METALS (ASX:GRE)

GRE pumped hard mid-month after early-stage rock chip sampling returned decent assays up to 1.65% lithium at the Ruth Well project in the Pilbara.

The explorer says pegmatites – both barren and spod-bearing — can be traced for 6km.

Being just 30km from Azure Minerals’ (ASX:AZS) huge find has also inspired the copper-focused company to ramp up its lithium hunt.

“This appears to be a significant mineralising event the extent of which both laterally and along strike is yet to be determined,” GRE exec director Thomas Reddicliffe says.

“This discovery in WA’s new lithium hot spot, combined with the company’s advanced Whundo copper project, where we recently reported a significant resource upgrade, positions GreenTech as a rapidly emerging critical metals business with an advanced project pipeline.”

TRUE NORTH COPPER (ASX:TNC)

Copper has an exciting future as per most analysts’ expectations. The energy transition is expected to see demand double by 2050, with RBC recently predicting a lift in prices from ~US$3.80/lb to US$4.50/lb to incentivise new production in the face of a predicted 10Mtpa shortfall by 2035.

That’s equivalent to 10 Escondidas — the world’s largest copper operation.

A reverse takeover conducted through the shell of fellow Qld copper play Duke Exploration, TNC raised $37.3 million at 25c per share in a reverse takeover offering.

Armed with a measured, indicated and inferred JORC resource base of 326,000t copper, 87,400oz gold and 4.3Moz of silver along with a concentrator, SX and copper sulphate crystallisation plant, it’s aiming to commission its mothballed Cloncurry hub within weeks.

The company plans to produce 10,000 to 15,000t of copper a year from Cloncurry over a 7-8 year mine life.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.