Upside ‘multiples of today’s share price’ for Myanmar Metals, says this expert investor

Pic: Tyler Stableford / Stone via Getty Images

Private Investor Group (P.I.G) is a loose collective of ~60 private retail investors determined to have a bigger say in the companies they invest in.

The group includes professionals (many in the resources industry) and investors from all states of Australia, New Zealand and expats living overseas.

Group founder Kalenn Amand says they were tired of being the last to know crucial info.

Through P.I.G, these investors were able to pool quality research, cultivate direct access to management, and ultimately have a bigger say in a company’s direction.

P.I.G’s foundations were established in 2012, when a number of retail investors in Avanco Resources met at an annual general meeting (AGM) in Perth.

“We started sharing our research and then began pooling our votes on AGM agenda items,” Amand says.

“As a consequence, the Avanco board began to reach out and communicate with us as it would any other major shareholder or fund.

“This allowed us to ask the hard questions and investigate topics not usually highlighted by companies in their presentations.”

Avanco Resources was ultimately taken over by mid-tier producer OZ Minerals (ASX:OZL).

“Because of our numbers, we were in communication with other major shareholders throughout the negotiation period and we collectively walked away with approximately 12 per cent of the $444m offer price,” Amand says.

As a group, P.I.G earned ~$50m from the OZ Minerals takeover.

It has since diversified into a select group of other companies.

“We hold a significant volume of shares in Canyon Resources (ASX:CAY), about 15 per cent of the company, and around 10 per cent of Myanmar Metals (ASX:MYL) ,” Amand says.

“We also have several other companies that we watch closely, with some members slowly building a position.”

But Amand’s personal favourite is Myanmar Metals, where he and a number of other P.I.G members are individual Top 20 shareholders.

The market more generally has not fully appreciated the unique nature of this resource and its scale, he says.

“While the majority of my research and investment is in the resources sector, I prefer to invest in projects that have certainty of development and the potential to grow enormously,” he says.

“[MYL chief exec] John Lamb and his team keep expanding the size of the resource and have not failed to miss a target.”

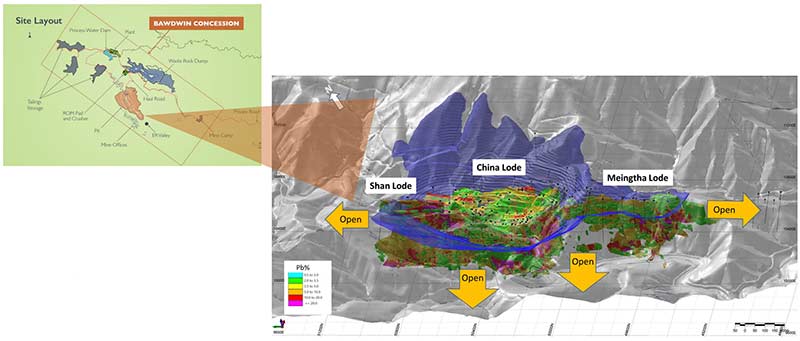

Bawdwin: A geological freak

Three years ago, junior explorer and mine developer MYL acquired a majority stake in one of the greatest metal deposits in history, Bawdwin, in the southeast Asian nation of Myanmar.

When production begins in 2022/2023, Bawdwin will be the world’s #3 lead producer and a top-10 silver producer.

It’s a monster. The first 13 years of production at Bawdwin is called the ‘starter pit’, but the company has since defined two further phases of open cut mining – that’s decades and decades of mining and processing.

“The first thing that attracted me to Myanmar Metals was the deposit,” Amand says.

“Bawdwin is an extraordinary deposit and it has continued to grow as MYL have undertaken development.

“They have already defined an operation that will be one of the world’s largest lead/silver mines and each drilling campaign increases the scope of the project.”

There’s no doubt that the resource will grow much further in time, Amand says.

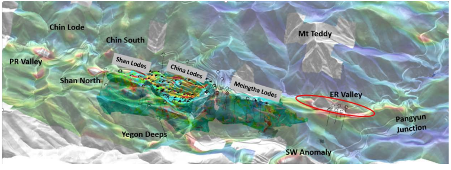

“Meingtha Gap, Meingtha Hill, ER Valley, Pangyun Junction, Chin, PR Valley — there are kilometres of open strike and the orebody is open at depth all along strike.

“It’s quite possible that the deposit will be mined for the next century.”

Amand knows the project very well. He has walked the ground at Bawdwin as an investor a number of times in the past two years.

“A large part of my role in P.I.G. is to take myself and my knowledge and experience of resource companies on-site,” he says.

Unlike some analysts and fund managers, Amand will travel halfway around the world to see the resource and speak to local stakeholders himself.

“That means travelling to site, visiting mines and core sheds, meeting with government ministers, bureaucrats, embassy representatives, local community, other investors, potential offtake partners, funds etc,” he says.

“All of these experiences have led me to conclude that Bawdwin is not just a great resource, but also that the Bawdwin Joint Venture has created a relatively risk-free operation which will be a lucrative investment,” he says.

“Nothing is guaranteed, but we believe all of this substantially mitigates risk and gives us opportunities that others will miss.”

Is MYL a takeover target?

P.I.G is not the only group excited by Bawdwin.

This is an attractive target to major miners and commodity traders, many of whom have already visited site, Amand says.

“I know for a fact that two of the largest metal traders in the world have been to site,” he says.

“One site visit I did was in the company of one of these groups. My reading of that visit was that they were very impressed with the potential at Bawdwin. I had some very interesting but very private conversations with them.

“Now whether that interest translates into a takeover offer or a serious partnership around offtake I can’t say but I would expect it is a real possibility.”

MYL would also be on the radar of some larger mining companies, Amand says.

A +50-year life of mine is the sort of security that might whet their appetite.

“So, do I expect corporate action? I think there is a strong chance,” he says.

“Given the upside in the project I’d expect offers to be close to current full value.

“Everyone will know there is upside, a lot of upside.”

H2 2020 is already packed with re-rating events

Irrespective of any takeover interest, this is the big year for MYL.

Very soon, the cashed-up company (with ~$15m in the bank) will lodge it’s MIC (Myanmar Investment Commission) application, crucial for any foreign company looking to build, own and operate an asset in-country.

Myanmar Metals estimates it will receive that permit sometime in H2 2020. A final feasibility study, which is now largely complete, will be released soon after.

“I always find short-term share price prediction a fraught business. However, my thinking is that a combination of MIC and DFS will give far greater clarity to what MYL have in Bawdwin,” Amand says.

“The PFS based on a 2-million-tonne plant gave MYL an NPV [net present value] with an 8 per cent discount of $414m … and that’s just Myanmar Metals’ share of the project.”

Total operating costs were pegged at $US108 per tonne and they had a 30 per cent internal rate of return (IRR), which puts the project in the lowest quartile for costs.

Amand now expects an upgraded plant size, which will lower operating costs and improve overall economics.

“As the prospectivity and upside are so substantial with this orebody I’d expect that value to be keenly appreciated and the market should start to value the company appropriately.

“Of course, any suggestion of a takeover would accelerate that process. Given the current share price there is significant upside, multiples of today’s share price.”

This story was developed in collaboration with Myanmar Metals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.