Who Made the Gains? Here are August’s top small cap miners and explorers

Pic: Tyler Stableford / Stone via Getty Images

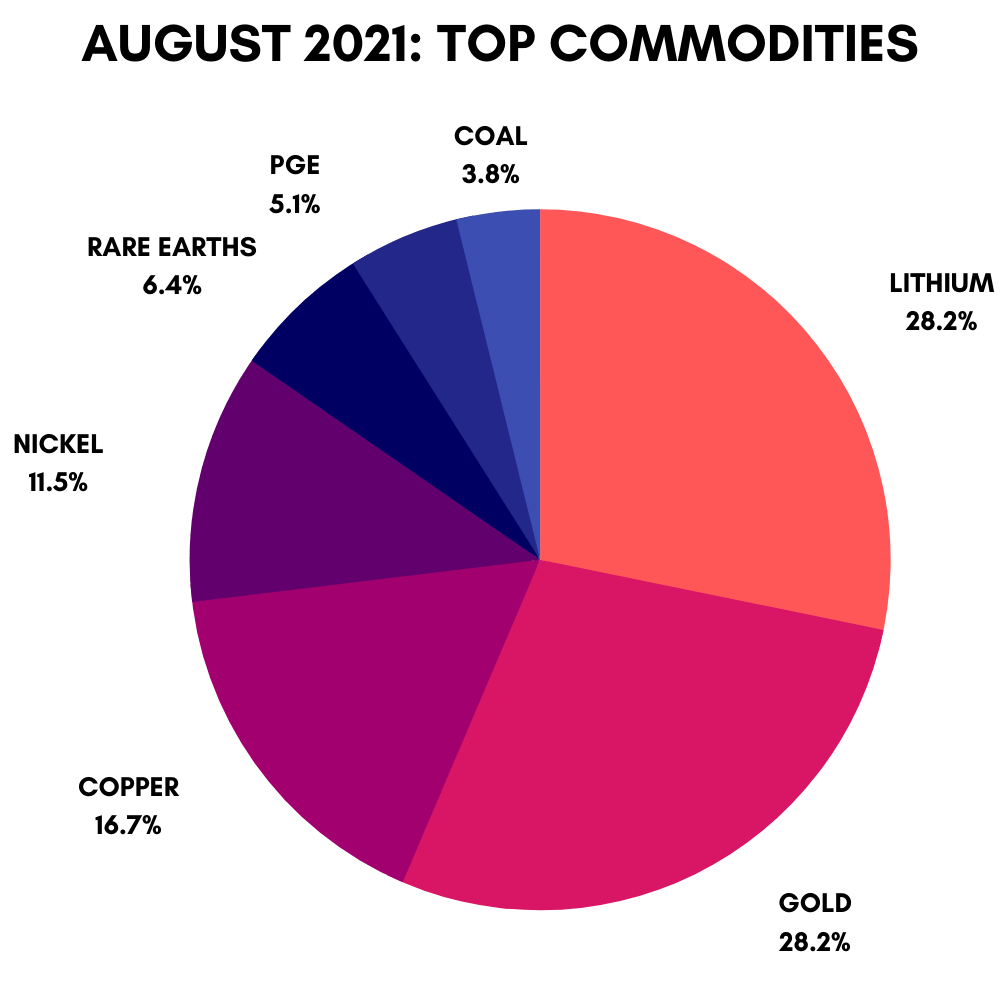

What happened to the most talked about commodities in August?

We are knee deep in a metals super cycle, the experts say. That means there are far more winners than losers.

Dominant this month was lithium, which continues to go gangbusters:

#Lithium prices as assessed by @benchmarkmin on 16 August 2021

Lithium carbonate up 131% in 2021

Lithium hydroxide prices up 107% in 2021 https://t.co/4k5Yyygq9d pic.twitter.com/upLNmKko1L

— Simon Moores (@sdmoores) September 1, 2021

As did lithium equities, with a remarkable 22 of the top 50 stocks enjoying exposure to the battery metal.

Meanwhile, Lynas Rare Earths (ASX:LYC) boss Amanda Lacaze says the rare earths market is ‘as good as it’s ever been’.

Premium Low Vol CFR China – a benchmark for Chinese coking coal imports — hit an all-time high of $US410/t. That’s a 248% increase over the past year. Thermal coal prices are doing even better.

August was a rollercoaster for the gold price, but — after a chaotic flash crash saw it plummet into the $US1600s earlier in the month — it ended up where it started.

Iron ore was one of the month’s only losers. After a tremendous run into the high $US220/t’s, the benchmark price fell to earth with a thud, and now trades sub $US150/t.

What were the top 50 resources winners for July searching for?

Here are the top 50 ASX resources stocks for the month of August>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | COMPANY | 1MONTH RETURN % | SHARE PRICE | MARKET CAP | LOOKING FOR |

|---|---|---|---|---|---|

| KNI | Kuniko | 1260 | 2.72 | $ 144,000,000.00 | Copper, Nickel, Cobalt |

| RHI | Red Hill Iron | 268 | 4.05 | $ 239,312,814.51 | Iron Ore |

| CHR | Charger Metals | 174 | 0.63 | $ 17,120,000.54 | Lithium, Nickel, Copper, PGE |

| PAM | Pan Asia Metals | 136 | 0.33 | $ 8,048,796.60 | Lithium, Tungsten |

| ORM | Orion Metals | 100 | 0.034 | $ 18,533,313.06 | Shell Company |

| GLA | Gladiator Resources | 93 | 0.029 | $ 11,941,962.41 | Gold, Uranium |

| SYA | Sayona Mining | 83 | 0.15 | $ 978,106,466.40 | Gold, Lithium |

| BCB | Bowen Coking Coal | 81 | 0.15 | $ 163,644,294.87 | Coal |

| AOA | Ausmon Resorces | 75 | 0.007 | $ 4,974,615.40 | Copper, Cobalt, Lead, Zinc |

| CKA | Cokal | 65 | 0.165 | $ 140,562,346.95 | Coal |

| EQR | Eq Resources | 65 | 0.051 | $ 66,981,086.18 | Tungsten |

| NXM | Nexus Minerals | 63 | 0.145 | $ 36,622,750.65 | Gold, Copper |

| CNJ | Conico | 58 | 0.09 | $ 88,887,602.98 | Nickel, Copper, Gold |

| JRL | Jindalee Resources | 55 | 3.8 | $ 199,196,793.18 | Lithium |

| HWK | Hawkstone Mng | 54 | 0.043 | $ 70,366,704.98 | Gold, Lithium |

| FYI | FYI Resources | 54 | 0.86 | $ 299,424,126.54 | HPA |

| MRZ | Mont Royal Resources | 50 | 0.33 | $ 12,499,315.95 | Gold, Silver, Copper, Nickel |

| BMM | Balkan Mining and Minerals | 50 | 0.63 | $ 20,800,000.00 | Lithium |

| FTZ | Fertoz | 50 | 0.33 | $ 66,848,552.51 | Phosphate |

| ADV | Ardiden | 50 | 0.012 | $ 27,941,604.81 | Gold, Lithium |

| EUR | European Lithium | 47 | 0.087 | $ 86,829,255.13 | Lithium |

| AGY | Argosy Minerals | 46 | 0.175 | $ 200,043,472.64 | Lithium |

| AAJ | Aruma Resources | 45 | 0.08 | $ 7,629,186.74 | Gold, Lithium |

| VUL | Vulcan Energy | 45 | 14.25 | $ 1,495,881,255.00 | Lithium |

| FFX | Firefinch | 45 | 0.58 | $ 493,020,625.86 | Gold, Lithium |

| AZS | Azure Minerals | 44 | 0.36 | $ 112,871,038.17 | Nickel, Copper |

| VML | Vital Metals | 39 | 0.068 | $ 287,418,332.80 | Rare Earths |

| ARV | Artemis Resources | 38 | 0.08 | $ 97,889,816.78 | Gold, Nickel, Copper, Cobalt, PGE |

| TIG | Tigers Realm Coal | 38 | 0.011 | $ 156,800,428.42 | Coal |

| AR3 | Australian Rare Earths | 37 | 1.05 | $ 48,589,909.80 | Rare Earths |

| KTA | Krakatoa Resources | 37 | 0.071 | $ 20,040,274.36 | Gold, Copper, Rare Earths |

| GTE | Great Western Exp. | 36 | 0.225 | $ 29,963,585.74 | Gold, Copper, Molybdenum, Potash |

| CAD | Caeneus Minerals | 36 | 0.015 | $ 64,299,076.11 | Gold, Lithium |

| ASM | Australian Strategic Materials | 35 | 11.68 | $ 1,534,566,066.00 | Rare Earths, Zirconium, Niobium, Hafnium |

| BRB | Breaker Resources | 34 | 0.215 | $ 65,168,185.80 | Gold, Lithium |

| INR | Ioneer | 34 | 0.55 | $ 999,703,373.03 | Lithium |

| MLS | Metals Australia | 33 | 0.002 | $ 8,454,376.09 | Graphite, Lithium, Nickel, Gold, Copper |

| HAW | Hawthorn Resources | 33 | 0.06 | $ 16,675,780.65 | Gold |

| LPD | Lepidico | 33 | 0.02 | $ 123,041,963.22 | Lithium |

| HYM | Hyperion Metals | 33 | 1.425 | $ 154,365,902.90 | Titanium, Rare Earths |

| AVZ | AVZ Minerals | 32 | 0.245 | $ 707,997,989.60 | Lithium, Tin |

| ASN | Anson Resources | 32 | 0.094 | $ 86,271,133.63 | Lithium, Nickel, Copper, PGE |

| ESS | Essential Metals | 32 | 0.185 | $ 42,771,595.32 | Lithium, Nickel, Gold |

| GL1 | Global Lithium | 32 | 0.37 | $ 33,810,840.48 | Lithium, Gold |

| AWV | Anova Metals | 32 | 0.025 | $ 35,827,355.00 | Gold |

| LKE | Lake Resources | 31 | 0.61 | $ 685,340,907.50 | Lithium |

| MNB | Minbos Resources | 31 | 0.11 | $ 53,363,783.16 | Phosphate, Green Hydrogen |

| OKJ | Oakajee Corp | 30 | 0.065 | $ 5,761,099.89 | Nickel, Copper, Gold |

| ANX | Anax Metals | 30 | 0.1 | $ 35,018,389.00 | Copper, Zinc, Lead, Gold, PGE |

| BEM | Blackearth Minerals | 29 | 0.135 | $ 27,174,408.38 | Graphite |

LITHIUM GETS LOOSE

22 stocks in our top 50 had lithium exposure, up from 9 in July.

What happened last month to kick investor FOMO up a gear?

Miner Pilbara Minerals’ (ASX:PLS) first auction of spodumene — a lithium precursor — went off at an amazing $US1,250t. That’s well above prevailing market price, and streets ahead of the ~$US380/t spod producers were accepting last year.

There was a rush to the doors for lithium stock exposure.

Leading the pack was newly listed lithium and base metals play Charger Metals (ASX:CHR) (+174%), which is currently mapping and sampling at its ‘Bynoe’ project in the Northern Territory.

Pan Asia Metals (ASX:PAM) announced the acquisition of a geothermal lithium project — sending the share price into the stratosphere.

Fan favourites Sayona Mining (ASX:SYA) and Vulcan Energy Resources continued to gain, and are now up ~1,500% and 400% since the start of the year.

It wasn’t just lithium-focused stocks that benefitted — punters also uncovered a bunch of explorers hiding exposure in the recesses of their respective portfolios – like gold-focussed Aruma Resources (ASX:AAJ), Caeneus Minerals (ASX:CAD) and Breaker Resources (ASX:BRB).

MEMESTONKS GET PUMPED?

In late August, Scandinavian base metals explorer Kuniko (ASX:KNI) stormed onto the ASX boards with a 325% first day gain.

The ‘zero carbon’ Vulcan Energy (ASX:VUL) spin-off then went on to notch up a remarkable 1,260% gain to month’s end.

The stock subsequently addressed its use of a paid investor relations services provider and knowledge of various “meme stock promoters” in response to an ASX query, but punters are still waiting on the ‘dump’ part on this possible pump and dump.

Is it fair value? Probably not. Is it fun to watch? Yes … yes it is.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.